Account has morphed into geeking out on Govt $ / econ / climate data. Hopefully shedding the occasional bit of light on important things. Anon for good reasons.

How to get URL link on X (Twitter) App

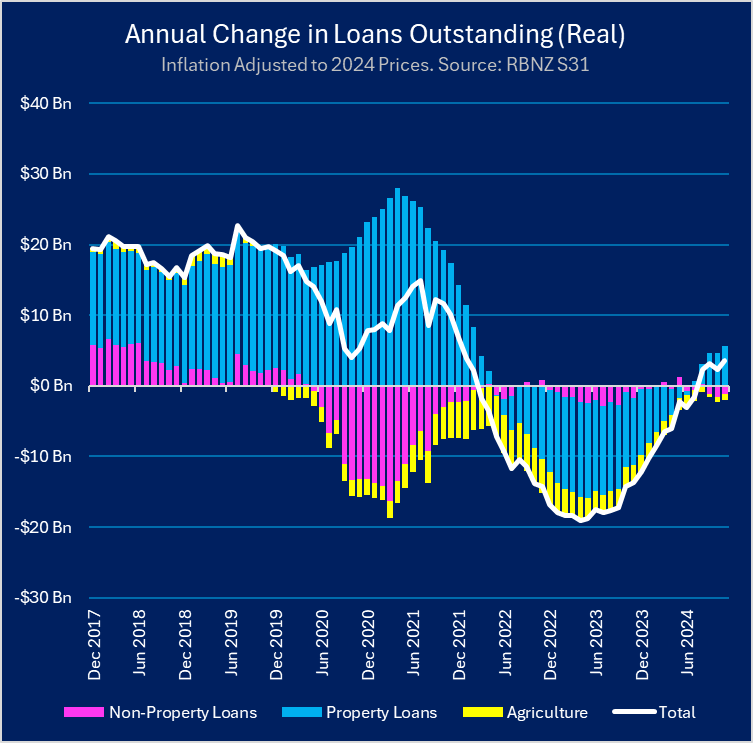

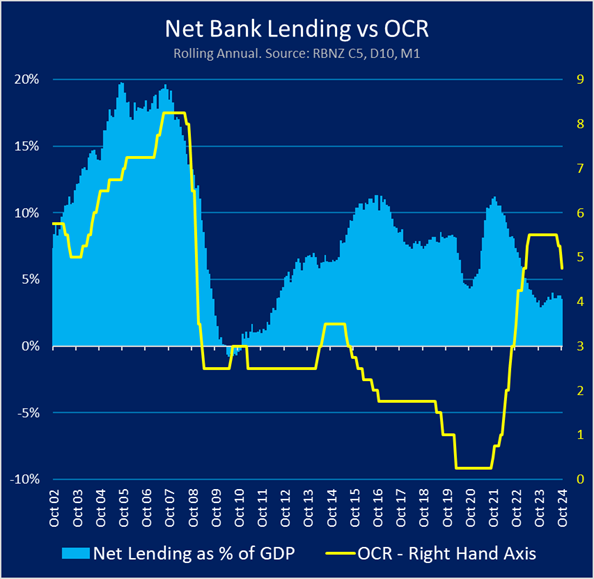

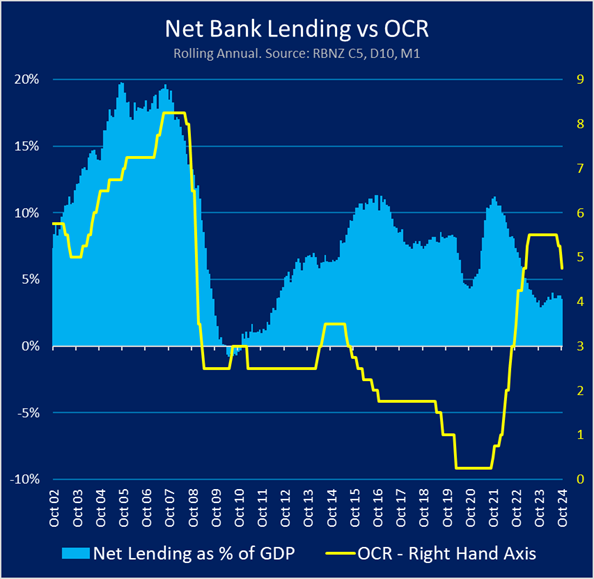

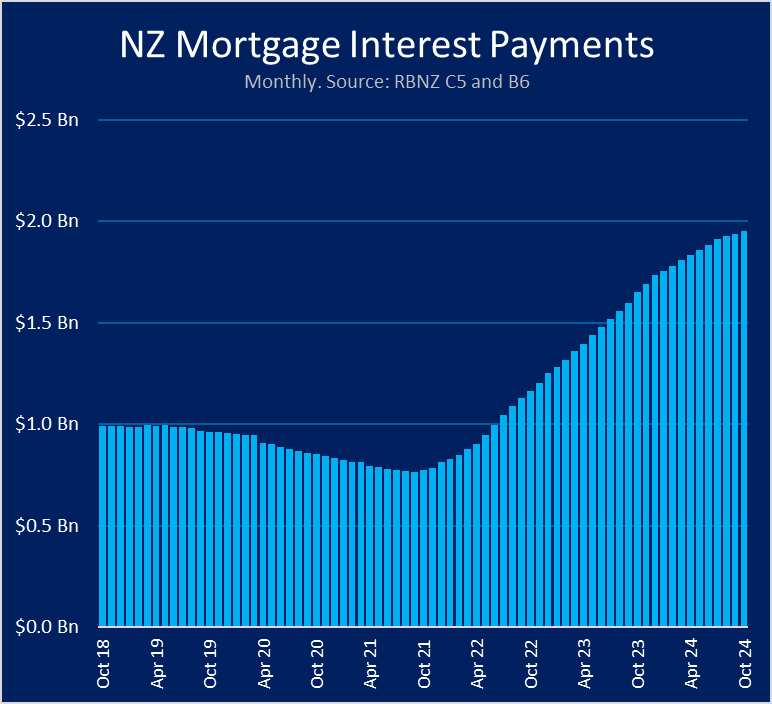

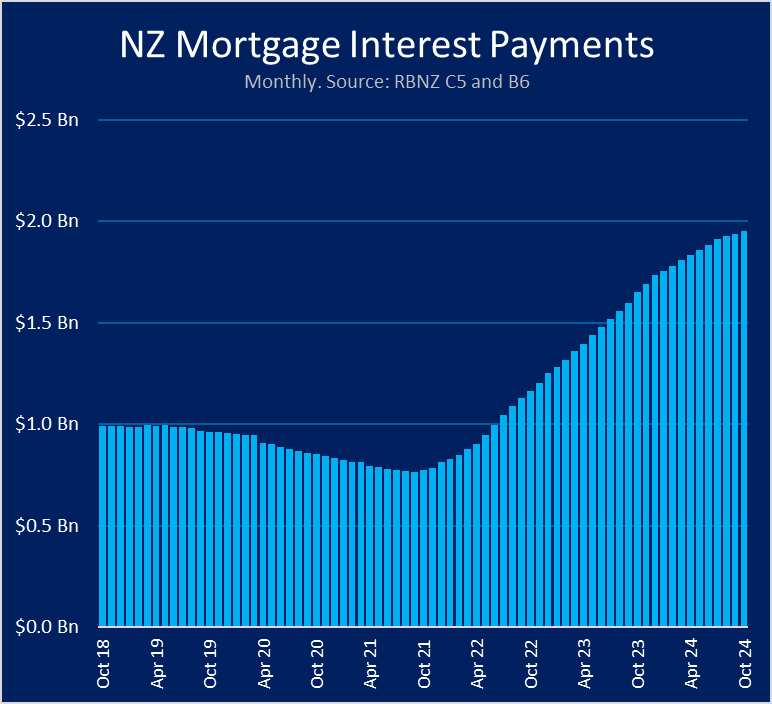

What's actually happening? RBNZ have dropped interest rates by 300pts, that reduced business debt costs by around $500m per month. Household and landlords are seeing similar cost savings come through but more slowly. So, a billion of disposable income released / month. And? (2/n)

What's actually happening? RBNZ have dropped interest rates by 300pts, that reduced business debt costs by around $500m per month. Household and landlords are seeing similar cost savings come through but more slowly. So, a billion of disposable income released / month. And? (2/n)

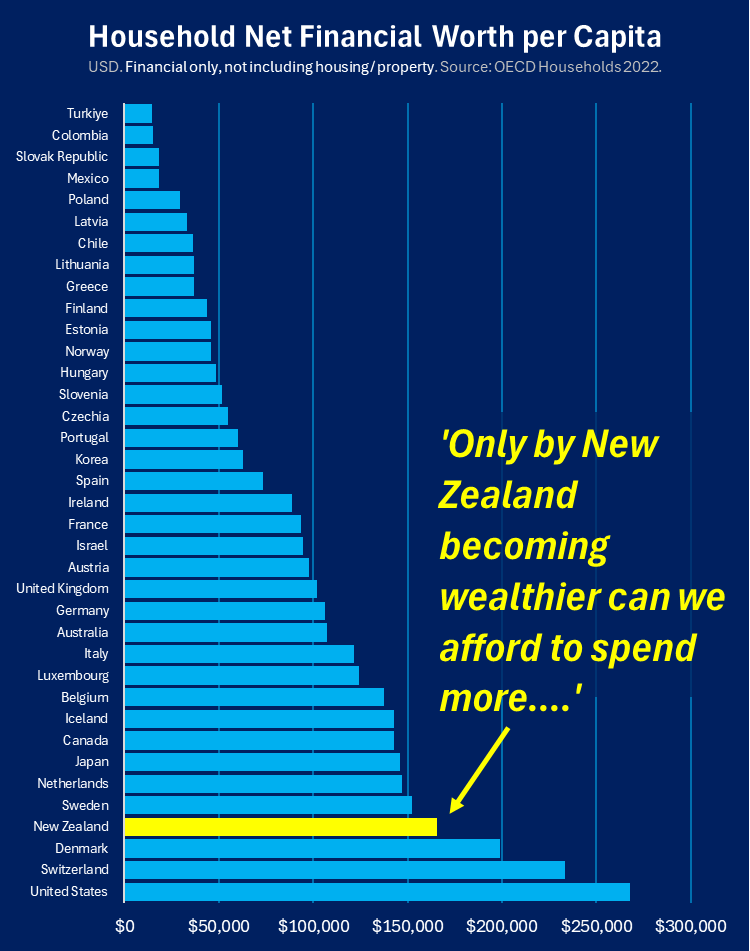

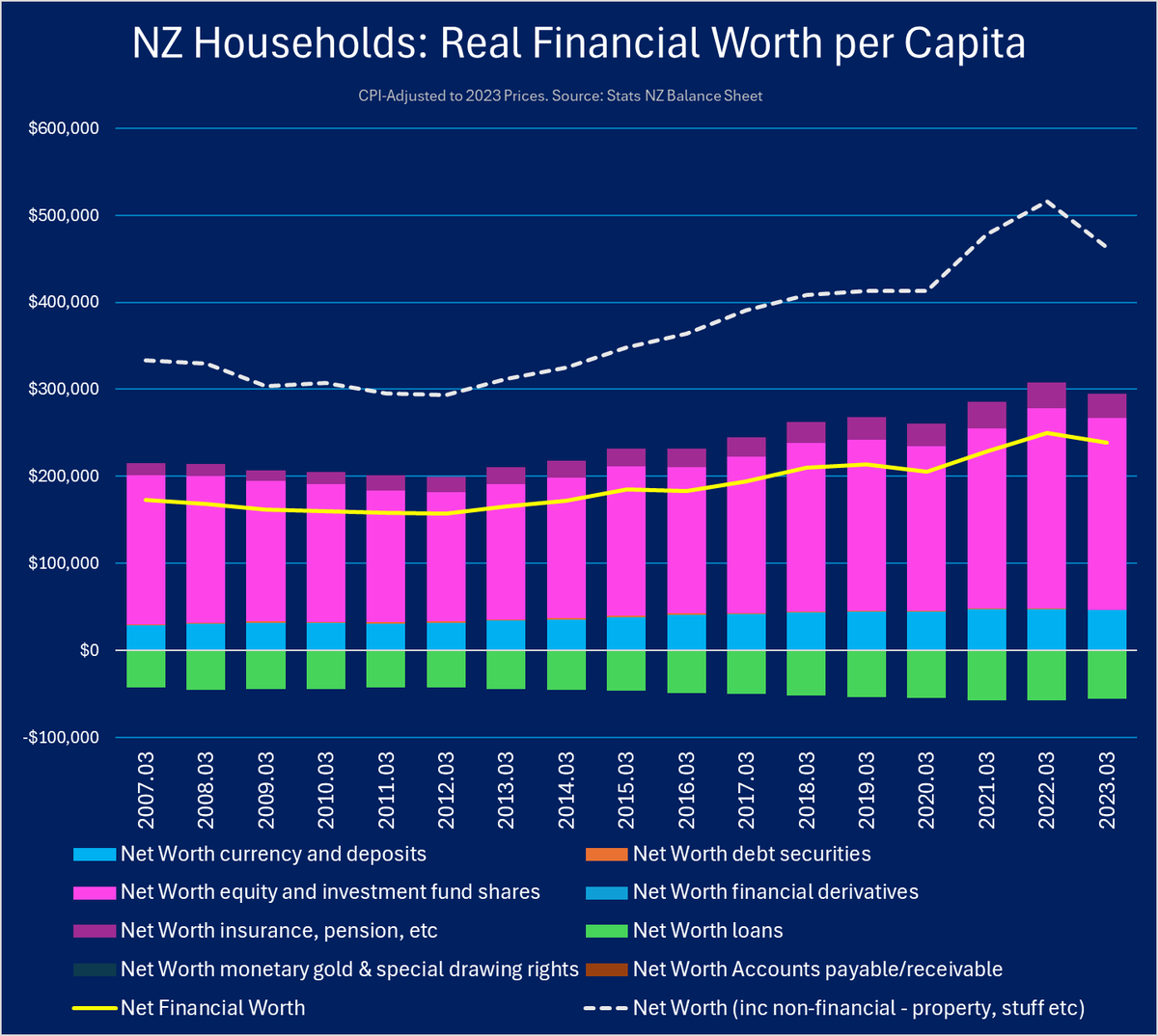

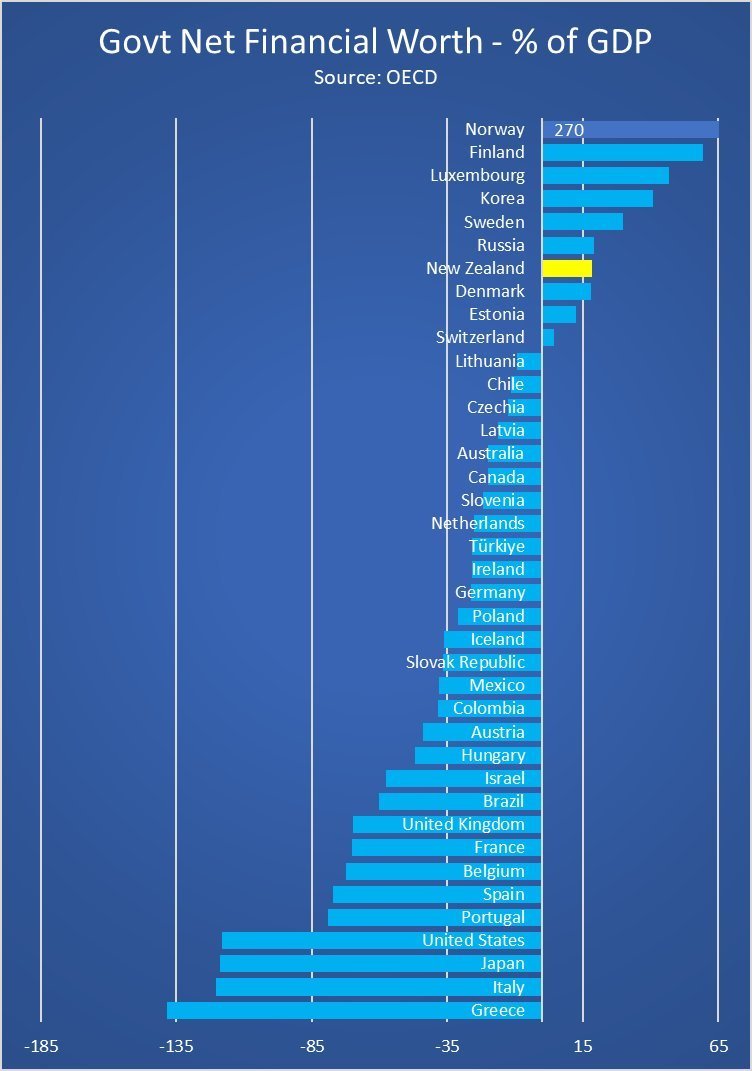

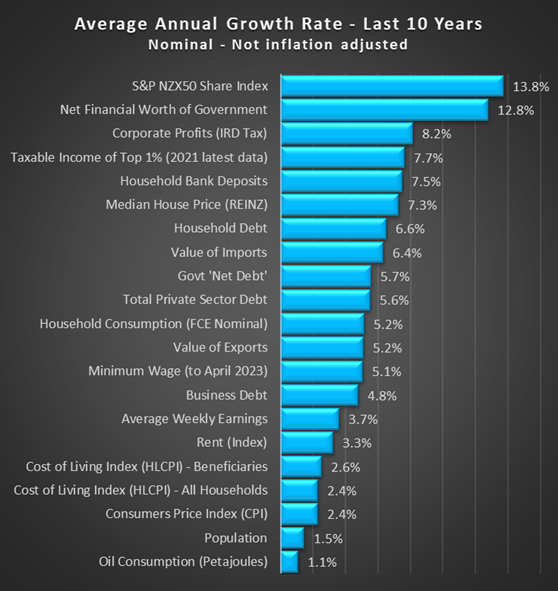

And, if you want to talk about comparative wealth, then let's TALK ABOUT IT! Our top few per cent rentiers have been stacking up the wealth for fking generations. We're stinking rich, up there with the big boys... well, on average. Ssshhh. [2/n]

And, if you want to talk about comparative wealth, then let's TALK ABOUT IT! Our top few per cent rentiers have been stacking up the wealth for fking generations. We're stinking rich, up there with the big boys... well, on average. Ssshhh. [2/n]

An 'almighty dose'! The IMF did some truly awful analysis of COVID stimulus in 2021. The 'neoliberal thought collective' added up random stuff - inc benefit increases over 4 years - and concluded that NZ had gone hard on stimulus, like crazies in Singapore, UK, USA, Aus... [2/n]

An 'almighty dose'! The IMF did some truly awful analysis of COVID stimulus in 2021. The 'neoliberal thought collective' added up random stuff - inc benefit increases over 4 years - and concluded that NZ had gone hard on stimulus, like crazies in Singapore, UK, USA, Aus... [2/n]

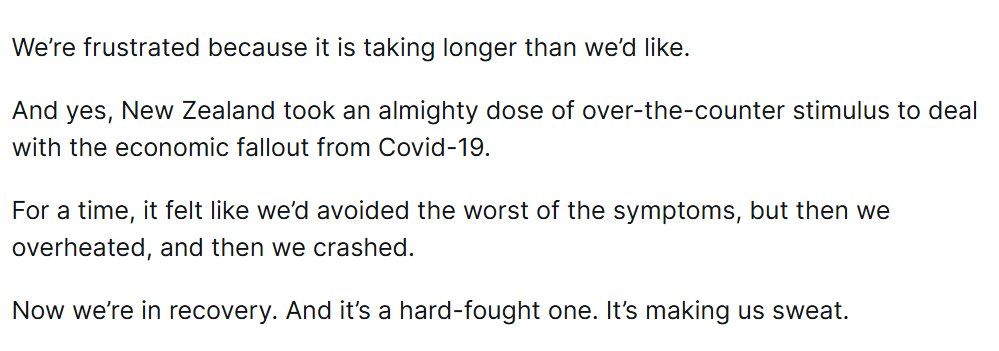

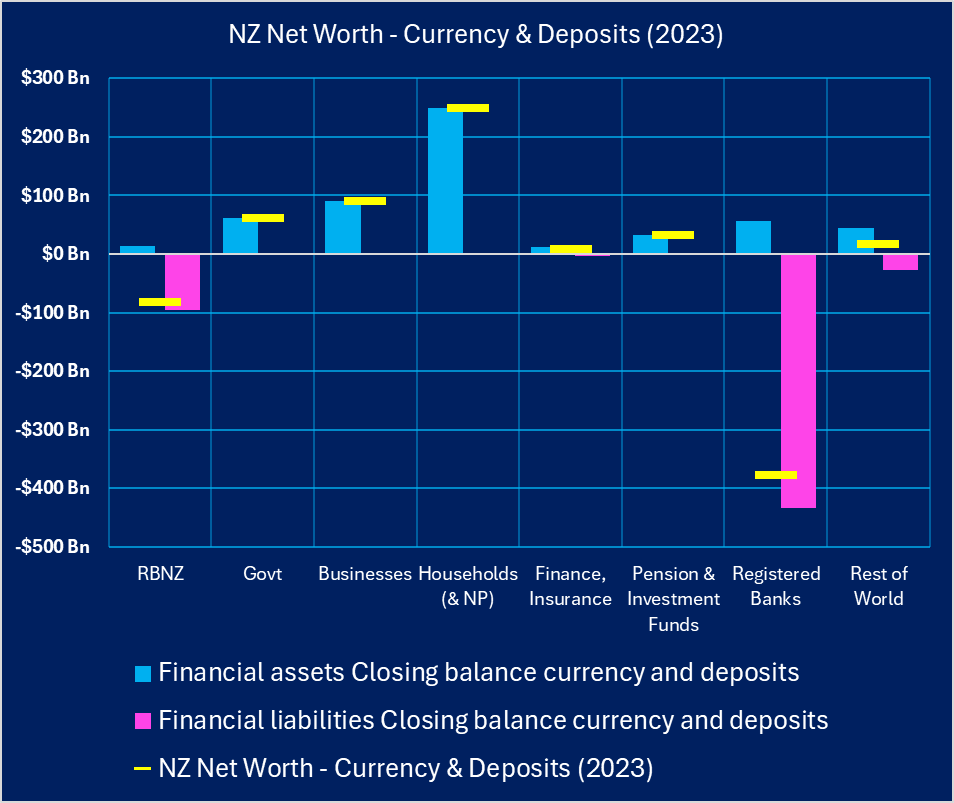

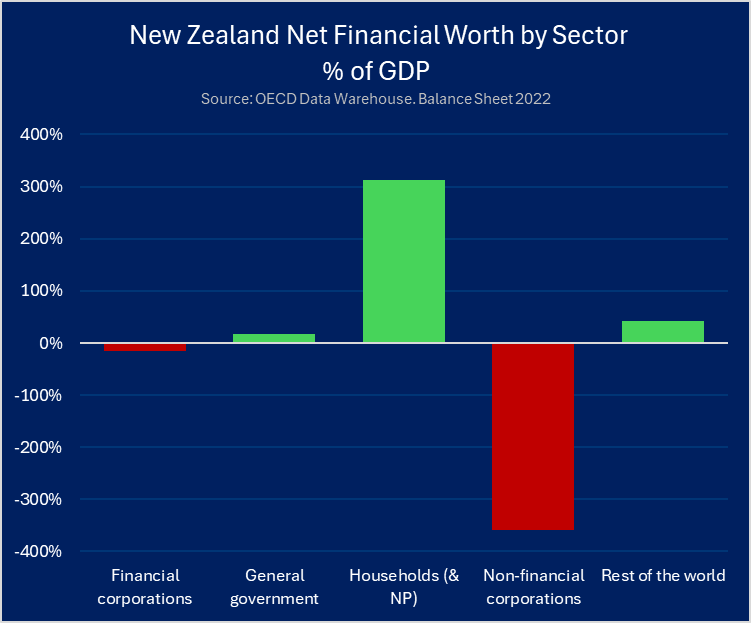

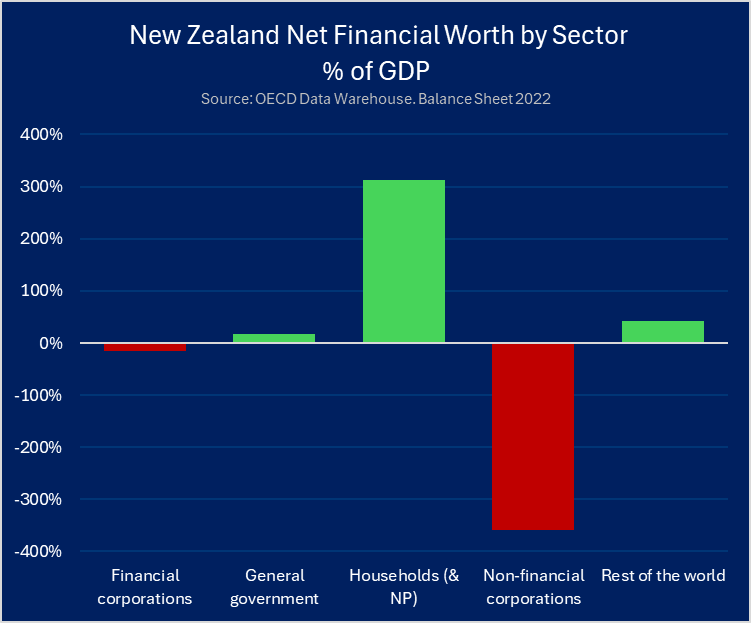

Say what? Yes, banks aren't rich because they have your money - your money is a *liability* to them.

Say what? Yes, banks aren't rich because they have your money - your money is a *liability* to them.

Myth 2: NZ Households are only 'wealthy' because they own loads of over-priced land and housing.

Myth 2: NZ Households are only 'wealthy' because they own loads of over-priced land and housing.

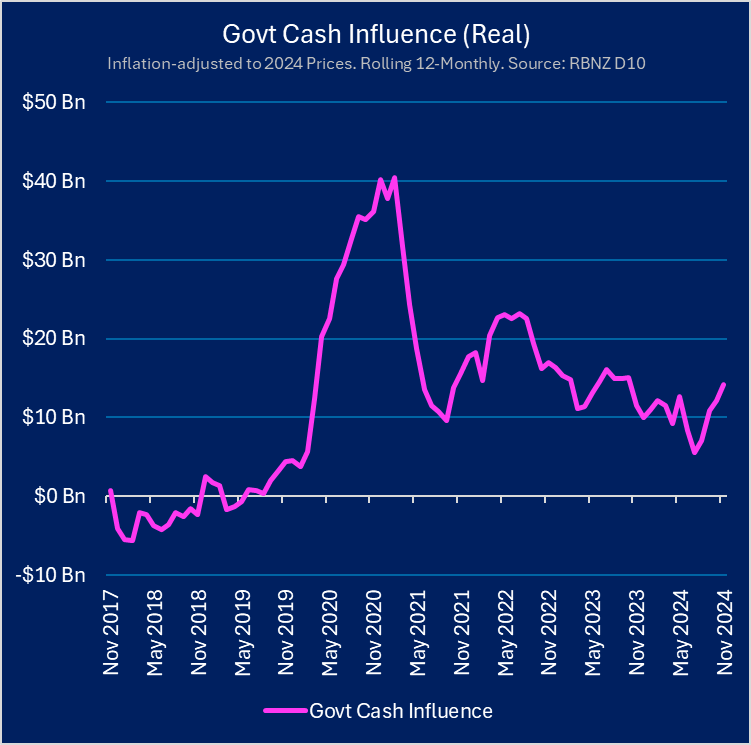

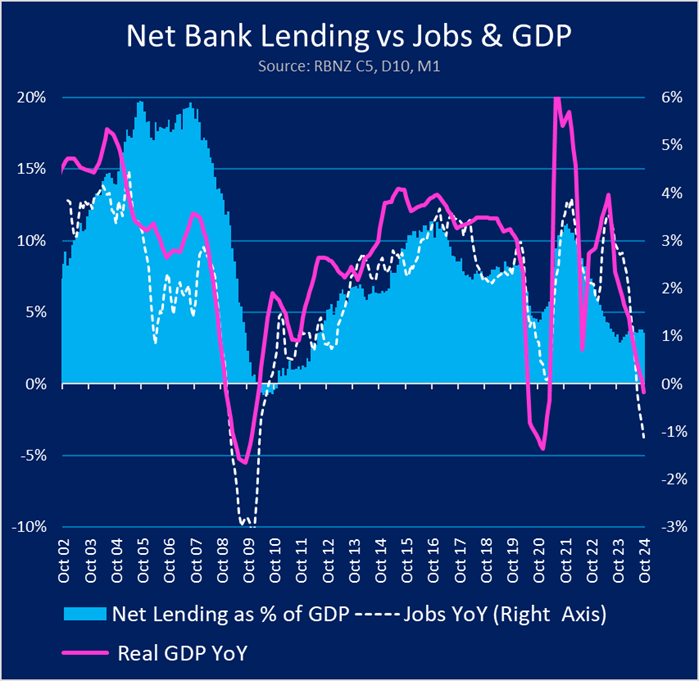

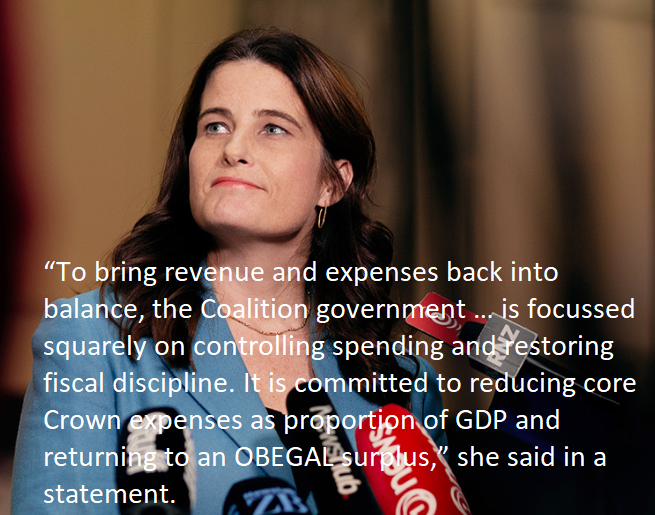

2. Govt are losing control. Our current account deficit is still high, net bank lending is still v.low, and savers aren't opening their wallets. This combo *inevitably* drives Govt deficit spending up. Auto stabilisers are kicking in & Willis ain't Milei (small mercies) [2/n]

2. Govt are losing control. Our current account deficit is still high, net bank lending is still v.low, and savers aren't opening their wallets. This combo *inevitably* drives Govt deficit spending up. Auto stabilisers are kicking in & Willis ain't Milei (small mercies) [2/n]

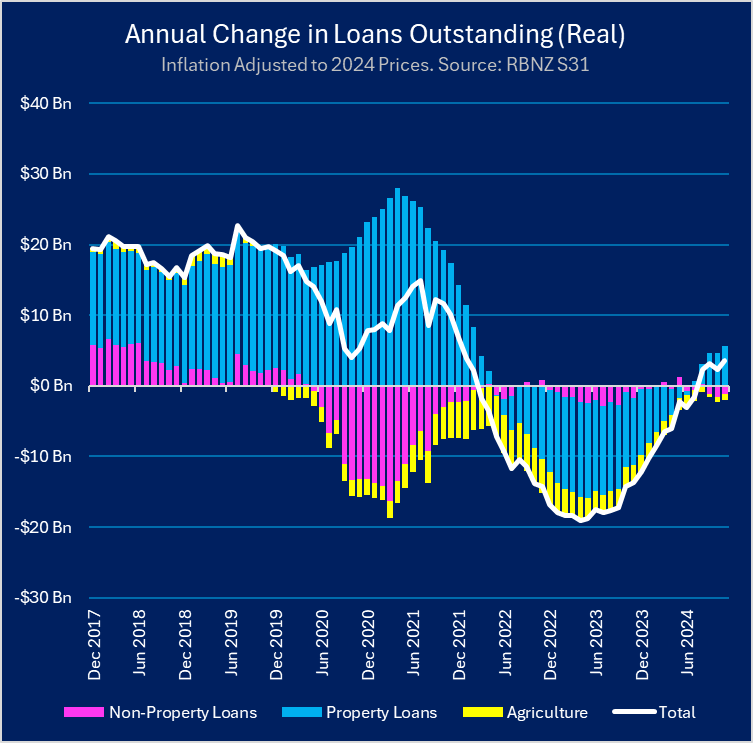

Why is the flow of credit important? Because we rely on banks pumping shiny new $ into the economy when they make loans. The 'net flow' of bank credit (new loans - repayments) fuels our 'growth' in NZ.

Why is the flow of credit important? Because we rely on banks pumping shiny new $ into the economy when they make loans. The 'net flow' of bank credit (new loans - repayments) fuels our 'growth' in NZ.

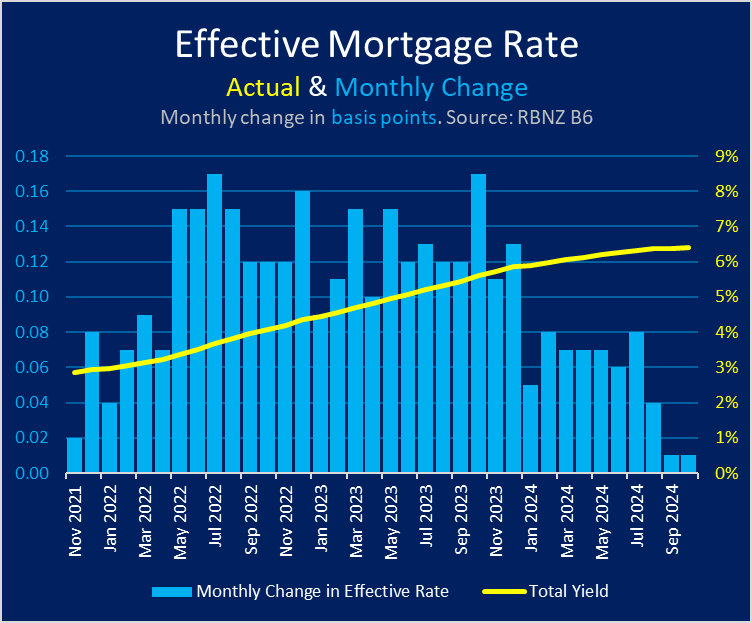

The effective interest rate on mortgages (weighted average) is still *creeping up* as people fix for longer, pay off their cheap rate mortgages, take on new ones, move to floating rates etc. What does this mean? [2/n]

The effective interest rate on mortgages (weighted average) is still *creeping up* as people fix for longer, pay off their cheap rate mortgages, take on new ones, move to floating rates etc. What does this mean? [2/n]

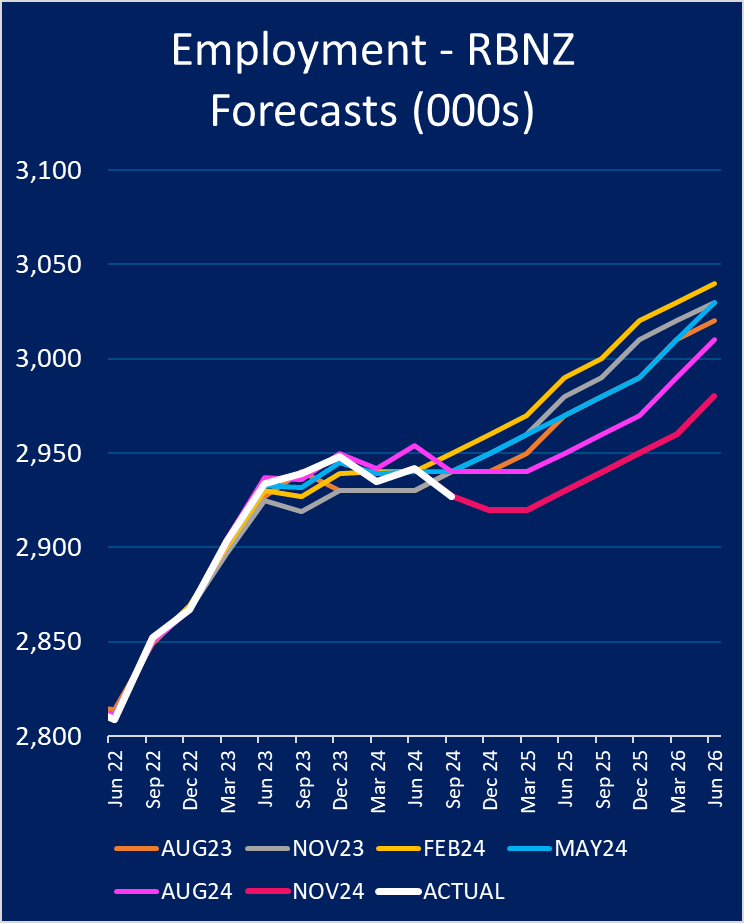

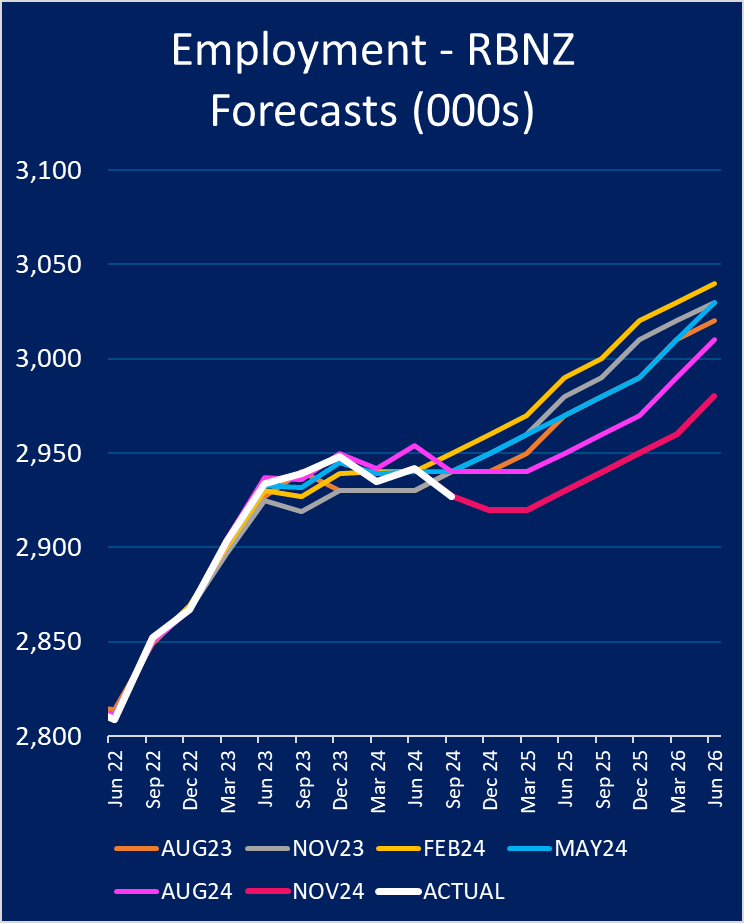

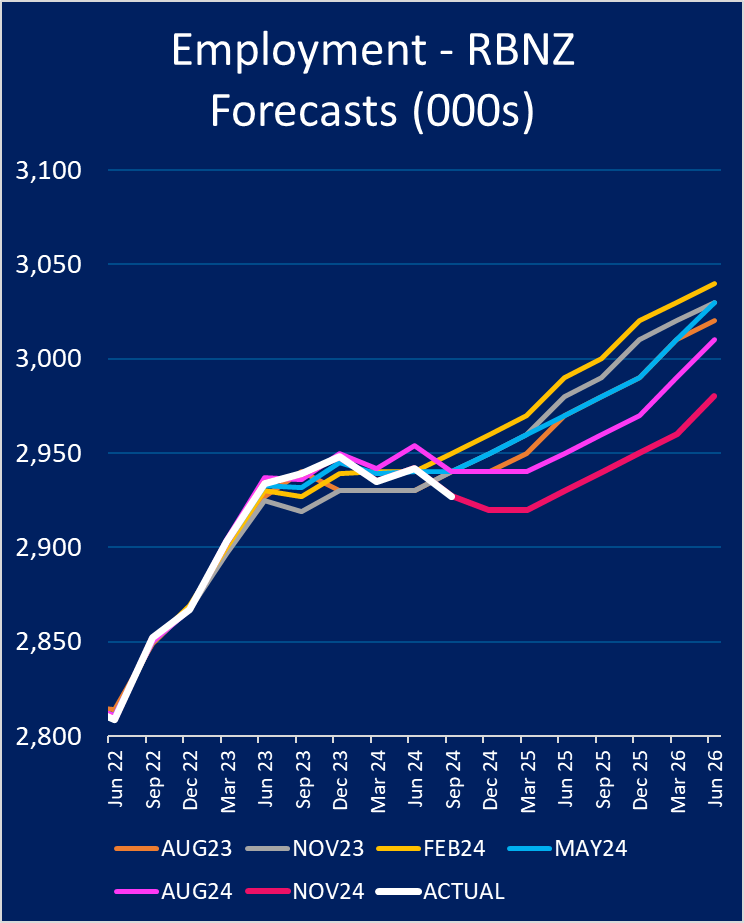

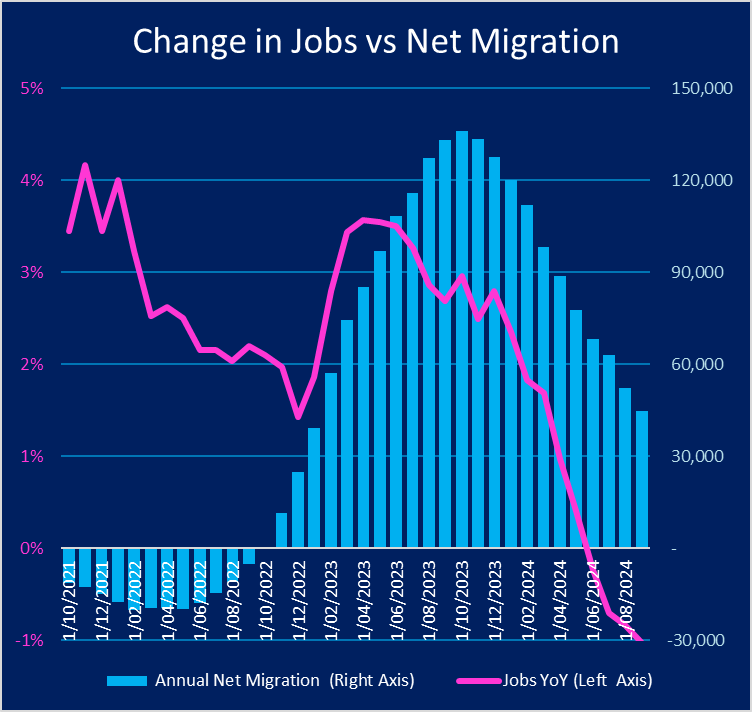

Now, note the actual employment figures exceeded RBNZ forecasts in 2023. Was that Labour's incredible handling of the economy? Well... they opened the borders and the precarious, poorly-paid, split-shift kinda vacancies got filled (graph 2). Then the descent resumed 👇 [2/n]

Now, note the actual employment figures exceeded RBNZ forecasts in 2023. Was that Labour's incredible handling of the economy? Well... they opened the borders and the precarious, poorly-paid, split-shift kinda vacancies got filled (graph 2). Then the descent resumed 👇 [2/n]

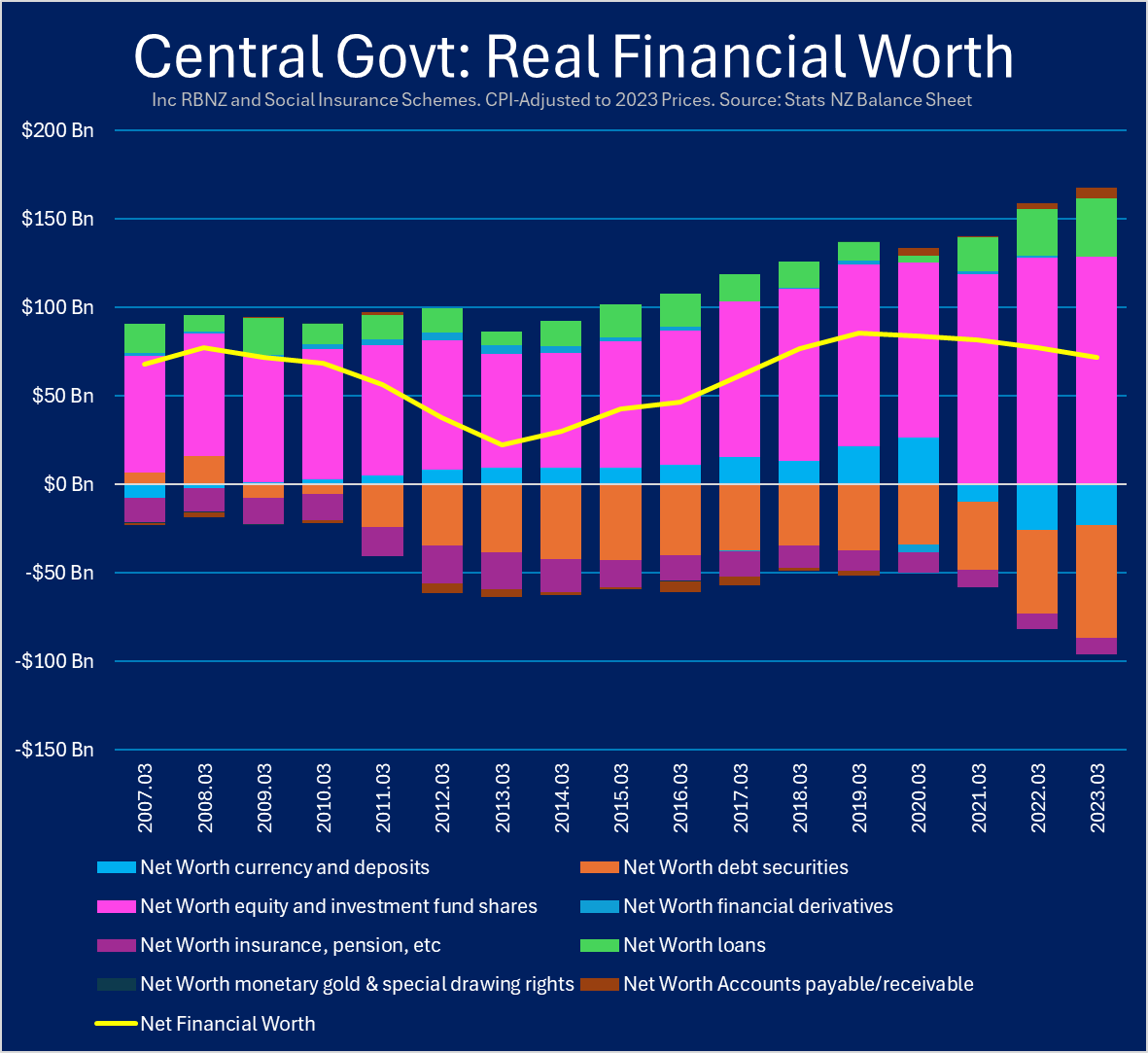

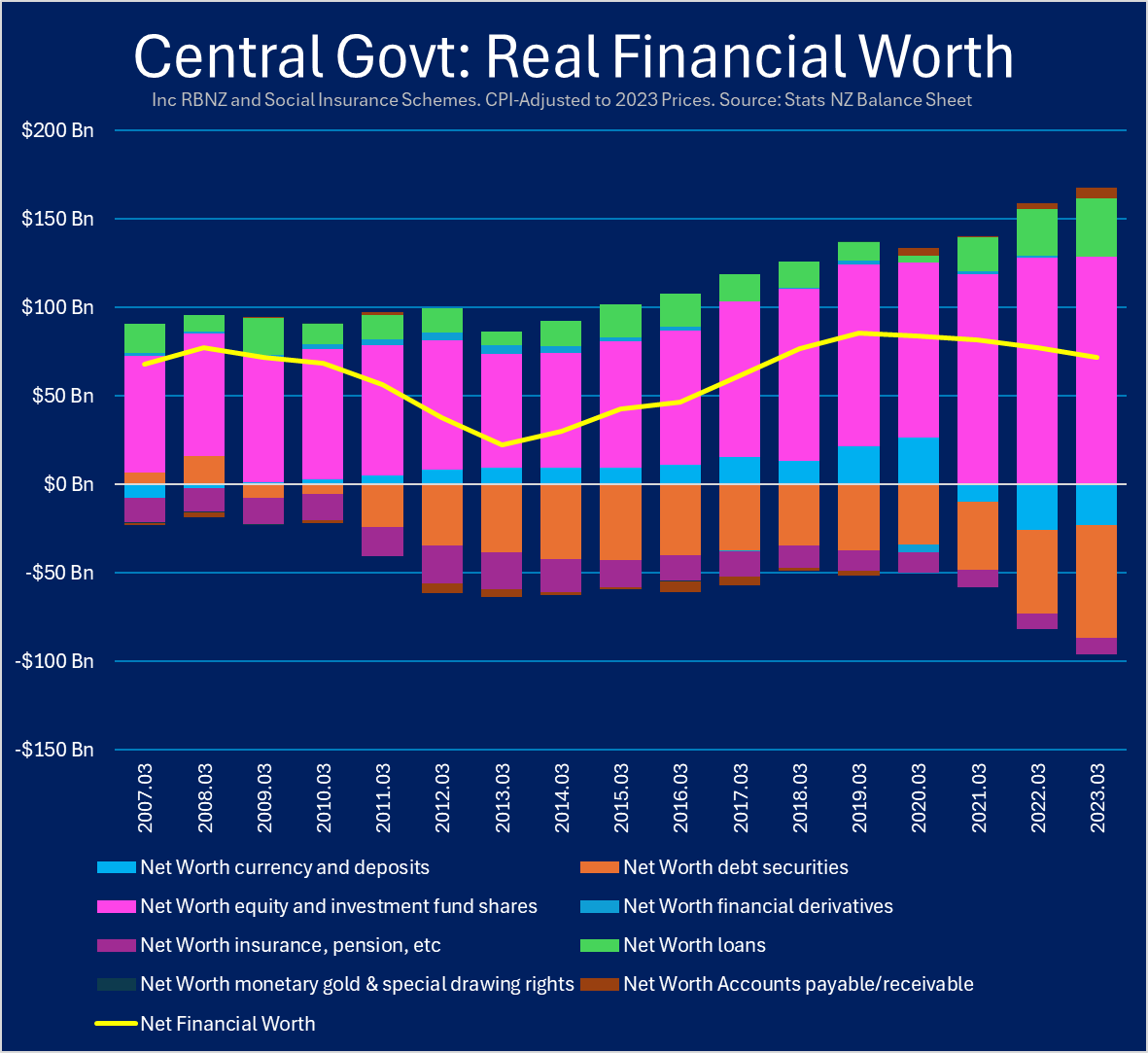

Yes, NZ Govt has a net positive financial worth thanks to all the shares and equity (and Govt debt!) they own. Those financial assets are worth more than their 'debts'.

Yes, NZ Govt has a net positive financial worth thanks to all the shares and equity (and Govt debt!) they own. Those financial assets are worth more than their 'debts'.

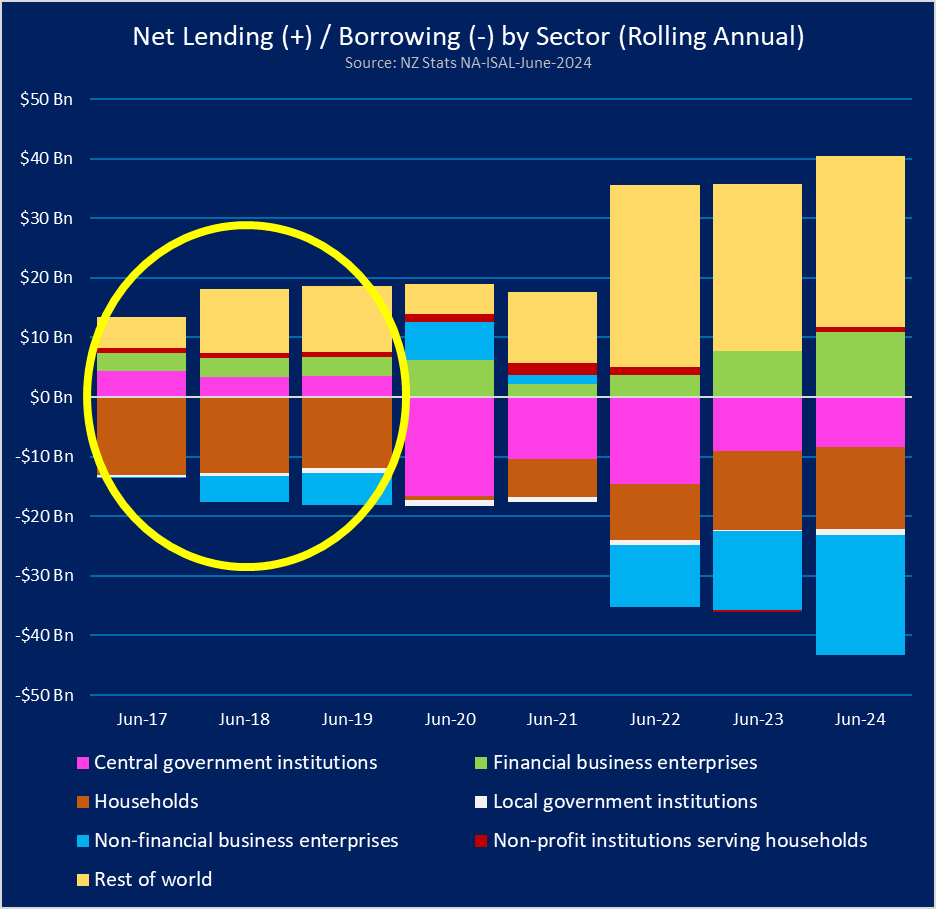

In normal times (2017 to 2019):

In normal times (2017 to 2019):

Govt debts are private sector assets. When Govt spend more than they tax, the private sector (that's us) gets *richer*.

Govt debts are private sector assets. When Govt spend more than they tax, the private sector (that's us) gets *richer*.

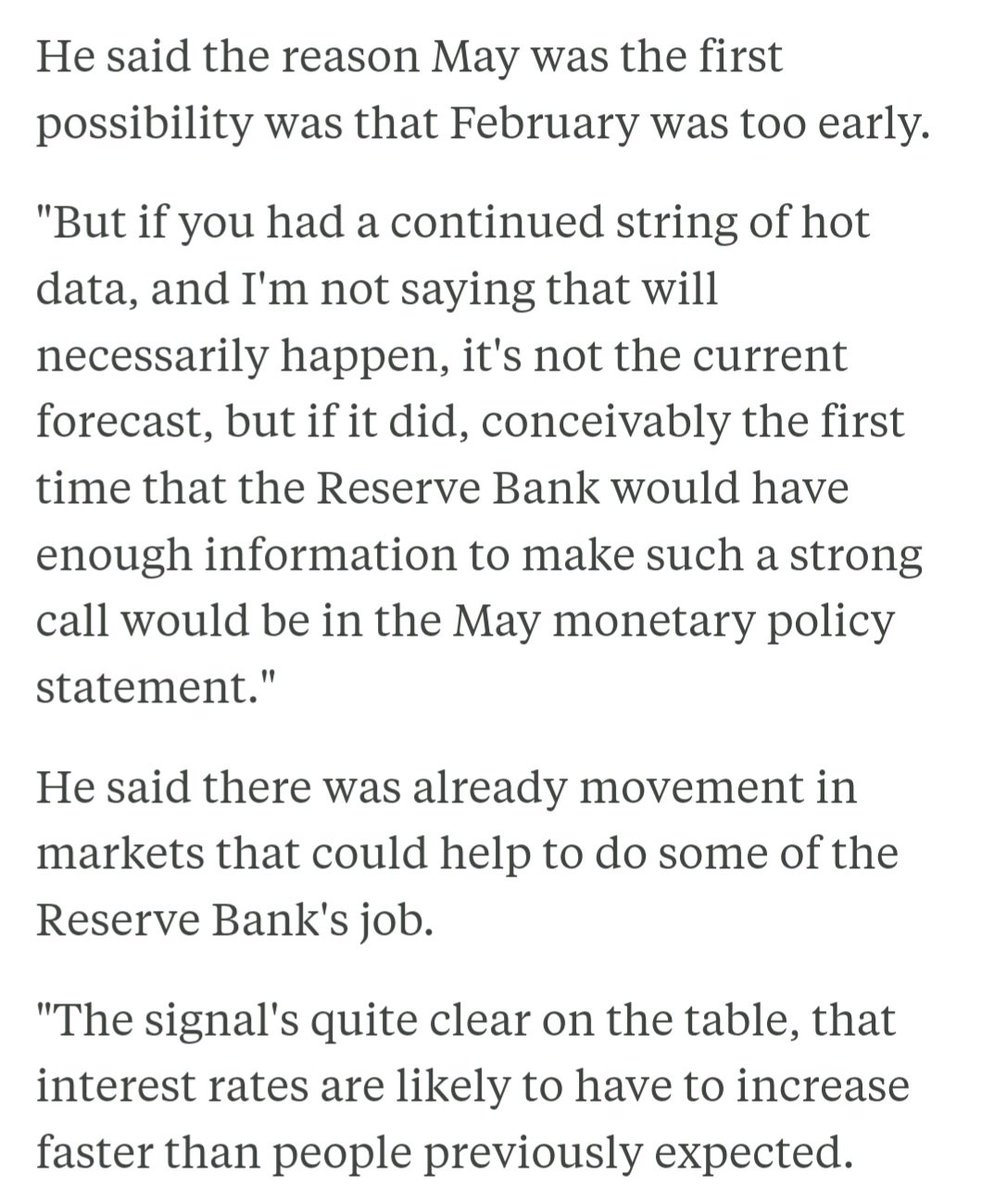

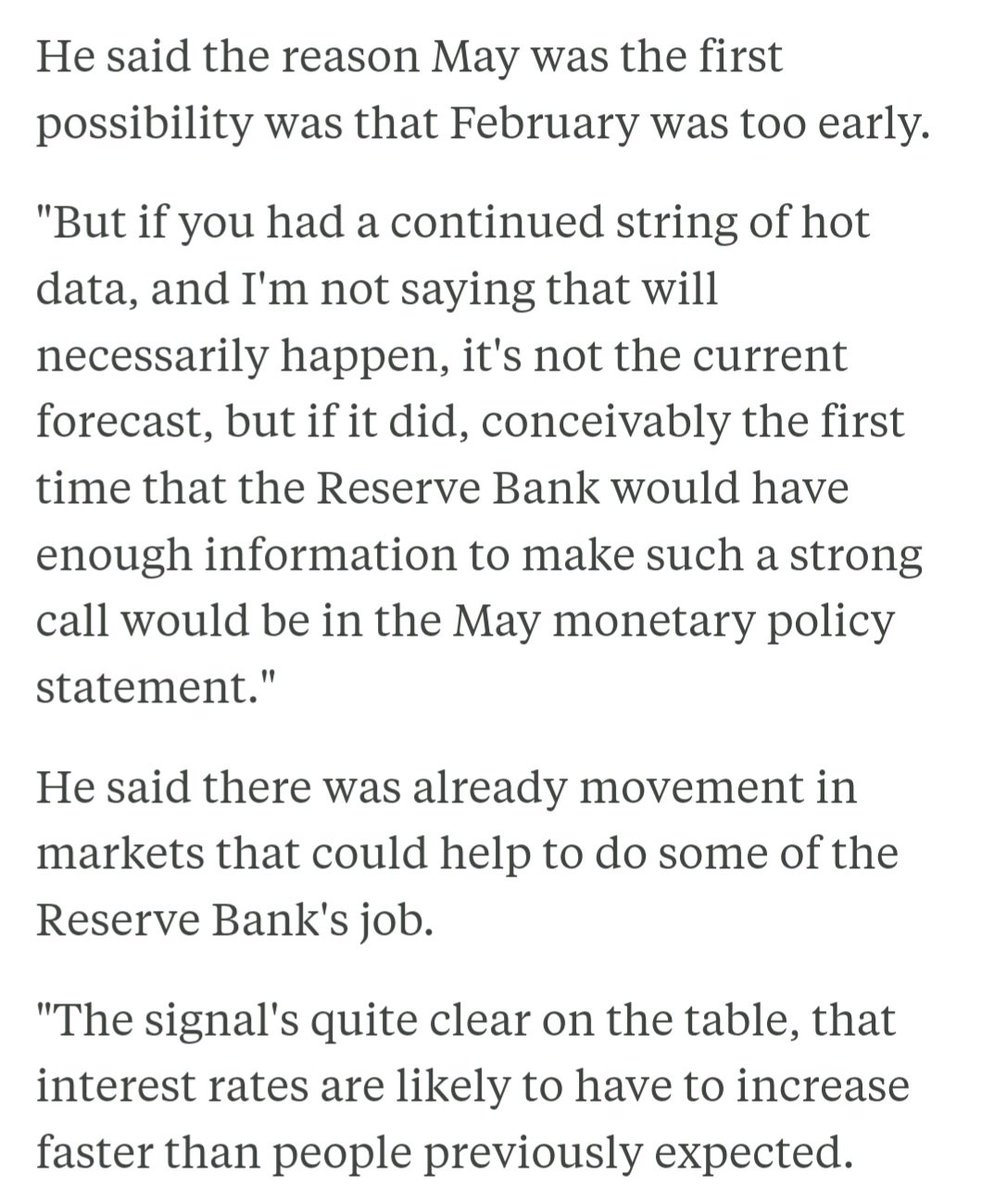

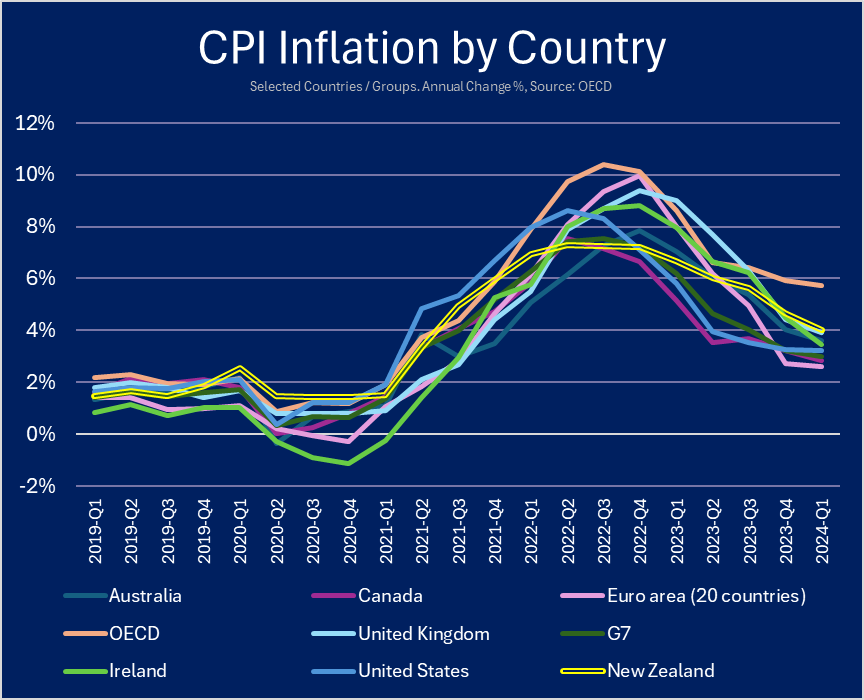

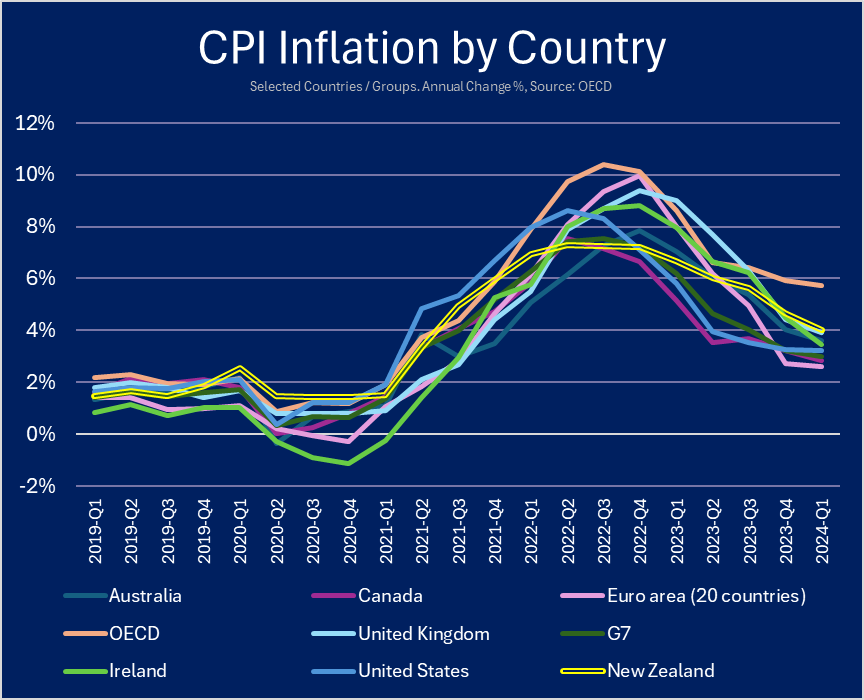

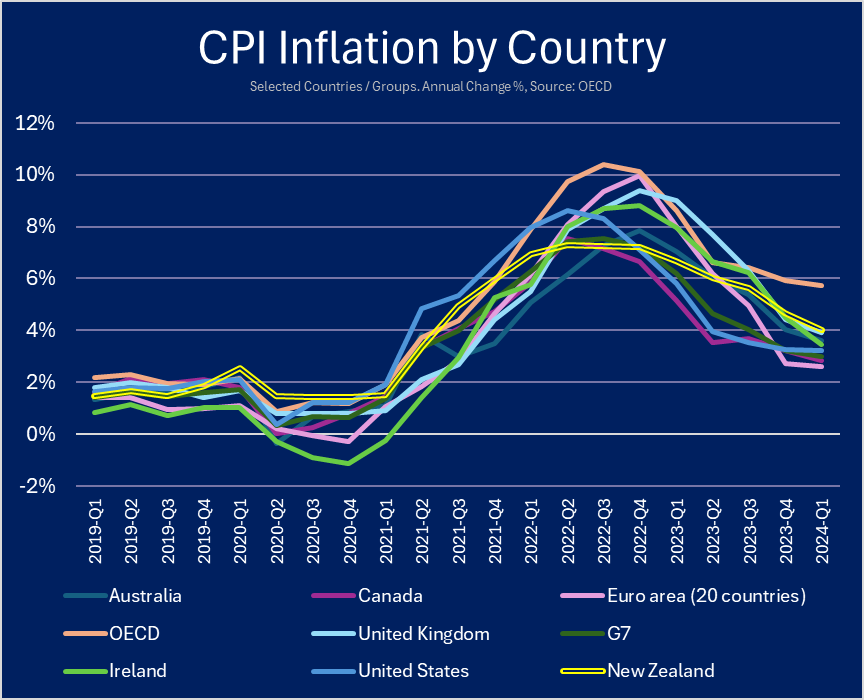

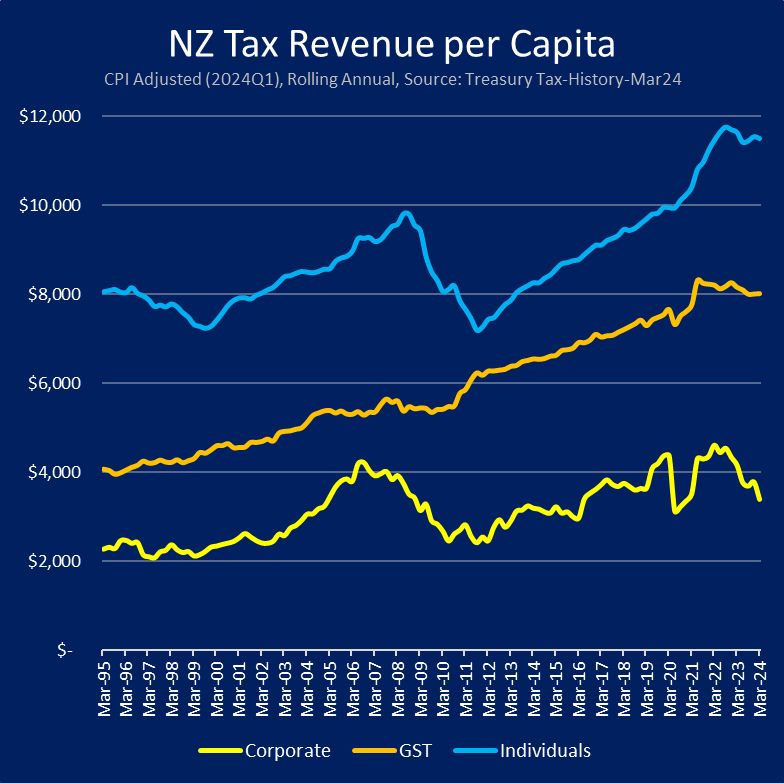

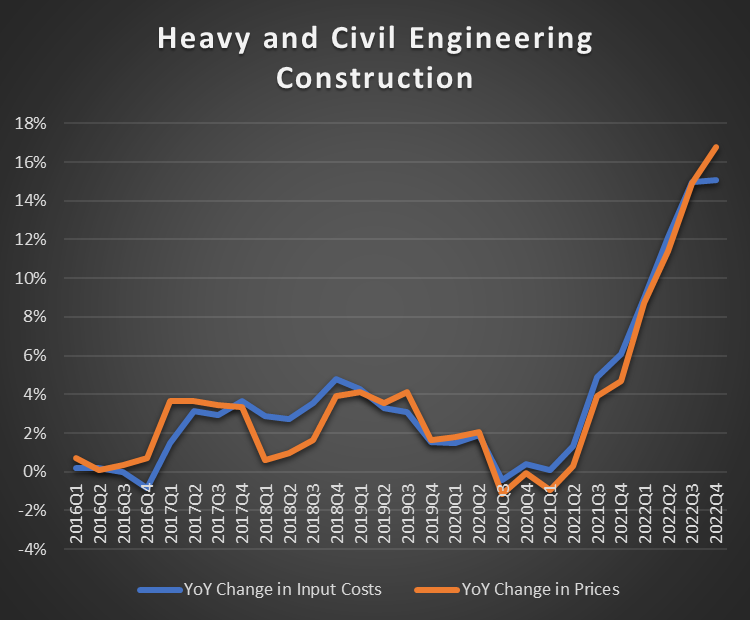

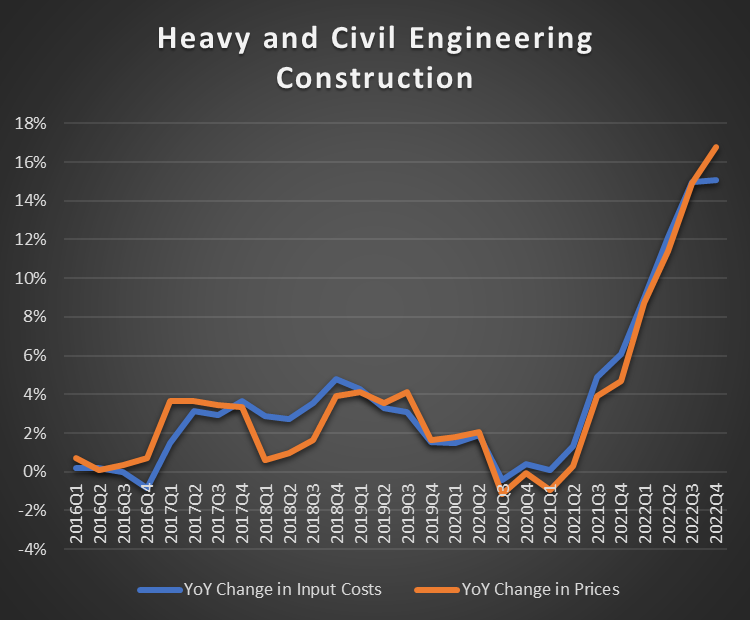

Bit of context: In 2021/22, oil & gas price spikes sent an inflation 'impulse' through the global economy. The world runs on fossil fuels so high energy prices quickly infected other prices (eg transport). This drove a 'sustained change in the price level' (aka inflation) [3/n]

Bit of context: In 2021/22, oil & gas price spikes sent an inflation 'impulse' through the global economy. The world runs on fossil fuels so high energy prices quickly infected other prices (eg transport). This drove a 'sustained change in the price level' (aka inflation) [3/n]

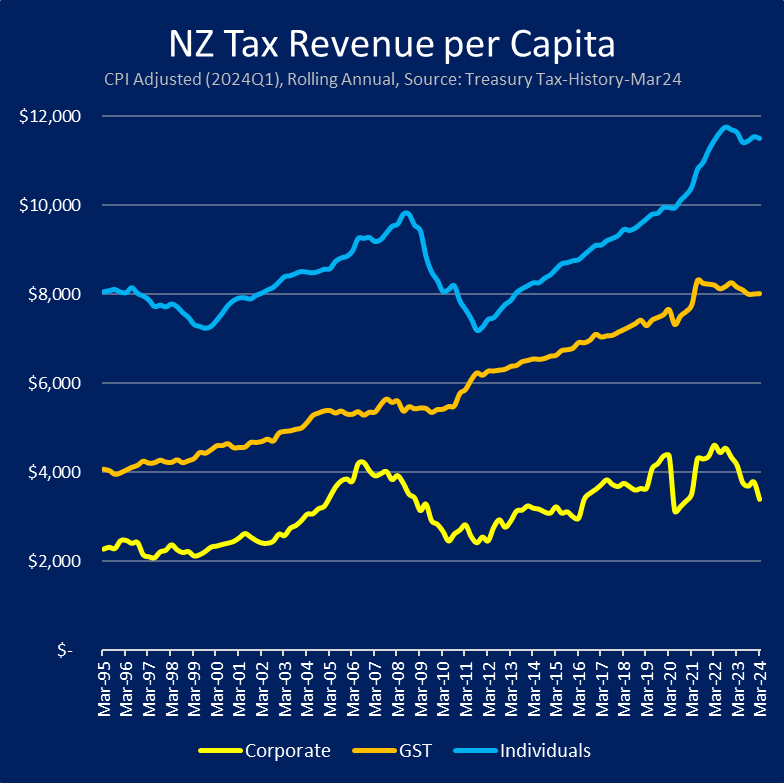

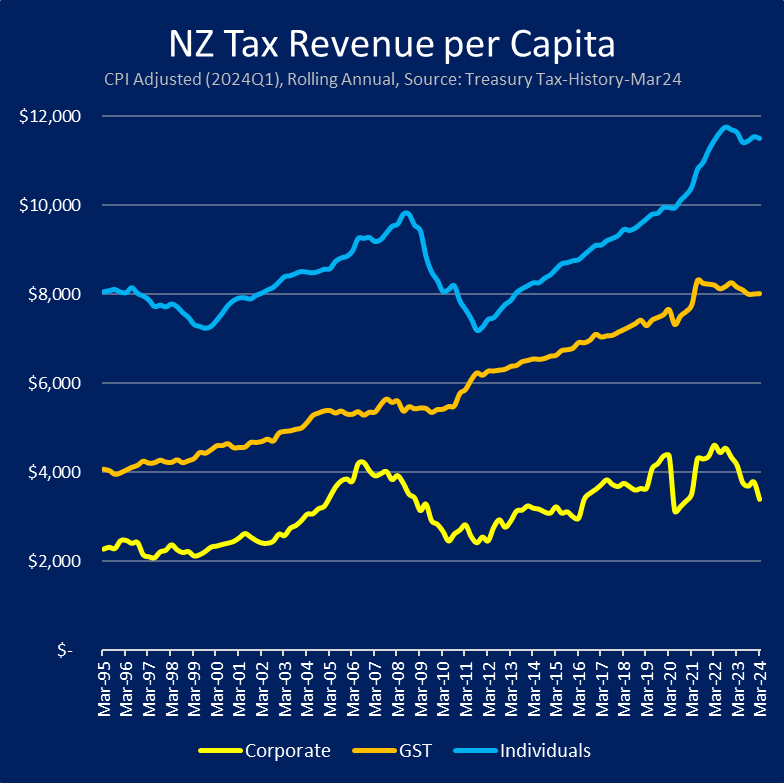

Income tax is holding on (for now) because new arrivals have filled vacant jobs, wages have been pulled up by cost of living, and more people are being caught by higher tax brackets. I say 'for now' because... [2/n]

Income tax is holding on (for now) because new arrivals have filled vacant jobs, wages have been pulled up by cost of living, and more people are being caught by higher tax brackets. I say 'for now' because... [2/n]

We had a few inflation blips between 2000 and 2023, all triggered by sudden increases in import costs - apart from *one* in 2011. What happened? We increased GST again for the win ✌️. [2/n]

We had a few inflation blips between 2000 and 2023, all triggered by sudden increases in import costs - apart from *one* in 2011. What happened? We increased GST again for the win ✌️. [2/n]

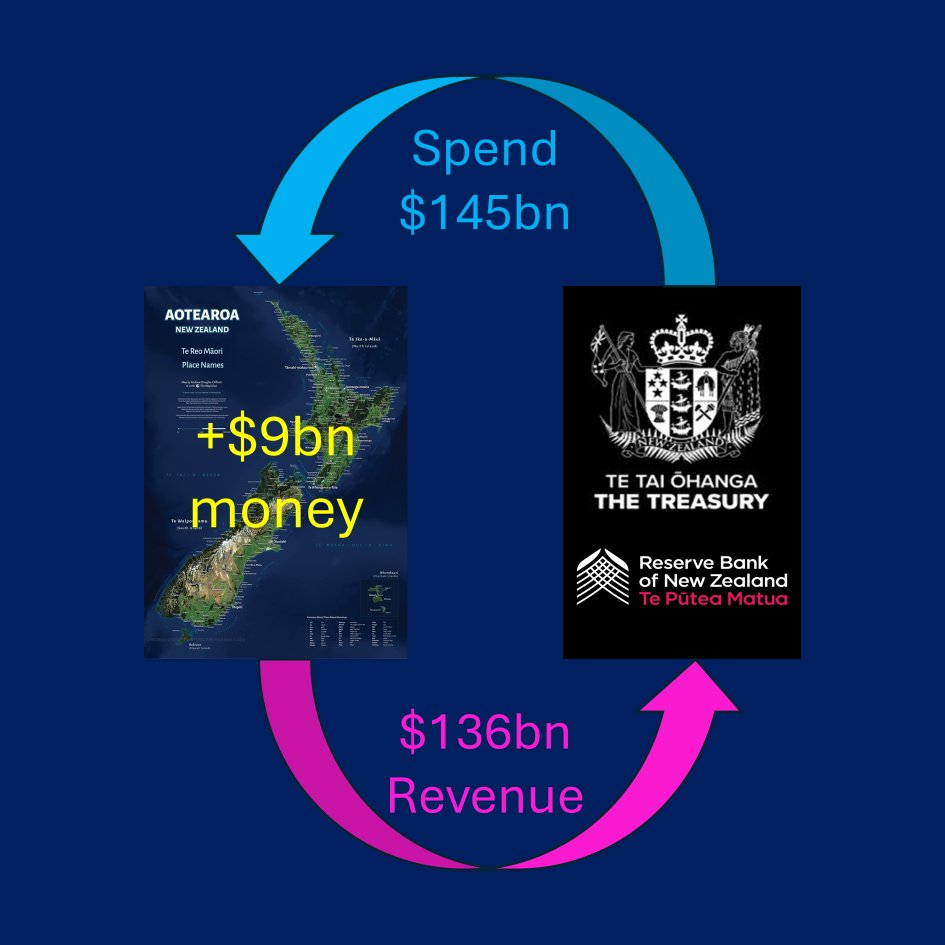

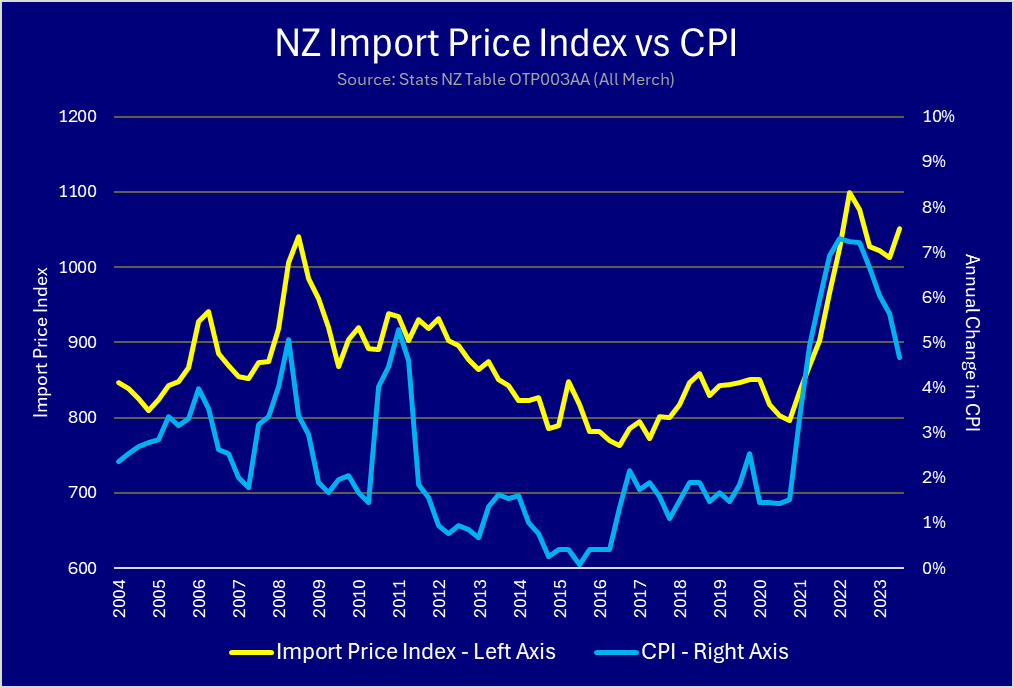

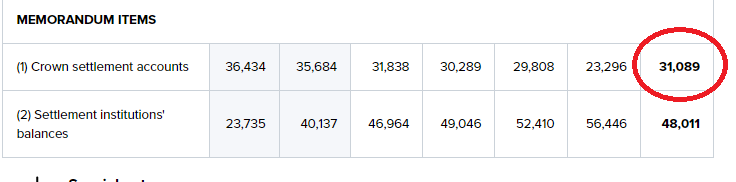

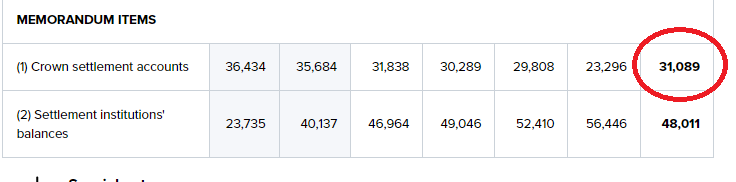

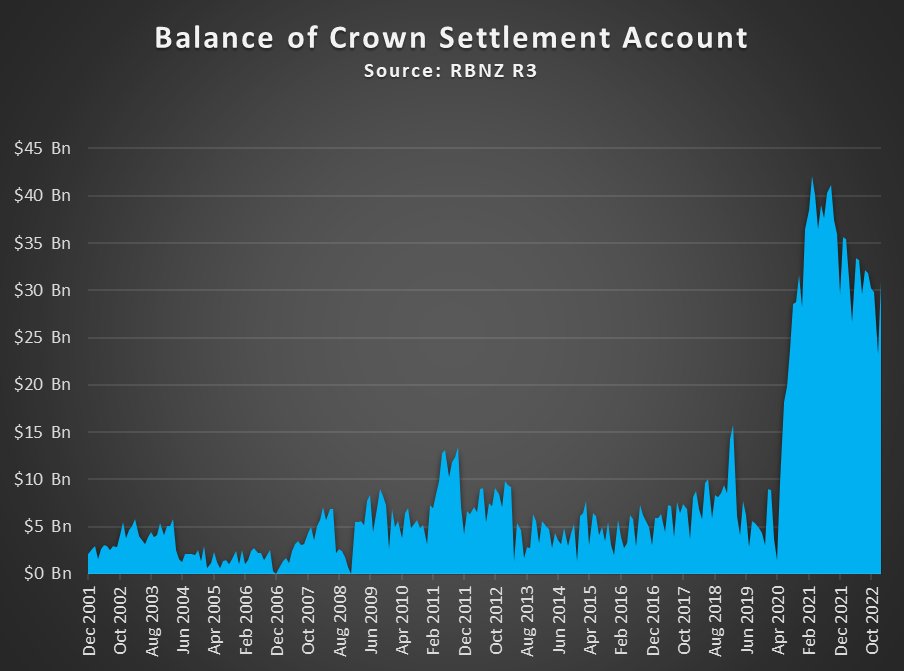

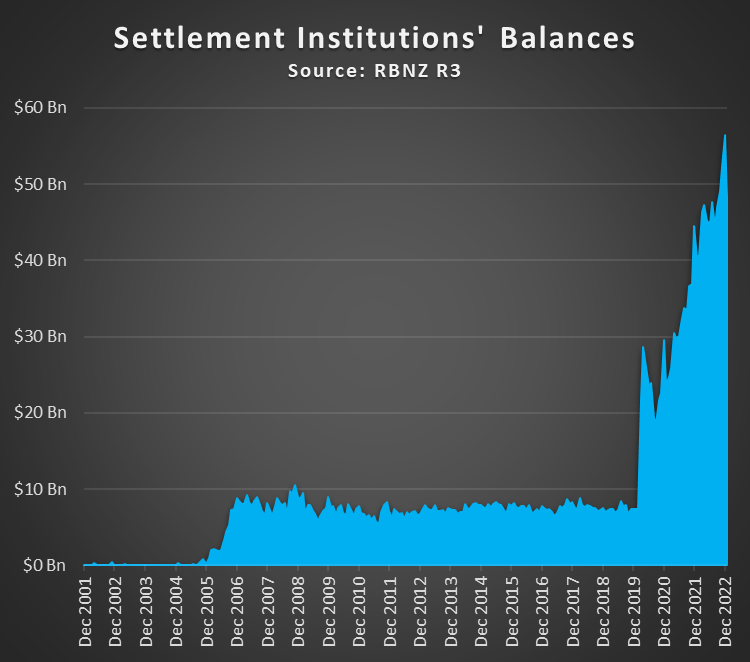

When Govt spends $100m, the Crown Settlement Account reduces by $100m, and the Settlement Account of a commercial bank goes up by $100m. The Crown then starts paying interest on that $100m at 4.75% (current OCR). Gross interest payments on total balances is $6.24m per day! [2/X]

When Govt spends $100m, the Crown Settlement Account reduces by $100m, and the Settlement Account of a commercial bank goes up by $100m. The Crown then starts paying interest on that $100m at 4.75% (current OCR). Gross interest payments on total balances is $6.24m per day! [2/X]

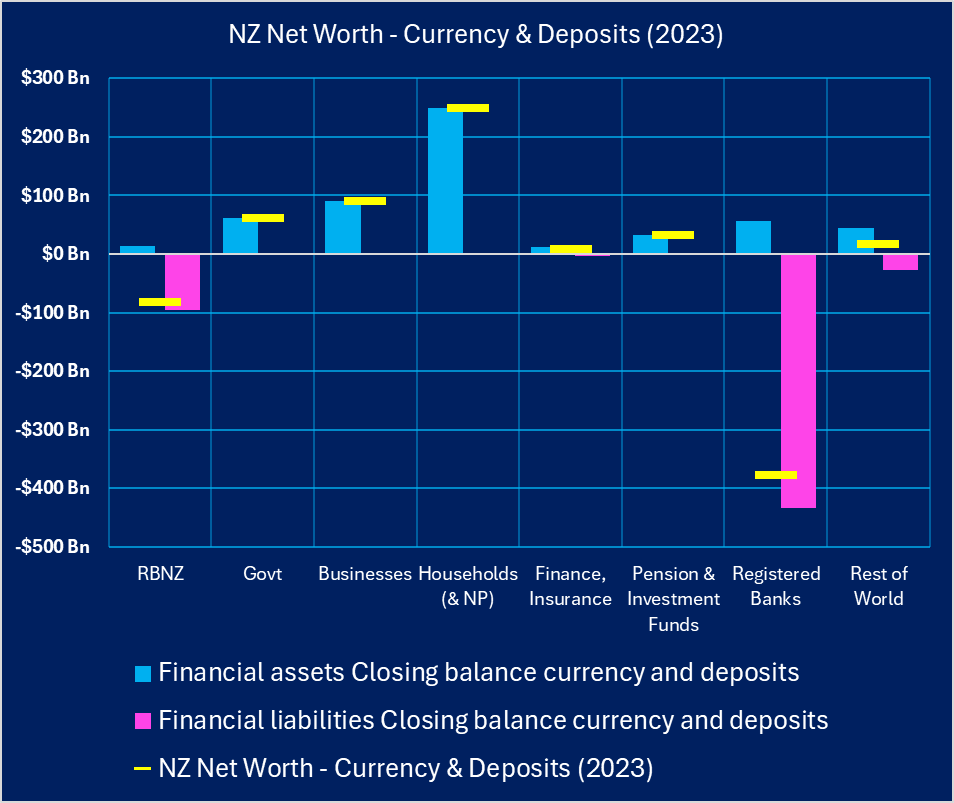

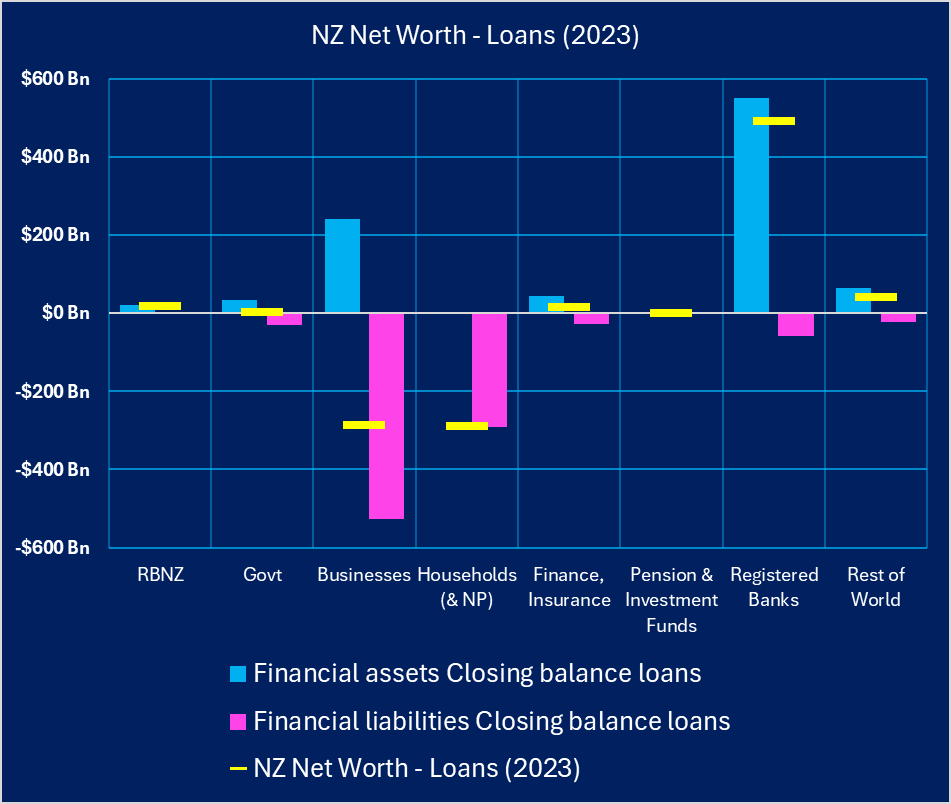

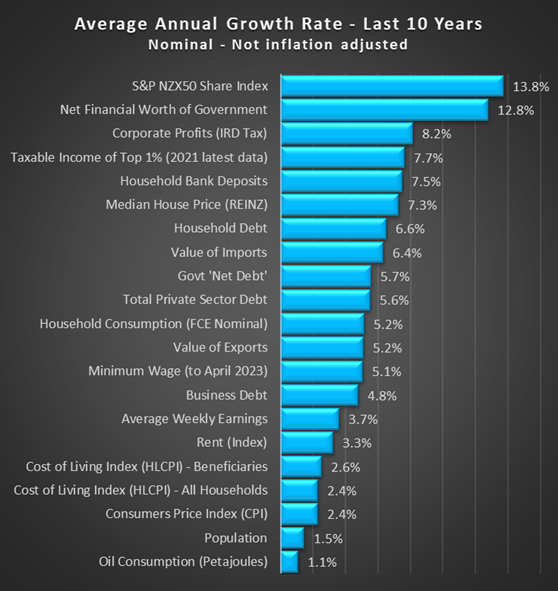

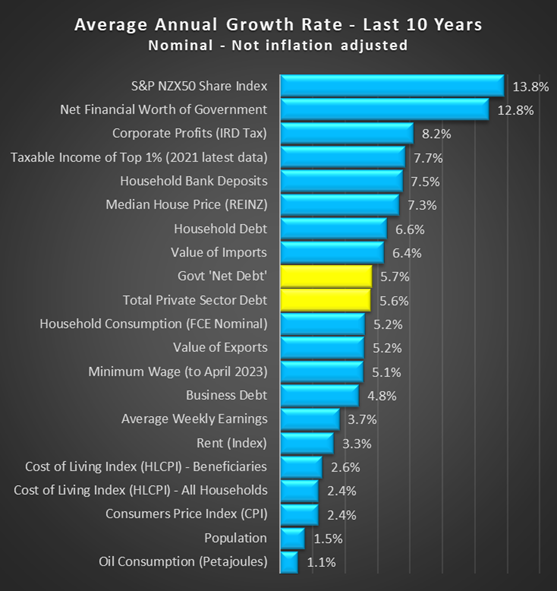

Brand new NZ Dollars come from 2 places: Commercial Bank lending and Govt spending. Commercial banks pumped $232Bn of new money into our economy over the last ten years (private debt is now a whopping $554Bn). Govt gave us a measly $30Bn - taking Govt ‘net debt’ to $70bn. [2/X]

Brand new NZ Dollars come from 2 places: Commercial Bank lending and Govt spending. Commercial banks pumped $232Bn of new money into our economy over the last ten years (private debt is now a whopping $554Bn). Govt gave us a measly $30Bn - taking Govt ‘net debt’ to $70bn. [2/X]

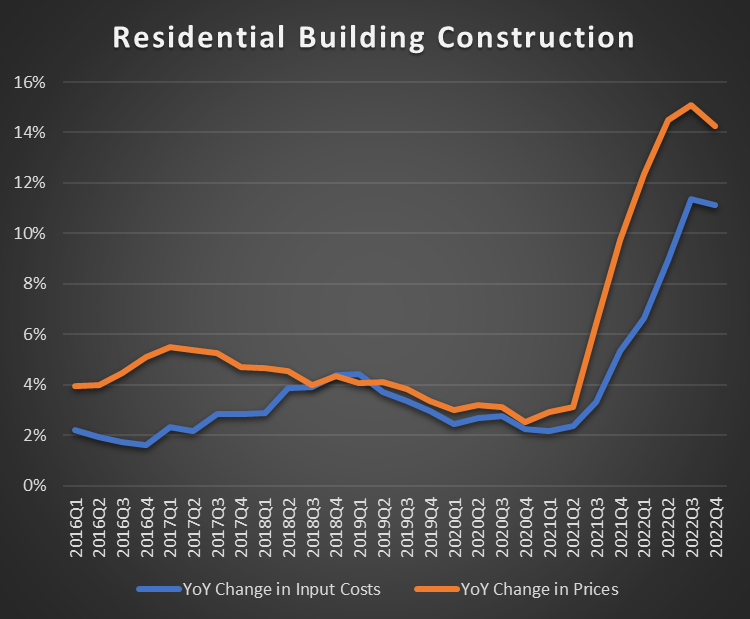

Now residential building construction - some signs of widening margins there as we went crazy building and renovating our weatherboard palaces in 2021 and 2022. [2/X]

Now residential building construction - some signs of widening margins there as we went crazy building and renovating our weatherboard palaces in 2021 and 2022. [2/X]