NY-Based Restructuring Analyst sharing restructuring/credit/distressed investing content!

Check out my newsletter - posts go behind paywall after publication!

2 subscribers

How to get URL link on X (Twitter) App

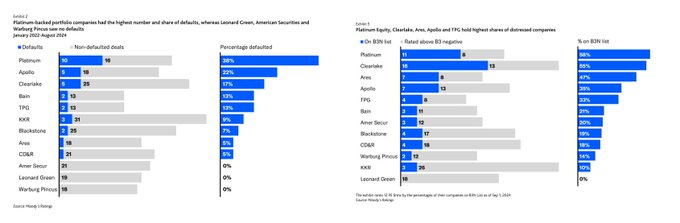

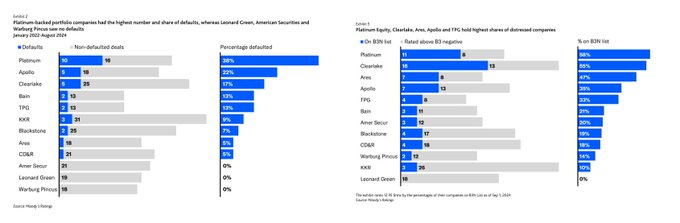

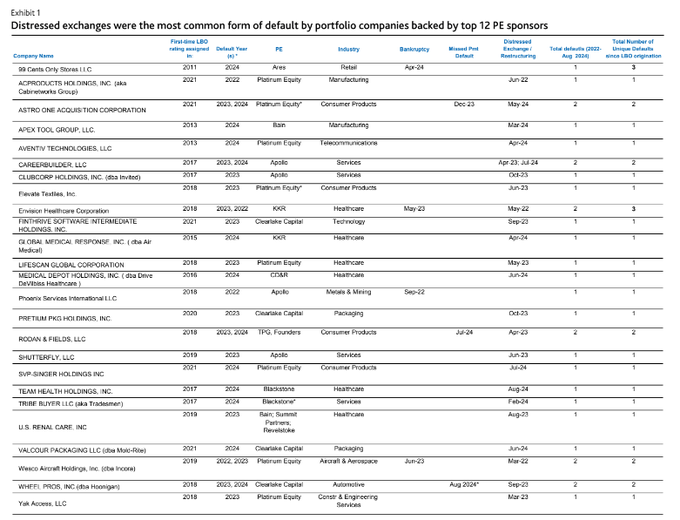

1) Large-Cap Private Equity Recent Defaults

1) Large-Cap Private Equity Recent Defaults

1) Large-Cap Private Equity Recent Defaults

1) Large-Cap Private Equity Recent Defaults