How to get URL link on X (Twitter) App

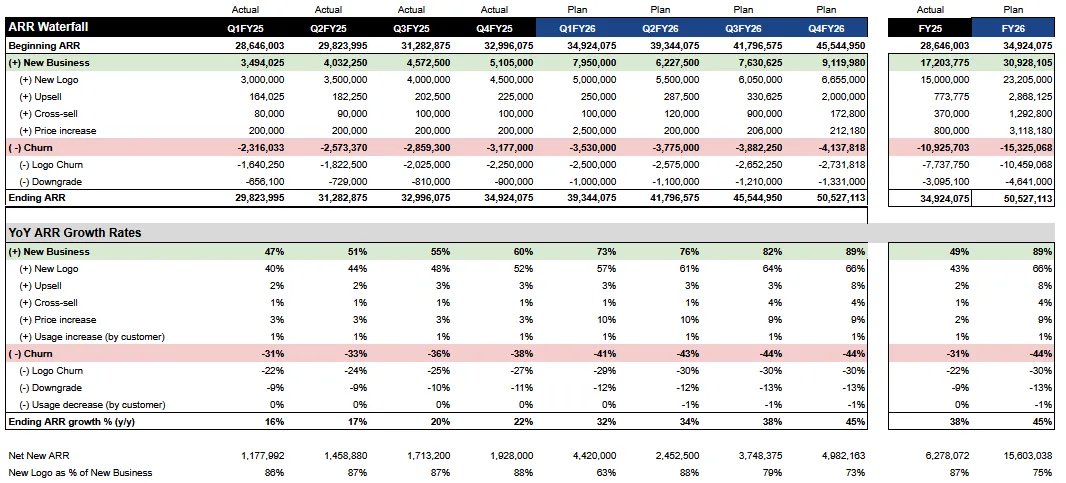

And here is how I present the full ARR waterfall.

And here is how I present the full ARR waterfall.

A company’s stock price can increase from:

A company’s stock price can increase from:

A quick like at the P&L would show screaming red flags

A quick like at the P&L would show screaming red flags

The cash flow statement shows the cash inflows and outflows of a company over a specific period of time.

The cash flow statement shows the cash inflows and outflows of a company over a specific period of time.

The yield curve looks at the relationship between the yield (i.e. investment return) on debt investments with different maturities.

The yield curve looks at the relationship between the yield (i.e. investment return) on debt investments with different maturities.

Span of control is defined as

Span of control is defined as https://twitter.com/HarryStebbings/status/1596478093329600512The best VCs will still help most of these “zombie companies”.

The obvious point is that average SaaS valuations are down.

The obvious point is that average SaaS valuations are down.