I will help you navigate the world of options by sharing valuable insights and strategies from 20 years experience | IBD and Barchart options expert.

2 subscribers

How to get URL link on X (Twitter) App

𝟭. 𝗠𝗮𝗿𝗸𝗲𝘁𝘀 𝗮𝗿𝗲𝗻’𝘁 𝗱𝗿𝗶𝘃𝗲𝗻 𝗯𝘆 𝗳𝘂𝗻𝗱𝗮𝗺𝗲𝗻𝘁𝗮𝗹𝘀.

𝟭. 𝗠𝗮𝗿𝗸𝗲𝘁𝘀 𝗮𝗿𝗲𝗻’𝘁 𝗱𝗿𝗶𝘃𝗲𝗻 𝗯𝘆 𝗳𝘂𝗻𝗱𝗮𝗺𝗲𝗻𝘁𝗮𝗹𝘀.

1.Cur Losses Quickly

1.Cur Losses Quickly

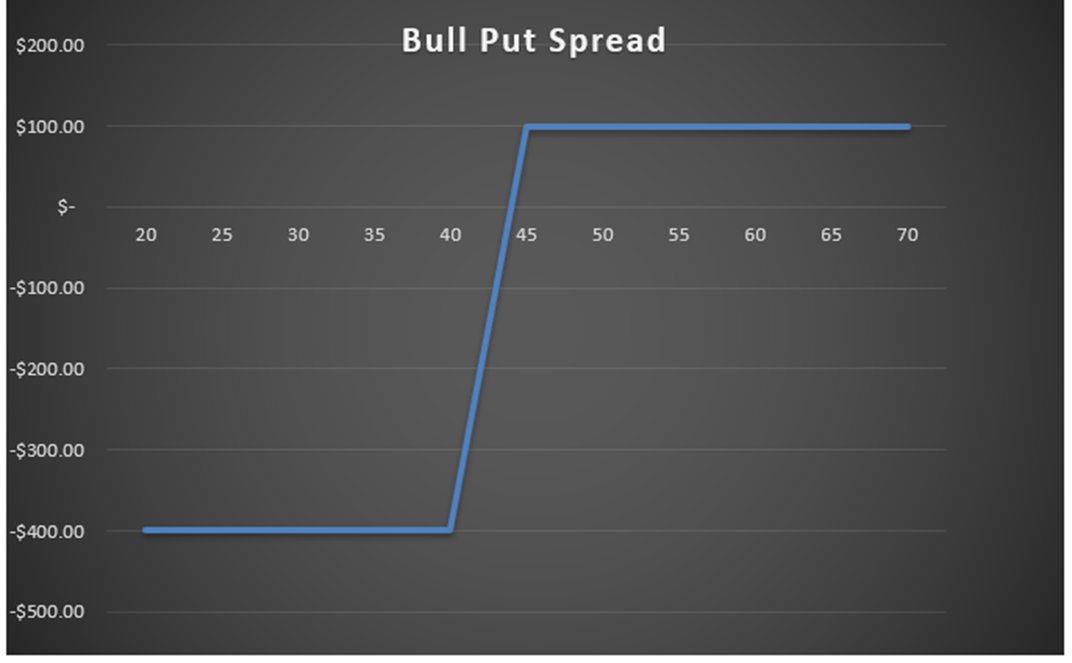

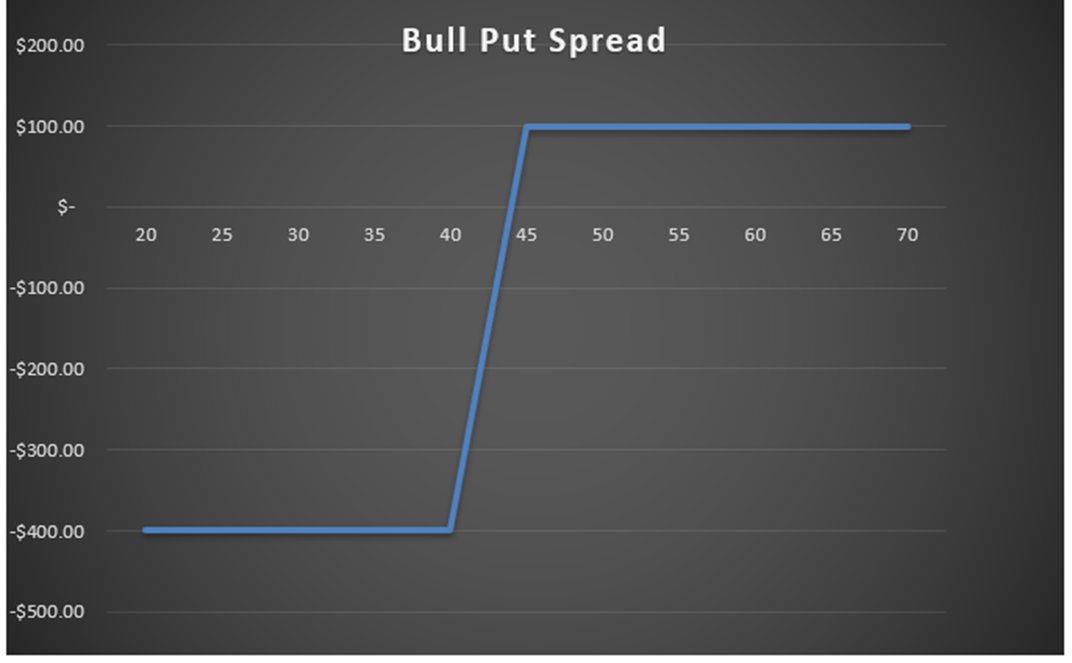

It's a powerful strategy that aims to take advantage of low volatility markets while limiting downside risk.

It's a powerful strategy that aims to take advantage of low volatility markets while limiting downside risk.

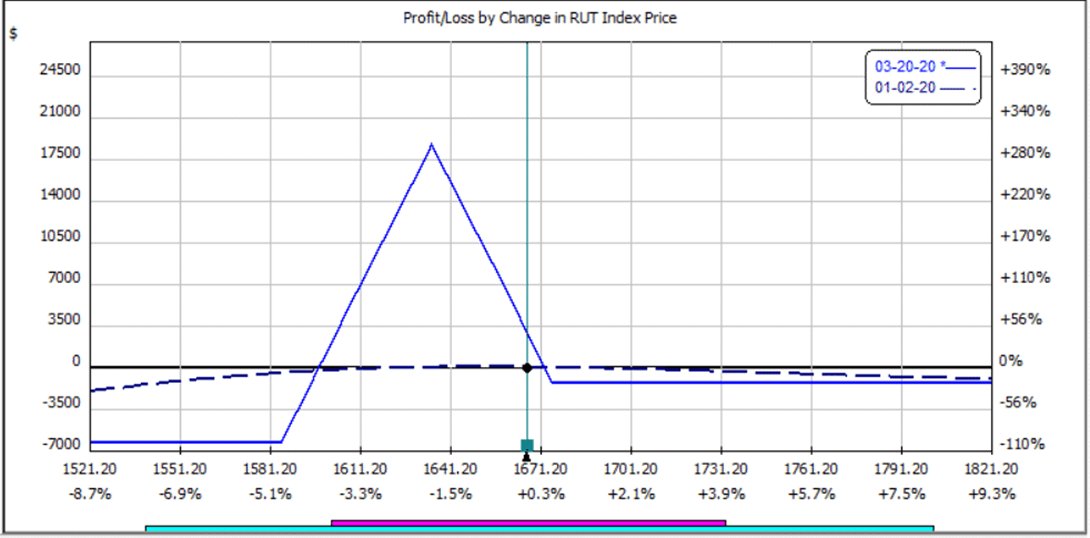

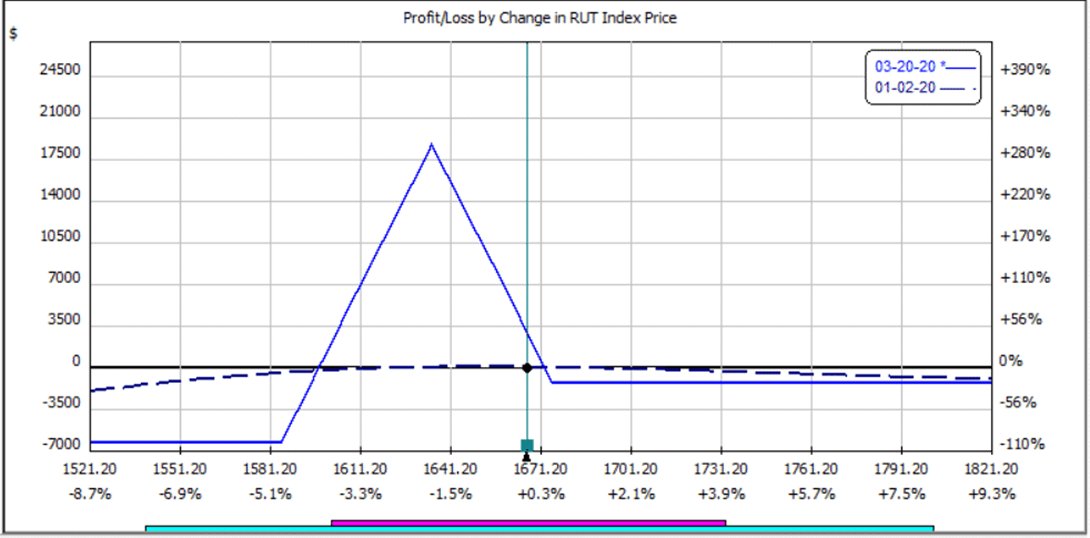

Discover his unique insights on risk management, market structure, and identifying profitable patterns

Discover his unique insights on risk management, market structure, and identifying profitable patterns

1. Price Patterns

1. Price Patterns