Market Analyst/Trader | Equities, FX/FI, commodities | Macro commentary | 24 | DMs always open

How to get URL link on X (Twitter) App

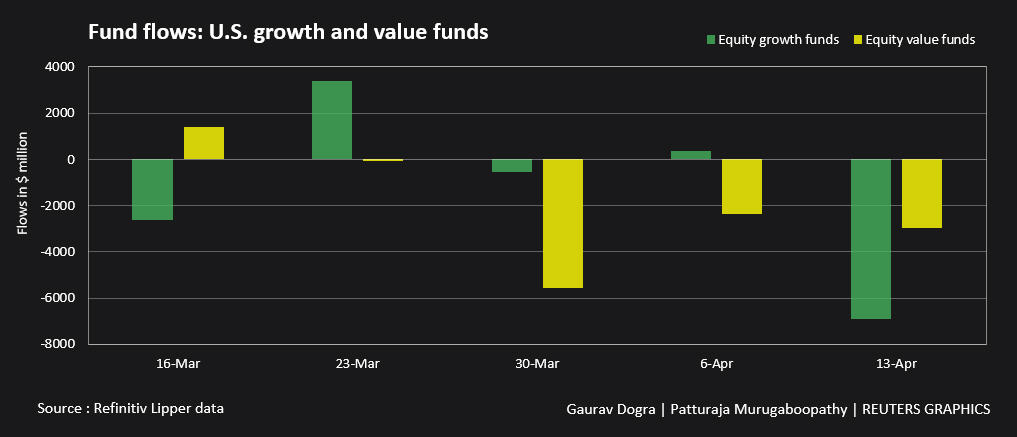

🔹 Growth funds saw weekly net selling of $6.91 billion, which was the biggest outflow since Jan 26.

🔹 Growth funds saw weekly net selling of $6.91 billion, which was the biggest outflow since Jan 26.

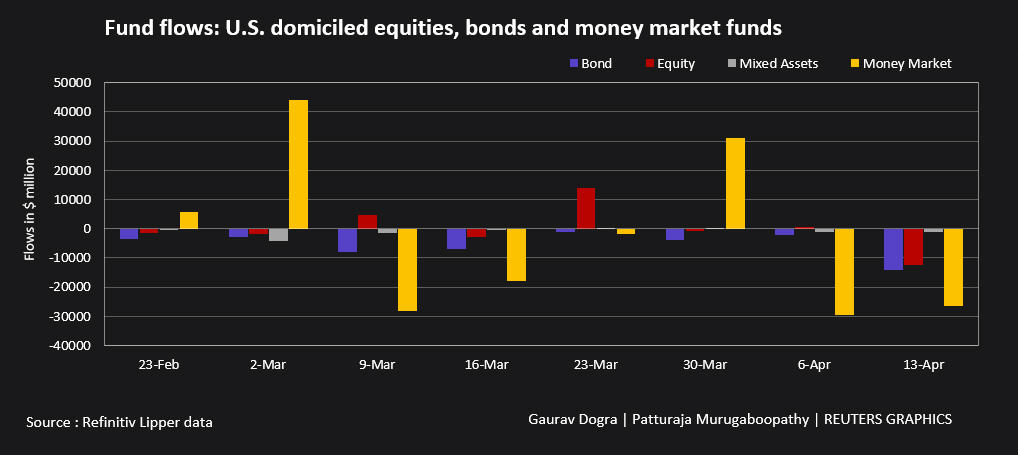

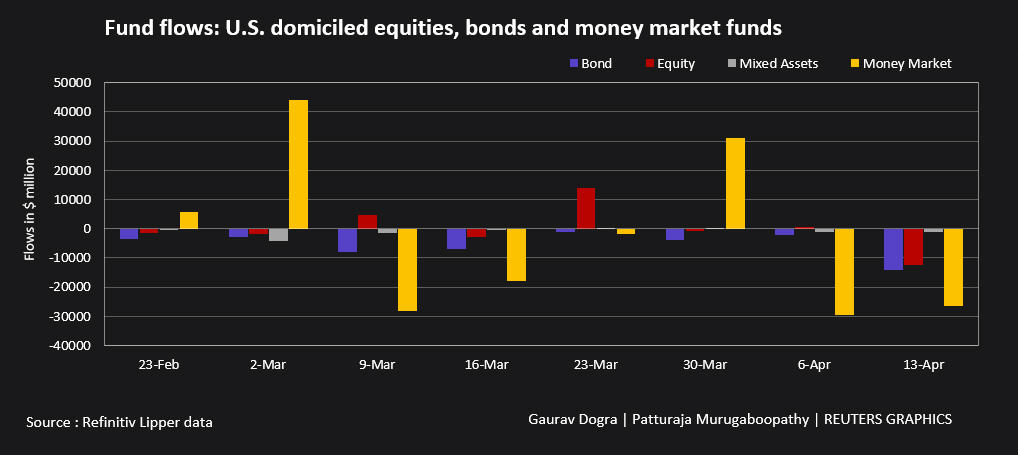

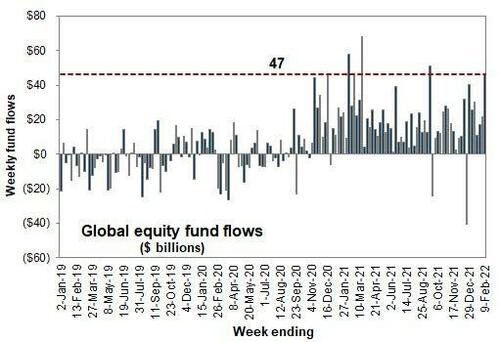

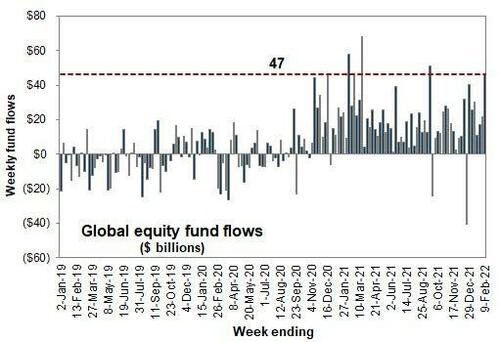

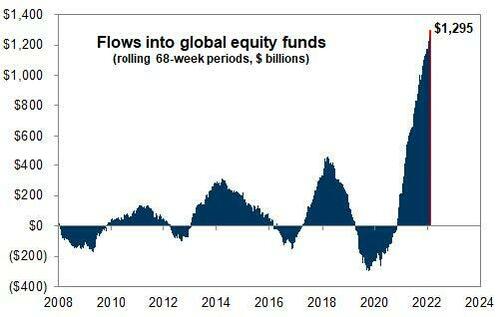

🔹 Adjust for quarterly rebalances (inflows one week vs. outflows the next), this is the 2nd largest weekly inflow on record, after $58.087B, which happened this exact week in 2021 (2/10/2021).

🔹 Adjust for quarterly rebalances (inflows one week vs. outflows the next), this is the 2nd largest weekly inflow on record, after $58.087B, which happened this exact week in 2021 (2/10/2021).

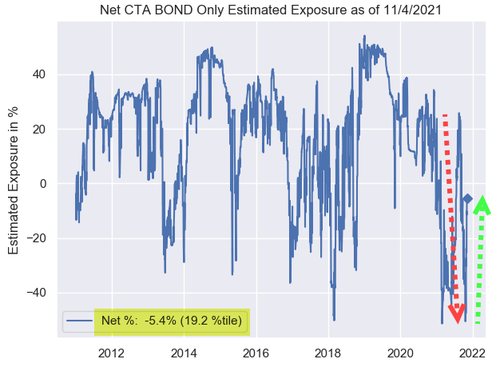

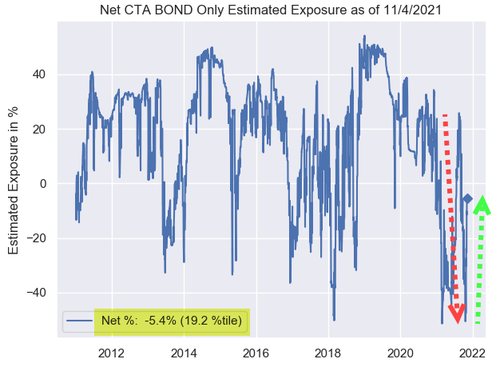

- Net Exposure across G10 Bond futures positions in the CTA model was close to max short at just 0.4%-ile on a 10 year historical lookback.

- Net Exposure across G10 Bond futures positions in the CTA model was close to max short at just 0.4%-ile on a 10 year historical lookback.

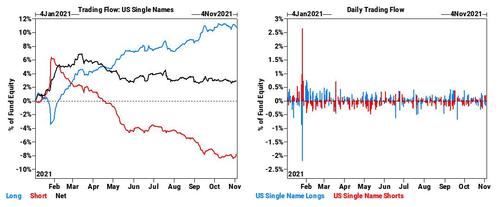

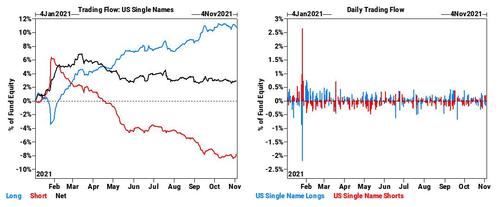

🔹 Shorts in the constituents of the Goldman "Most Shorted basket" collectively decreased -9.7% yesterday (-11.3% week/week).

🔹 Shorts in the constituents of the Goldman "Most Shorted basket" collectively decreased -9.7% yesterday (-11.3% week/week).

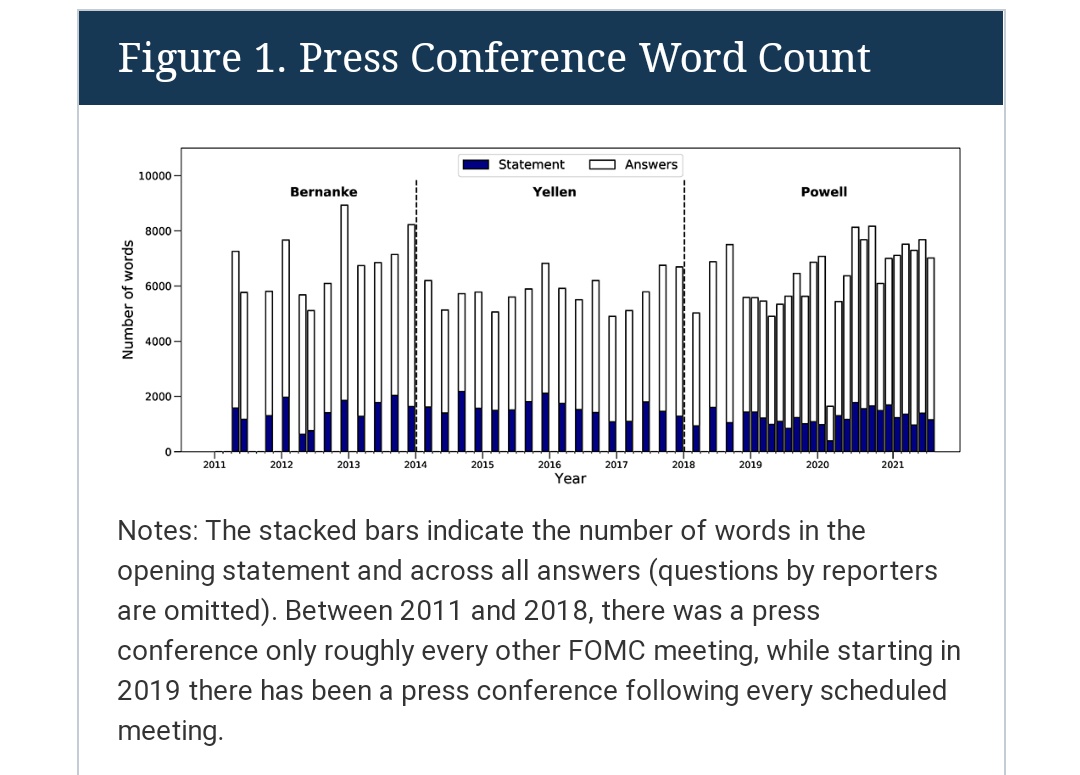

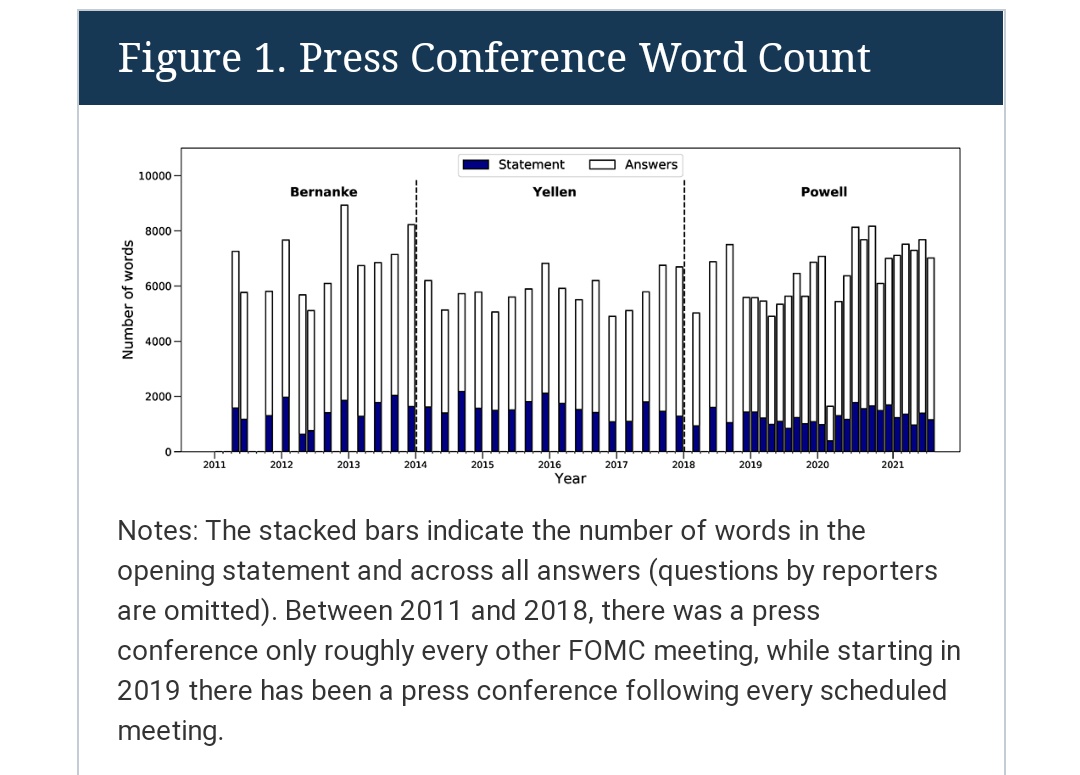

https://twitter.com/MichaelGoodwell/status/1448005545781235714Press conference word count

https://twitter.com/MichaelGoodwell/status/1411826300185157633

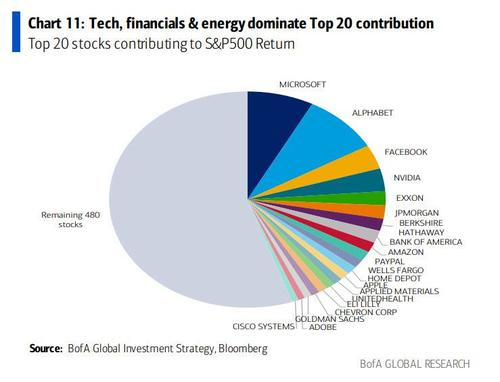

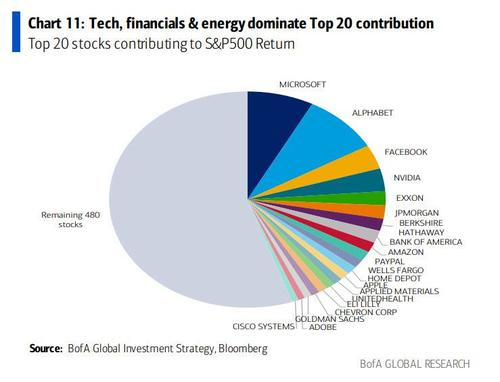

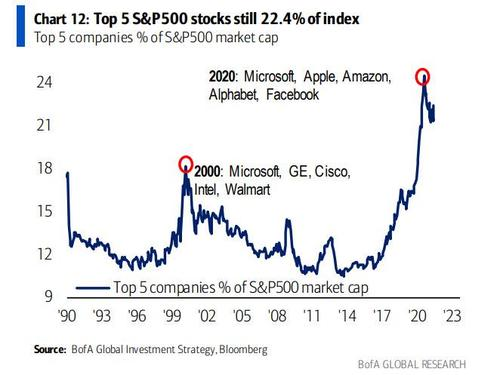

The “known unknowns” for H2 2021 - according to BofA:

The “known unknowns” for H2 2021 - according to BofA:

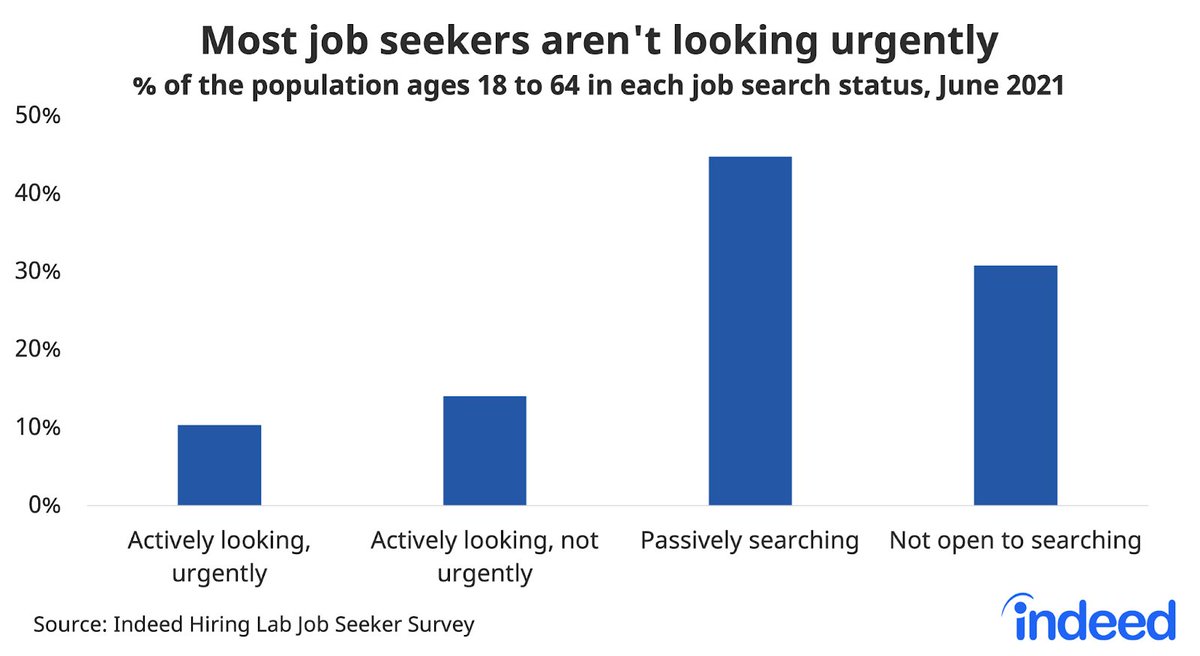

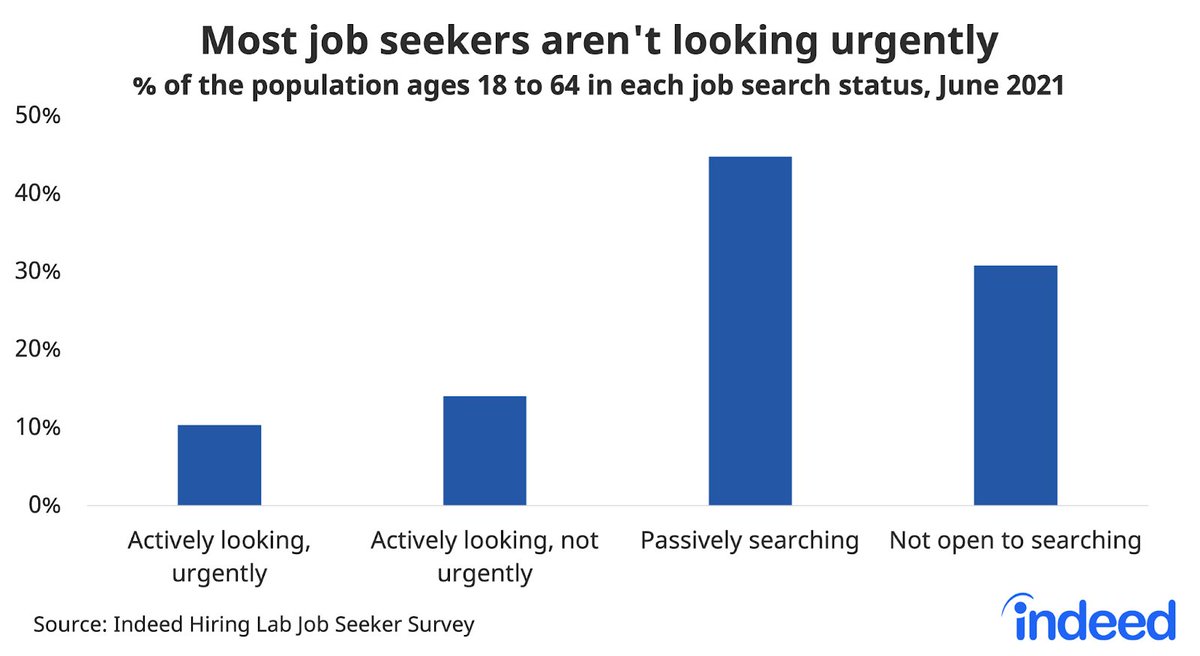

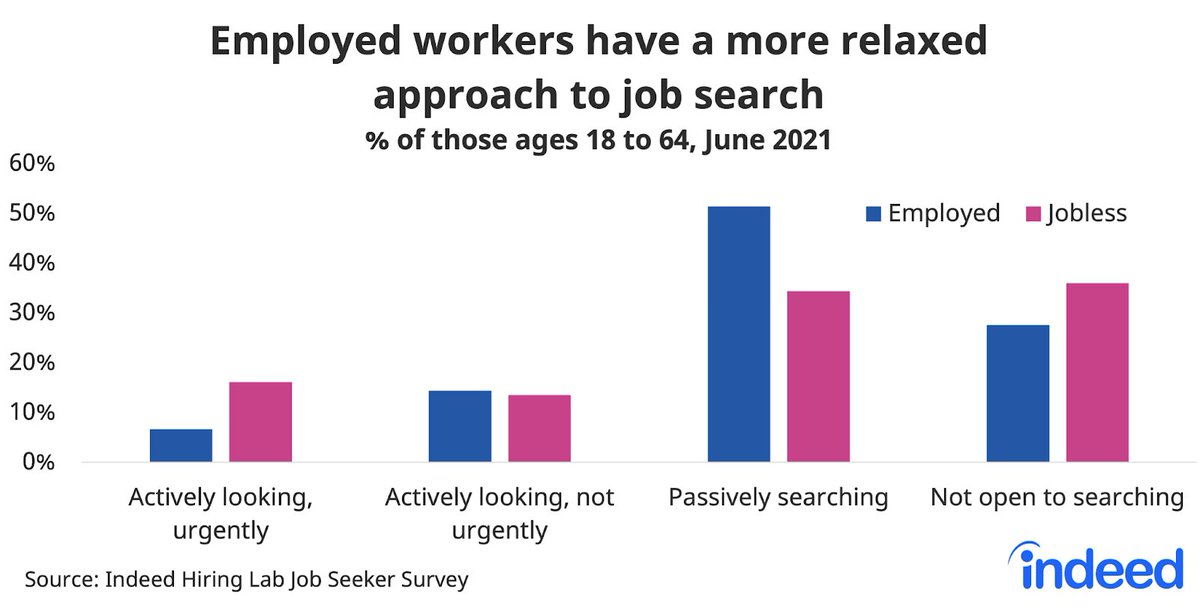

🔹 Workers with jobs are much more likely to look for work passively. They’re open to getting a new job, but they’re not actively seeking one.

🔹 Workers with jobs are much more likely to look for work passively. They’re open to getting a new job, but they’re not actively seeking one.

https://twitter.com/MichaelGoodwell/status/1404617331339403267

https://twitter.com/MichaelGoodwell/status/1399377344733892610

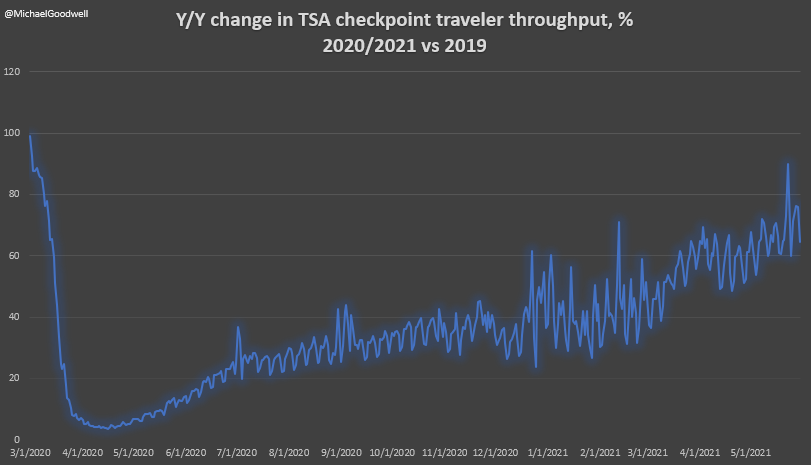

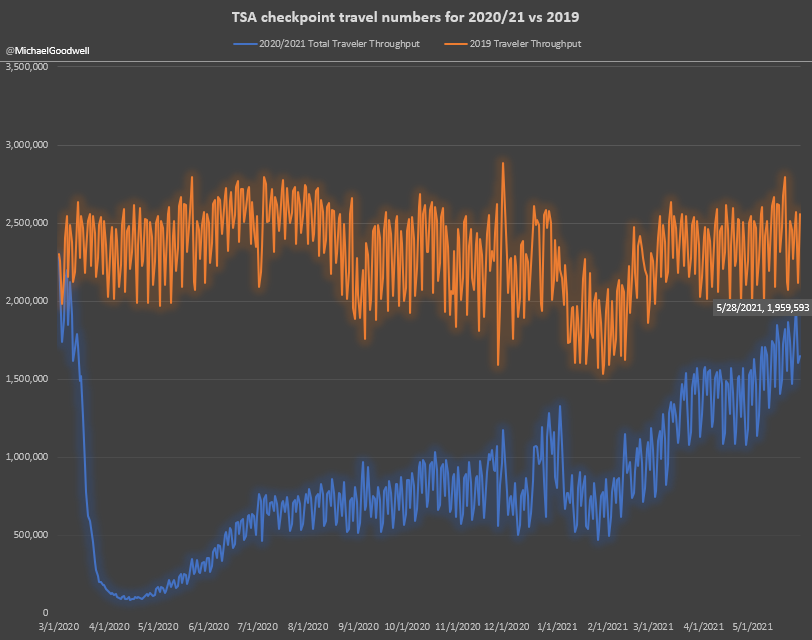

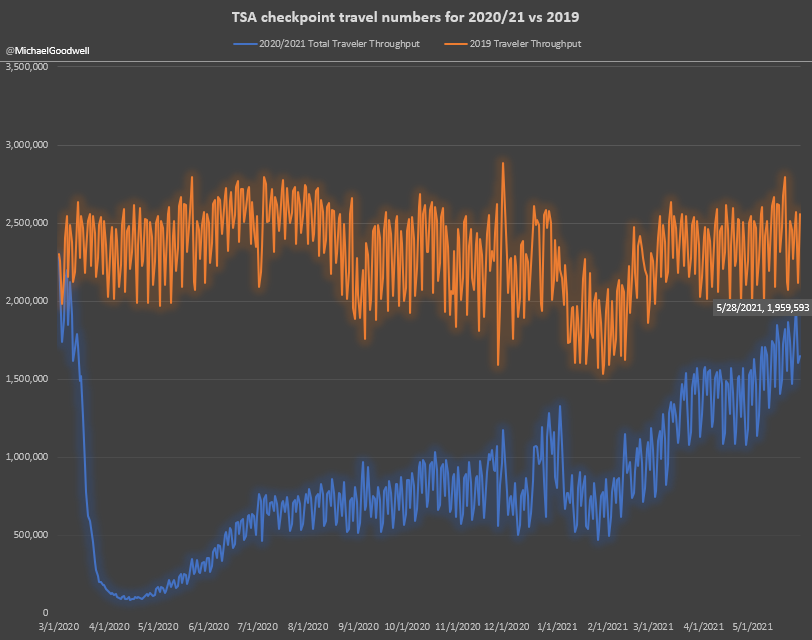

🔹 However, as shown below, air travel numbers are only around 70% of pre-pandemic (2019) numbers.

🔹 However, as shown below, air travel numbers are only around 70% of pre-pandemic (2019) numbers.