Chemical Engr. Full time FNO Trader since Dec. 2017.. Views only for learning. No Paid Tips. No Telegram. Old telegram channel Inactive.

104 subscribers

How to get URL link on X (Twitter) App

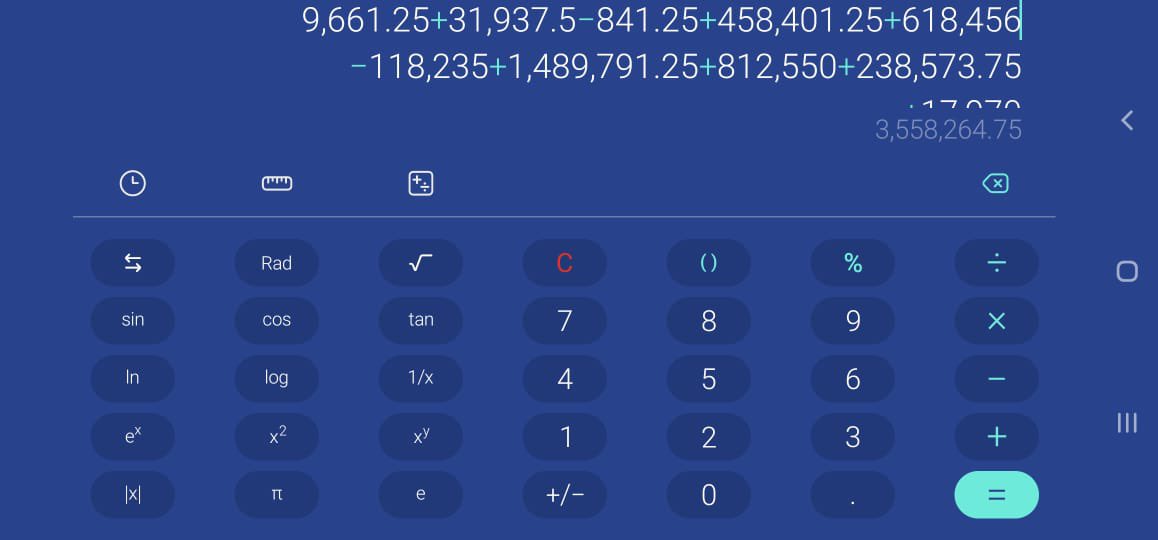

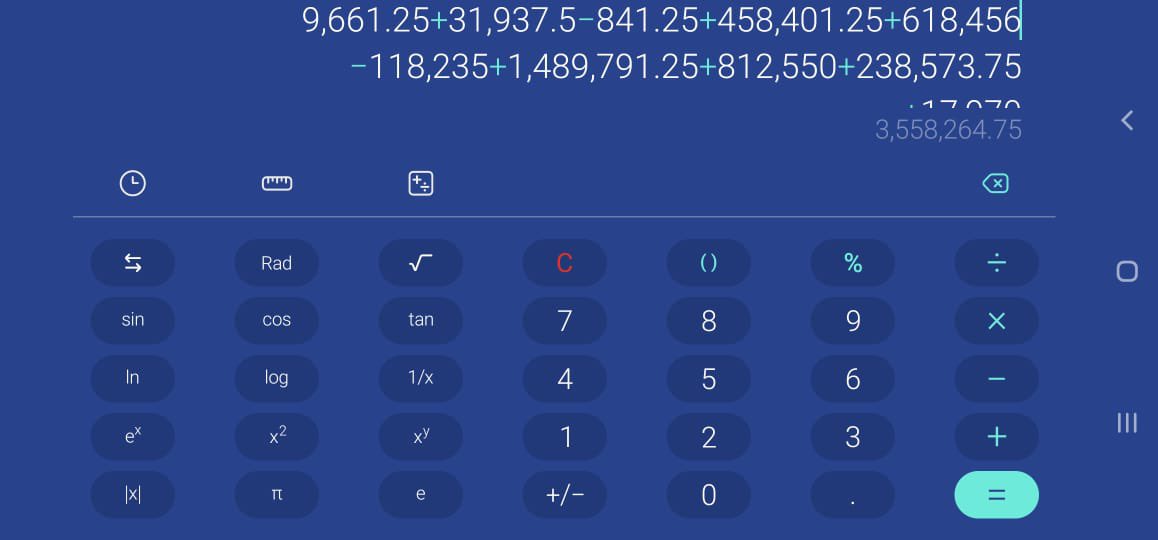

https://twitter.com/snehach95169600/status/1488826078718459905If I will add all figure then Profit will come to a total of 3658264.75