https://t.co/14shhrD1TU Director of Research, Policy & Comms @probonoecon. Charity, politics, numbers, cats. She/her🏳️🌈

4 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/stand_for_all/status/1462362618149187584Of the 14,600 initial asylum applications the Home Office rejects each year, 11,500 lodge appeals and around 3,700 of those appeals are successful. So mistakes have been made in the initial process.

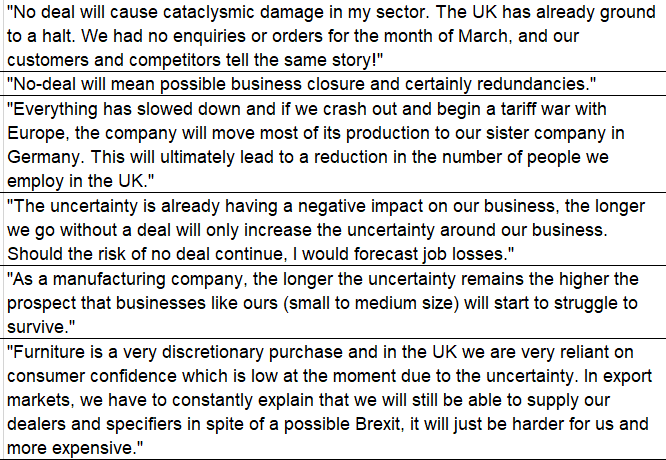

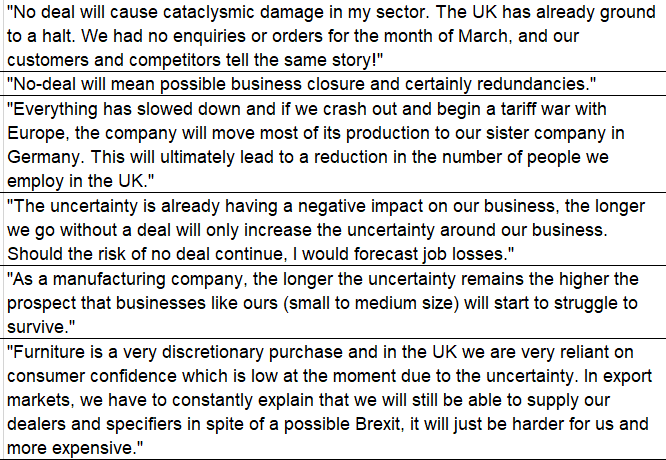

https://twitter.com/MileEndInst/status/1335910782836633600I’ve lost track of how many times I’ve been told over the last 5yrs that it’s because business wasn’t loud enough. 1st during the referendum (though post-🗳️ analysis tends to agree the economic argument was won, it just wasn’t important enough). 2nd during the negotiations (2/)

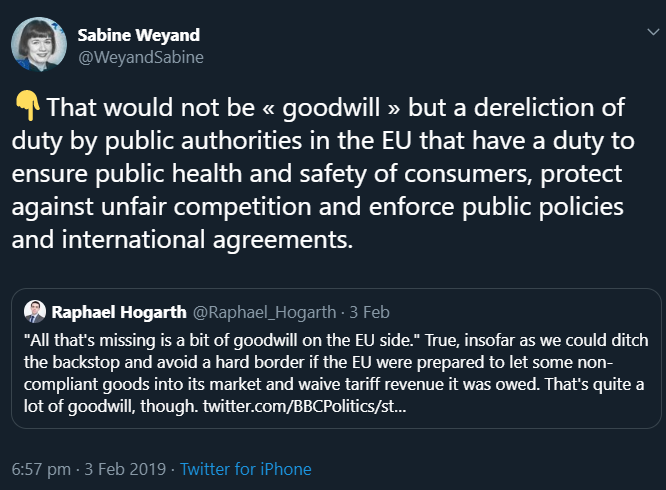

https://twitter.com/EUlondonrep/status/1155875118670909440And there's politics, negotiation dynamics, international law in the way. I get it.

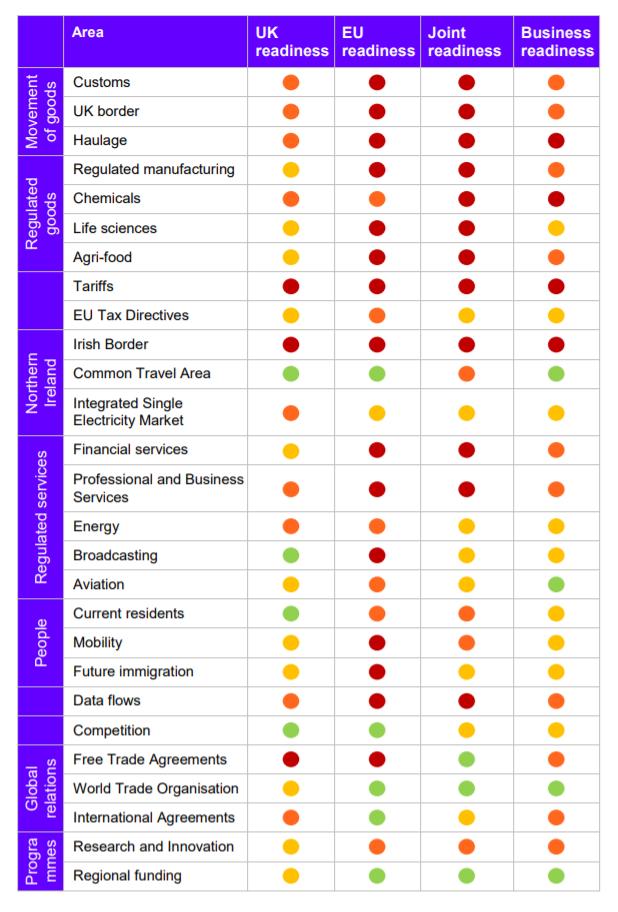

The @CBI_Economics team have started to see the level of stockpiling become is so high it's coming through in surveys, not just anecdote.

The @CBI_Economics team have started to see the level of stockpiling become is so high it's coming through in surveys, not just anecdote.