Chief economist at @InnovateEconomy. Host of the EconTwitter Water Cooler, live on twitter spaces and downloadable here: https://t.co/toyjfDruRu

How to get URL link on X (Twitter) App

https://twitter.com/Noahpinion/status/1912403016088731845Let me give concrete examples. First, high skilled immigration is a core tenant of neoliberalism. But if we just staple green cards to diplomas we will create many problems eg diploma mills & probably end up with blowback. We need a real plan. Here it is eig.org/exceptional-by…

@I_Am_NickBloom @arjun_ramani3 Zipcode is sparse for CA, so lets look at the distribution of county level price changes from 8/22 to 4/23... Uh oh

@I_Am_NickBloom @arjun_ramani3 Zipcode is sparse for CA, so lets look at the distribution of county level price changes from 8/22 to 4/23... Uh oh

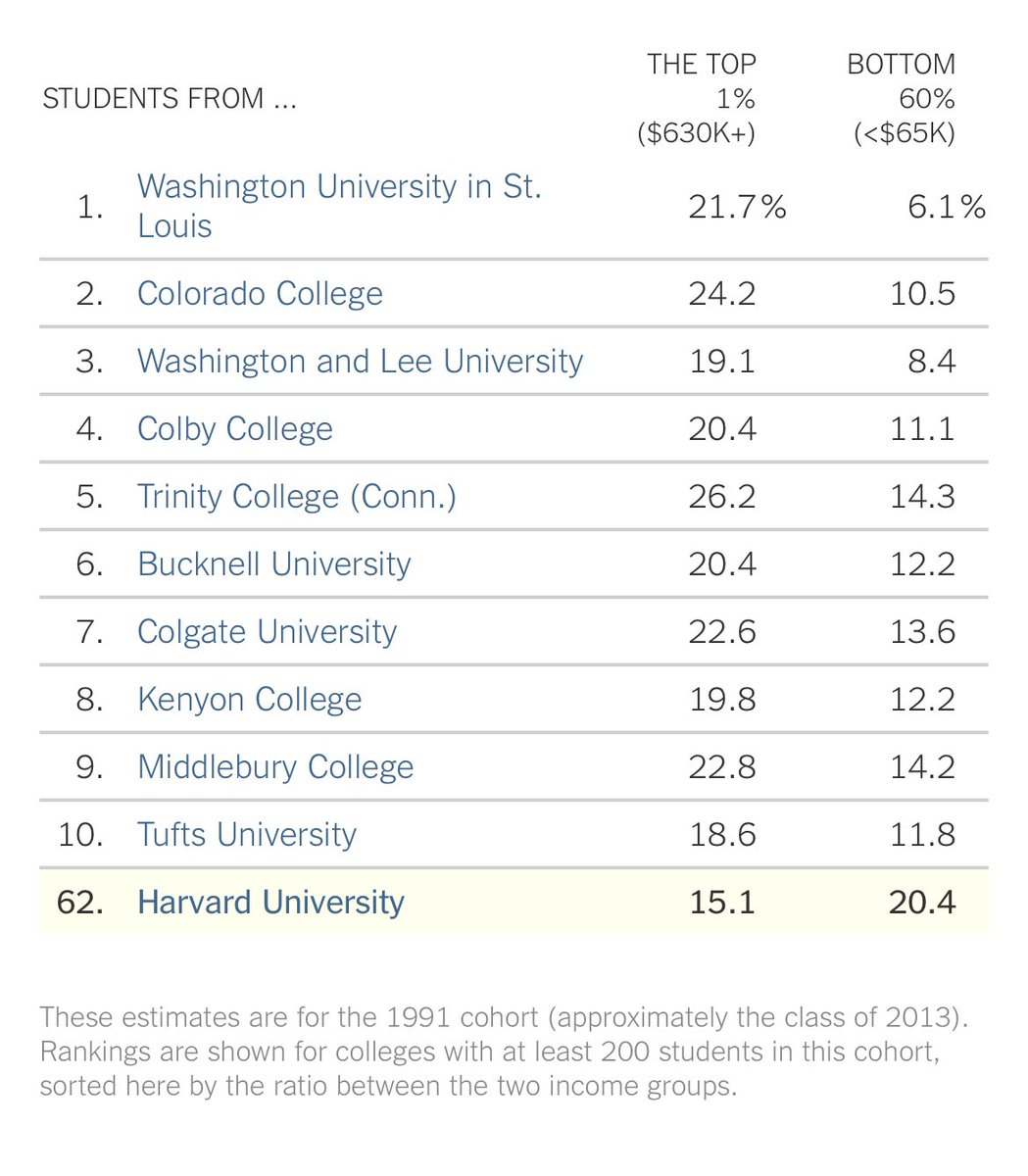

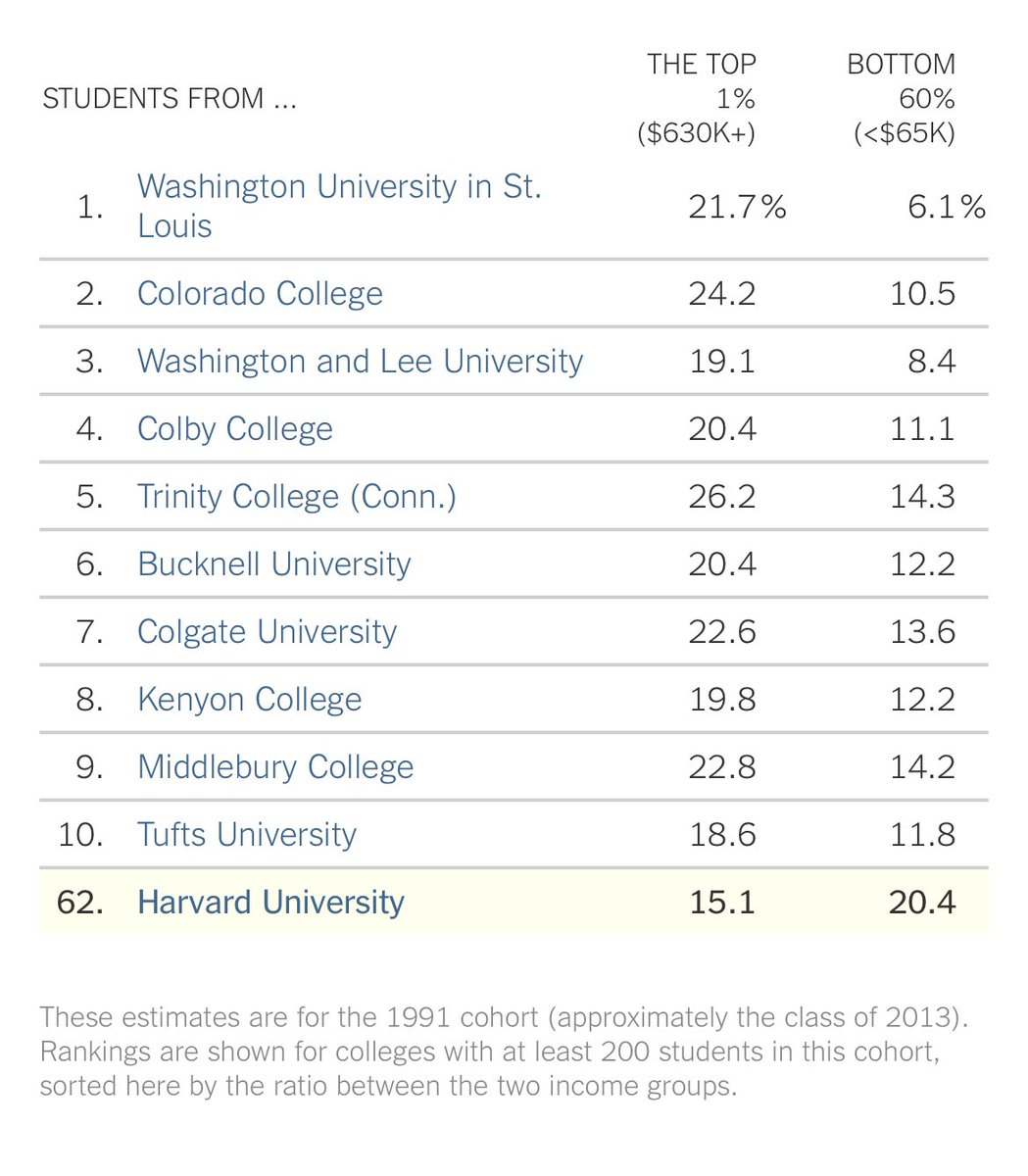

nytimes.com/interactive/20…

nytimes.com/interactive/20…

How will we determine excess profits due to innovation or increased demand versus simply profiting “too much” from the incentives?

How will we determine excess profits due to innovation or increased demand versus simply profiting “too much” from the incentives?