Mercenary at your local Multistrat hedge fund. HF recruiters wet dream...

In between gardening leaves.

Not selling any newsletter or something of that sort

3 subscribers

How to get URL link on X (Twitter) App

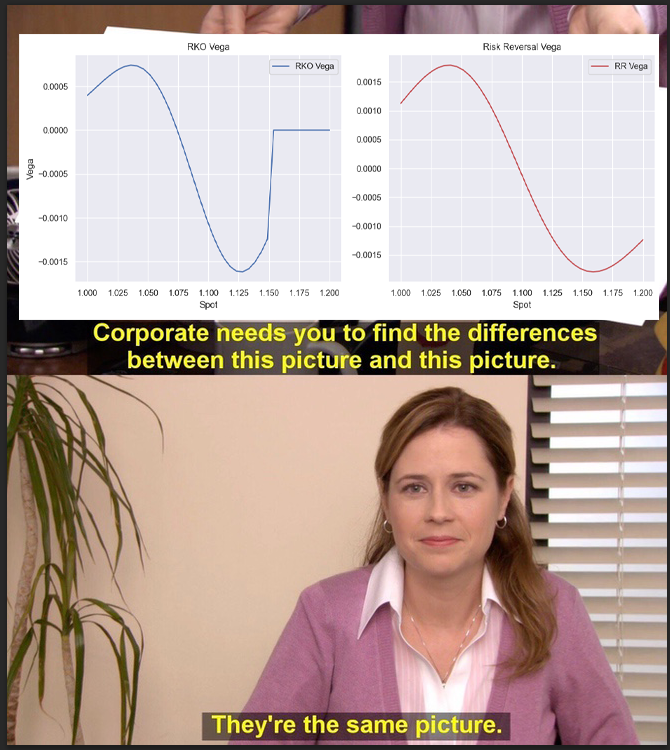

https://twitter.com/liquiditygoblin/status/1948297554543919559or in other words, the change in the value of the option wrt the change in the underlying asset. That was mostly true because one of the other key assumptions of the B&S model is that implied volatility is constant across all strikes and maturities

https://twitter.com/OneHotCode1/status/1900623726208503949Correlation-type products, which are interesting af and worth delving into, bring another level of complexity to an already complex topic, so we'll leave them out (for now...)

https://twitter.com/tuvidux/status/1898119741937430928The major flaws imho are:

https://twitter.com/OneHotCode1/status/1895529796312187043Before we jump into the deep end, let's think about two real-life trading scenarios:

https://twitter.com/OneHotCode1/status/1893199785118543952The story of what we know as vol rv strategies starts around the late 90s/early 2000s when many head traders on the sell-side realized that they could get paid much better on the buy-side (namely hedge funds) doing what they do on the sell-side (minus the favorable friction)

https://twitter.com/bennpeifert/status/1888254737075835311Vanna Volga, which I believe originated in FX about 25-30yrs ago fits the vol smile using 3-5 liquidly traded instruments (ATM , RRs , BFs of different delta strikes).

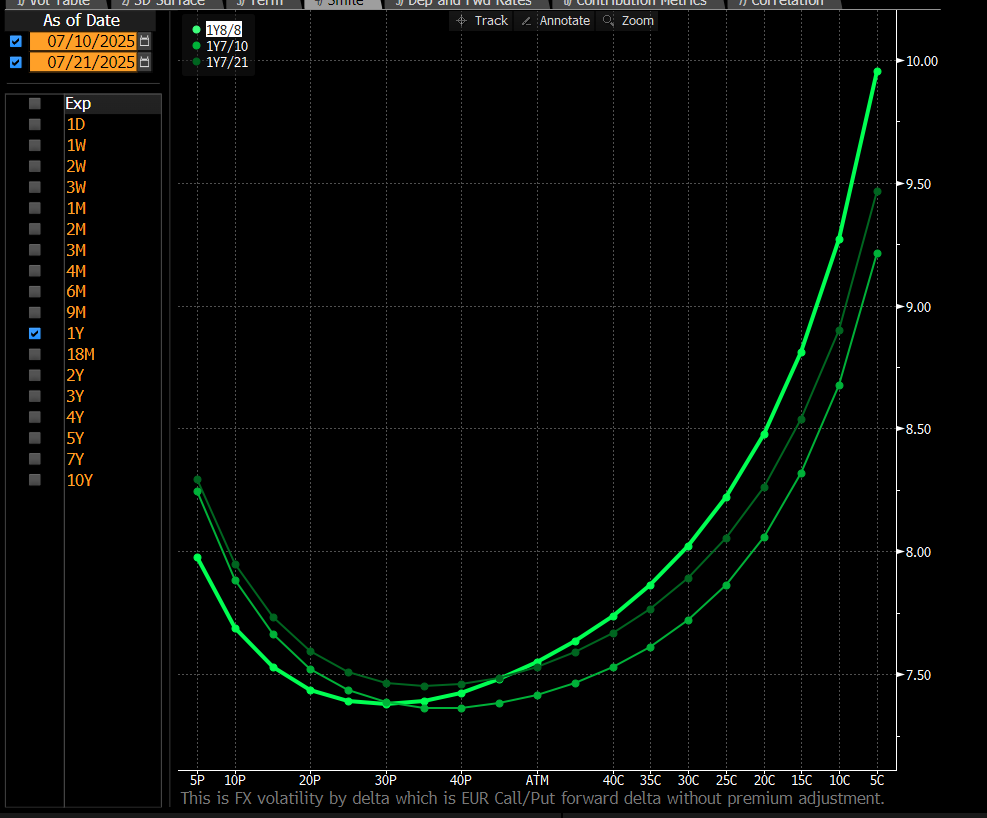

https://twitter.com/OneHotCode1/status/1883453437142331534Let's level the ground w.r.t. market vol quotation - different markets may have different quoting conventions/standards, but market-makers/dealers will usually quote vol runs (or vol term structure) in the way of generic/liquid expires (i.e., 1w,2w,1m,3m, etc..)

https://twitter.com/OneHotCode1/status/1873353067720278069Vol strategies, generally speaking, try to extract value from vol surfaces (i.e., atm vol and/or high-order moments like skew/convexity). There are many ways to skin that cat (metaphorically, of course), but most buy-side vol desks run what we like to call "vol rv" strategies