Crypto Econ Guy

Building: @pandaterminal | @deployfinance

Analyst: @jlabsdigital | Brownstone Research

Writings: https://t.co/O6alAX2Abq

5 subscribers

How to get URL link on X (Twitter) App

August 9, 1995

August 9, 1995

The goal of every layer one asset should be to spark Jevons Paradox

The goal of every layer one asset should be to spark Jevons Paradox

2/ DeFi Llama reports $5.9bn TVL

2/ DeFi Llama reports $5.9bn TVL

2/ Some may recall how Grayscale Bitcoin Trust worked.

2/ Some may recall how Grayscale Bitcoin Trust worked.

2/ So, this Zoltan guy. He's pretty smart.

2/ So, this Zoltan guy. He's pretty smart.

2/ At the time, the Providence of Massachusetts Bay acted like pirates.

2/ At the time, the Providence of Massachusetts Bay acted like pirates.

2/ The double bounce. You know it.

2/ The double bounce. You know it.

https://twitter.com/MrBenLilly/status/1620884770963222528

2/ Here is another way to visualize this market shift of late

2/ Here is another way to visualize this market shift of latehttps://twitter.com/M_McDonough/status/1625126649153961987?s=20&t=-8-WFVsFtr3M0BdBxsL8IA

2/ It’s no secret that inflation got out of control the past few years.

2/ It’s no secret that inflation got out of control the past few years.

2/ If you look at the curve today, (pause for dramatic effect)

2/ If you look at the curve today, (pause for dramatic effect)

2/ Sam issued tokens under the guise of decentralization.

2/ Sam issued tokens under the guise of decentralization.

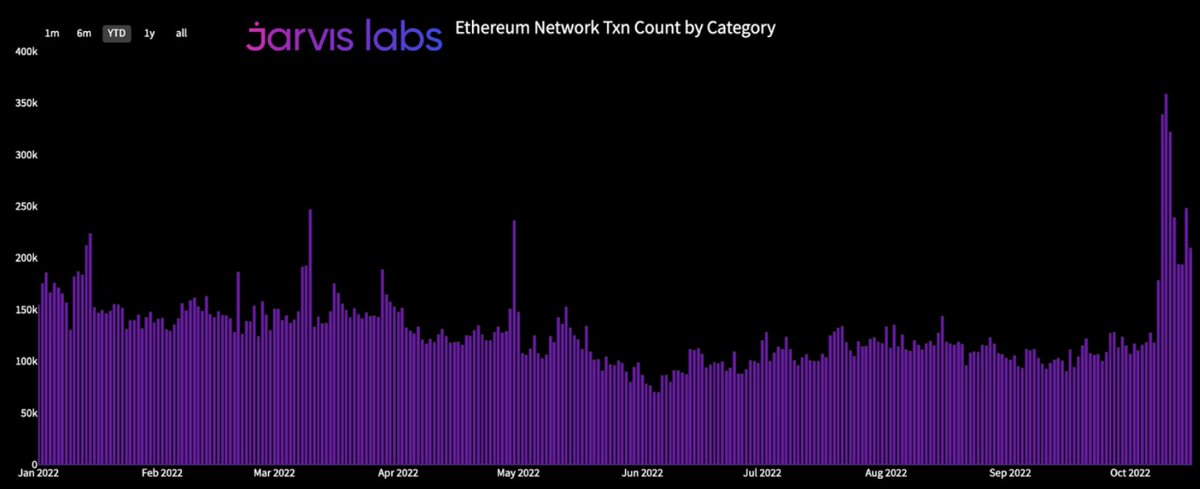

2/ Last week the team at Jarvis Labs noticed the # of TXs on Ethereum were skewed.

2/ Last week the team at Jarvis Labs noticed the # of TXs on Ethereum were skewed.

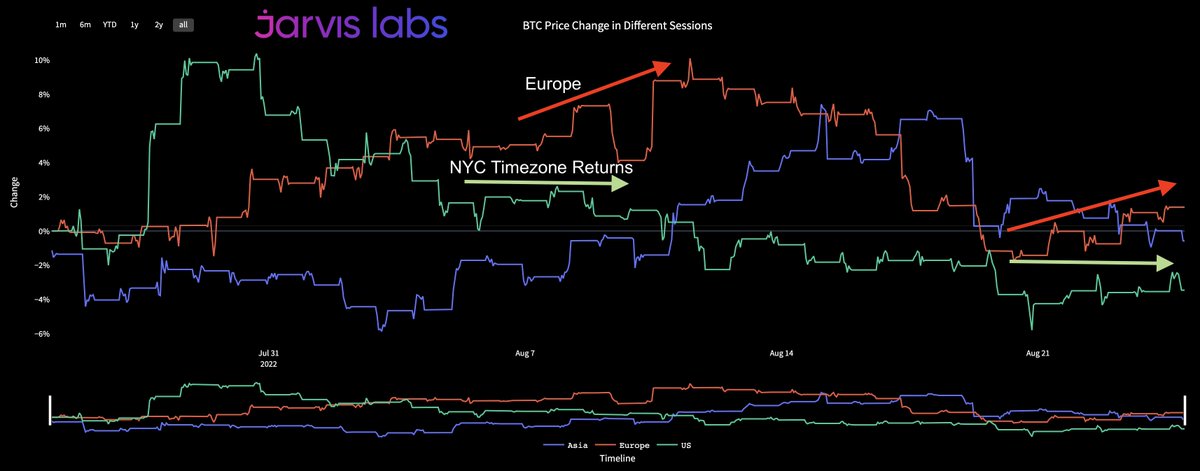

2/ We saw this divergence play out earlier this month as the market made its last run up to the highest price in two months. That's the two lines in the middle of the chart.

2/ We saw this divergence play out earlier this month as the market made its last run up to the highest price in two months. That's the two lines in the middle of the chart.

2/ Fear and Greed (F&G) Index is measured between 1 and 100. 1 is extreme fear while 100 is greed.

2/ Fear and Greed (F&G) Index is measured between 1 and 100. 1 is extreme fear while 100 is greed.

https://twitter.com/MrBenLilly/status/14994502883731210292/ JP Morgan owns ethereum infrastructure. Has an ethereum compatible JPM Coin that can act as a settlement currency for sovereign currency swaps. It has a 400+ member bank settlement network. They also have one of the largest blockchain teams in the world.

2/ Bitcoin dominance is retesting its support.

2/ Bitcoin dominance is retesting its support.

1/17 HODL waves help you visualize when new cohorts or a new wave of investors enter bitcoin. New cohorts tend to happen when euphoria sets in.

1/17 HODL waves help you visualize when new cohorts or a new wave of investors enter bitcoin. New cohorts tend to happen when euphoria sets in.