Author:

8th Wonder Investment - A Stock Market Compendium

Available on Amazon.

https://t.co/vbywxAN34e

Nothing I ever say or post is financial advice. Ever.

How to get URL link on X (Twitter) App

2/5

2/5

2/10

2/10

[2/5]

[2/5]

The Kaspi.kz app has become an indispensable tool for daily life in Kazakhstan, integrating a vast array of financial, e-commerce, and government services into a single, user-friendly platform. Its ecosystem is built on three core business segments: Payments, Marketplace, and Fintech, which together offer a seamless and comprehensive user experience. As of the second quarter of 2025, the Kaspi.kz Super App has 14.2 million monthly active users in Kazakhstan. With the total population of the country being 20 million, this represents 71% of the entire country. That’s how dominant $KSPI is, and this figure continues to grow.

The Kaspi.kz app has become an indispensable tool for daily life in Kazakhstan, integrating a vast array of financial, e-commerce, and government services into a single, user-friendly platform. Its ecosystem is built on three core business segments: Payments, Marketplace, and Fintech, which together offer a seamless and comprehensive user experience. As of the second quarter of 2025, the Kaspi.kz Super App has 14.2 million monthly active users in Kazakhstan. With the total population of the country being 20 million, this represents 71% of the entire country. That’s how dominant $KSPI is, and this figure continues to grow.

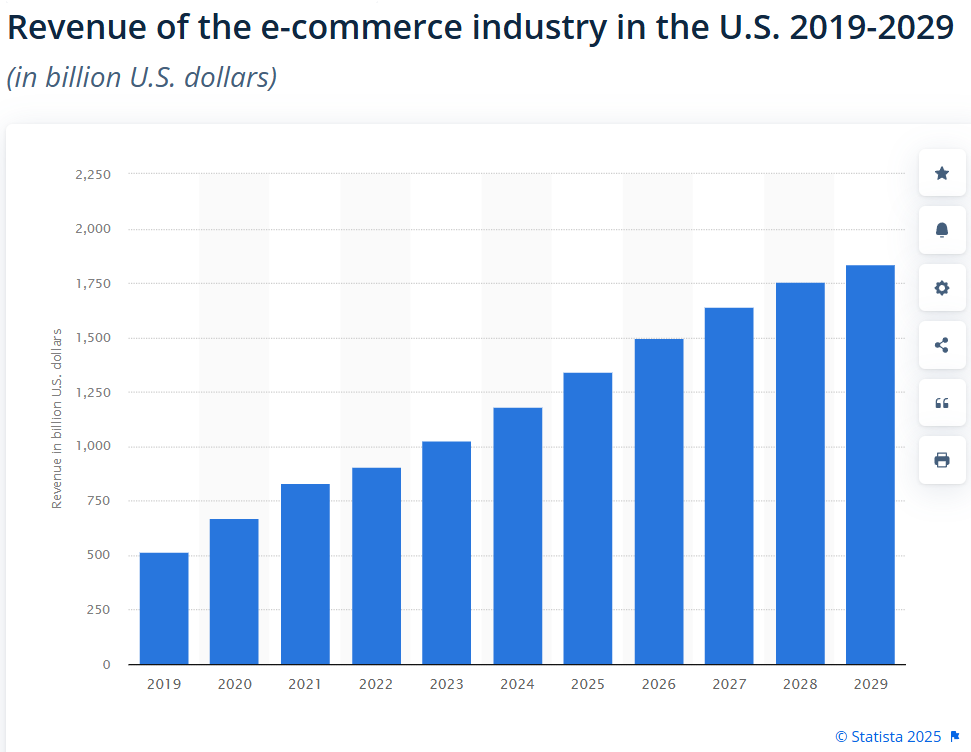

While most analysts are hyper-focused on the extremely impressive AWS business, zooming in on the e-commerce business shows something surprising. Market research suggests that the US e-commerce TAM will expand over the next 5 years to $1.8T. What does this mean for $AMZN?

While most analysts are hyper-focused on the extremely impressive AWS business, zooming in on the e-commerce business shows something surprising. Market research suggests that the US e-commerce TAM will expand over the next 5 years to $1.8T. What does this mean for $AMZN?