Insights, news, and lessons from the Family Office world

Sign up for the newsletter 👨👩👧👦📈🚀

How to get URL link on X (Twitter) App

Chief Executive Officer/President

Chief Executive Officer/President

1. The Founder’s Family Office

1. The Founder’s Family Office

• Family offices are active in both direct investments and M&A as buyers and sellers

• Family offices are active in both direct investments and M&A as buyers and sellers

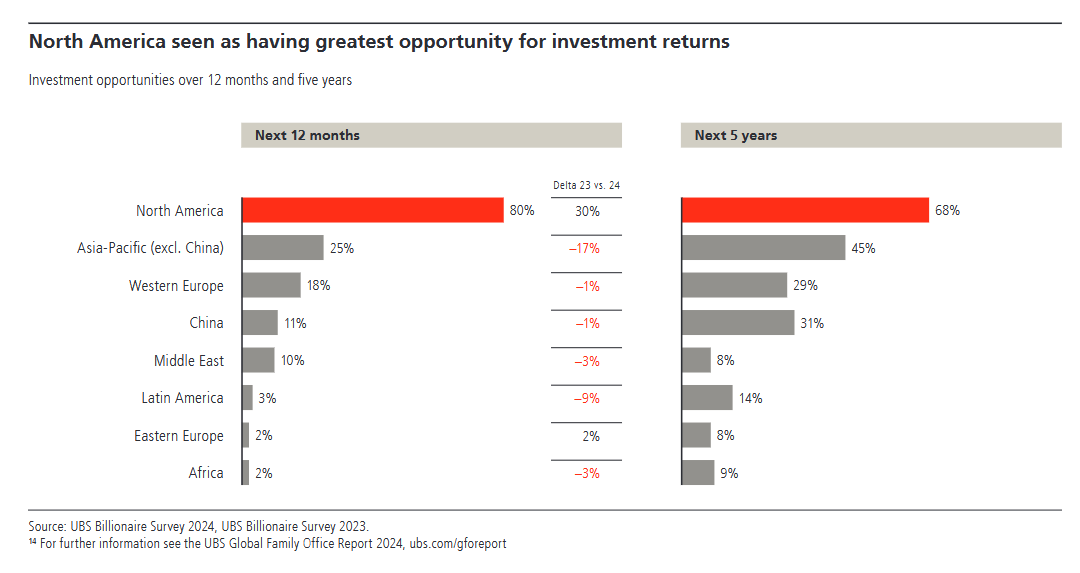

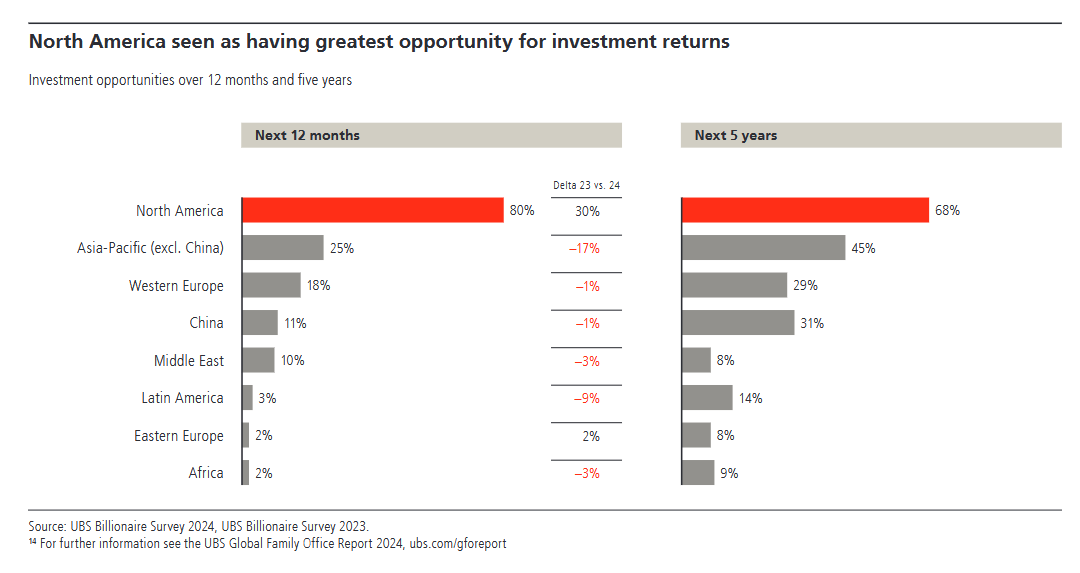

2. what billionaires plan to invest in

2. what billionaires plan to invest in

Portfolio Managers

Portfolio Managers

Tactic 1: Leveraging Investments Without Selling

Tactic 1: Leveraging Investments Without Selling