Equity Analysis at Rebellionaire. Finance and energy nerd. Giga-dad of 7 young kids. Catholic. Tweets are not financial advice!

How to get URL link on X (Twitter) App

It's no surprise that $TSLA ranks high on this list, as it is something of an indication that it may be overvalued (markets view, not ours) relative to peers. In a tough macro environment, it does make sense that all multiples will be compressed, but growth ones especially.

It's no surprise that $TSLA ranks high on this list, as it is something of an indication that it may be overvalued (markets view, not ours) relative to peers. In a tough macro environment, it does make sense that all multiples will be compressed, but growth ones especially.

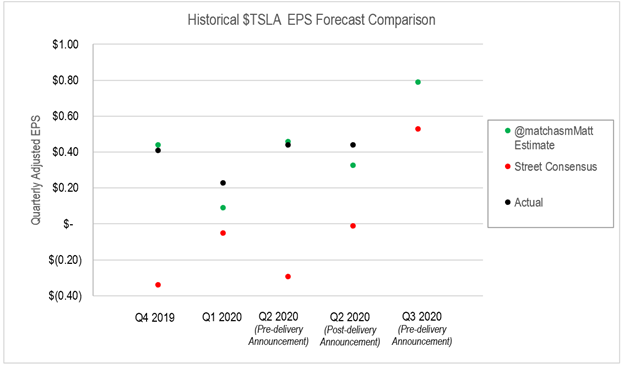

Tesla’s PEG ratio has fallen dramatically since November, and these figures are using analyst forward estimates which have repeatedly proven to be too conservative. Using my estimates Tesla’s PEG is already well below 1.0, which is a strong signal that the stock is mispriced.

Tesla’s PEG ratio has fallen dramatically since November, and these figures are using analyst forward estimates which have repeatedly proven to be too conservative. Using my estimates Tesla’s PEG is already well below 1.0, which is a strong signal that the stock is mispriced.

While bragging about my past accuracy is all well and good, what really gets me excited is when I look forward and realize that Wall Street is only expecting $15.23 for Tesla's 2023 Adj. EPS.

While bragging about my past accuracy is all well and good, what really gets me excited is when I look forward and realize that Wall Street is only expecting $15.23 for Tesla's 2023 Adj. EPS.

https://twitter.com/heydave7/status/1478423791726383107Analyst consensus Adj. Earnings for AMZN for FY '22 is $26B. Analyst consensus for TSLA is $9.4B, and the valuation difference between the two companies kinda makes sense if this is the way '22 pans out.

Many of these renewable projects were built over a decade ago, as Germany guaranteed a rate of return via above-market feed-in tariffs, which ensured the financial viability of the emerging technology.

Many of these renewable projects were built over a decade ago, as Germany guaranteed a rate of return via above-market feed-in tariffs, which ensured the financial viability of the emerging technology.

https://twitter.com/MatchasmMatt/status/1275160126081708032