Chief Economist @economics_ma. Host of Inside Economics podcast https://t.co/ONmSCQ65Ib. Co-founder of https://t.co/ZAo6ME72qu. Views expressed here are my own.

How to get URL link on X (Twitter) App

Home sales are already uber depressed, but homebuilders providing rate buydowns had been propping sales up. They are giving up. It’s simply too expensive. A big tell is that many builders are delaying their land purchases from the land banks. New home sales, starts, and completions will soon fall.

Home sales are already uber depressed, but homebuilders providing rate buydowns had been propping sales up. They are giving up. It’s simply too expensive. A big tell is that many builders are delaying their land purchases from the land banks. New home sales, starts, and completions will soon fall.

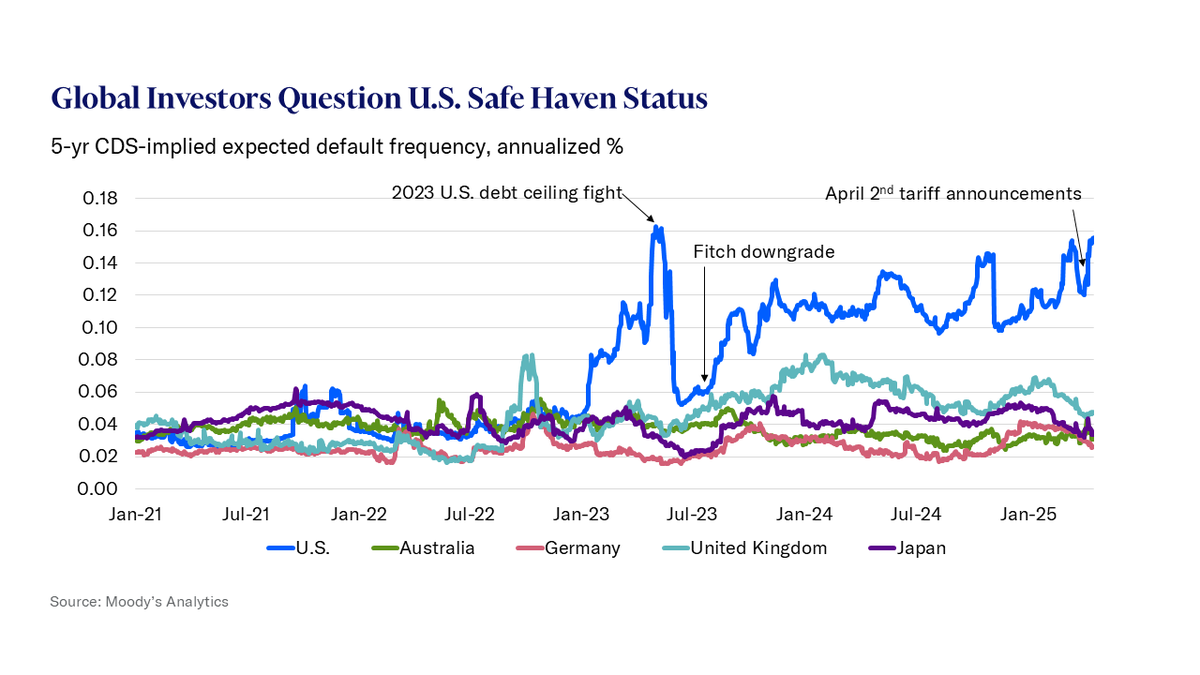

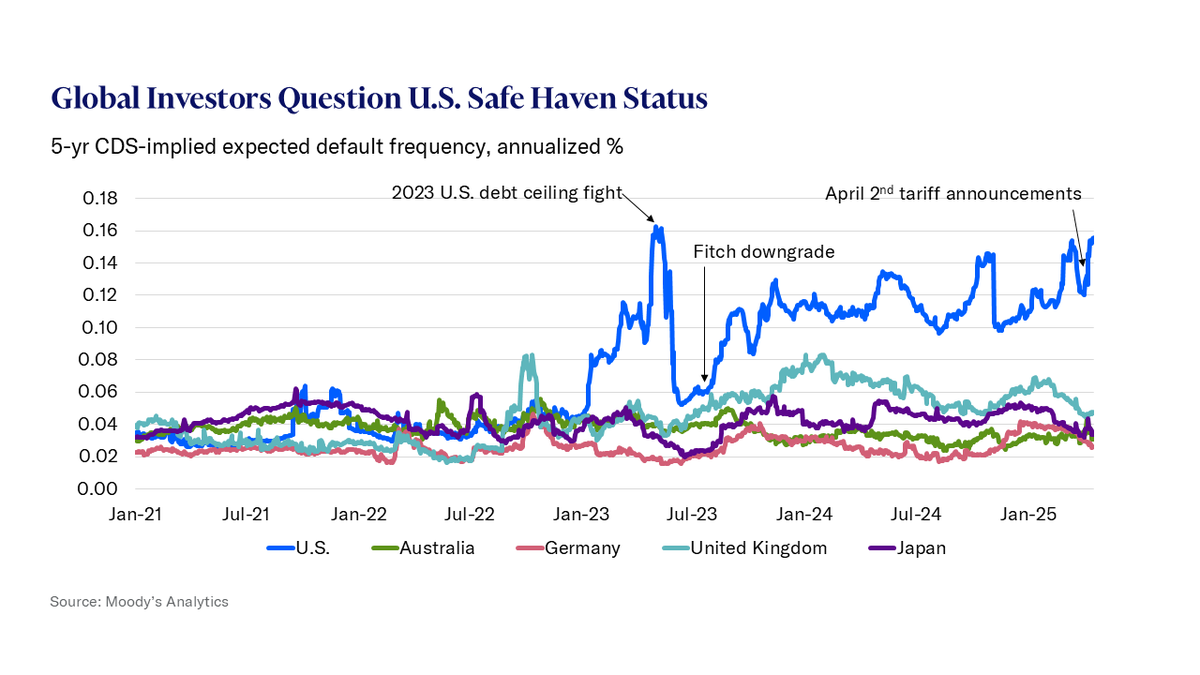

Safe-haven status means that global investors know that if they invest in the U.S., in a Treasury bond or anything else, their investments’ value won’t be upended by a capricious government; laws and regulations are transparent, and while they may change, only after deliberation and due process.

Safe-haven status means that global investors know that if they invest in the U.S., in a Treasury bond or anything else, their investments’ value won’t be upended by a capricious government; laws and regulations are transparent, and while they may change, only after deliberation and due process.

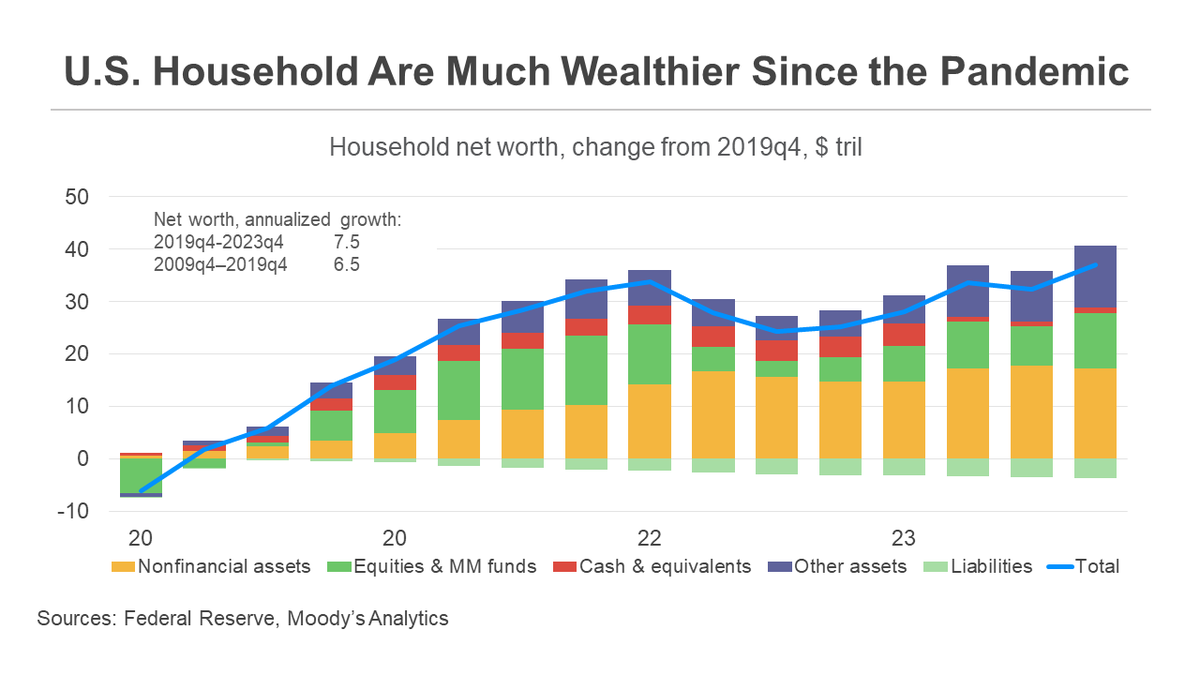

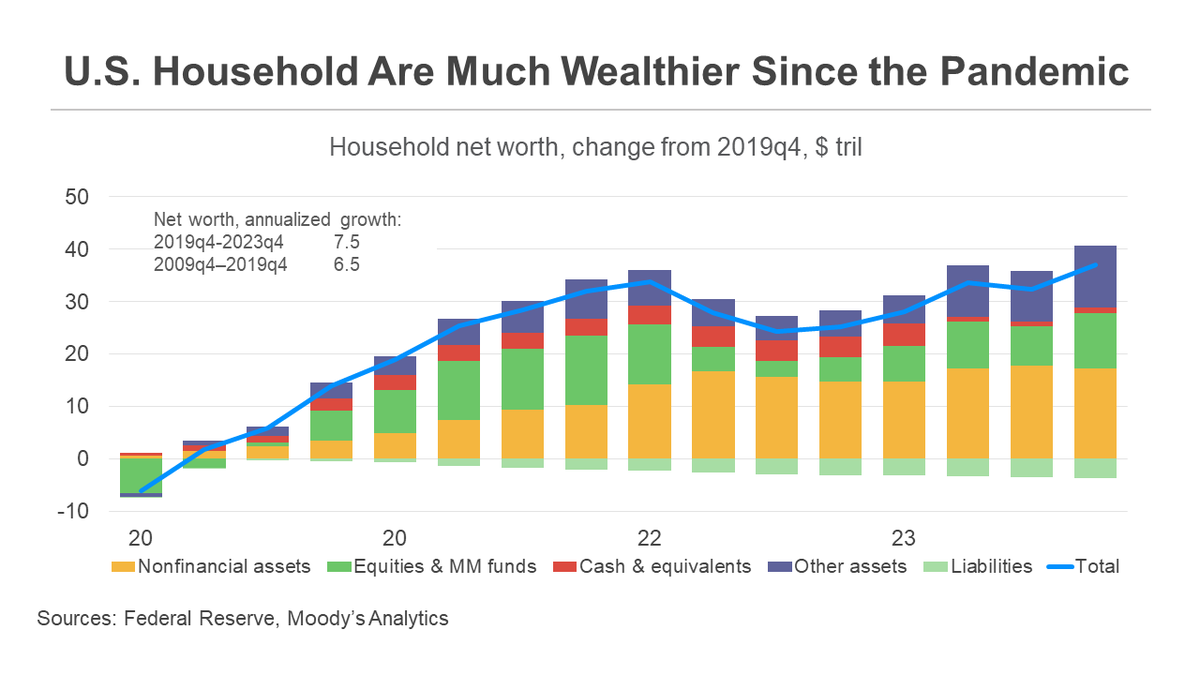

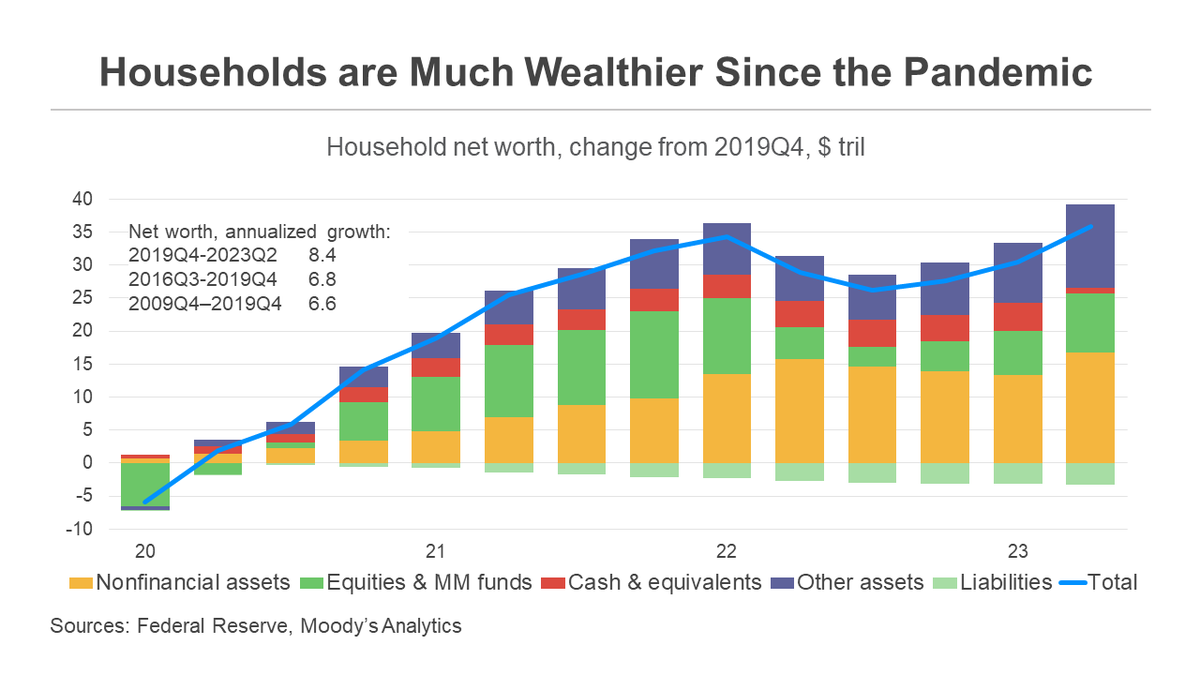

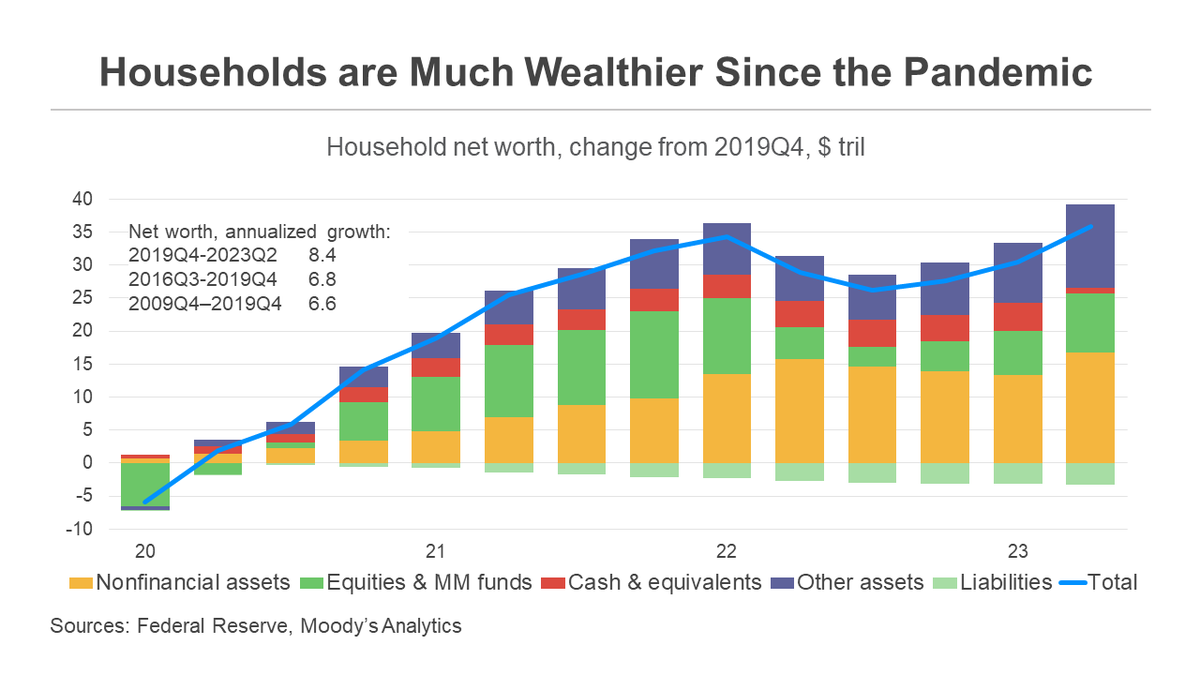

The record stock and house prices reflect the strong economy and in turn power it. This works through the so-called wealth effect – wealthier households are able and willing to save less and spend more. Indeed, stalwart consumer spending has driven the economy’s growth.

The record stock and house prices reflect the strong economy and in turn power it. This works through the so-called wealth effect – wealthier households are able and willing to save less and spend more. Indeed, stalwart consumer spending has driven the economy’s growth.

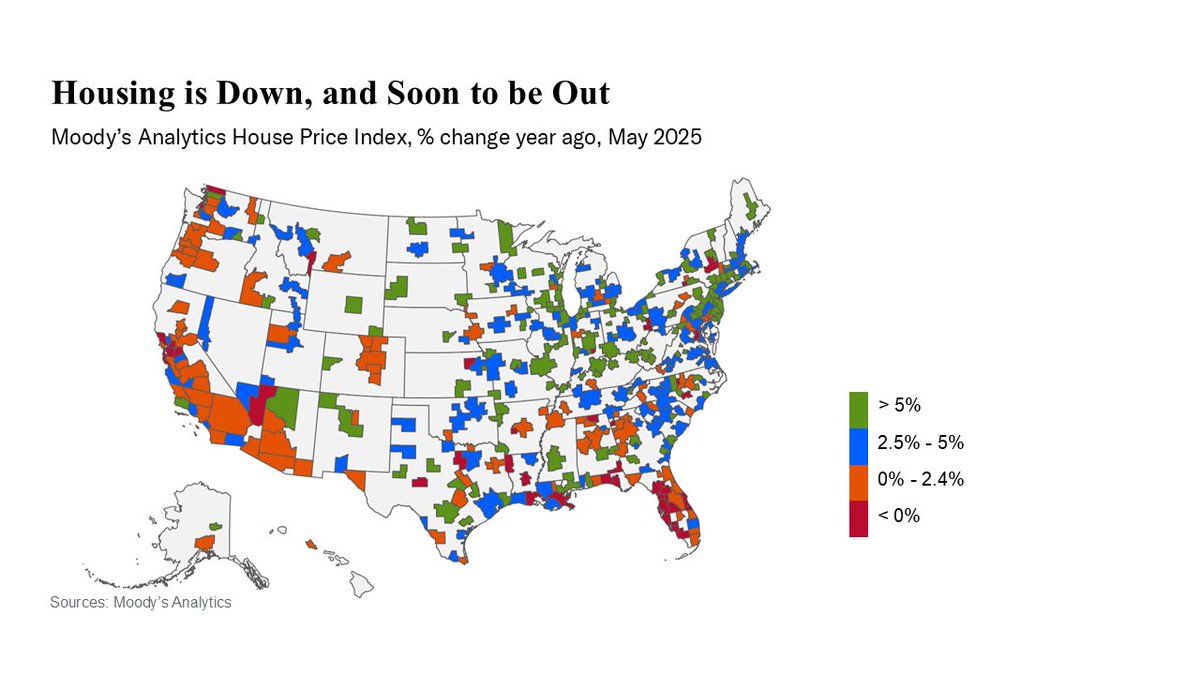

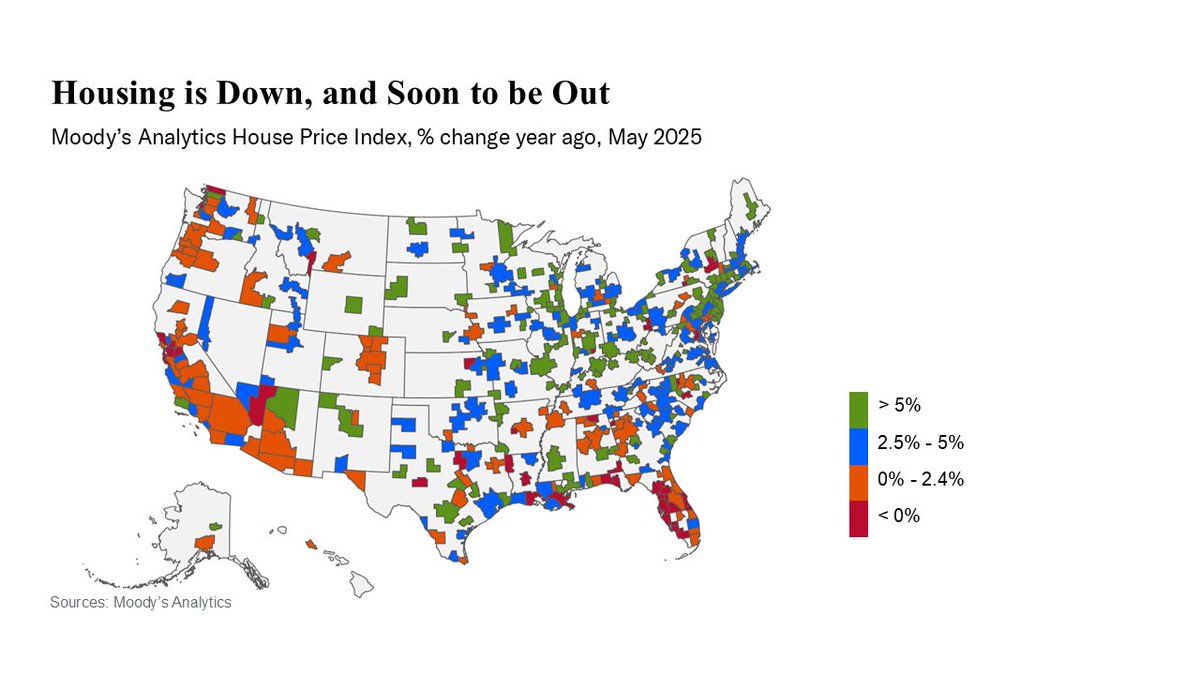

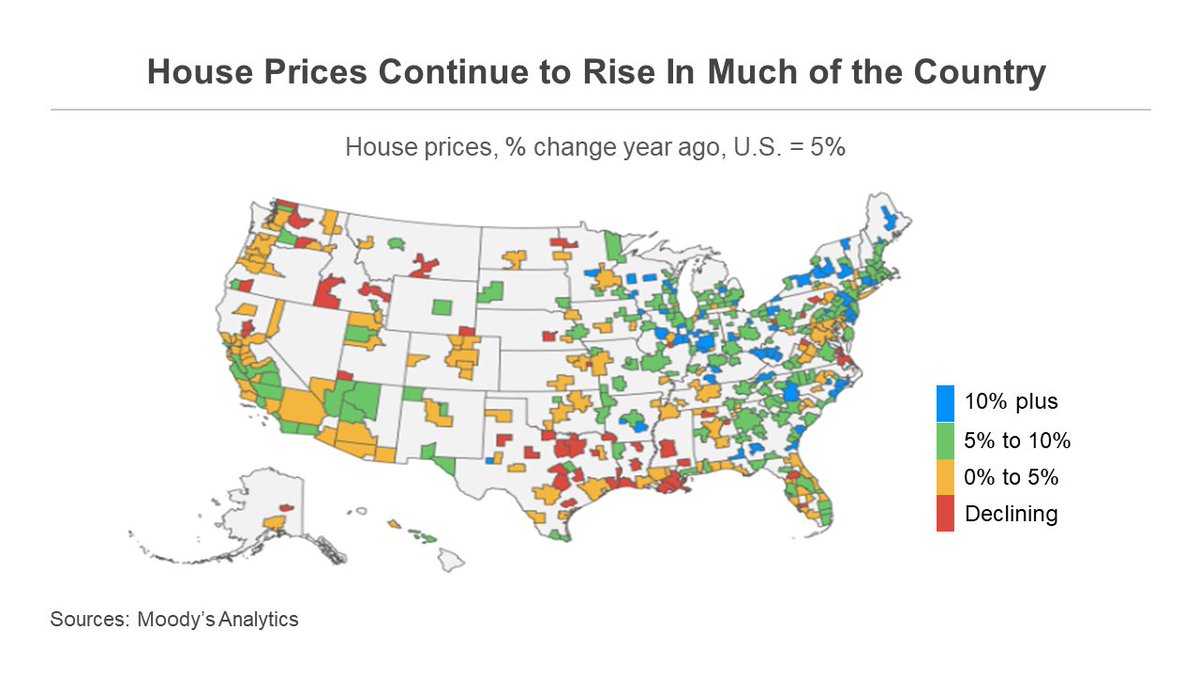

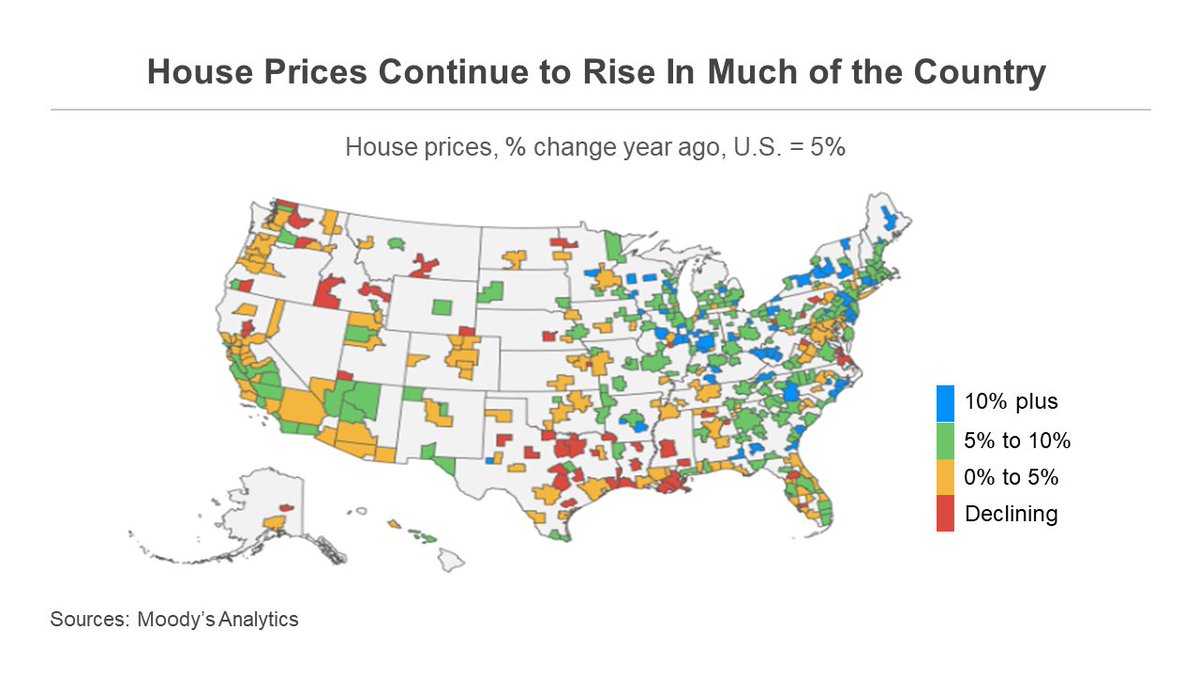

House prices are off from their all-time highs in and around Texas and the Pacific Northwest, but only modestly, and they continue to push higher in the Northeast, and industrial Midwest and Southeast. In Philly, my hometown, house prices are up 7% from a year ago.

House prices are off from their all-time highs in and around Texas and the Pacific Northwest, but only modestly, and they continue to push higher in the Northeast, and industrial Midwest and Southeast. In Philly, my hometown, house prices are up 7% from a year ago.

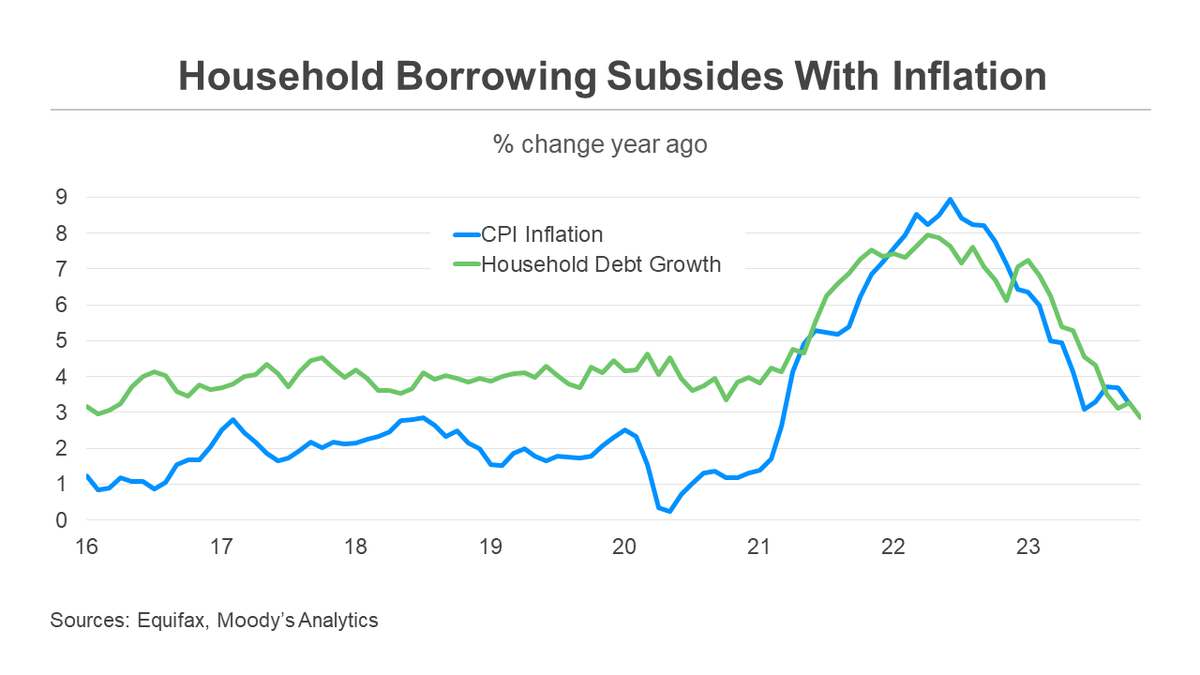

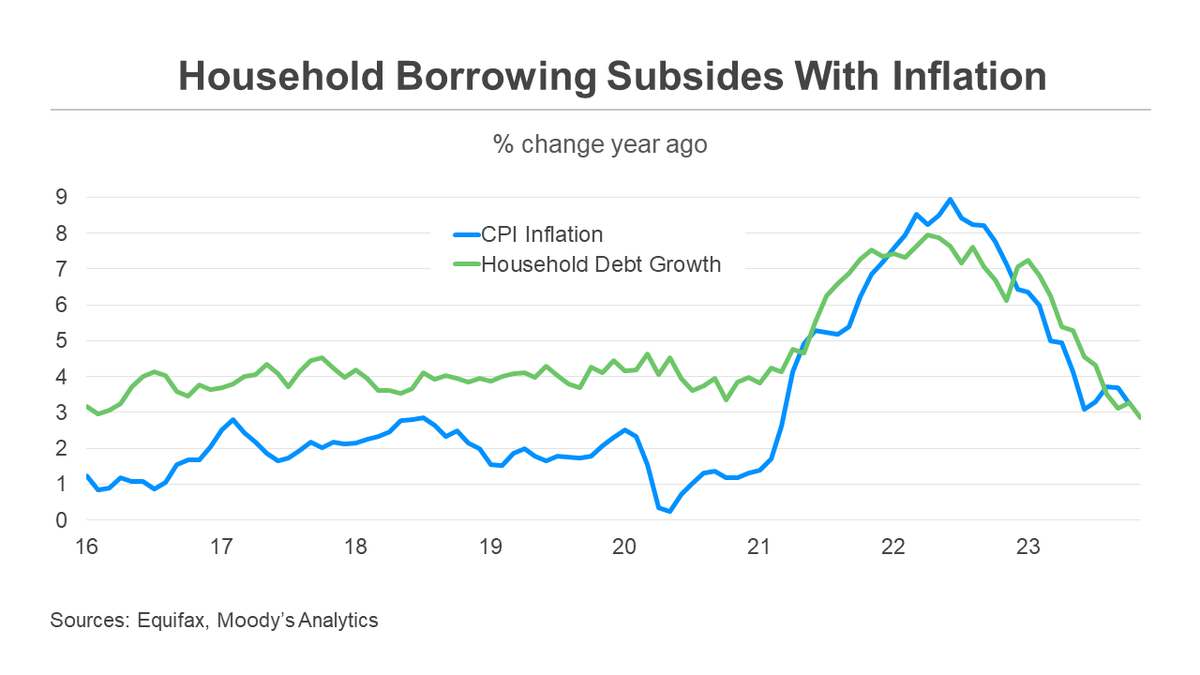

Credit cards, consumer finance loans, and auto loans did take off after the pandemic shutdowns ended. This reflected the higher inflation, as we had to spend more to buy the same stuff, and as the higher prices cut into the purchasing power of particularly low-income households.

Credit cards, consumer finance loans, and auto loans did take off after the pandemic shutdowns ended. This reflected the higher inflation, as we had to spend more to buy the same stuff, and as the higher prices cut into the purchasing power of particularly low-income households.

Housing is the poster child, despite surging mortgage rates, prices nationwide have simply gone sideways since peaking in summer 2022. Prices are still up a stunning 40% since the pandemic hit. Thank the severe affordable housing shortage for propping up prices.

Housing is the poster child, despite surging mortgage rates, prices nationwide have simply gone sideways since peaking in summer 2022. Prices are still up a stunning 40% since the pandemic hit. Thank the severe affordable housing shortage for propping up prices.

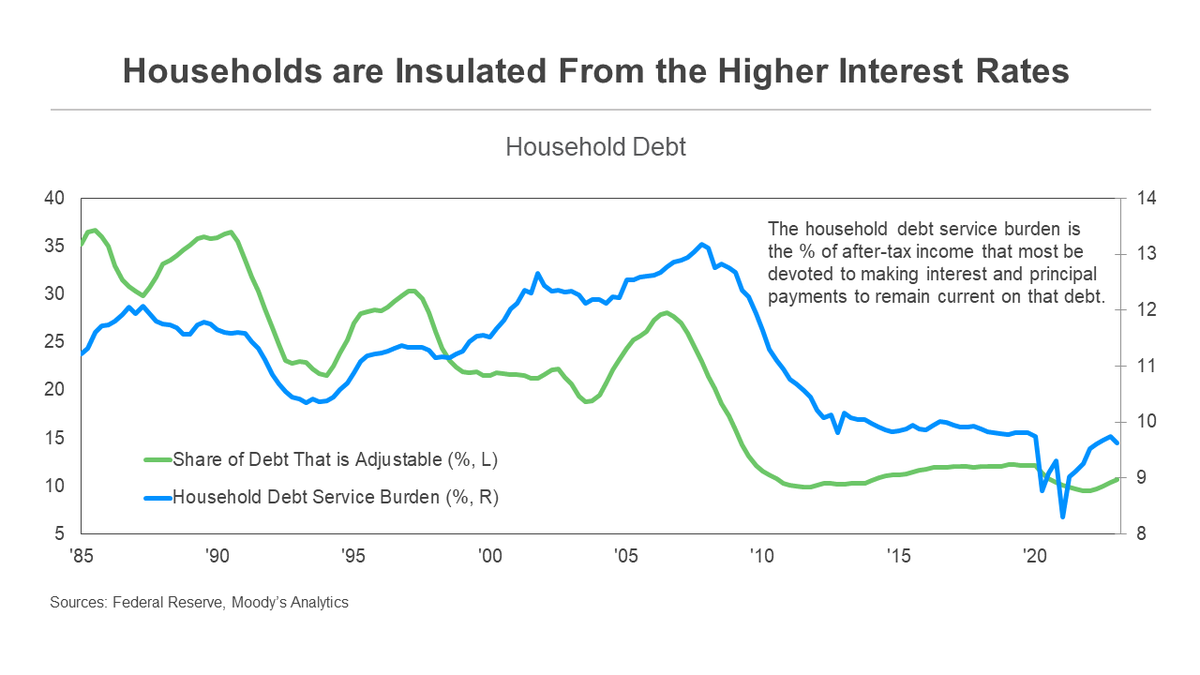

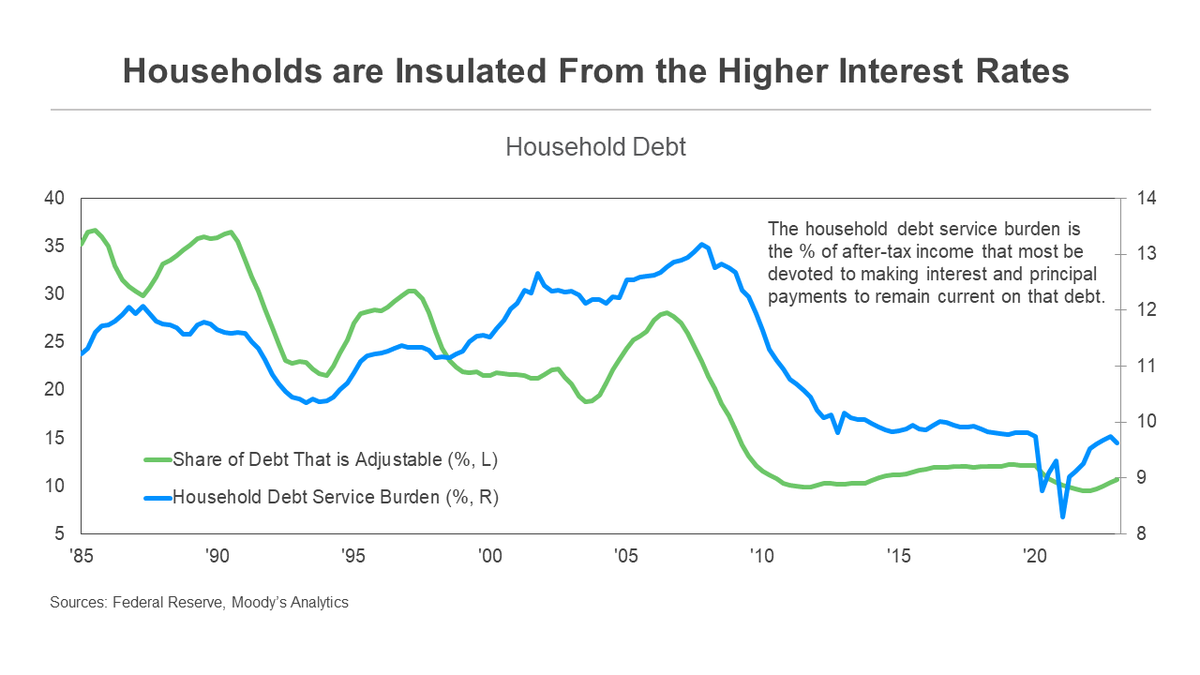

A big reason for the economy’s increasing rate insensitivity is that households have admirably locked in the previously record low rates. Only 10% of household debts have rates that adjust within one-year of a change in market rates. That’s down from 35% in the early 1980s.

A big reason for the economy’s increasing rate insensitivity is that households have admirably locked in the previously record low rates. Only 10% of household debts have rates that adjust within one-year of a change in market rates. That’s down from 35% in the early 1980s.

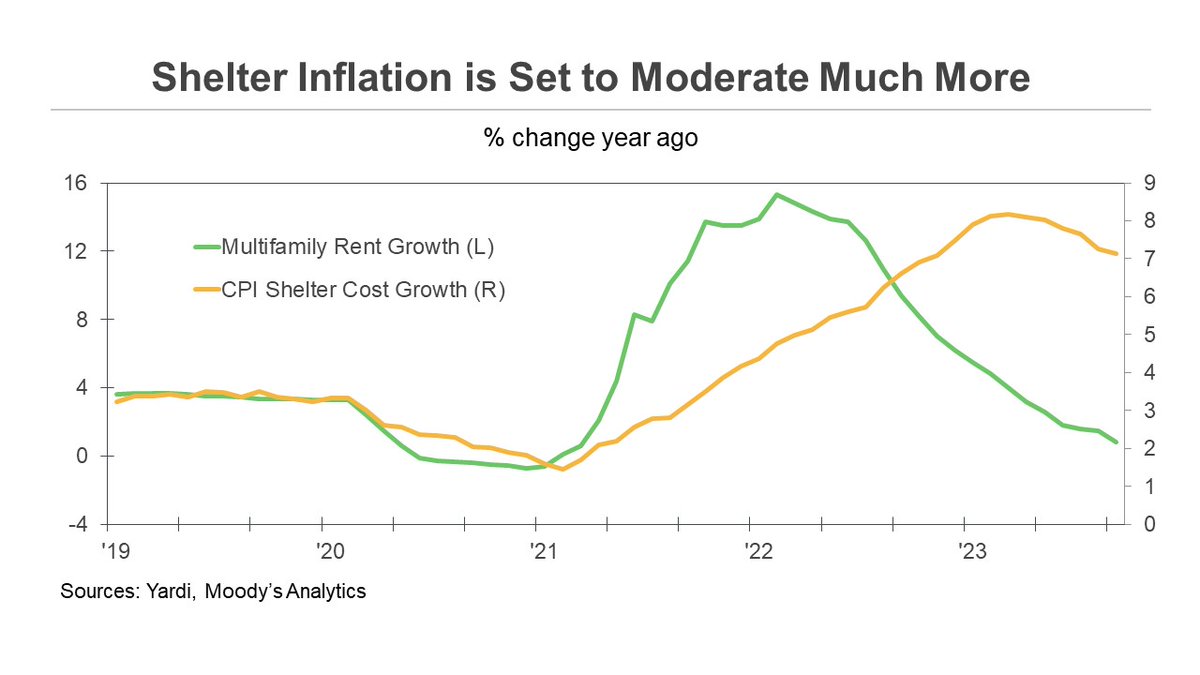

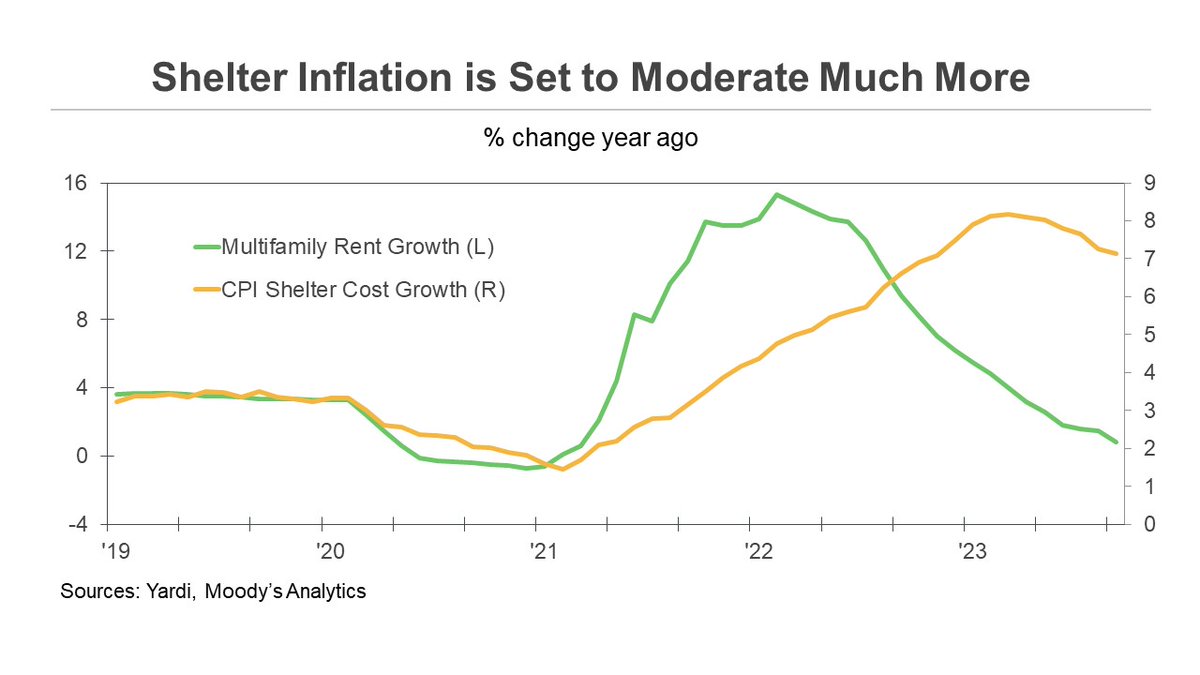

My confidence rests on market rents, which have gone flat over the past year. This will weigh on the growth in the shelter CPI in the coming year, given that the BLS uses market rents in its construction of the CPI, and that it takes about a year for rental leases to roll over.

My confidence rests on market rents, which have gone flat over the past year. This will weigh on the growth in the shelter CPI in the coming year, given that the BLS uses market rents in its construction of the CPI, and that it takes about a year for rental leases to roll over.

Unless lawmakers act by early June on the limit, the X-date, the Treasury won’t be able to pay all of the government’s bills on time. Investors are worried that means them too. The yield on 1-month T-bills has surged in recent days as they mature on the other side of the X-date.

Unless lawmakers act by early June on the limit, the X-date, the Treasury won’t be able to pay all of the government’s bills on time. Investors are worried that means them too. The yield on 1-month T-bills has surged in recent days as they mature on the other side of the X-date.