Neither noise nor guessworks - only insights.

Illuminating your investing journey with facts, data, charts, and more.

#MarketInsights

How to get URL link on X (Twitter) App

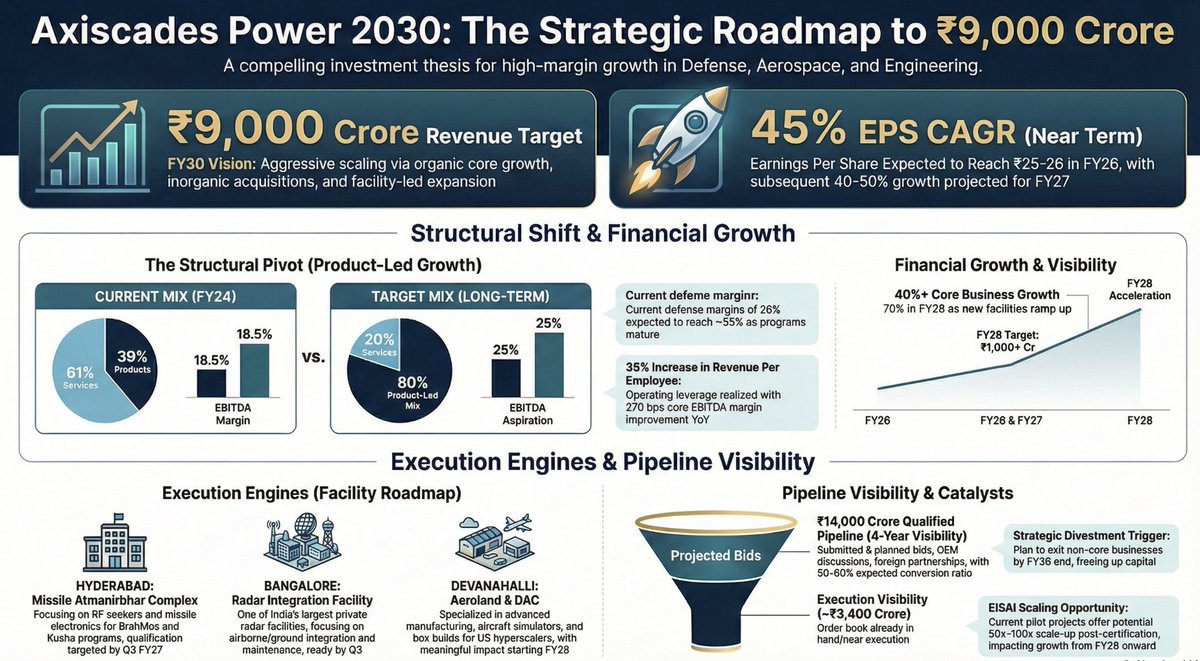

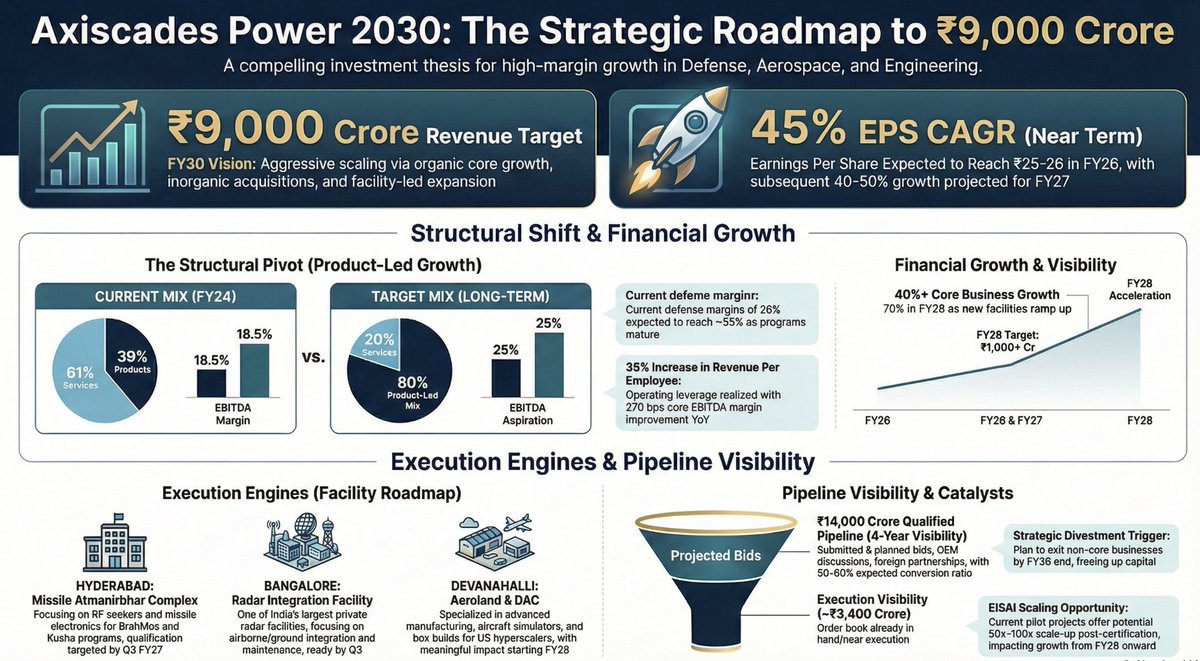

📈 Revenue Growth Guidance

📈 Revenue Growth Guidance

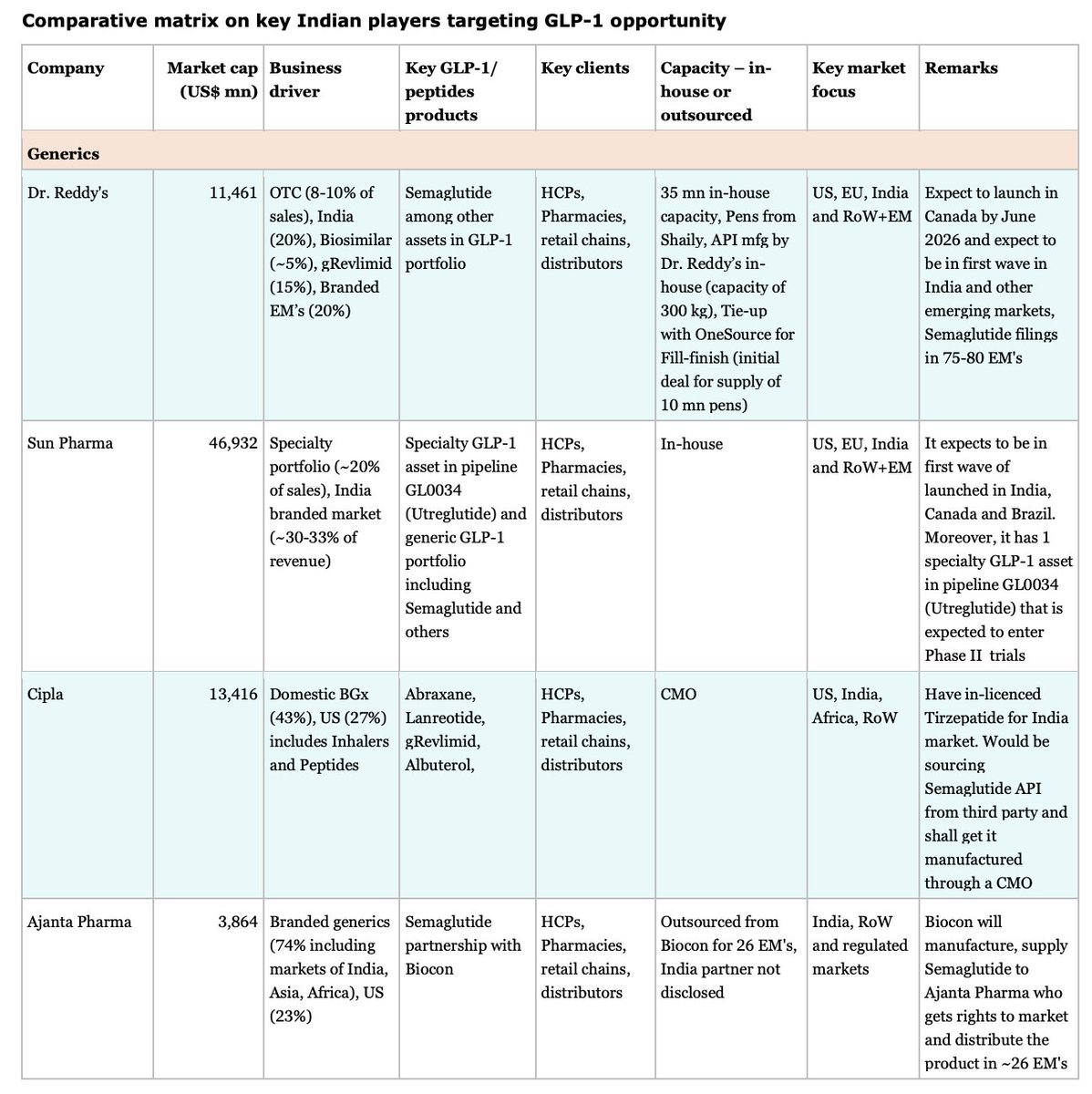

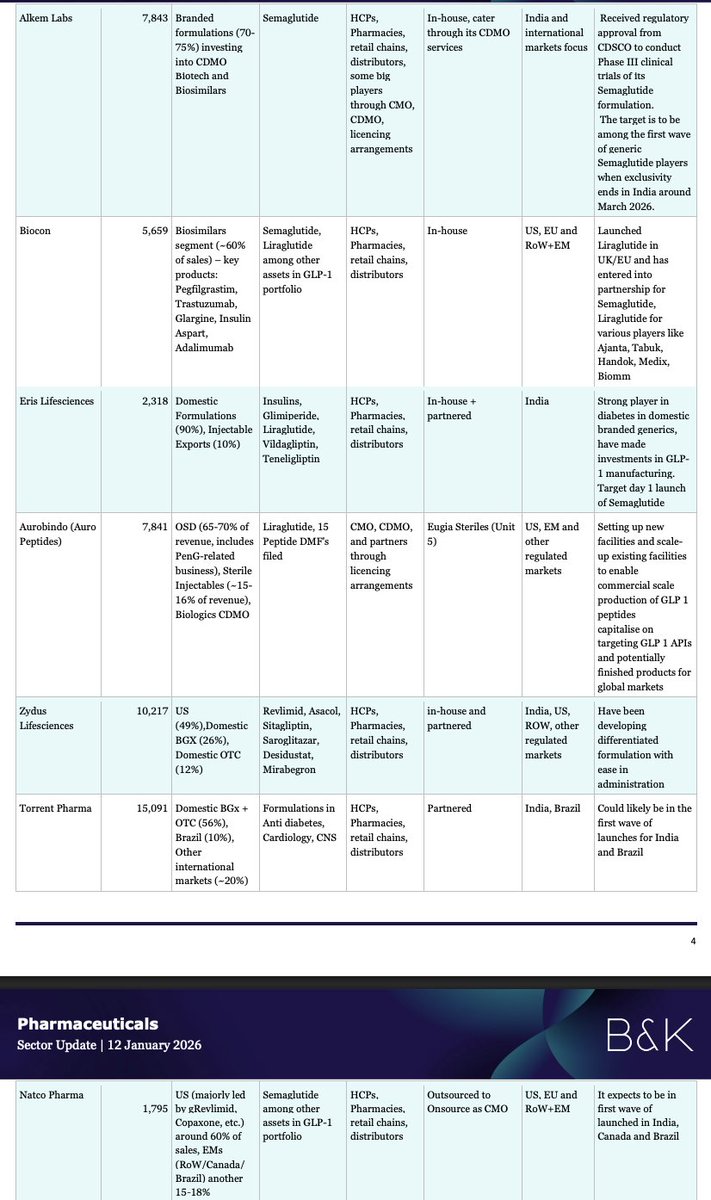

Generics

Generics

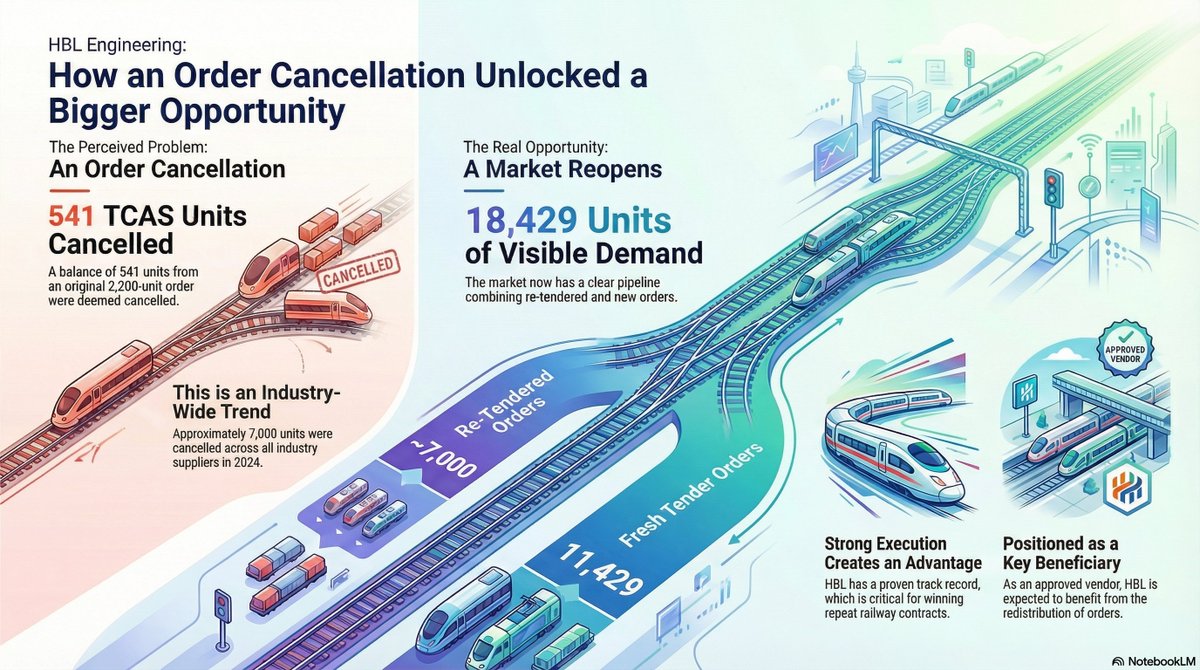

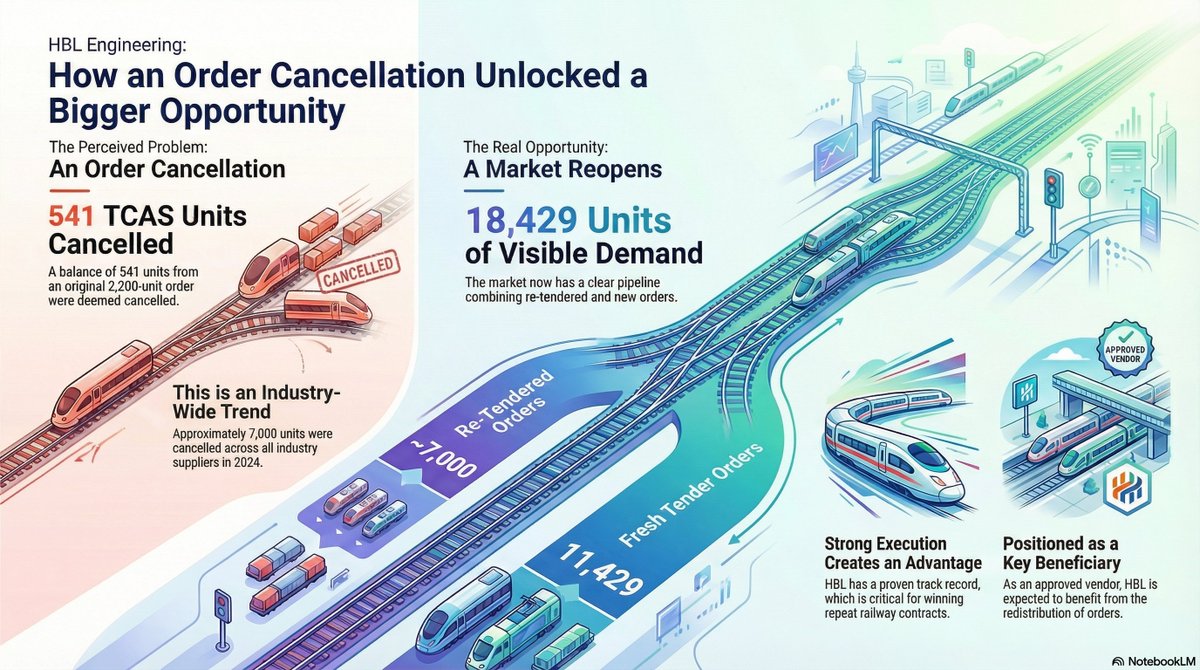

1️⃣ HBL ENGINEERING | What actually happened

1️⃣ HBL ENGINEERING | What actually happened

This flywheel design explains Meesho’s structural cost advantage.

This flywheel design explains Meesho’s structural cost advantage.