Triangulating markets through technicals, sentiment, & macro

MO: A Community for traders seeking an uncommon edge https://t.co/4VCCRiFxm6

Fmr: USMC, DIA, FBI

17 subscribers

How to get URL link on X (Twitter) App

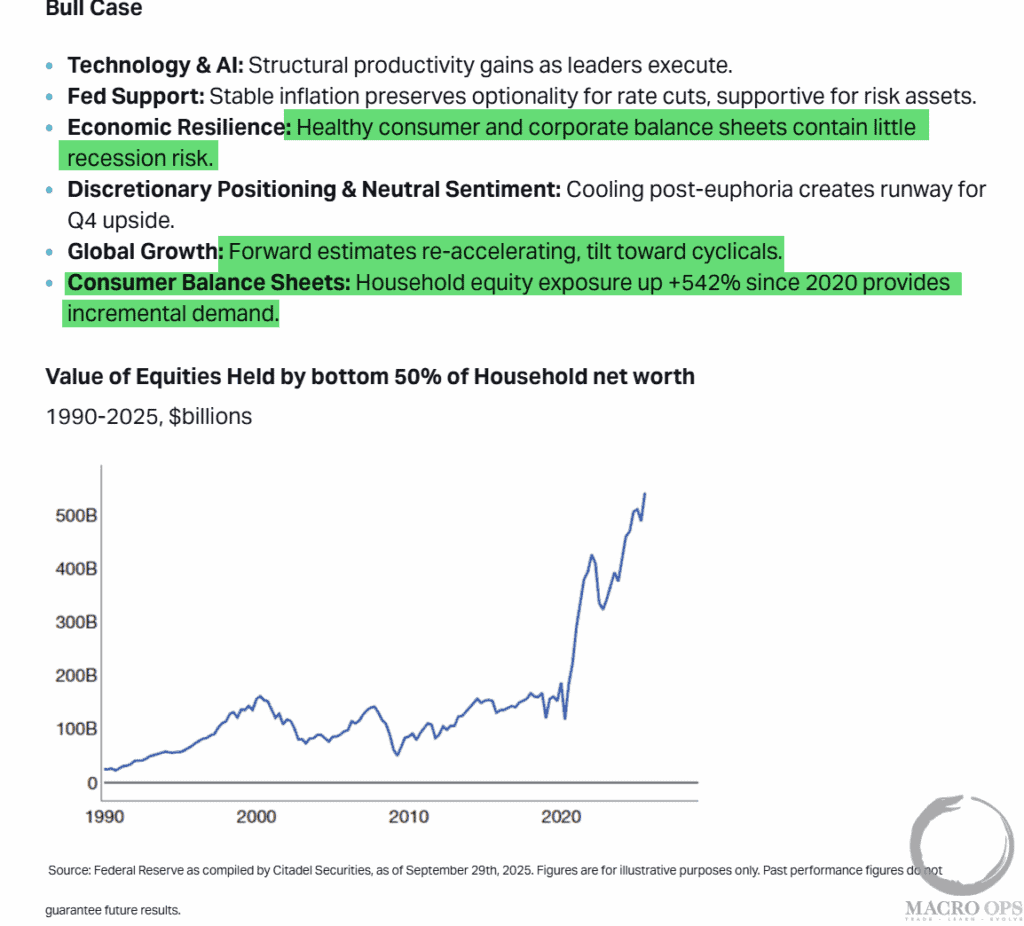

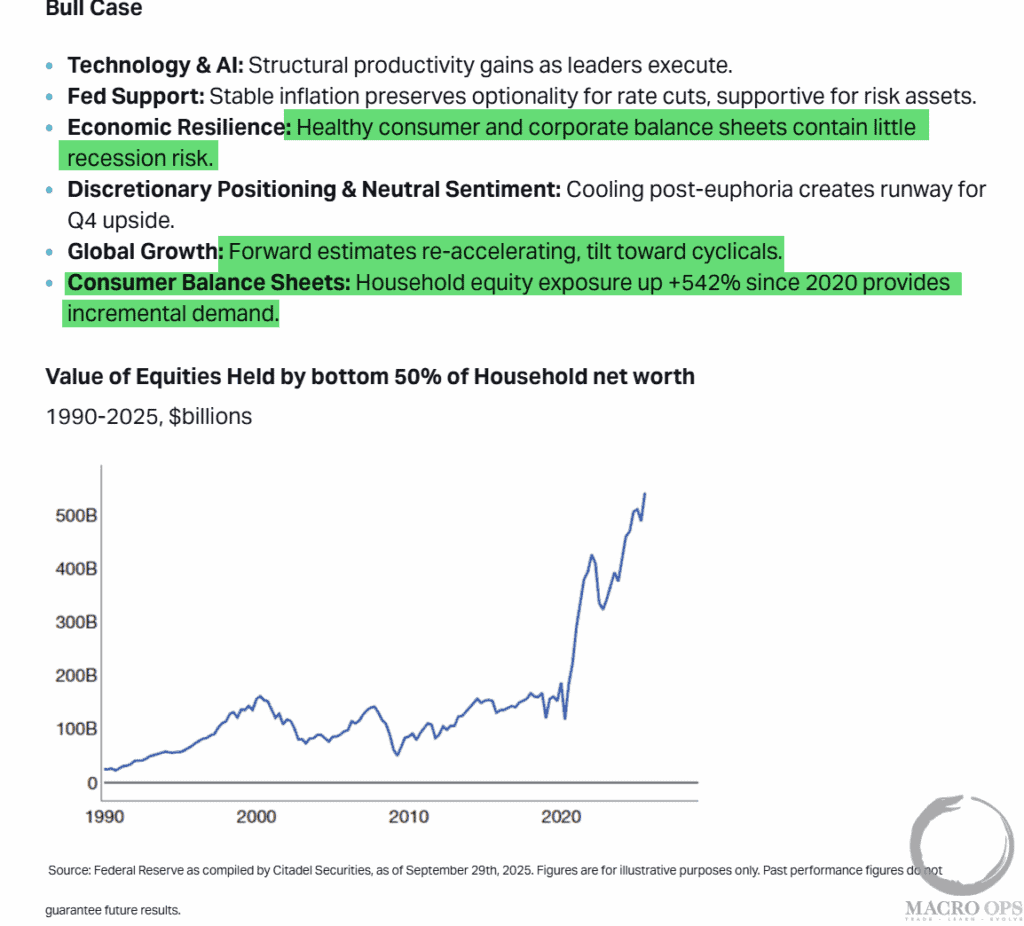

2/ The short-to-intermediate bull call is tougher now than it has been over the past five months, with positioning and sentiment slowly starting to catch up to price action. Citadel points out that their retail clients have been “Net buyers in 21 of the last 24 weeks, rebounding after April weakness.”

2/ The short-to-intermediate bull call is tougher now than it has been over the past five months, with positioning and sentiment slowly starting to catch up to price action. Citadel points out that their retail clients have been “Net buyers in 21 of the last 24 weeks, rebounding after April weakness.”

2/ Our Trend Fragility indicator (a composite of sentiment, positioning, and flows) hit a low of 11% a few weeks ago, which is just 1% away from the 10% needed to trigger a classic buy signal.

2/ Our Trend Fragility indicator (a composite of sentiment, positioning, and flows) hit a low of 11% a few weeks ago, which is just 1% away from the 10% needed to trigger a classic buy signal.

2/ The Russell chart is broken because of the knee-jerk reaction in financials last week following the SIVB news. It’ll be important to see if IWM can retrace that damage this week.

2/ The Russell chart is broken because of the knee-jerk reaction in financials last week following the SIVB news. It’ll be important to see if IWM can retrace that damage this week.

2/ We’re fairly neutral in our short-to-intermediate term outlook. So we’ll wait for the market tip its hand on this one. Bonds will be the tell. If they can’t hold a line, then neither will stocks.

2/ We’re fairly neutral in our short-to-intermediate term outlook. So we’ll wait for the market tip its hand on this one. Bonds will be the tell. If they can’t hold a line, then neither will stocks.

2/ For those who think we’ve started a new cyclical bull market... NOPE.

2/ For those who think we’ve started a new cyclical bull market... NOPE.

2/ Key to watch: Momentum and short-term breadth indicators such as those below. These collectively signaled failed bullish breakouts on each of the last market advances over the past year. They are strong for now, but we’ll have to see how they hold up in the week ahead.

2/ Key to watch: Momentum and short-term breadth indicators such as those below. These collectively signaled failed bullish breakouts on each of the last market advances over the past year. They are strong for now, but we’ll have to see how they hold up in the week ahead.

2/ One interesting development is the large improvement in longer-term breadth indicators. Many are starting to look as if the cyclical bear is already over. We this does support our bullish view over the next 1-3 months.

2/ One interesting development is the large improvement in longer-term breadth indicators. Many are starting to look as if the cyclical bear is already over. We this does support our bullish view over the next 1-3 months.

2/ This table shows the 3m annualized sub-components of the CPI, where we can see that the largest detractors to inflation over the last four months have been energy/fuel related.

2/ This table shows the 3m annualized sub-components of the CPI, where we can see that the largest detractors to inflation over the last four months have been energy/fuel related.

2/ Here’s NDR’s version (slightly more relaxed parameters) of Deemer’s BAM signal, along with historical returns.

2/ Here’s NDR’s version (slightly more relaxed parameters) of Deemer’s BAM signal, along with historical returns.

2/ Crescat Capital shared a good update on precious metals over the weekend: crescat.net/mining-industr…

2/ Crescat Capital shared a good update on precious metals over the weekend: crescat.net/mining-industr…

2/ If it keeps trading down, then it raises the odds this bounce is done.

2/ If it keeps trading down, then it raises the odds this bounce is done.

2/ The more that form and technique are perfected, the more that proper reaction becomes intuitive.

2/ The more that form and technique are perfected, the more that proper reaction becomes intuitive.

2/ Crude put in four consecutive monthly bear bars followed by a very weak bull bar (candle closed below its middle) in October.

2/ Crude put in four consecutive monthly bear bars followed by a very weak bull bar (candle closed below its middle) in October.

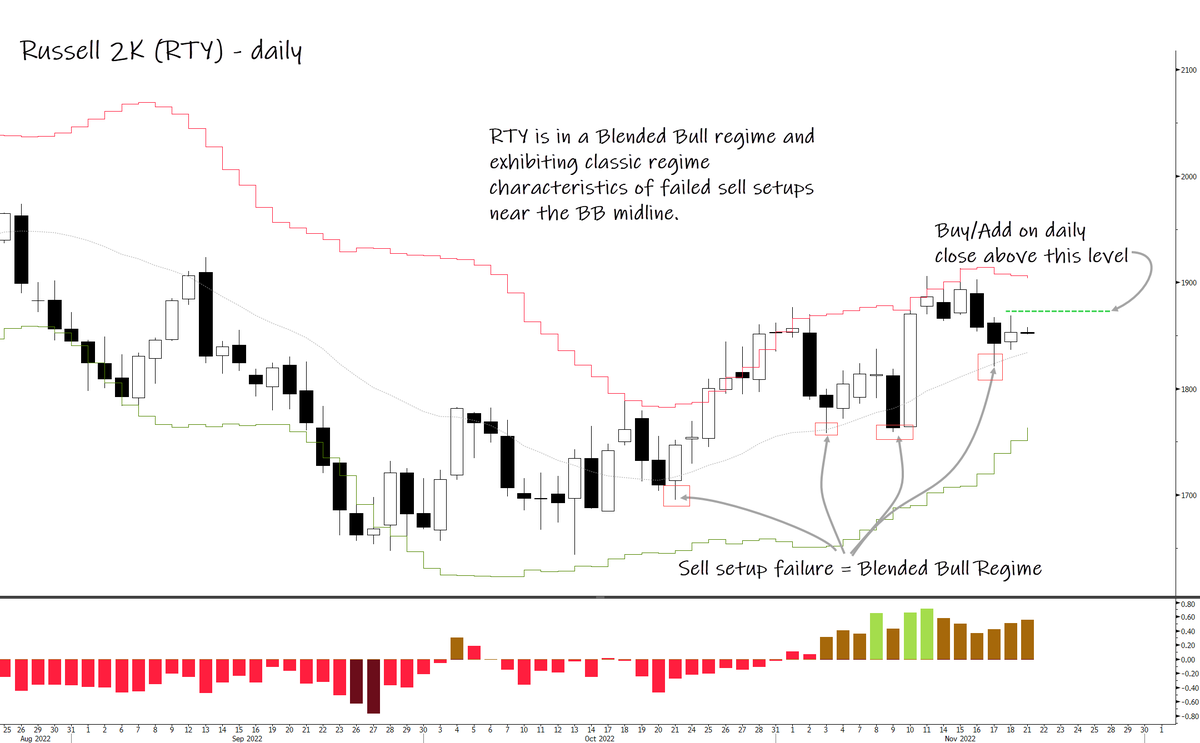

https://twitter.com/MacroOps/status/15770120044597944372/ R2K has put in a double bottom on the monthly chart and is now crossing above resistance at the 1,900 level.

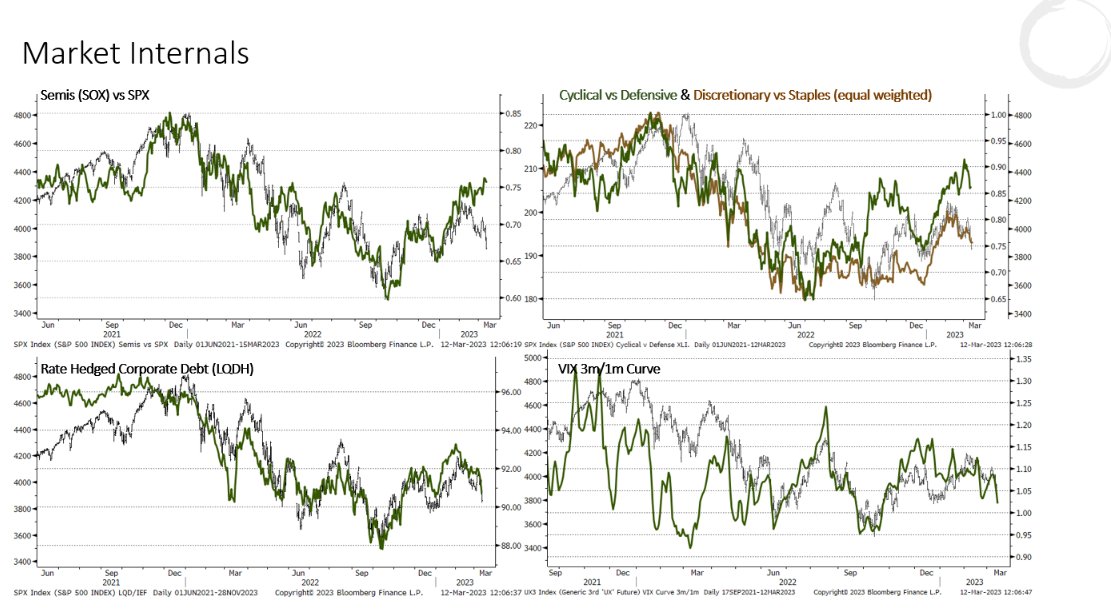

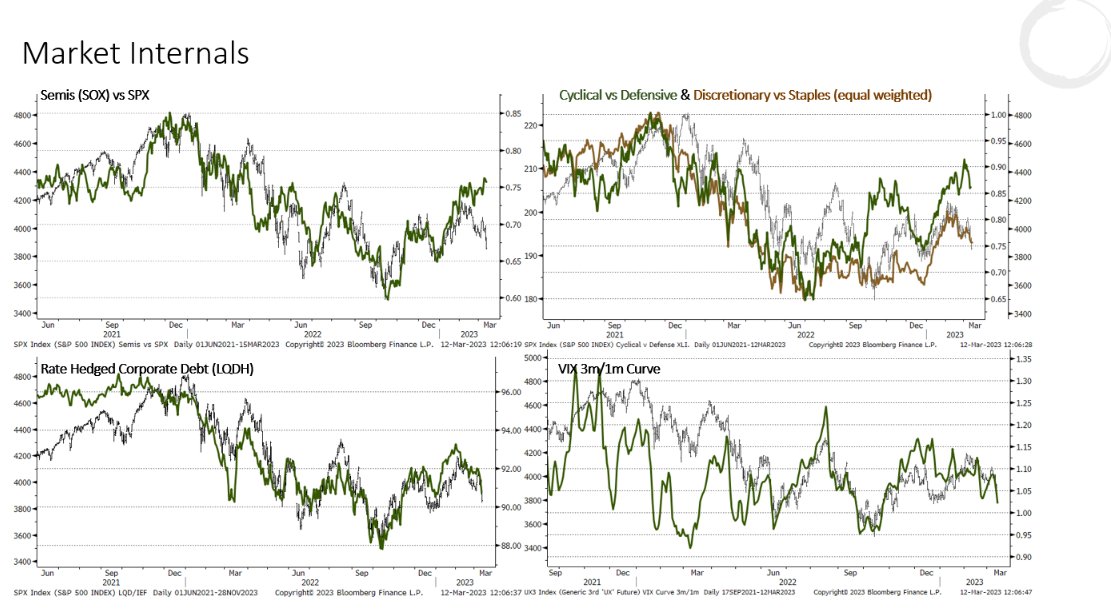

2/ ST read: sentiment/positioning has set the conditions for a bear market rally. Leads such as Cyc vs Def r pointing higher. Breadth is recovering from oversold levels, & the market is ripe for technical reversion

2/ ST read: sentiment/positioning has set the conditions for a bear market rally. Leads such as Cyc vs Def r pointing higher. Breadth is recovering from oversold levels, & the market is ripe for technical reversion