LT Investor

Largest holding $PLTR $AMD $TSLA (75%)

Others $XYZ $AMZN $NVDA $LMT $HIMS $BTC $PYPL $META $SNAP $GOOG $PSFE $DIS $GRAB $WING $DKNG $ADBE $BROS $TSM

How to get URL link on X (Twitter) App

From @AnthonyPY_Tan on Q2

From @AnthonyPY_Tan on Q2

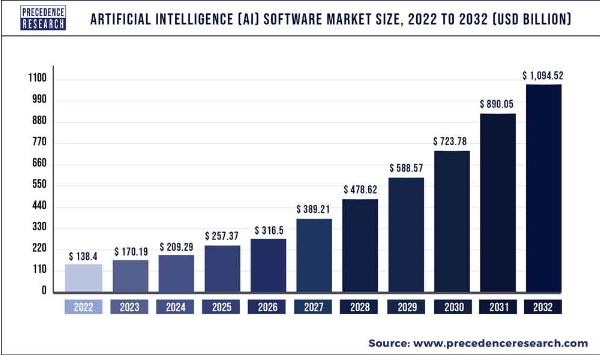

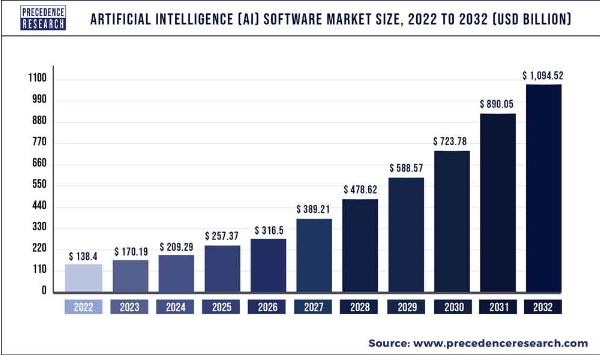

Rising demand for improved business IoT solutions,self-driving cars,and robots will likely drive the growth of the AI software market. AI software is one of the most efficient ways to reduce human efforts consumption;it is integrated into most fields,from healthcare to defense.

Rising demand for improved business IoT solutions,self-driving cars,and robots will likely drive the growth of the AI software market. AI software is one of the most efficient ways to reduce human efforts consumption;it is integrated into most fields,from healthcare to defense.