📈 Mutual Fund insider | Spotting undervalued stocks & emerging sectors | 🌍Macros, markets & geopolitics decoded | Follow for deep, actionable insights

How to get URL link on X (Twitter) App

💡𝐓𝐡𝐞 𝐑𝐞𝐯𝐞𝐫𝐬𝐚𝐥 𝐍𝐨 𝐎𝐧𝐞 𝐒𝐚𝐰 𝐂𝐨𝐦𝐢𝐧𝐠

💡𝐓𝐡𝐞 𝐑𝐞𝐯𝐞𝐫𝐬𝐚𝐥 𝐍𝐨 𝐎𝐧𝐞 𝐒𝐚𝐰 𝐂𝐨𝐦𝐢𝐧𝐠

🔷 𝐓𝐡𝐞 𝐁𝐚𝐬𝐢𝐜𝐬:

🔷 𝐓𝐡𝐞 𝐁𝐚𝐬𝐢𝐜𝐬:

𝐓𝐡𝐞 𝐃𝐨𝐥𝐥𝐚𝐫’𝐬 𝐑𝐢𝐬𝐞:

𝐓𝐡𝐞 𝐃𝐨𝐥𝐥𝐚𝐫’𝐬 𝐑𝐢𝐬𝐞:

𝐖𝐡𝐚𝐭 𝐢𝐭 𝐢𝐬:

𝐖𝐡𝐚𝐭 𝐢𝐭 𝐢𝐬:

𝗪𝗵𝗮𝘁 𝗱𝗼 𝗣𝗖𝗕𝘀 𝗱𝗼?

𝗪𝗵𝗮𝘁 𝗱𝗼 𝗣𝗖𝗕𝘀 𝗱𝗼?

Outlived Every Civilization

Outlived Every Civilization

𝗧𝗵𝗲 𝗕𝗶𝗴 𝗥𝗲𝘃𝗲𝗮𝗹 📊

𝗧𝗵𝗲 𝗕𝗶𝗴 𝗥𝗲𝘃𝗲𝗮𝗹 📊

𝗦𝗼𝗹𝗮𝗿 𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝗶𝗲𝘀:

𝗦𝗼𝗹𝗮𝗿 𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝗶𝗲𝘀:

Why Energy is HOT right now:

Why Energy is HOT right now:

In the 𝟐𝟎𝟐𝟎 𝐀𝐆𝐌, 𝐌𝐮𝐤𝐞𝐬𝐡 𝐀𝐦𝐛𝐚𝐧𝐢 announced:

In the 𝟐𝟎𝟐𝟎 𝐀𝐆𝐌, 𝐌𝐮𝐤𝐞𝐬𝐡 𝐀𝐦𝐛𝐚𝐧𝐢 announced:

𝗧𝗵𝗲 𝗦𝗲𝗺𝗶𝗰𝗼𝗻𝗱𝘂𝗰𝘁𝗼𝗿 𝗩𝗮𝗹𝘂𝗲 𝗖𝗵𝗮𝗶𝗻 🧩

𝗧𝗵𝗲 𝗦𝗲𝗺𝗶𝗰𝗼𝗻𝗱𝘂𝗰𝘁𝗼𝗿 𝗩𝗮𝗹𝘂𝗲 𝗖𝗵𝗮𝗶𝗻 🧩

1/ Chalet Hotels 🏨

1/ Chalet Hotels 🏨

⚡ 𝐖𝐡𝐲 𝐃𝐚𝐭𝐚 𝐂𝐞𝐧𝐭𝐞𝐫𝐬?

⚡ 𝐖𝐡𝐲 𝐃𝐚𝐭𝐚 𝐂𝐞𝐧𝐭𝐞𝐫𝐬?

Markets move in cycles:

Markets move in cycles:

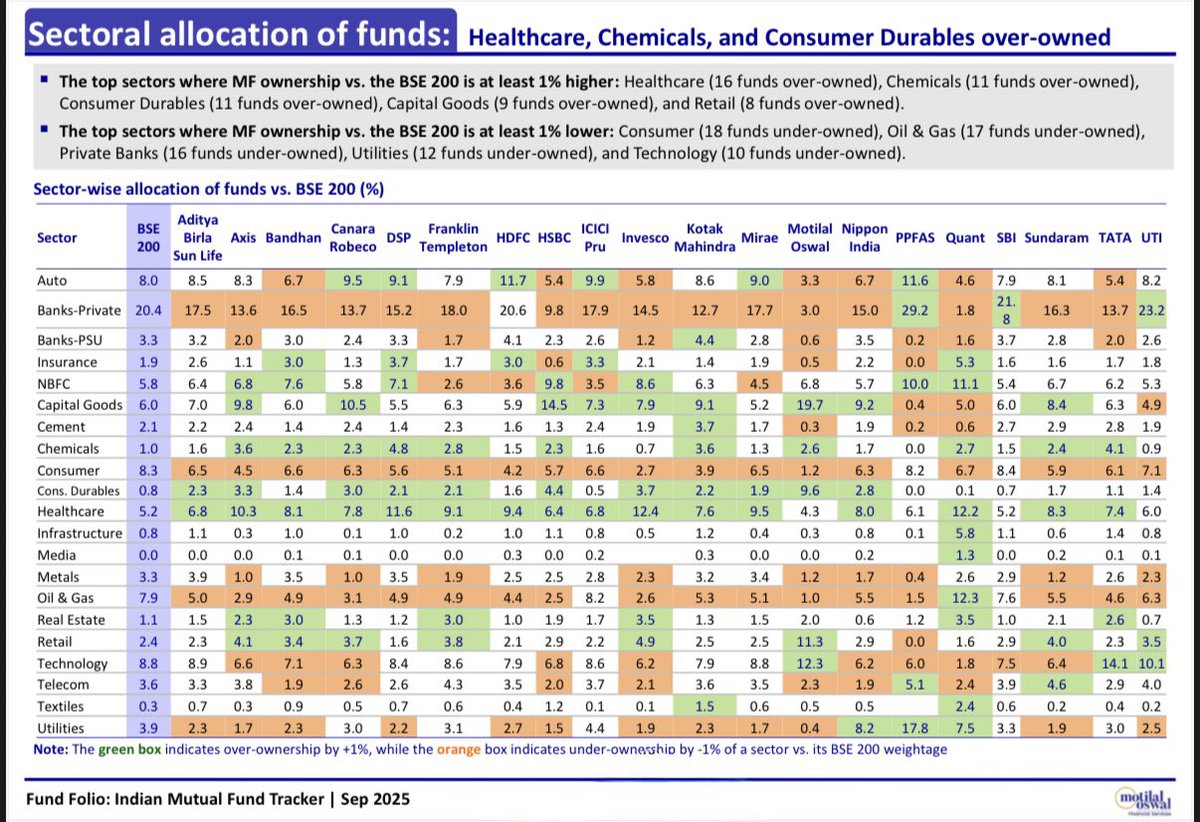

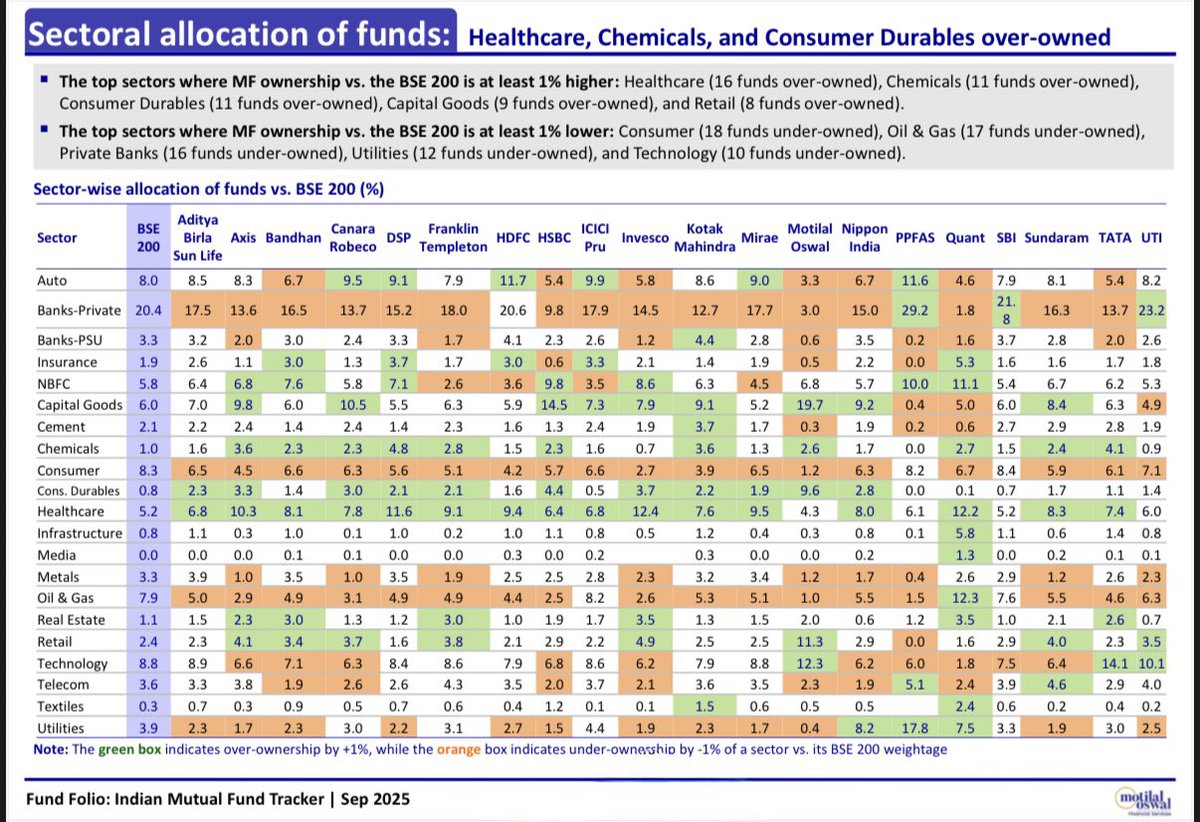

The Big Picture 📊

The Big Picture 📊

1. Executive Summary

1. Executive Summary