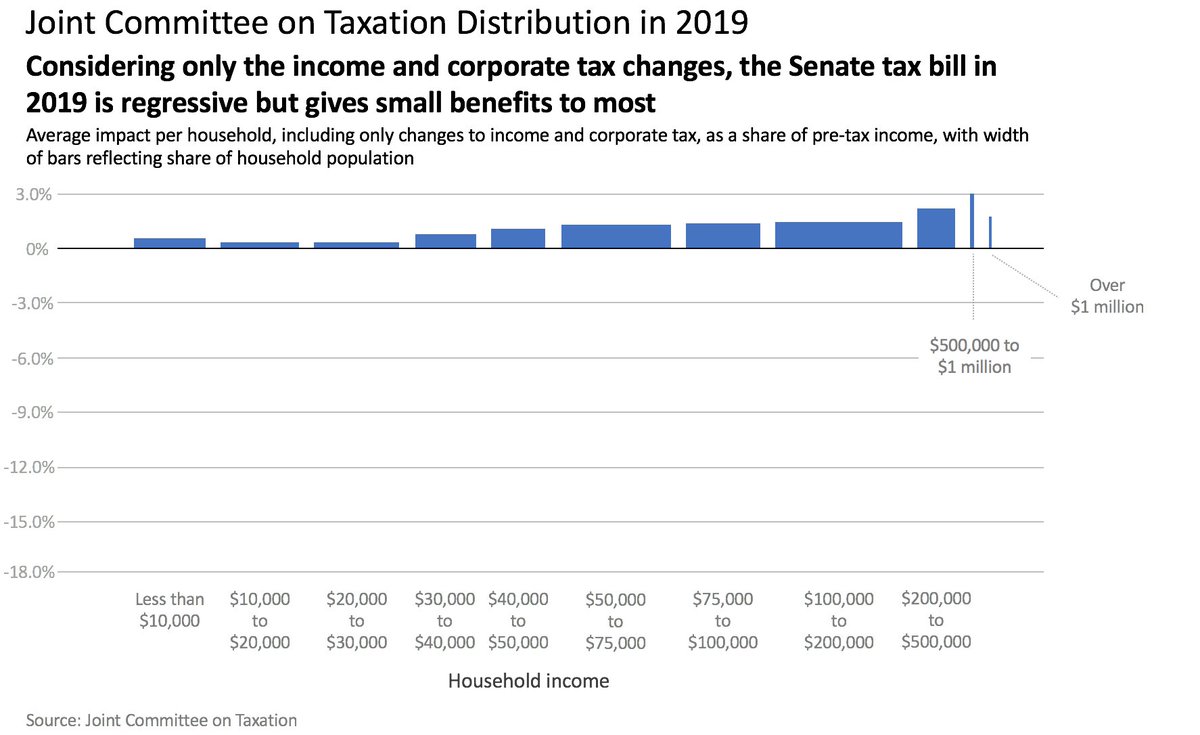

Thinks we shouldn't give more tax breaks to billionaires.

Formerly @ombpress @Groundwork @RooseveltInst @amprog @senatebudget @HELPCmteDems. Personal account.

How to get URL link on X (Twitter) App

https://twitter.com/DeItaone/status/1928161909448007711Let's step back. What is the "deficit." This is actually important and a lot of people get it wrong. The deficit is the difference between annual spending (money out) and annual revenue (money in).

https://twitter.com/politico/status/1081207384960368640@AOC Starting with the basic fiscal implications, the best and most recent research suggests that rates around 70 percent for top earners will raise the most revenue. At 37% currently, we are leaving a lot of $$ on the table.