Obsessed about real estate | CEO at https://t.co/ayaxX40kpW, which can help you finance, sell, or analyze your home 🏡

How to get URL link on X (Twitter) App

It's been raining listings in Portland. The inventory has risen rapidly since May'22, hitting its peak in August, easing things for the buyers.

It's been raining listings in Portland. The inventory has risen rapidly since May'22, hitting its peak in August, easing things for the buyers.

1. Akron, OH

1. Akron, OH

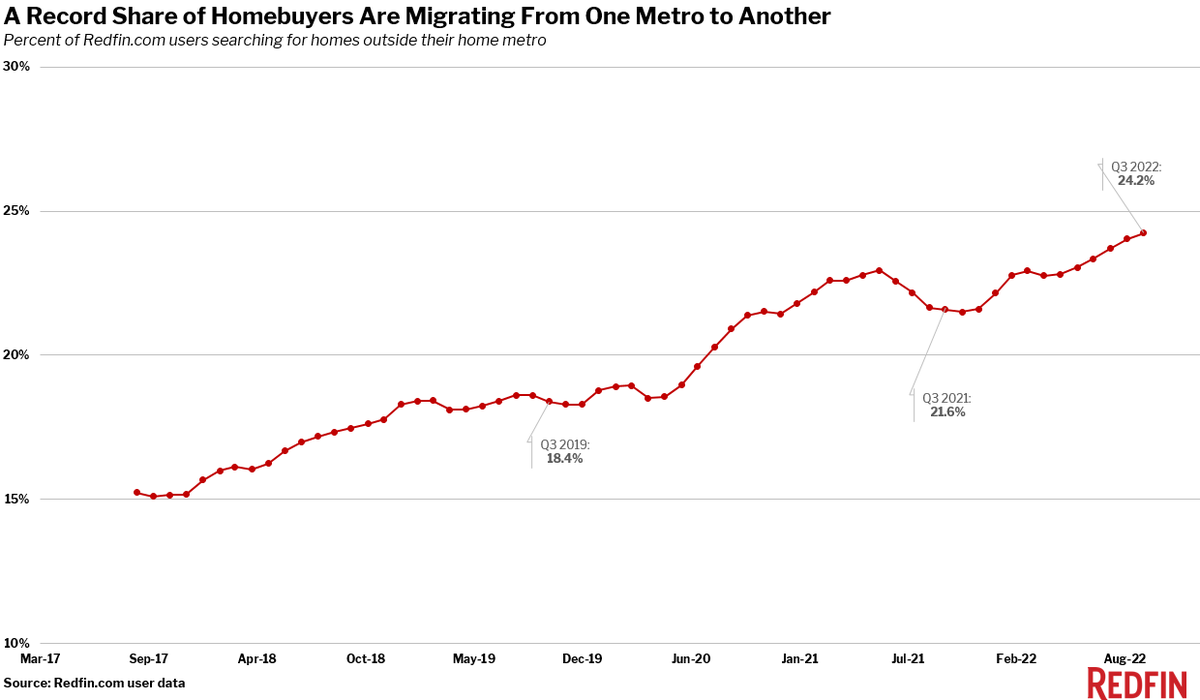

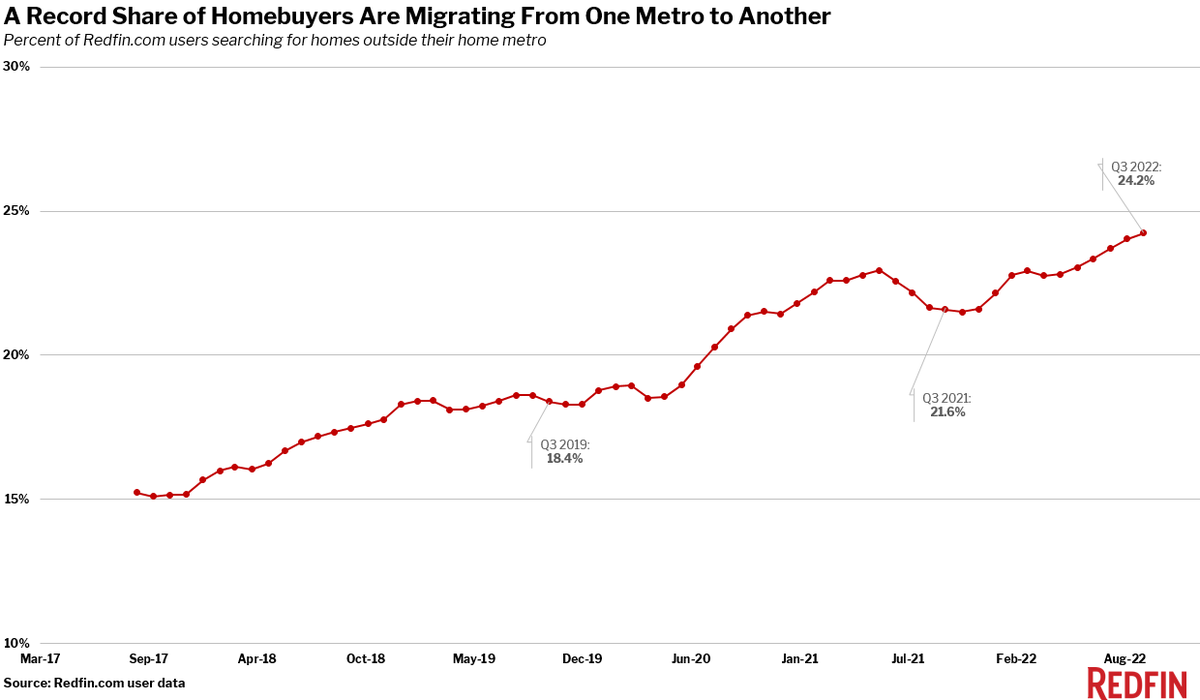

@Redfin People are looking to leave largest metros like New York, Los Angeles & Chicago.

@Redfin People are looking to leave largest metros like New York, Los Angeles & Chicago.

1. Las Vegas

1. Las Vegas

2. Mortgage rate hikes don't negatively impact home prices.

2. Mortgage rate hikes don't negatively impact home prices.

https://twitter.com/NikhaarShah/status/1537465310042890241

Despite the spike, homebuying activity rebounded 8% this week, after a sharp decline the week prior.

Despite the spike, homebuying activity rebounded 8% this week, after a sharp decline the week prior.

Most areas will see a deceleration in home prices - not a crash.

Most areas will see a deceleration in home prices - not a crash.