Commentary and analysis. Philosophy. Funny, mood changes etc. Not financial advice. Always do your own research. Telegram channel: https://t.co/BFT2ax7Hns

How to get URL link on X (Twitter) App

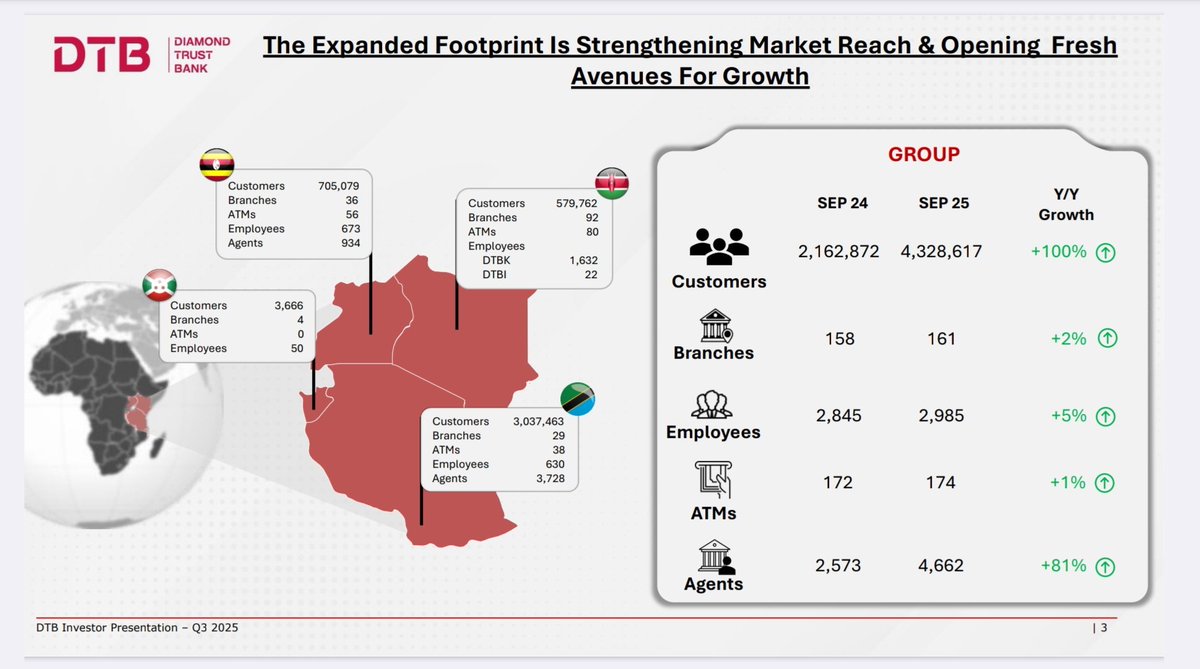

1. DTB has over 3 million customers in Tanzania, 705,000 customers in Uganda and 580,000 customers in Kenya. The true definition of an East African bank.

1. DTB has over 3 million customers in Tanzania, 705,000 customers in Uganda and 580,000 customers in Kenya. The true definition of an East African bank.

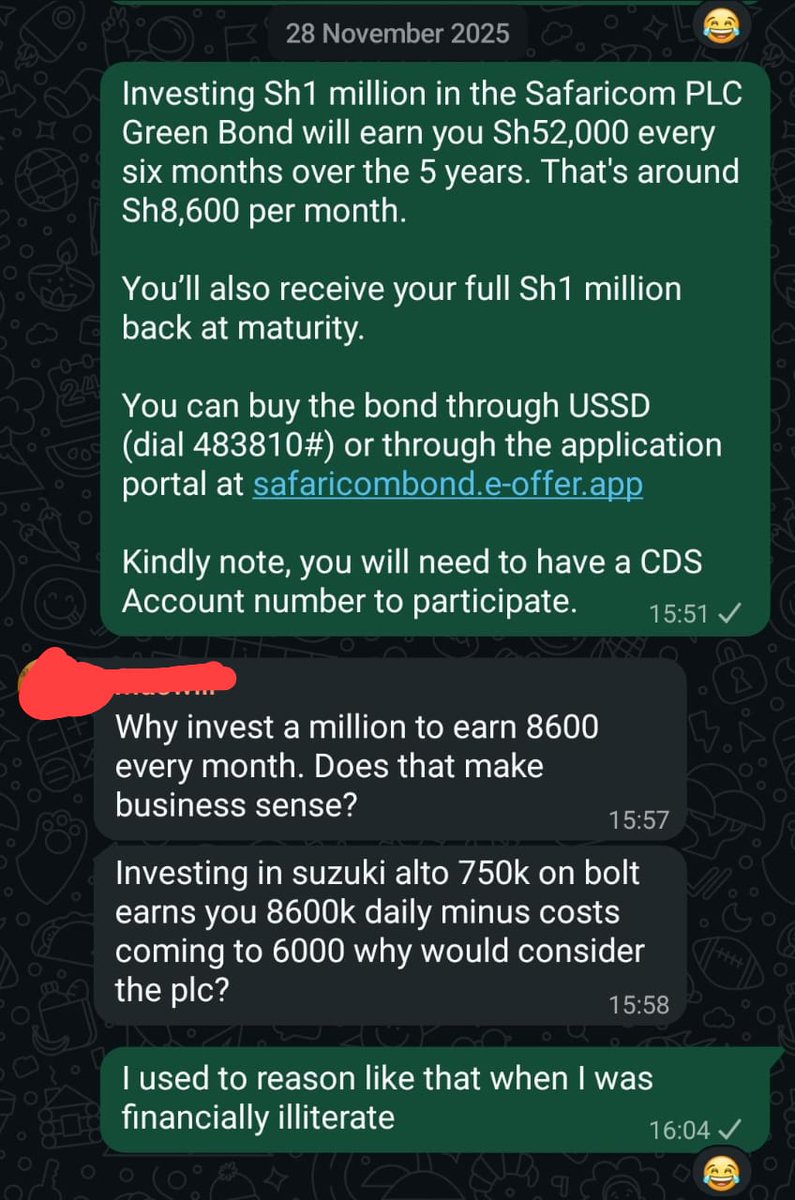

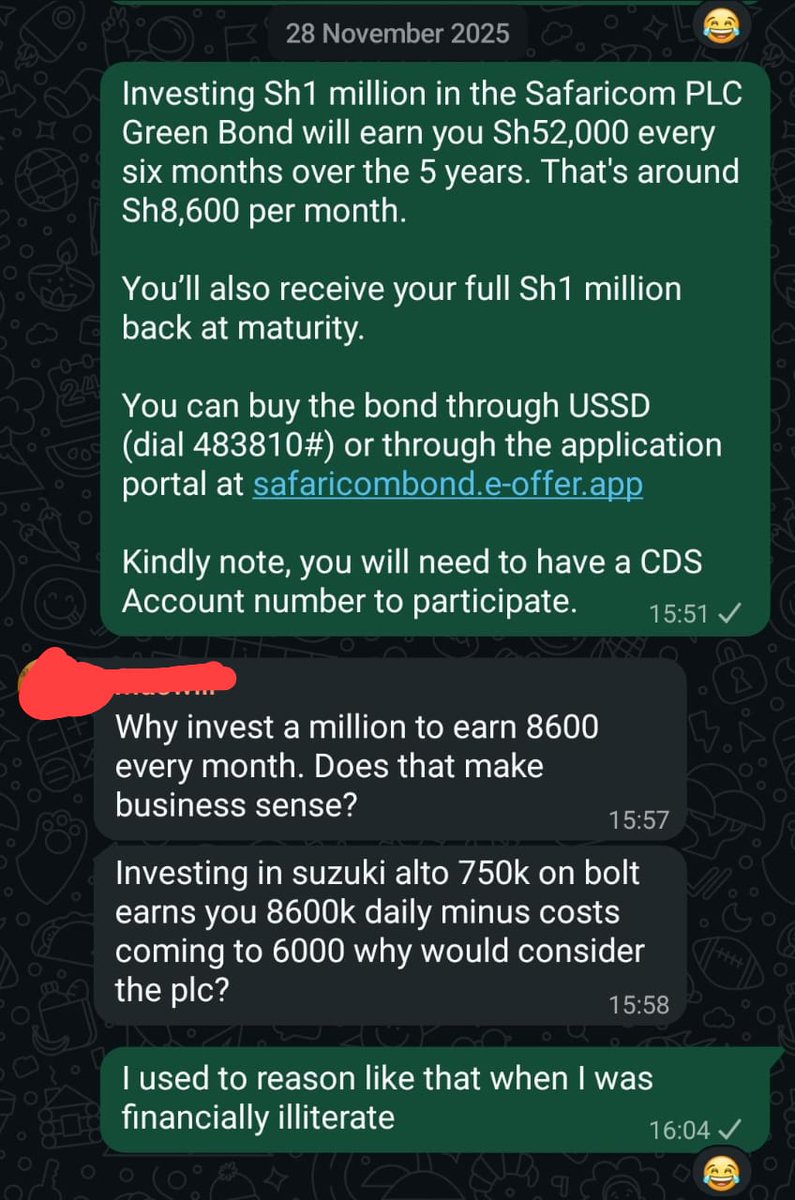

People who think in long-term don’t ask 'How much can this make this month?' They ask 'What does this do to my balance sheet, my risk, my time, and my future optionality?'

People who think in long-term don’t ask 'How much can this make this month?' They ask 'What does this do to my balance sheet, my risk, my time, and my future optionality?'

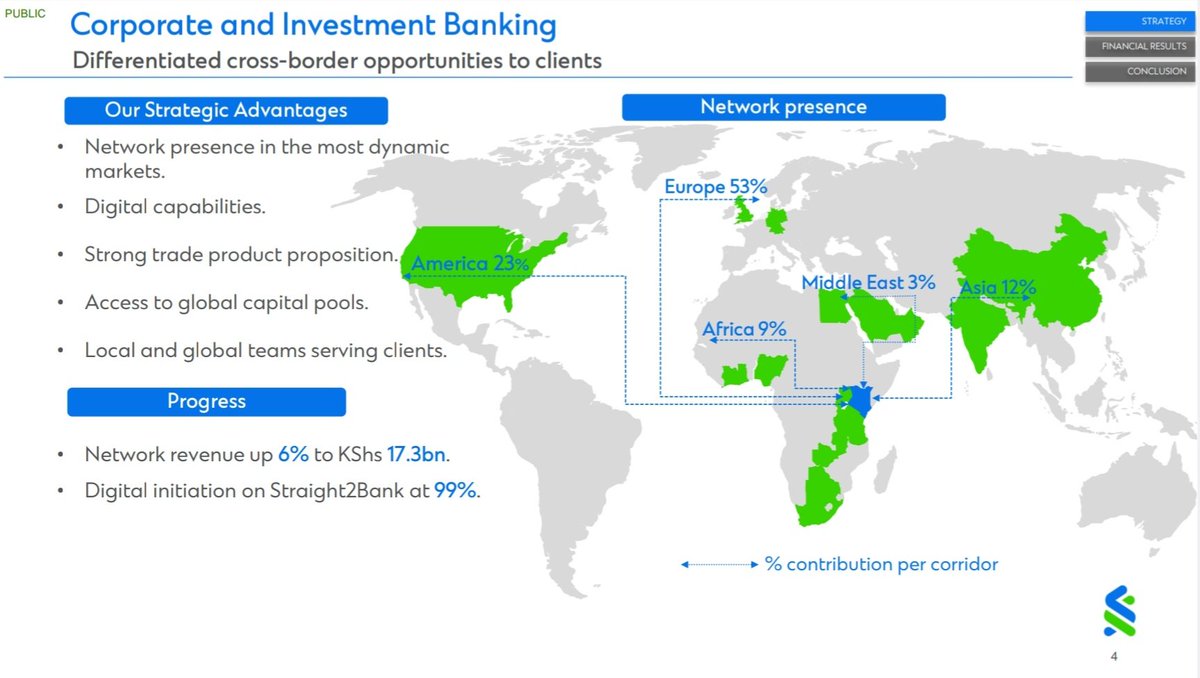

1. The bank's main appeal for corporate clients is its cross-border presence and availability of reliable international instruments.

1. The bank's main appeal for corporate clients is its cross-border presence and availability of reliable international instruments.