Futures and Options Trader | Trading Community @_GalaxyTrading | Learn the #MandoModel MAND(o)DNAM | Not Financial Advice |

How to get URL link on X (Twitter) App

There is quite a bit that goes into identifying buyable dips for me, and if you are new to my content (welcome) or not in Galaxy Trading, I need to break down a few key concepts first...

There is quite a bit that goes into identifying buyable dips for me, and if you are new to my content (welcome) or not in Galaxy Trading, I need to break down a few key concepts first...

First, let me explain what the LKZ is so you can see the efficacy of the setup throughout the week.

First, let me explain what the LKZ is so you can see the efficacy of the setup throughout the week.

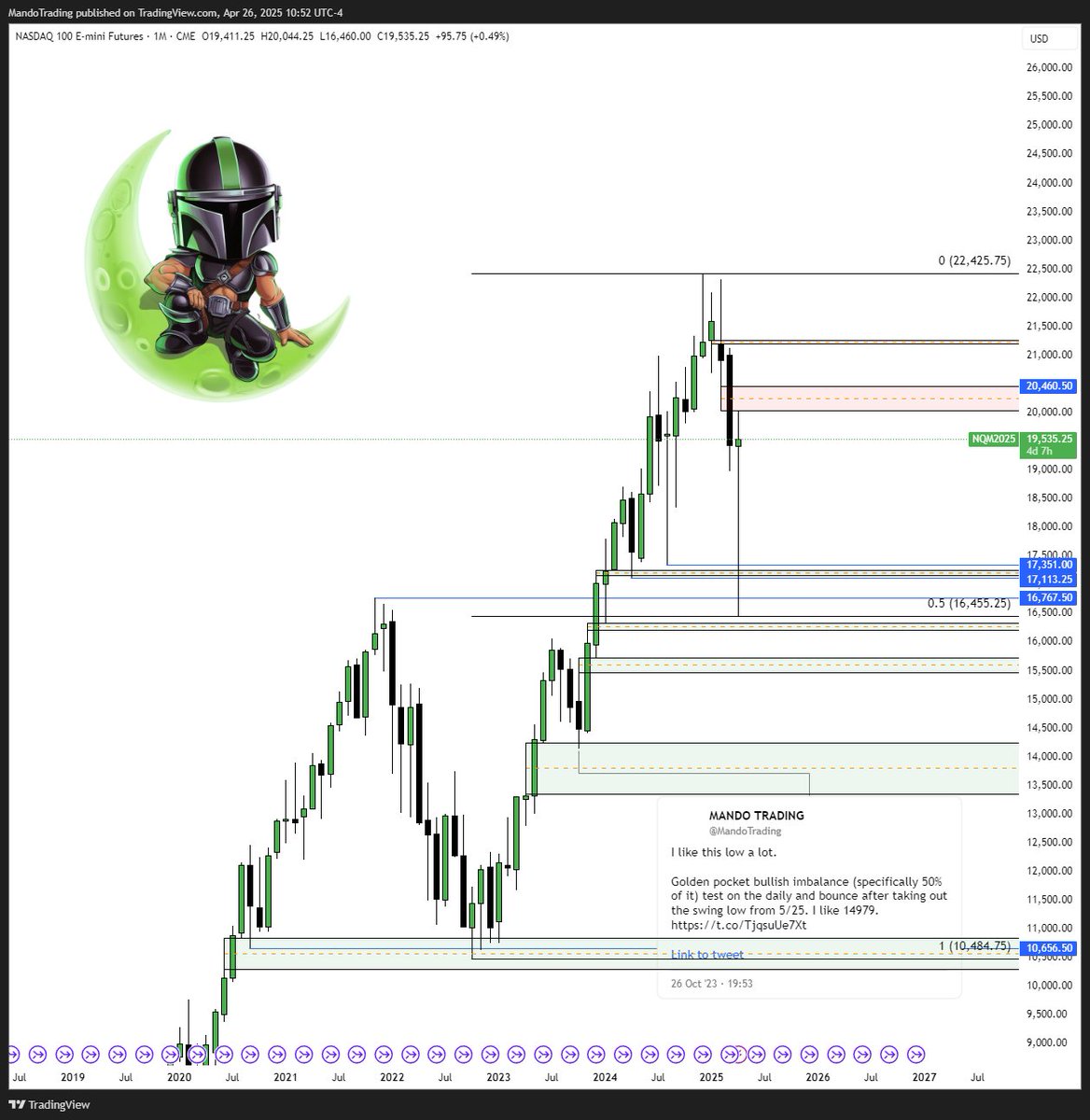

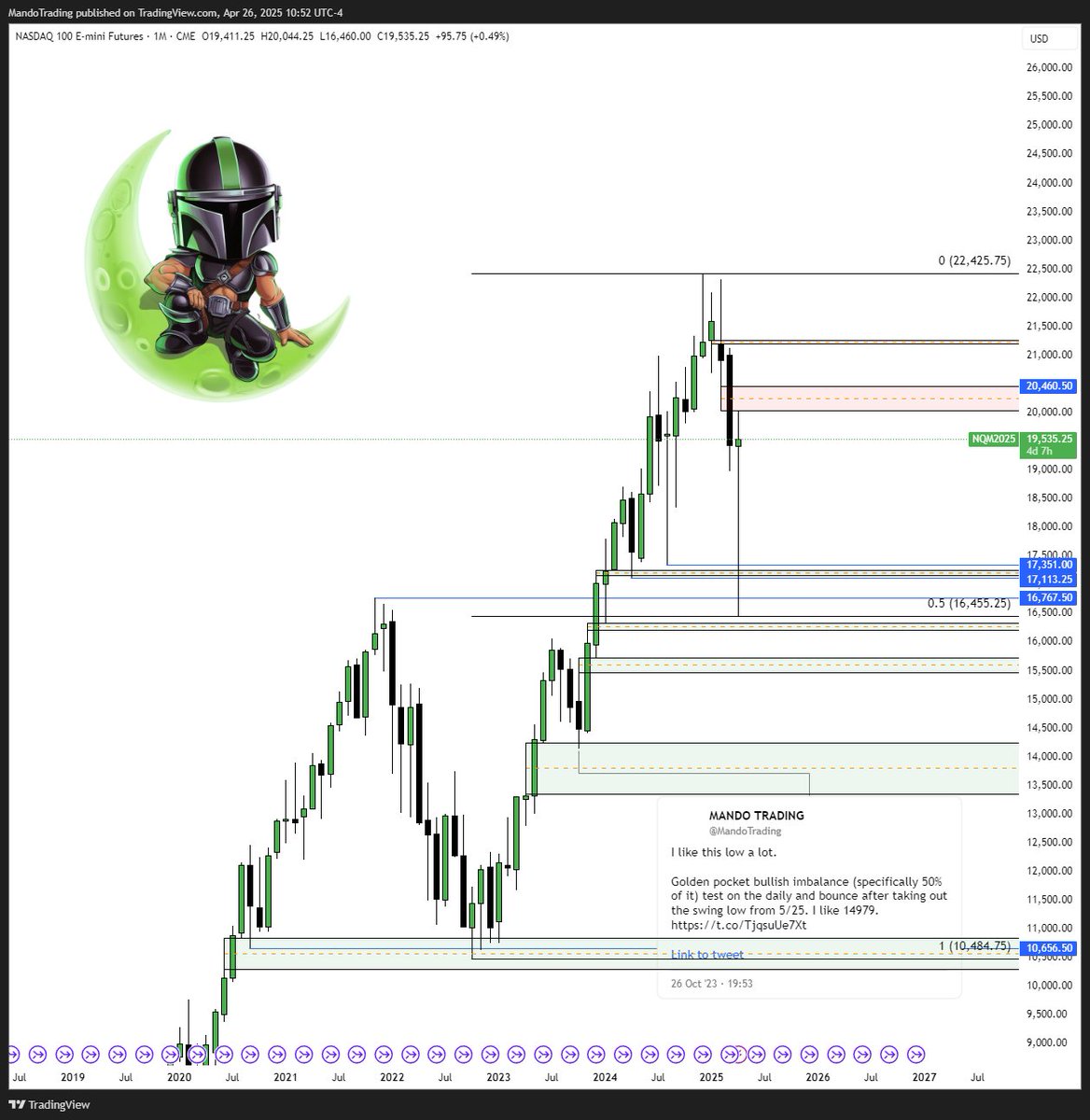

A beautiful move last week, as expected (tweet attached below) and is has now set up for an extremely important close to the April Monthly candle.

A beautiful move last week, as expected (tweet attached below) and is has now set up for an extremely important close to the April Monthly candle. https://x.com/MandoTrading/status/1915178873253224852

During the past week, the price of $SPY got into a quarterly bullish imbalance and responded nicely.

During the past week, the price of $SPY got into a quarterly bullish imbalance and responded nicely.

Let's first start by addressing today's move, which we were all over as the criteria for the "TGIF Setup" was met perfectly.

Let's first start by addressing today's move, which we were all over as the criteria for the "TGIF Setup" was met perfectly.