Most stock market forecasts are both boring & wrong so i decided to make my forecasts lively & wrong.

Tweets are for information purpose only.

23 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/MeetshahV/status/1450690655659782145?t=EVPSnj_OJtJxF1MzdtA_BQ&s=08

The Psychology of Money.

The Psychology of Money.

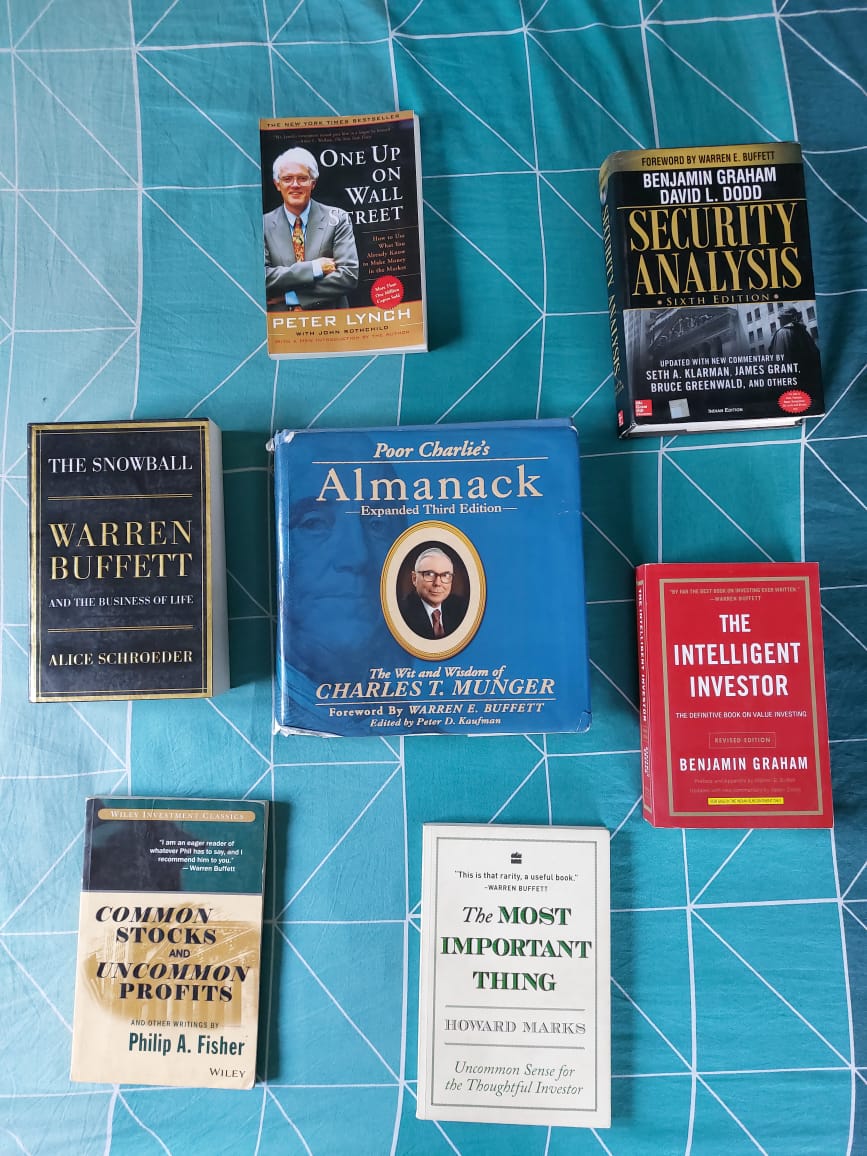

One up on wall street by Peter Lynch.

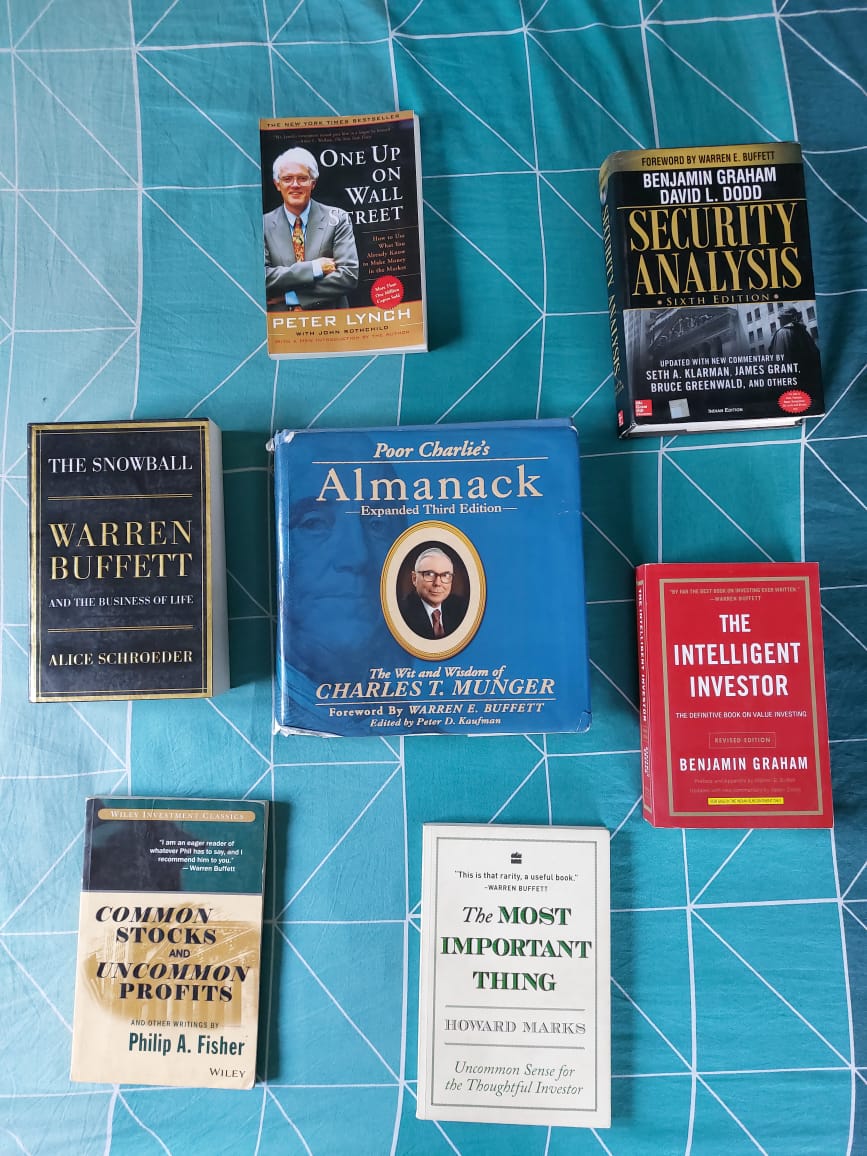

One up on wall street by Peter Lynch.