Quant. Stocks, options (cred spreads) Anon due to public wealth management. Markets since 2003. Current research S&P 500 constituents database to 1957

How to get URL link on X (Twitter) App

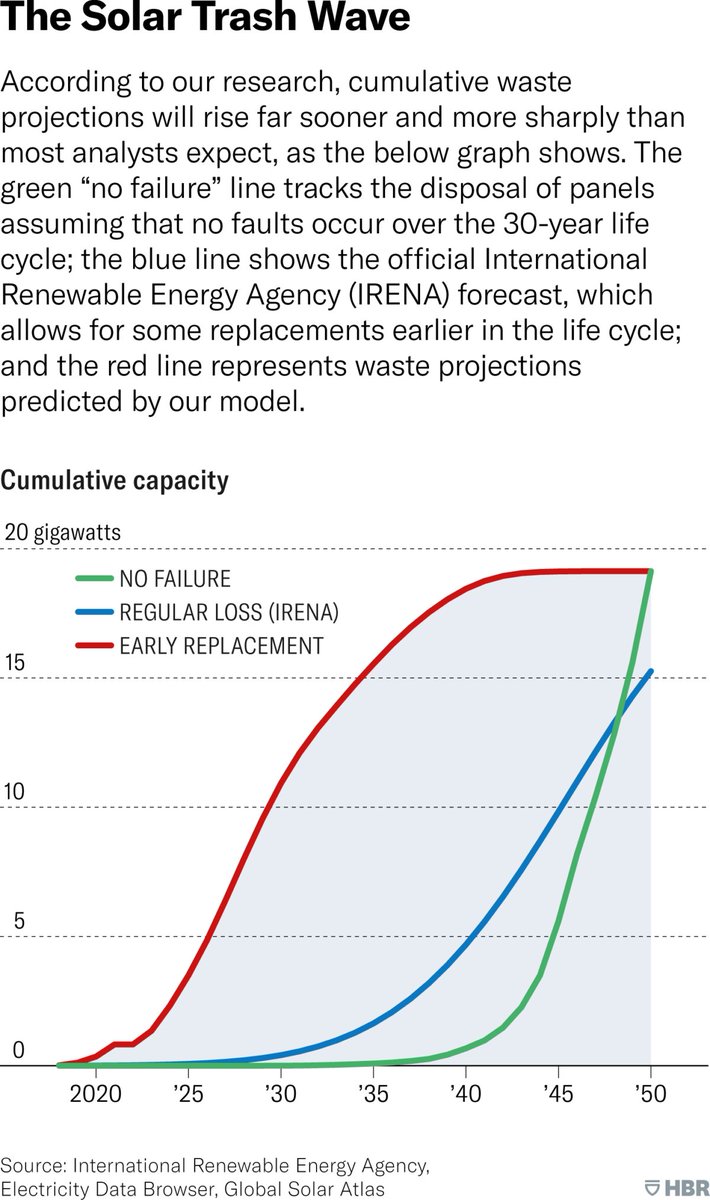

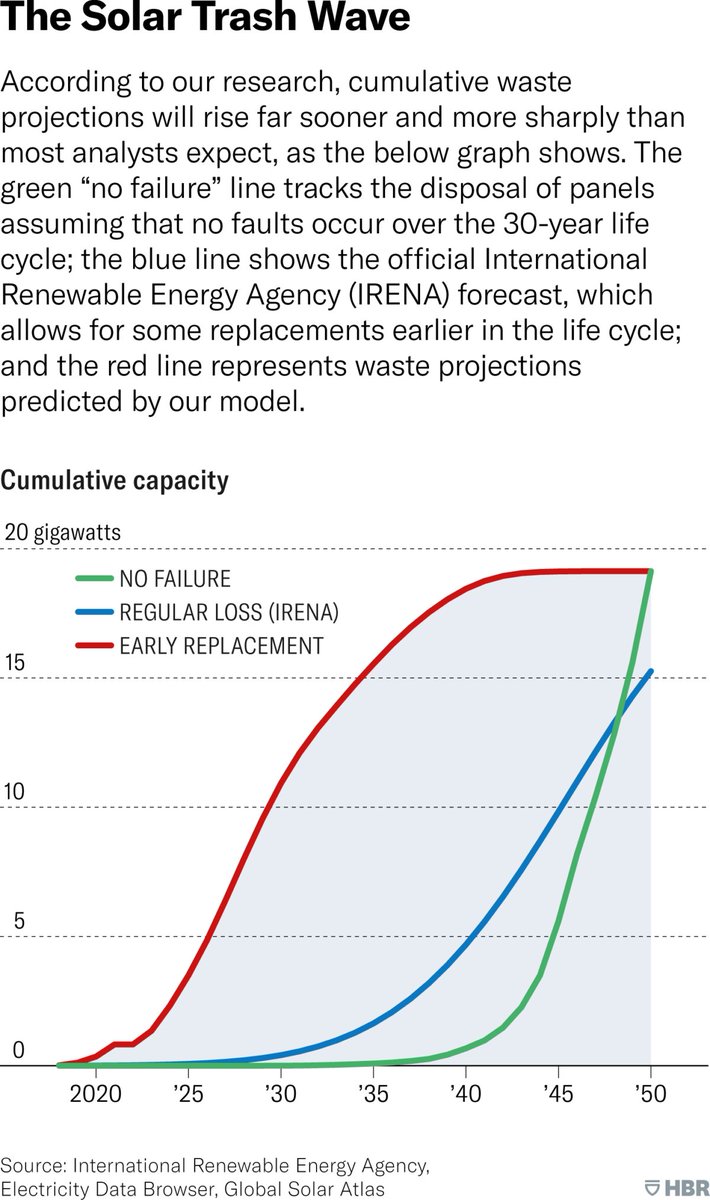

Meet Ms. Brown. In 2011, she embraced solar power, investing $40,800 in panels for her California home. With a 30% tax credit and an expectation of $2,100 yearly from 12,000 kilowatt-hours, her green journey began. 🌞💡♻️💚

Meet Ms. Brown. In 2011, she embraced solar power, investing $40,800 in panels for her California home. With a 30% tax credit and an expectation of $2,100 yearly from 12,000 kilowatt-hours, her green journey began. 🌞💡♻️💚

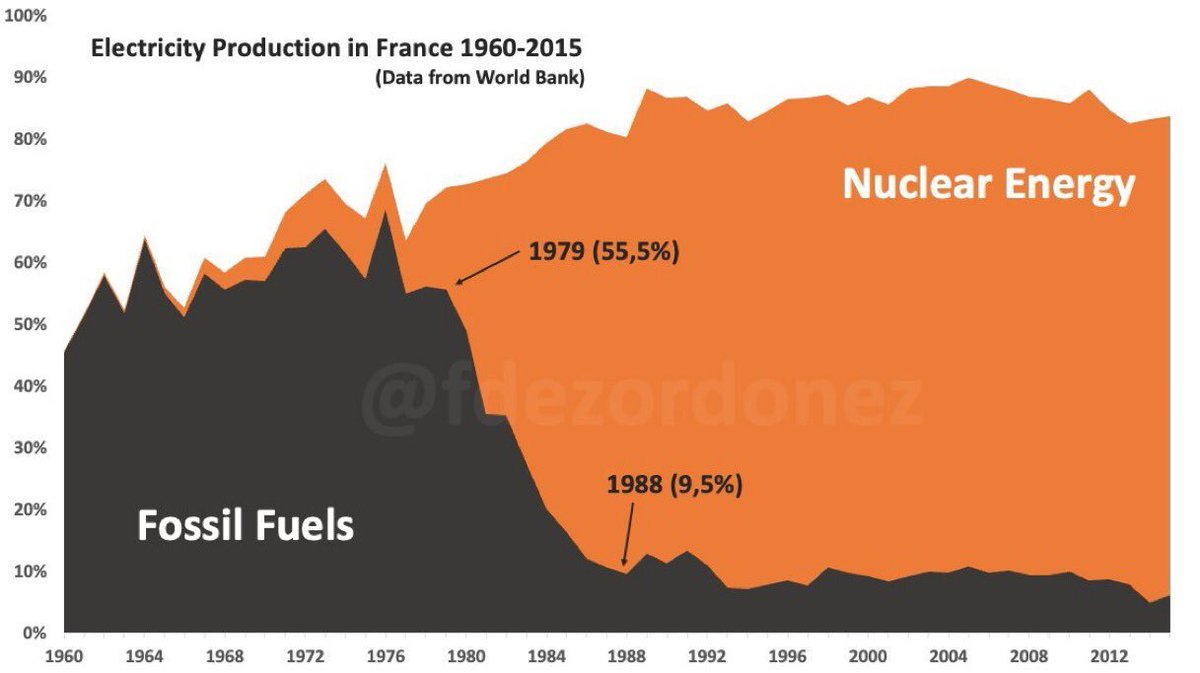

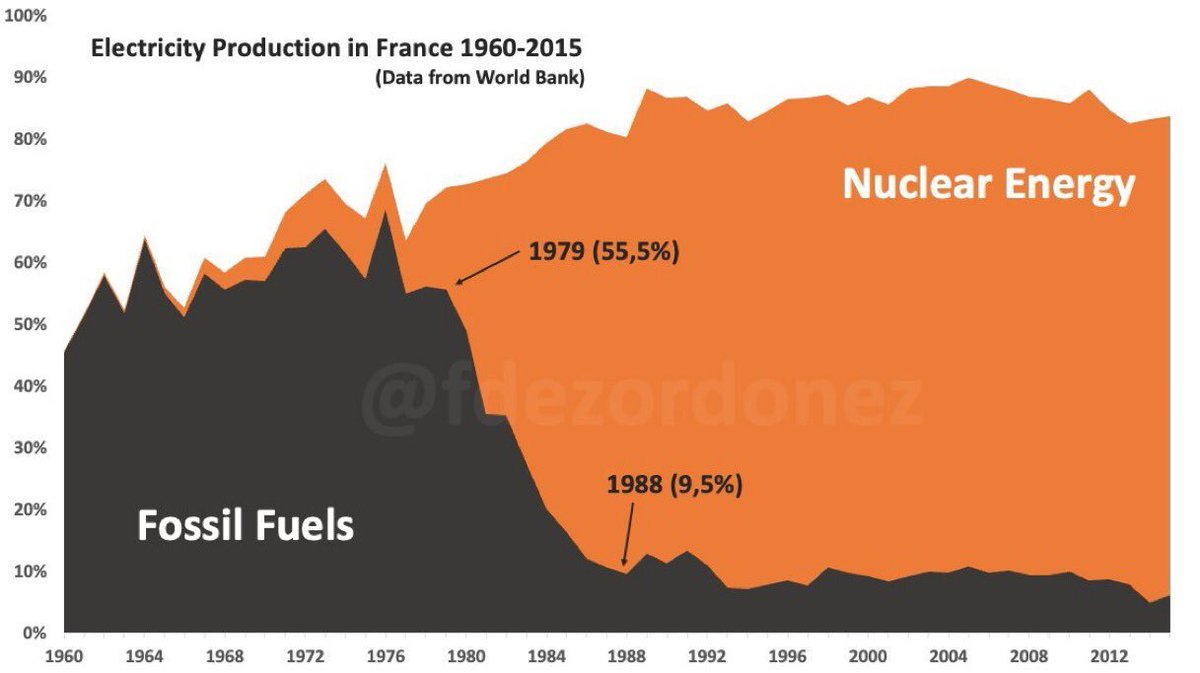

🇫🇷 In France, the centralized energy policy and state control over the nuclear sector facilitated swift decision-making and implementation. The government's commitment to energy independence, especially after the oil shocks of the '70s, paved the way for the nuclear push. Today, regulatory complexities and public opposition make such rapid expansion more challenging.

🇫🇷 In France, the centralized energy policy and state control over the nuclear sector facilitated swift decision-making and implementation. The government's commitment to energy independence, especially after the oil shocks of the '70s, paved the way for the nuclear push. Today, regulatory complexities and public opposition make such rapid expansion more challenging.

This AI-driven future puts an end to search revenue and removes the motivation for content creators to produce free content.

This AI-driven future puts an end to search revenue and removes the motivation for content creators to produce free content.

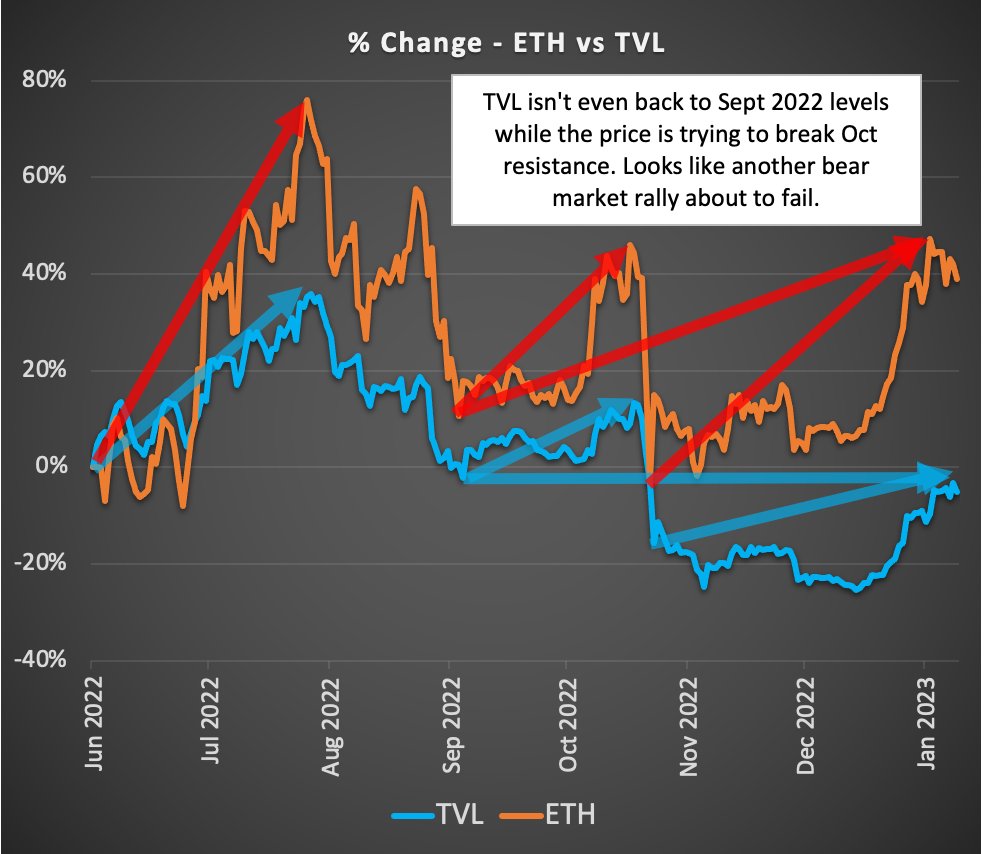

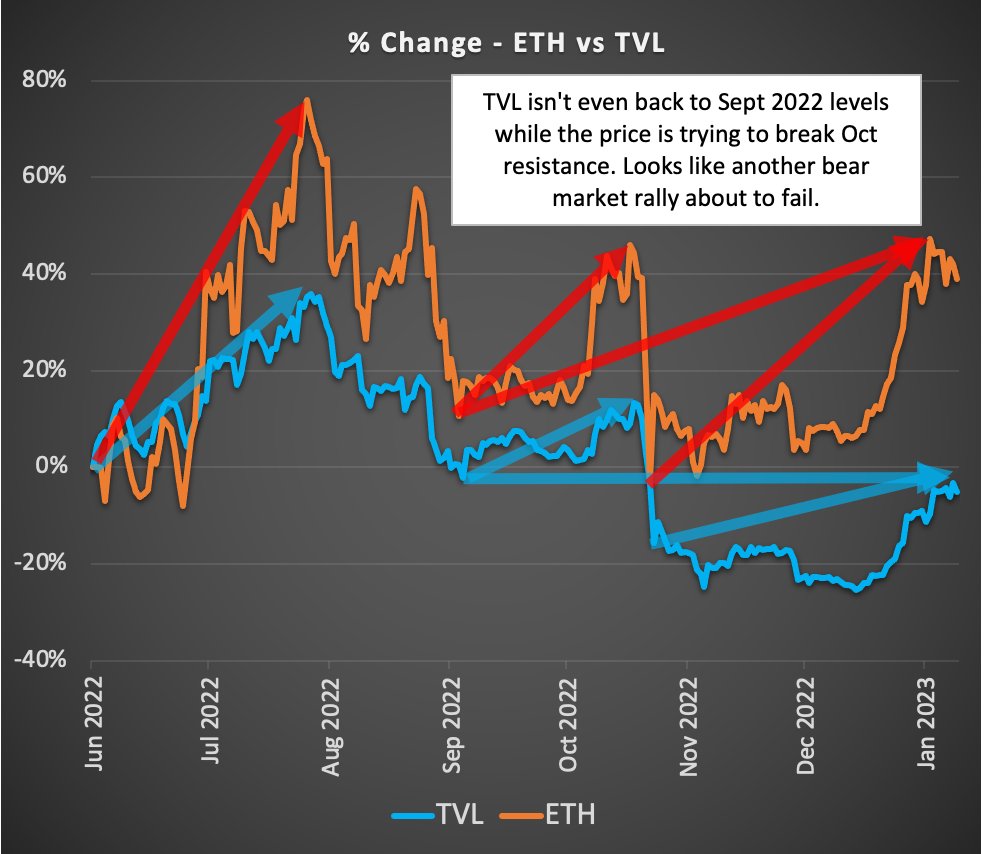

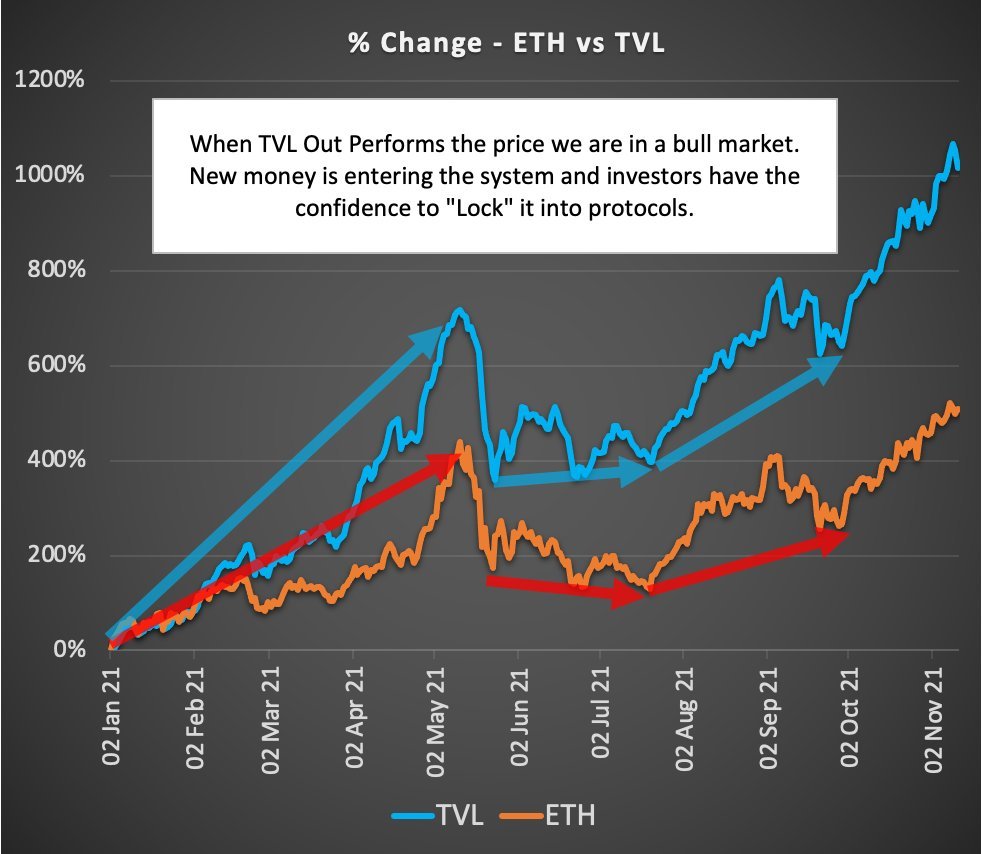

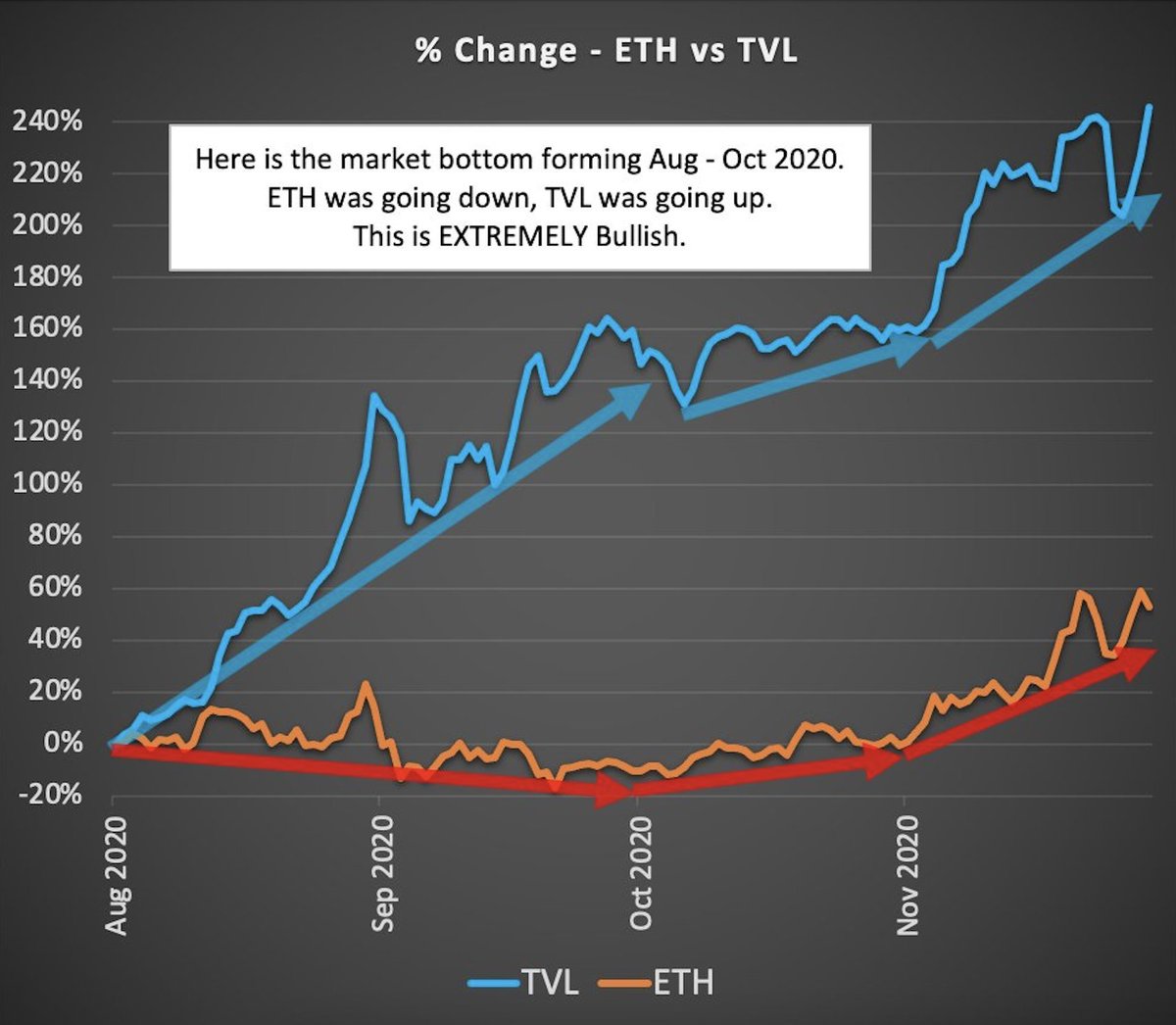

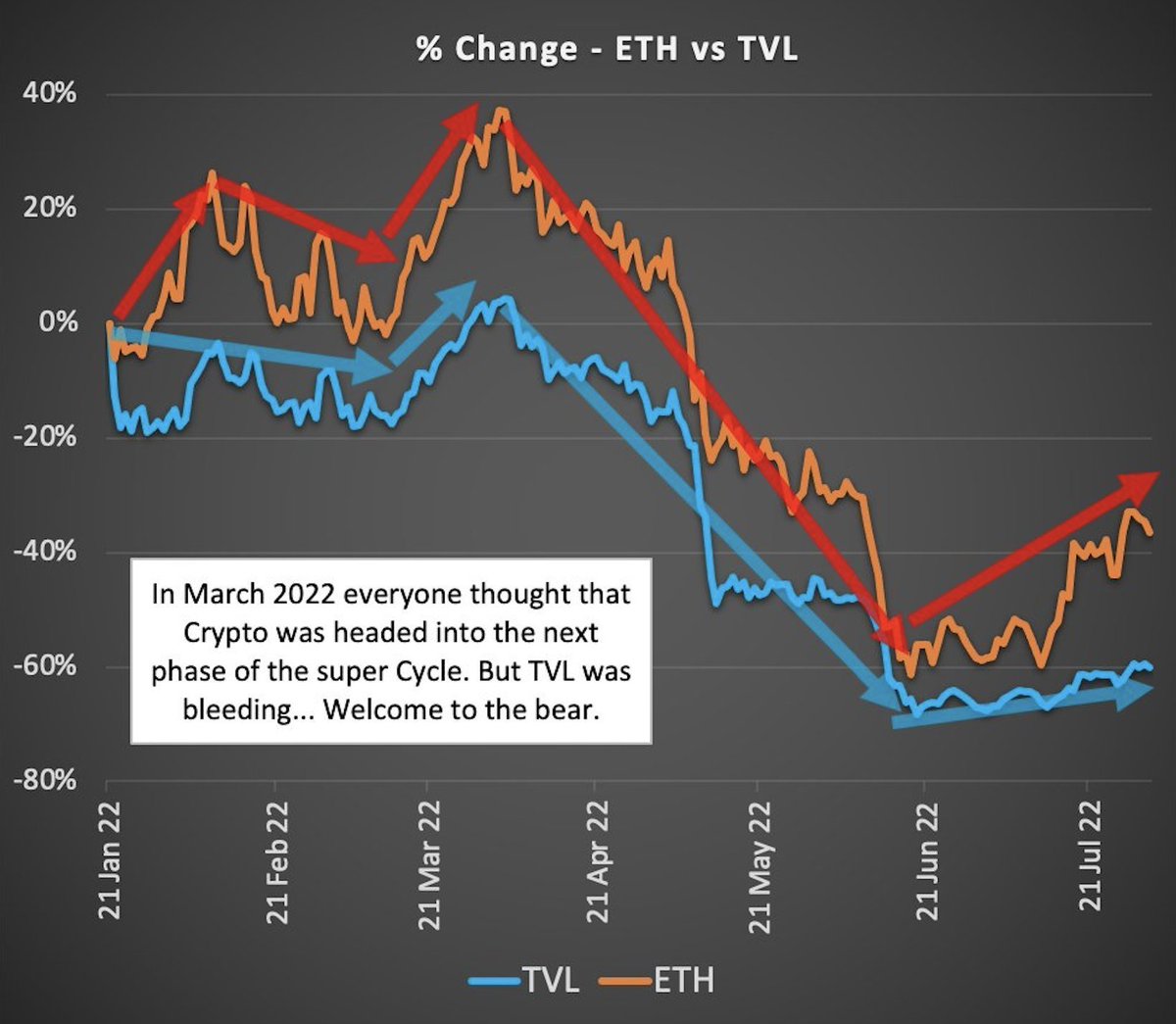

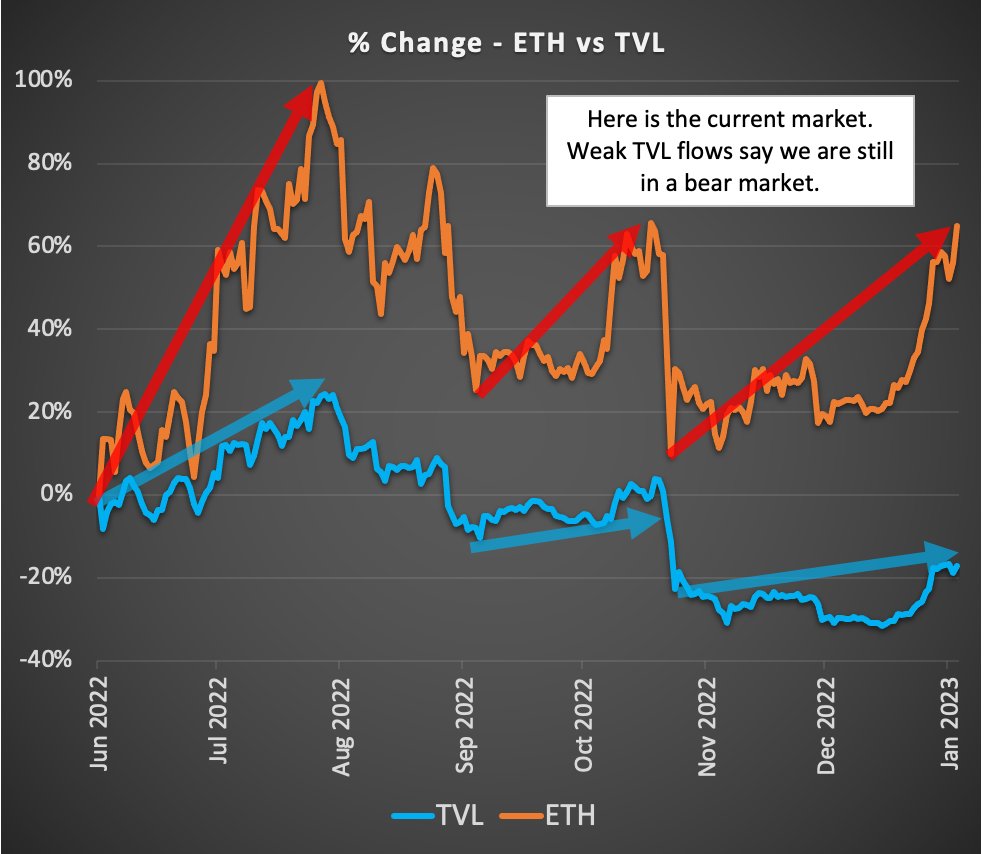

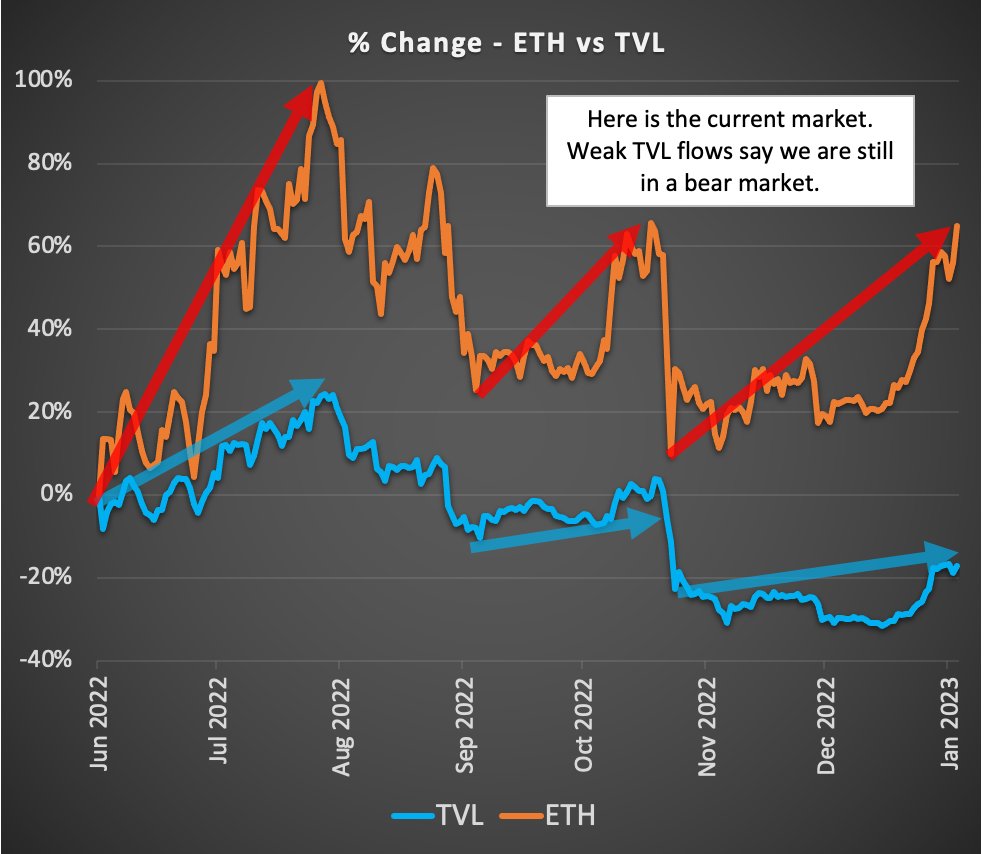

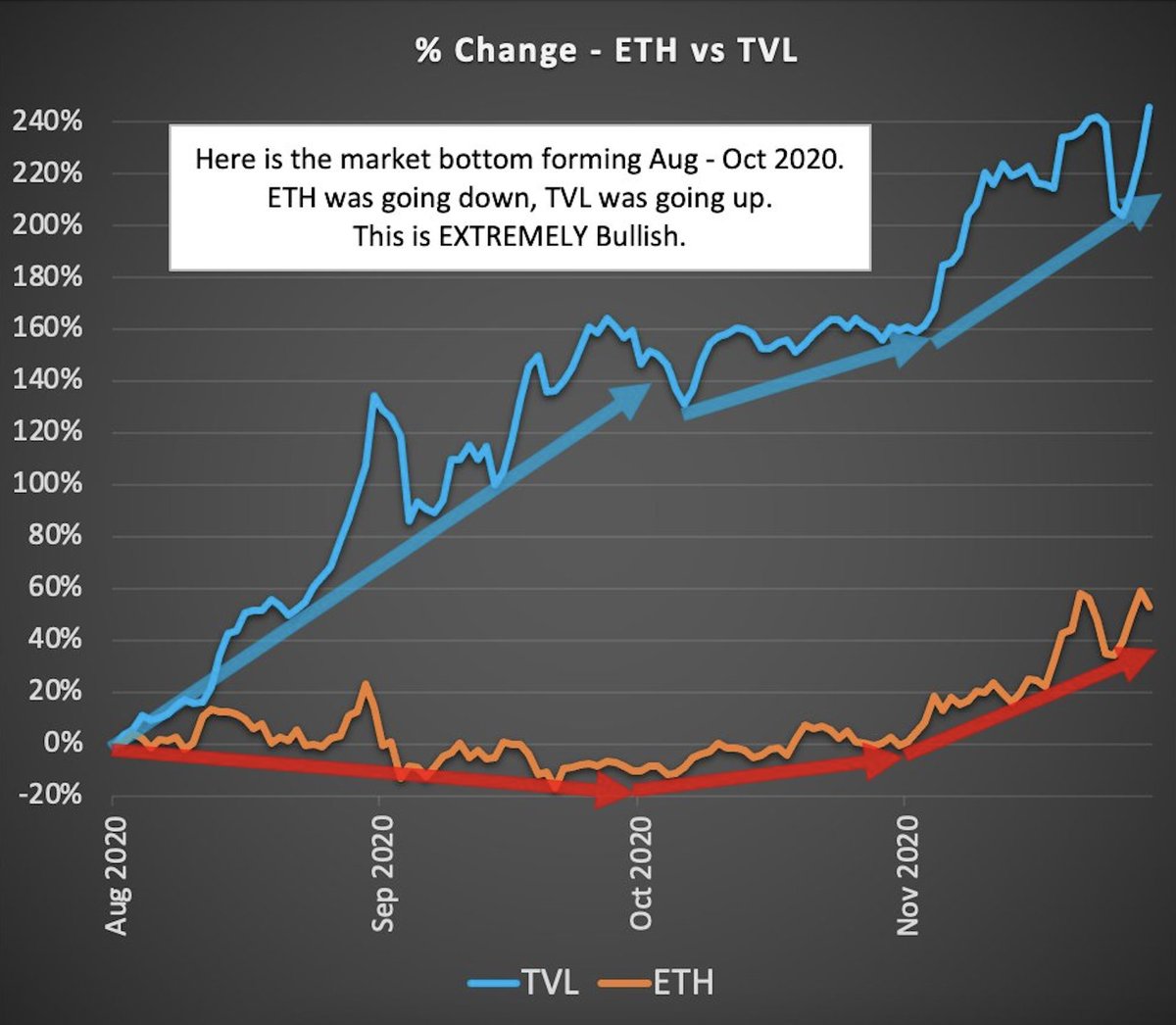

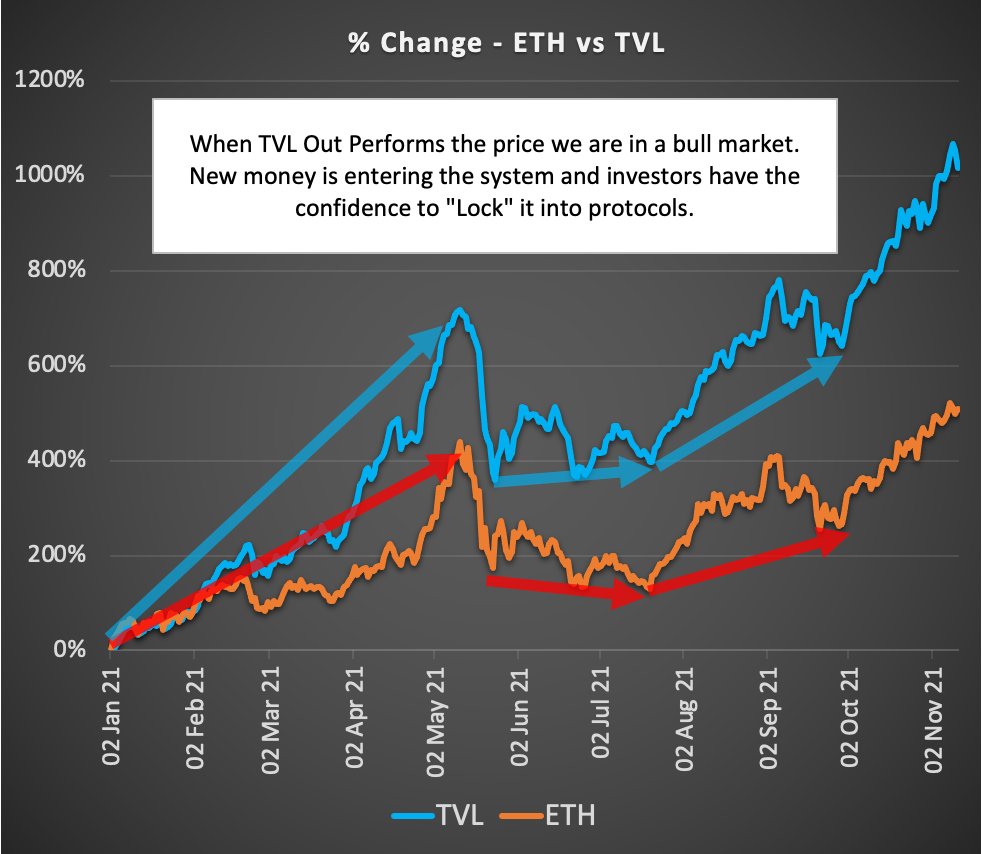

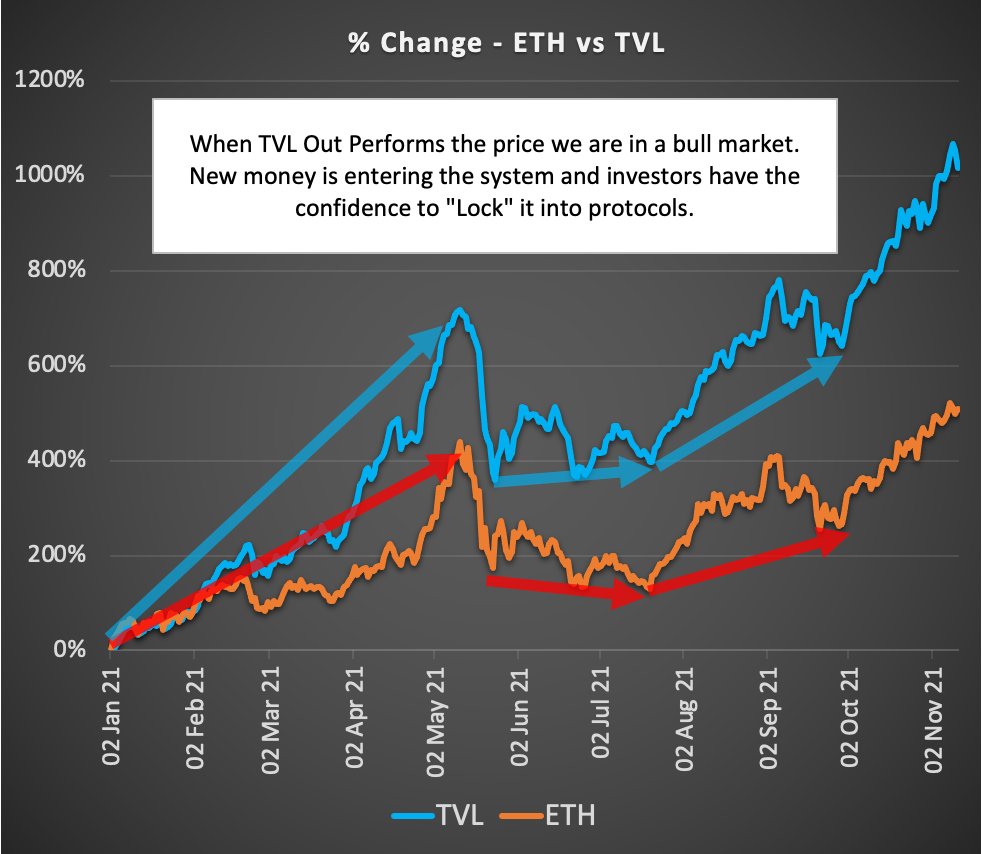

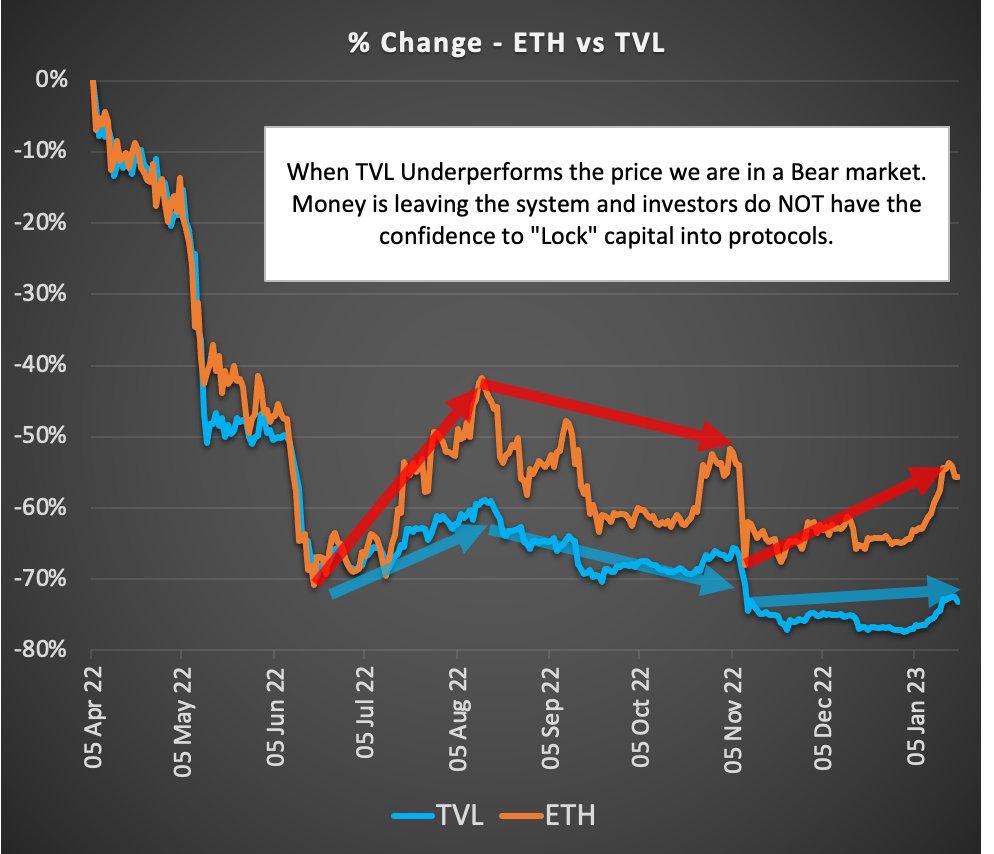

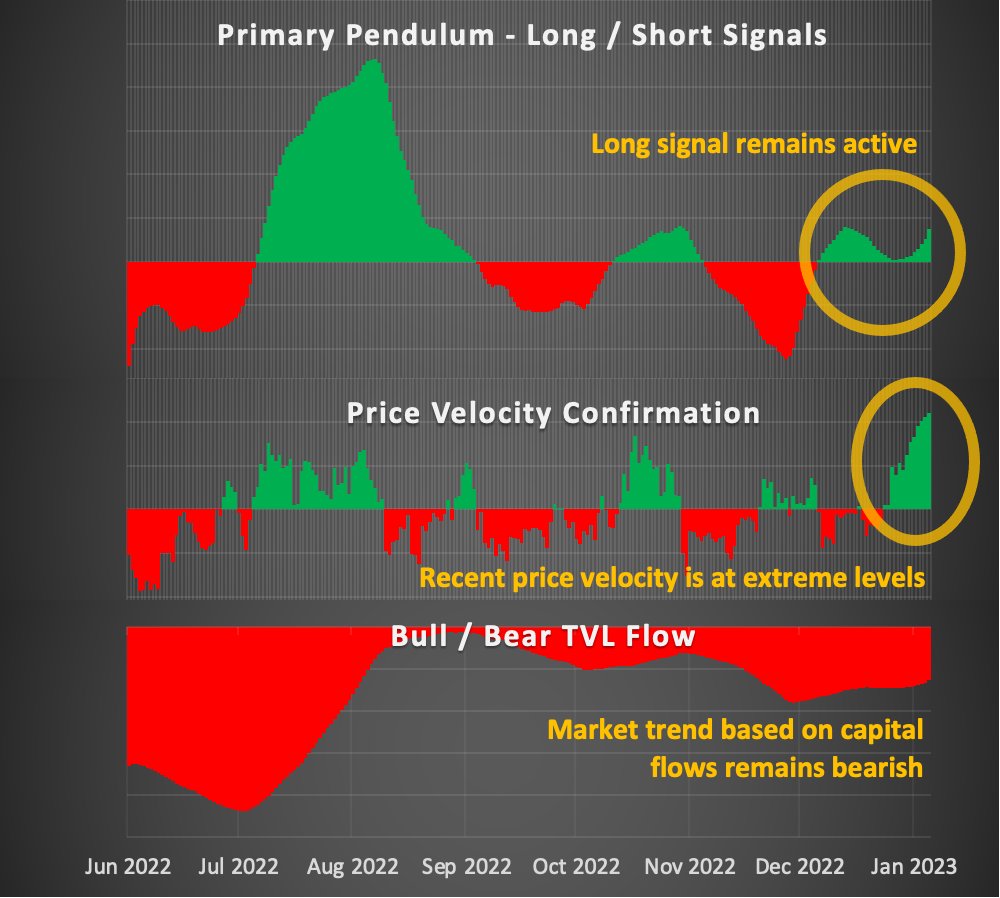

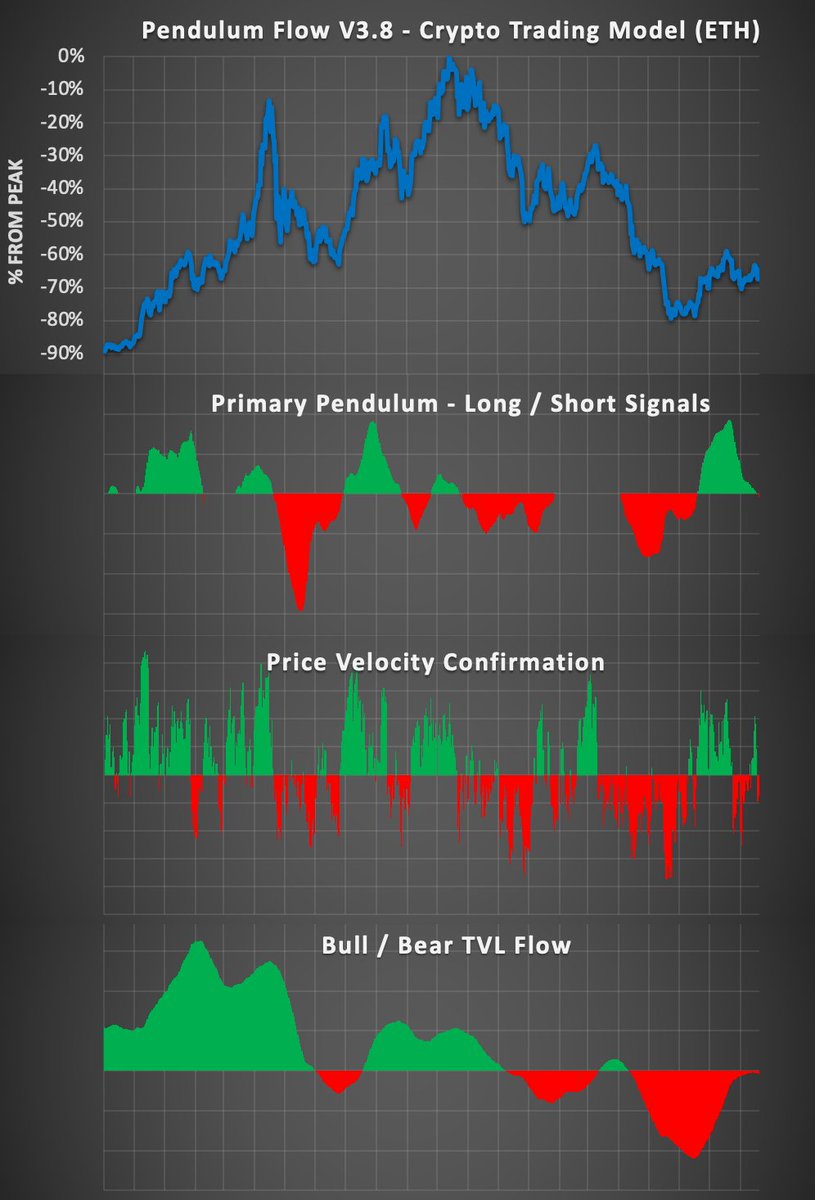

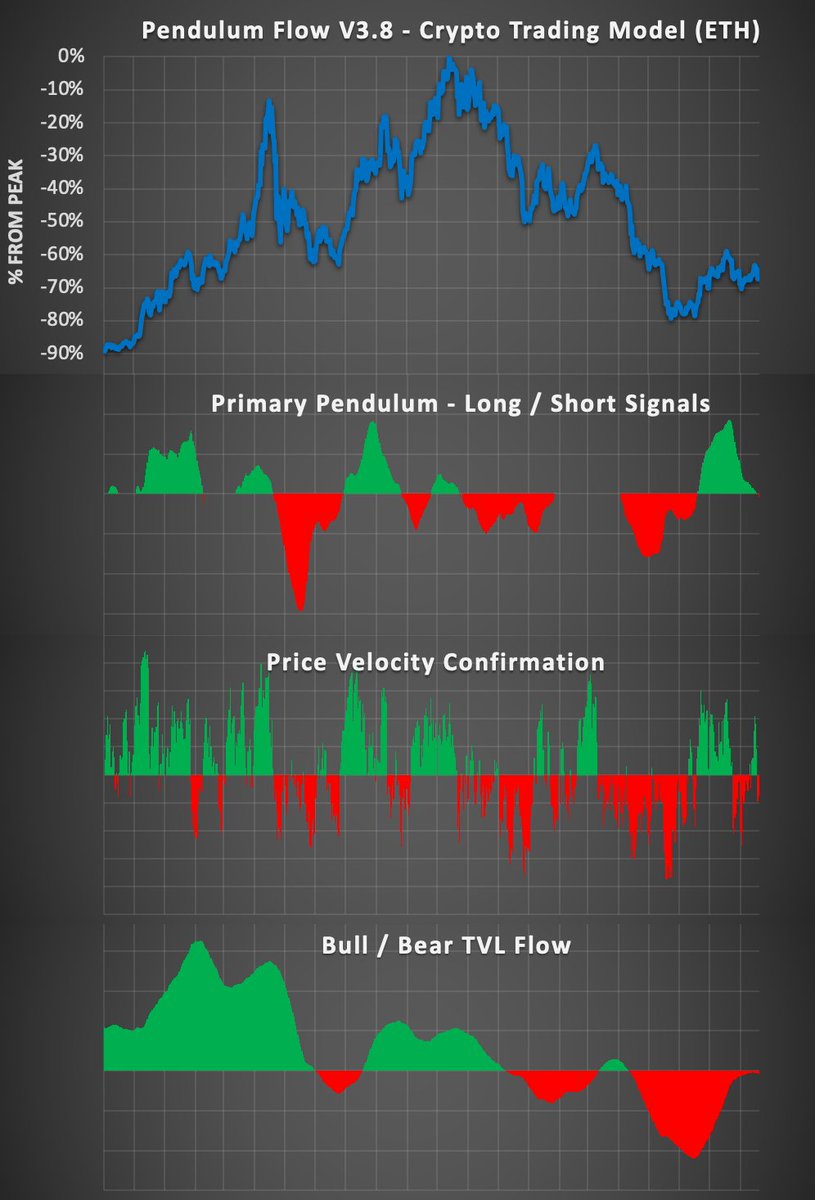

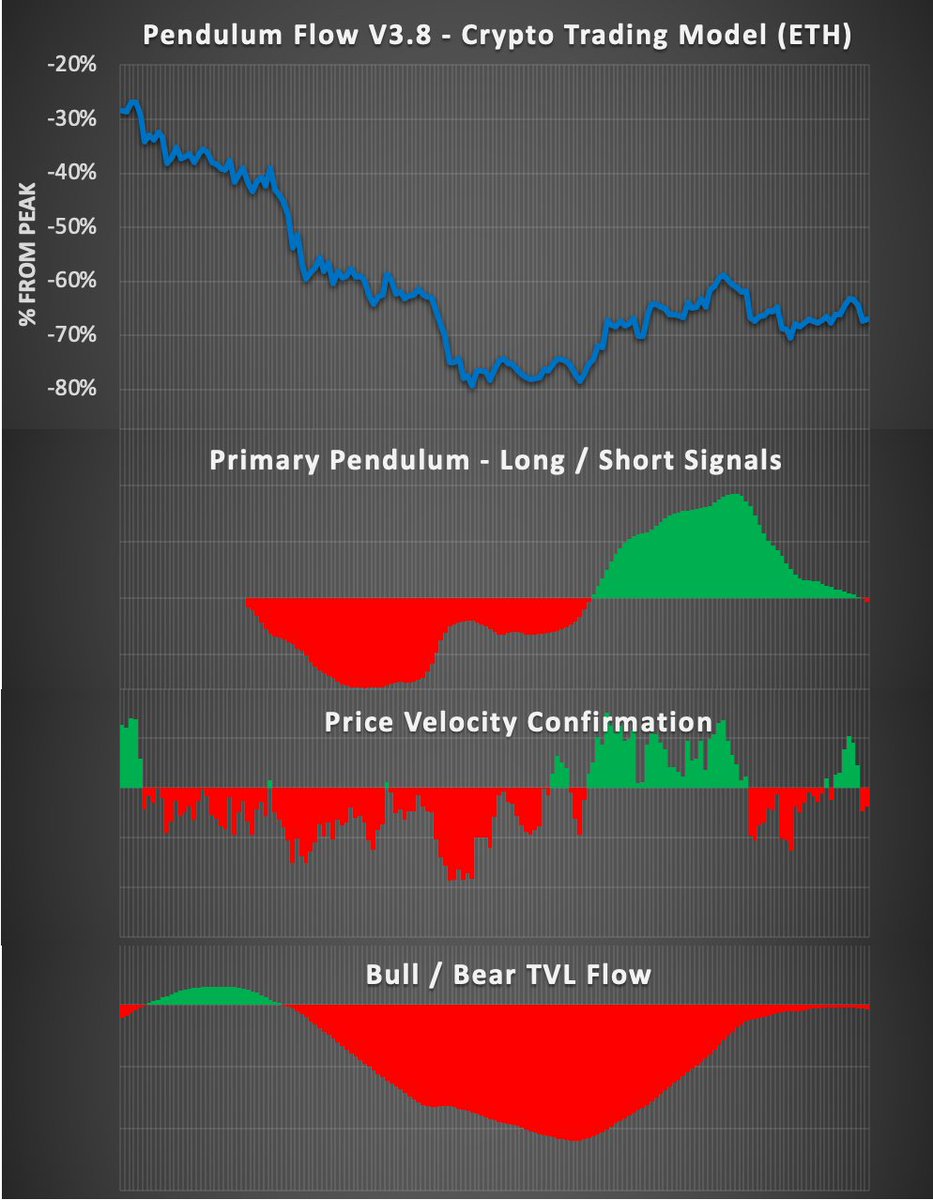

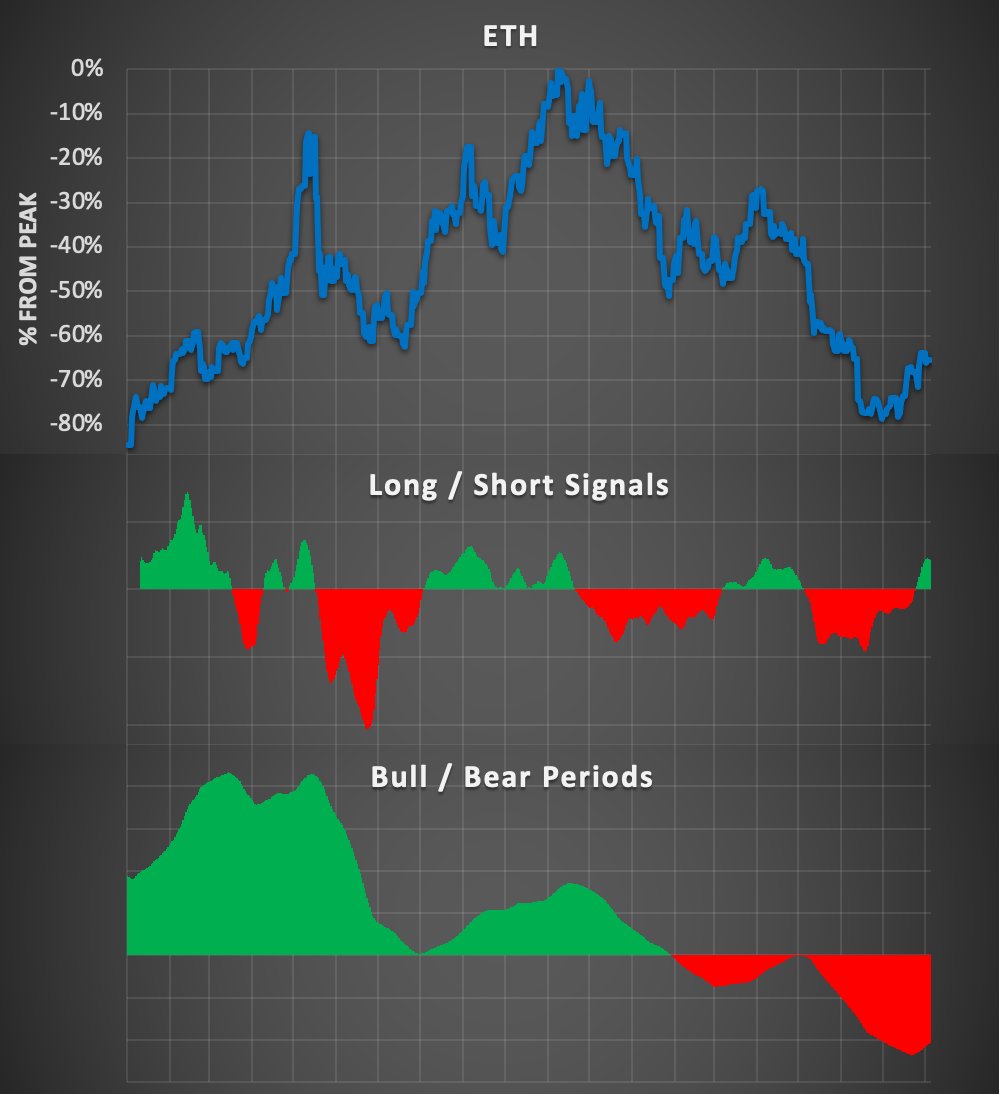

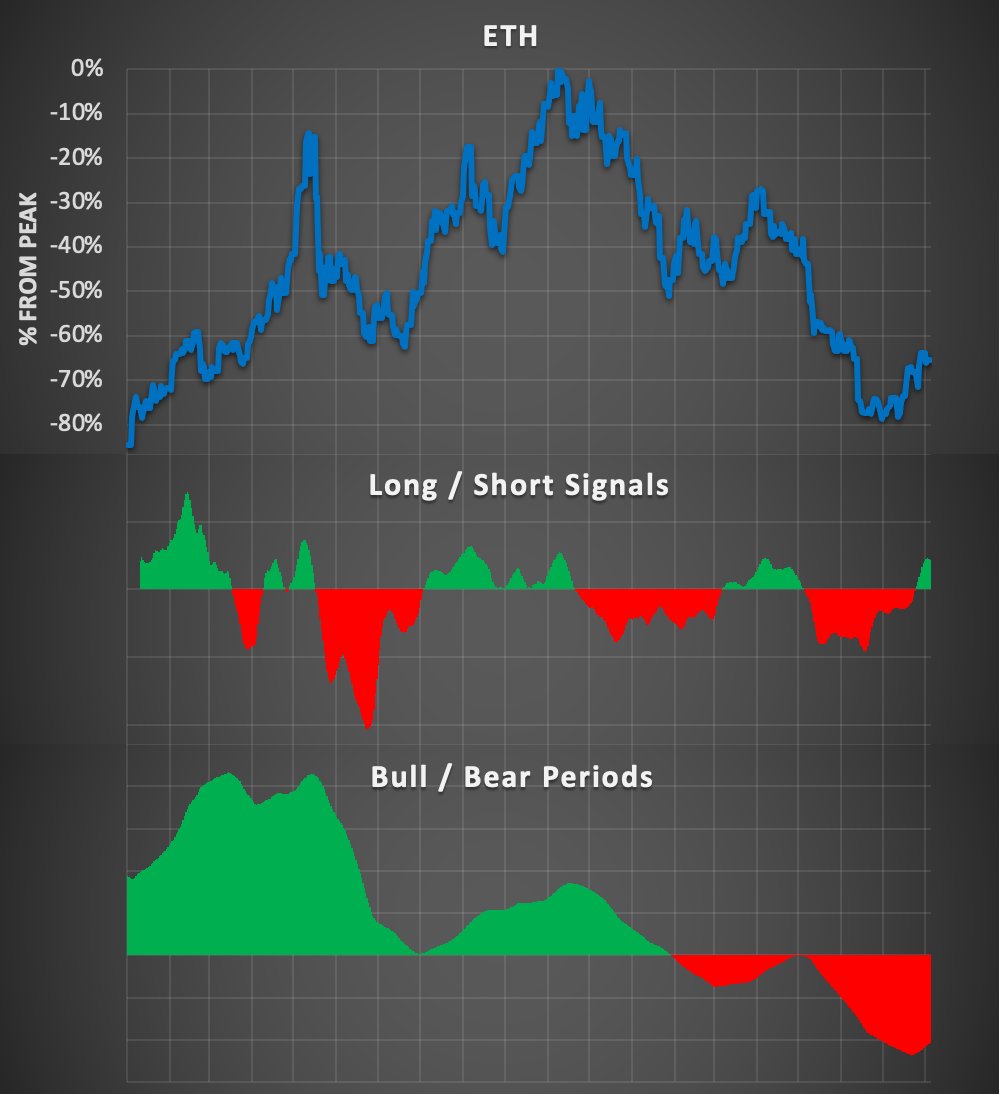

TVL is an overlooked & powerful leading indicator. The three charts below prove that clearly

TVL is an overlooked & powerful leading indicator. The three charts below prove that clearly

TVL is a leading indicator and when the Bull Market returns we can expect to see TVL outperforming the price. Or at the very least not underperforming.

TVL is a leading indicator and when the Bull Market returns we can expect to see TVL outperforming the price. Or at the very least not underperforming.

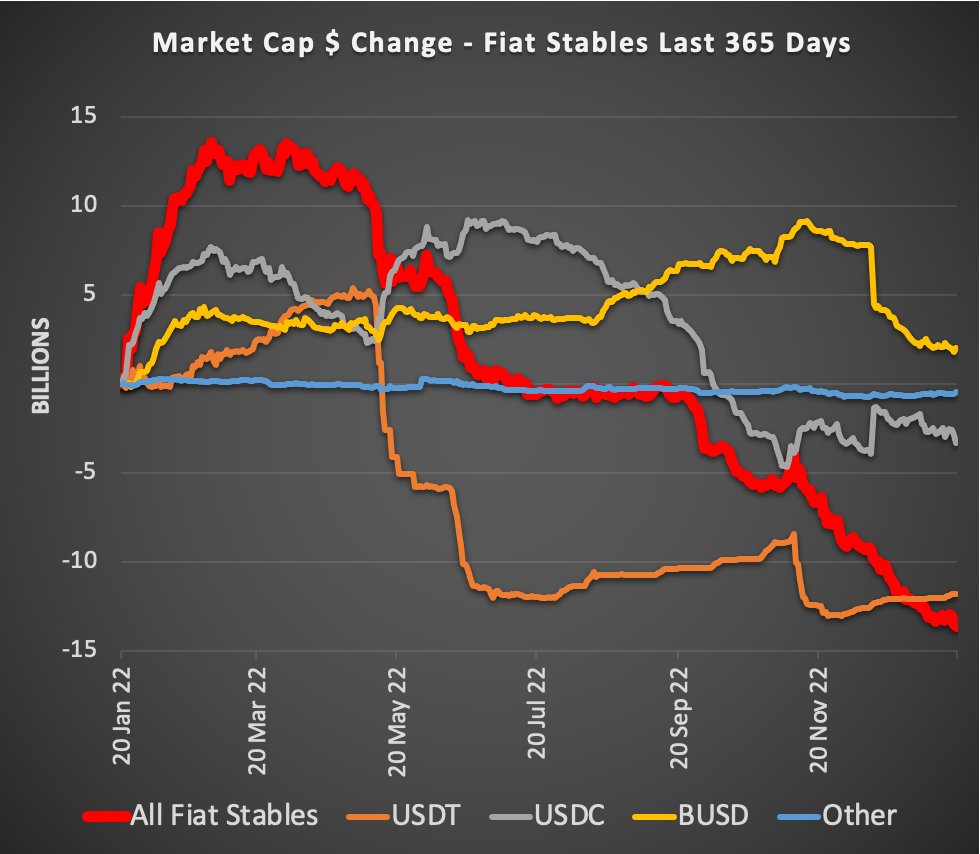

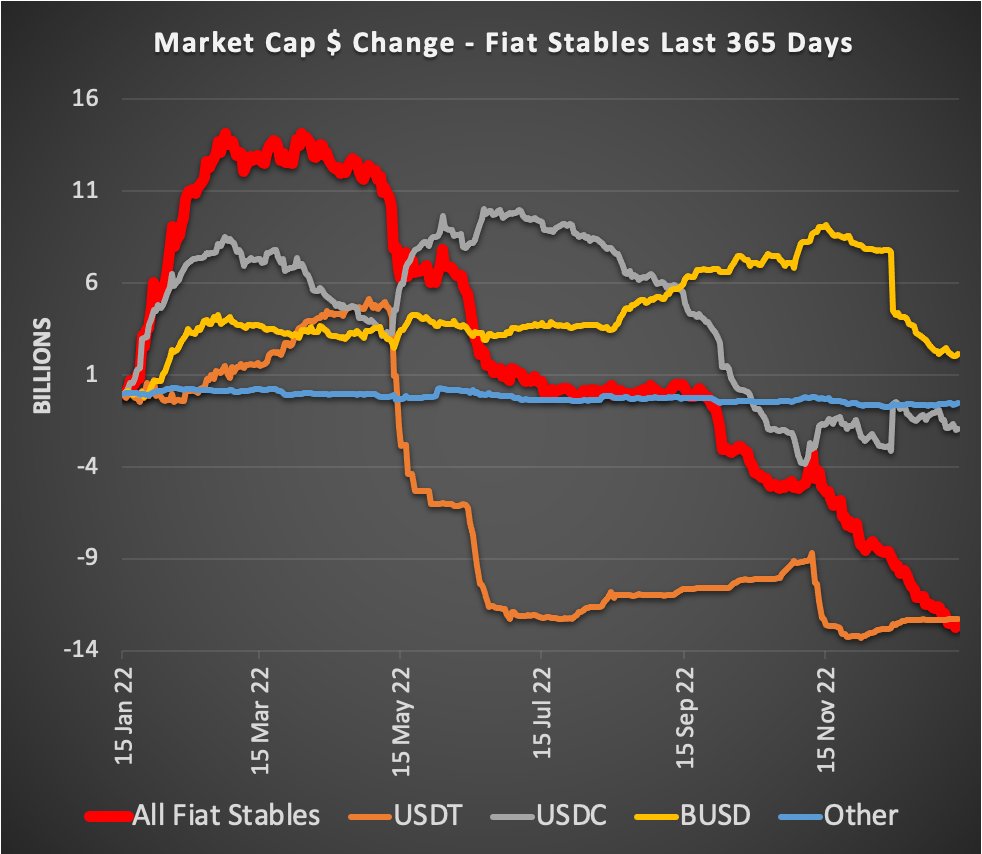

Oh... fiat stables are down only plus hit a new low today.

Oh... fiat stables are down only plus hit a new low today.

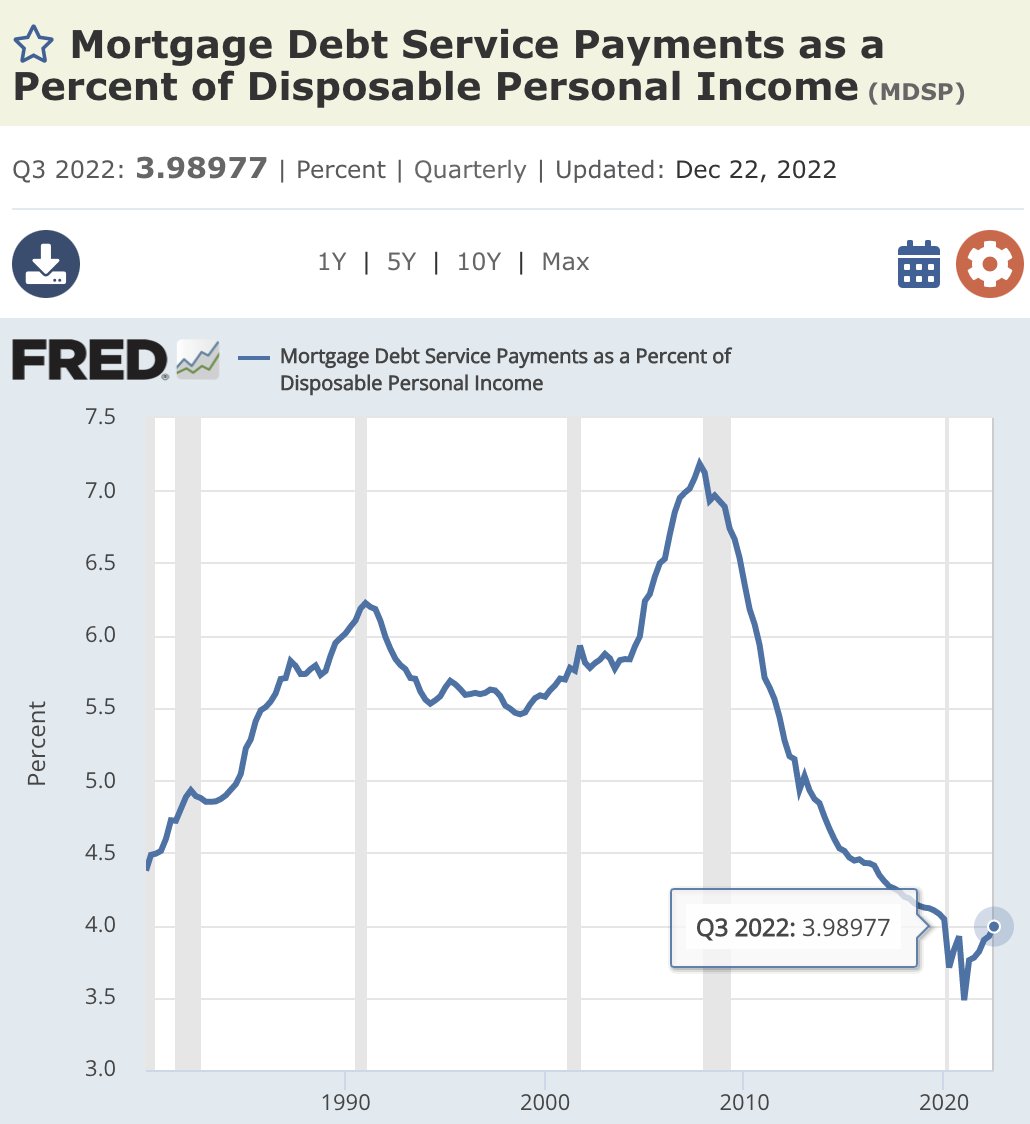

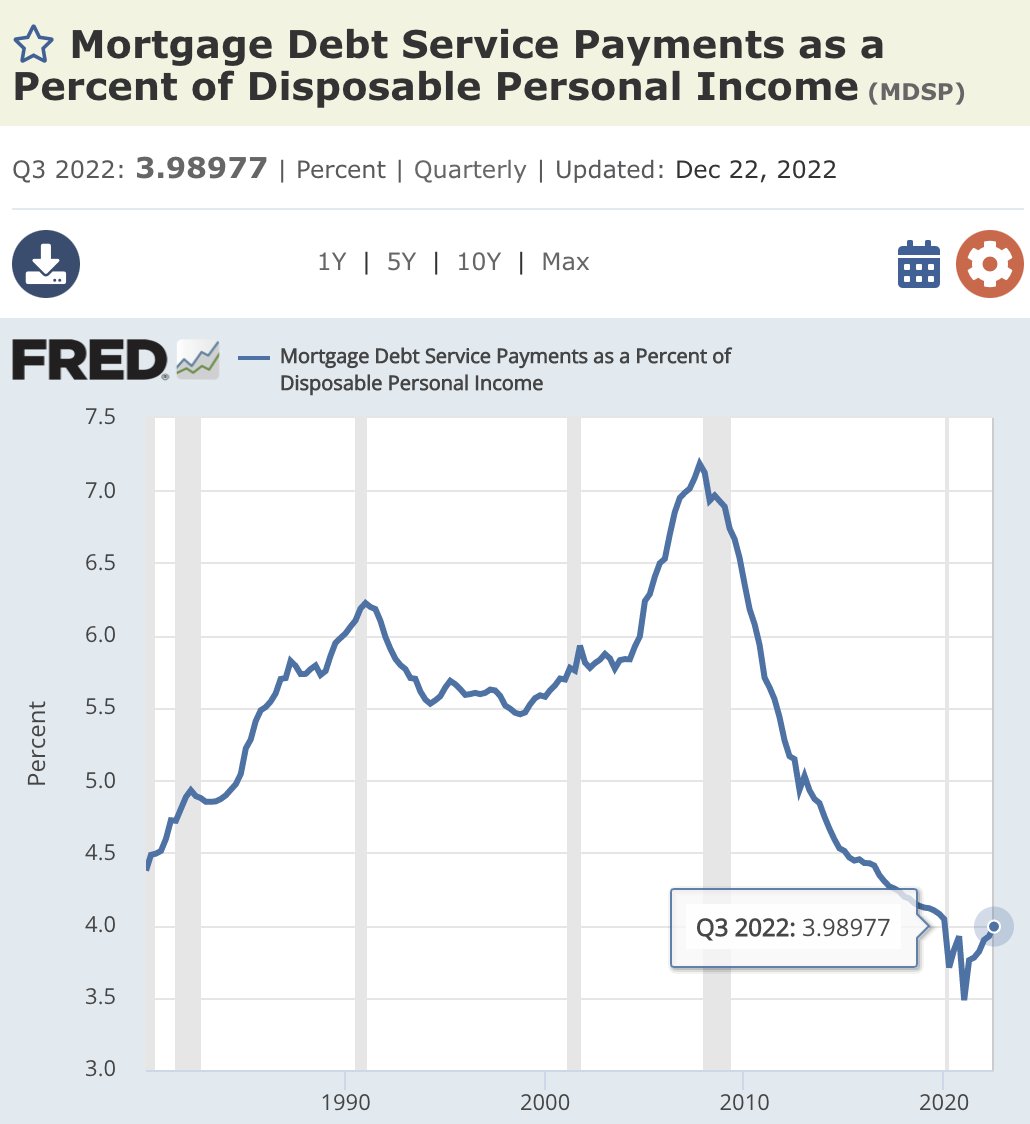

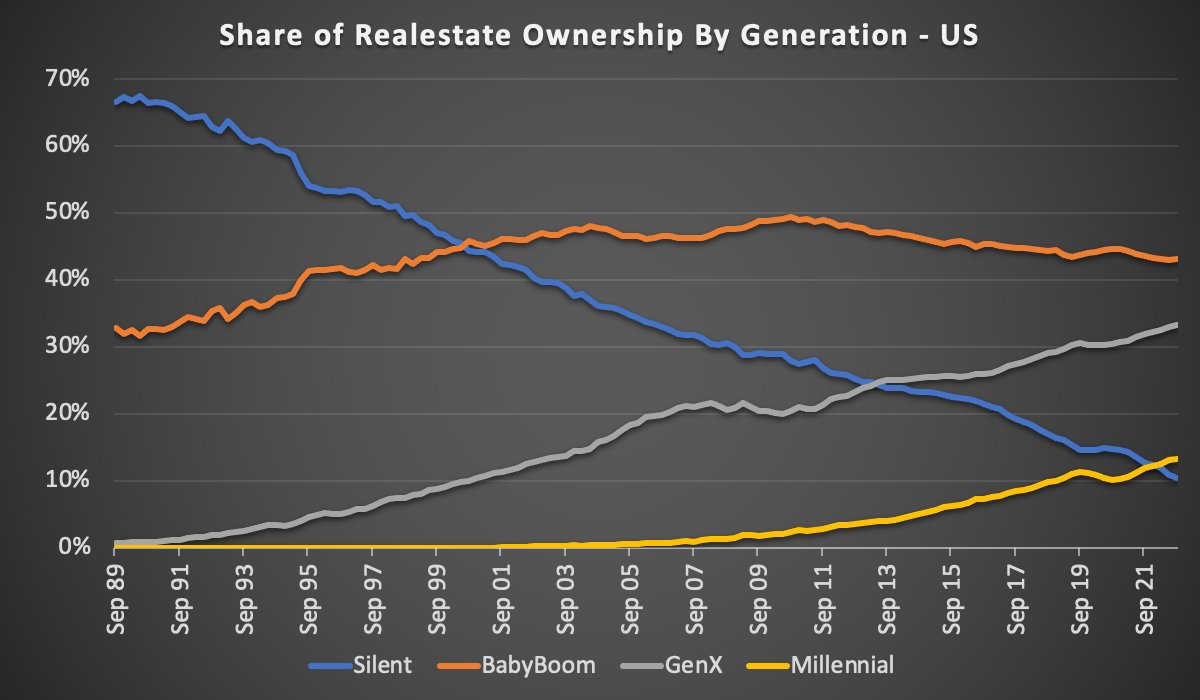

The Millennials only own control 13% of the value of the real estate market.

The Millennials only own control 13% of the value of the real estate market.

Fiat Stables are down only 🚩🚩🚩

Fiat Stables are down only 🚩🚩🚩

https://twitter.com/lieber2k/status/1598440191374524416

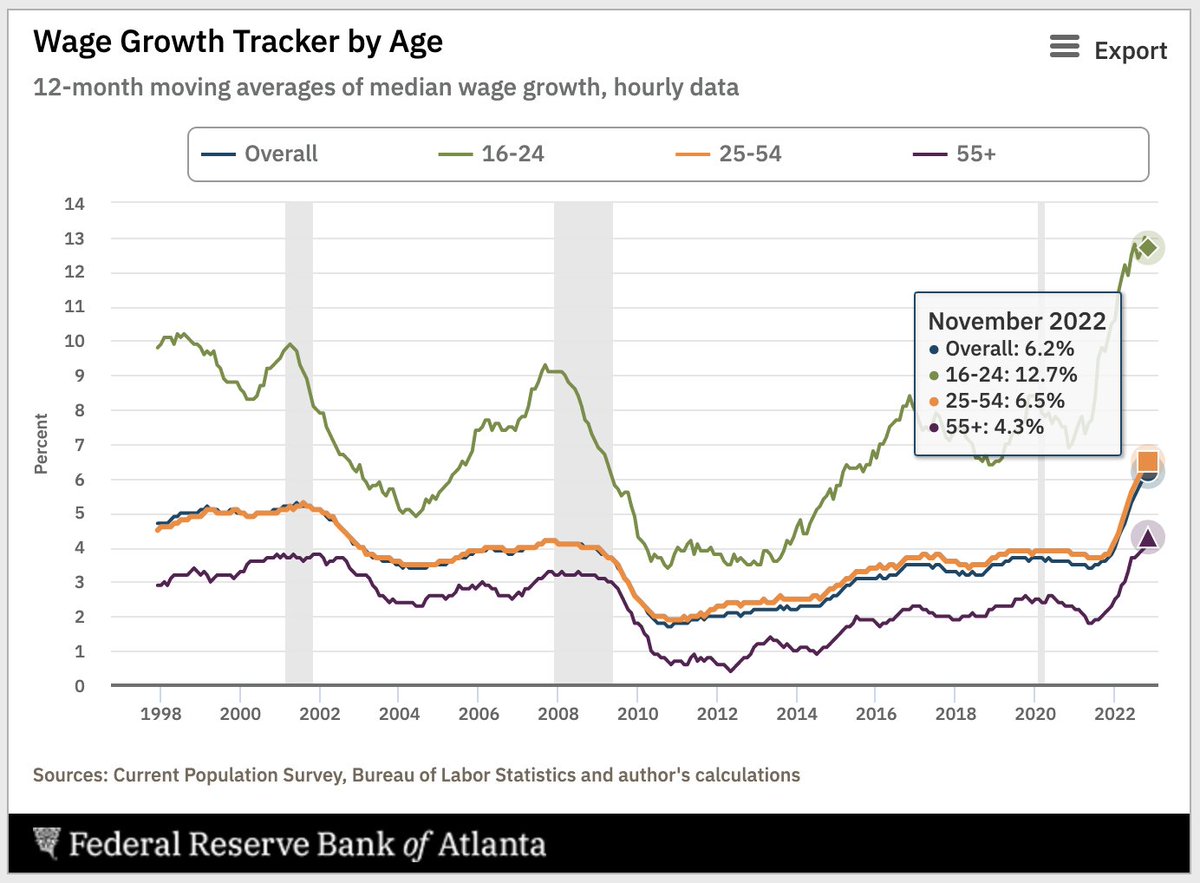

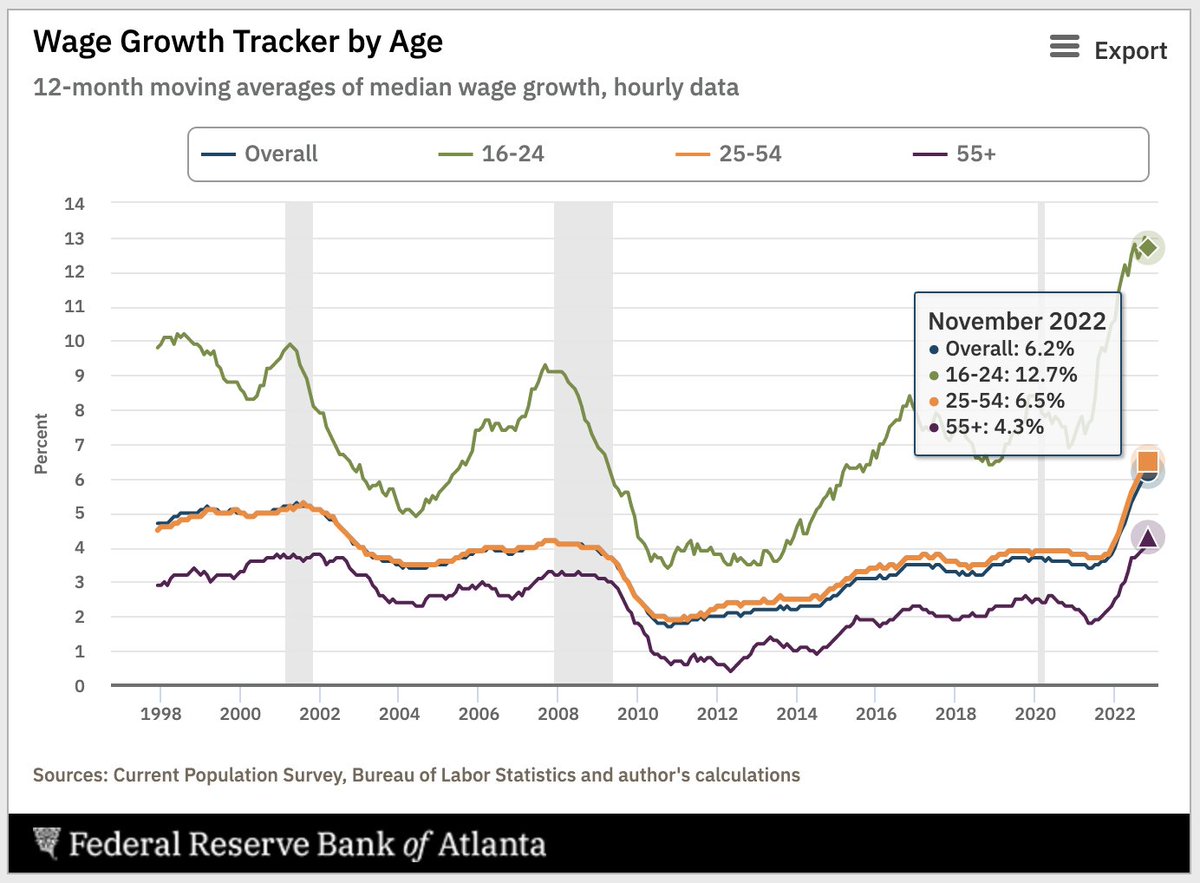

atlantafed.org/chcs/wage-grow…

atlantafed.org/chcs/wage-grow…

Here is a closer look at the new short signal. The model tracks the total market TVL flow as provided by @DefiLlama <3

Here is a closer look at the new short signal. The model tracks the total market TVL flow as provided by @DefiLlama <3

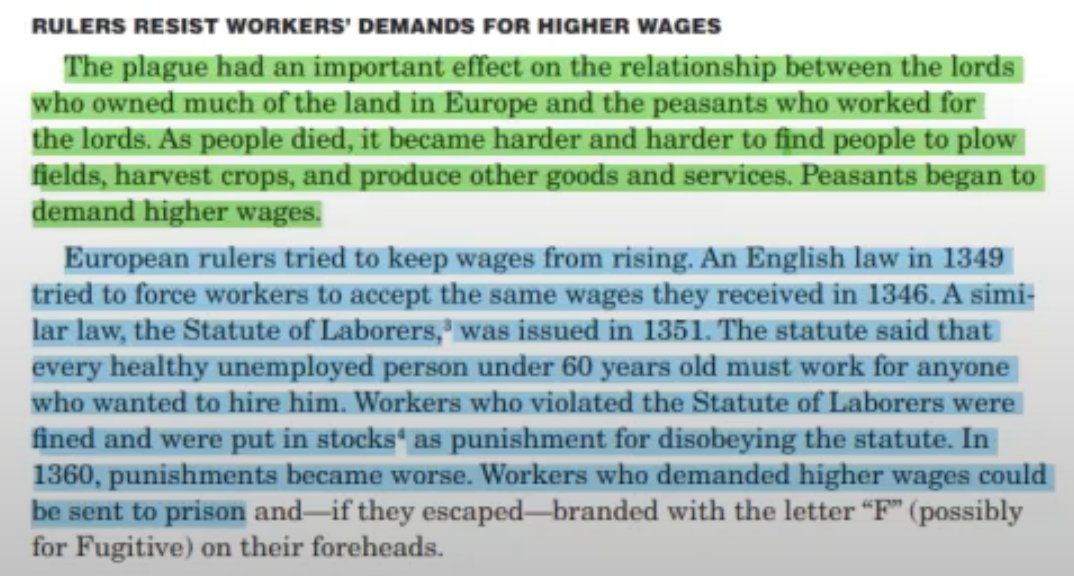

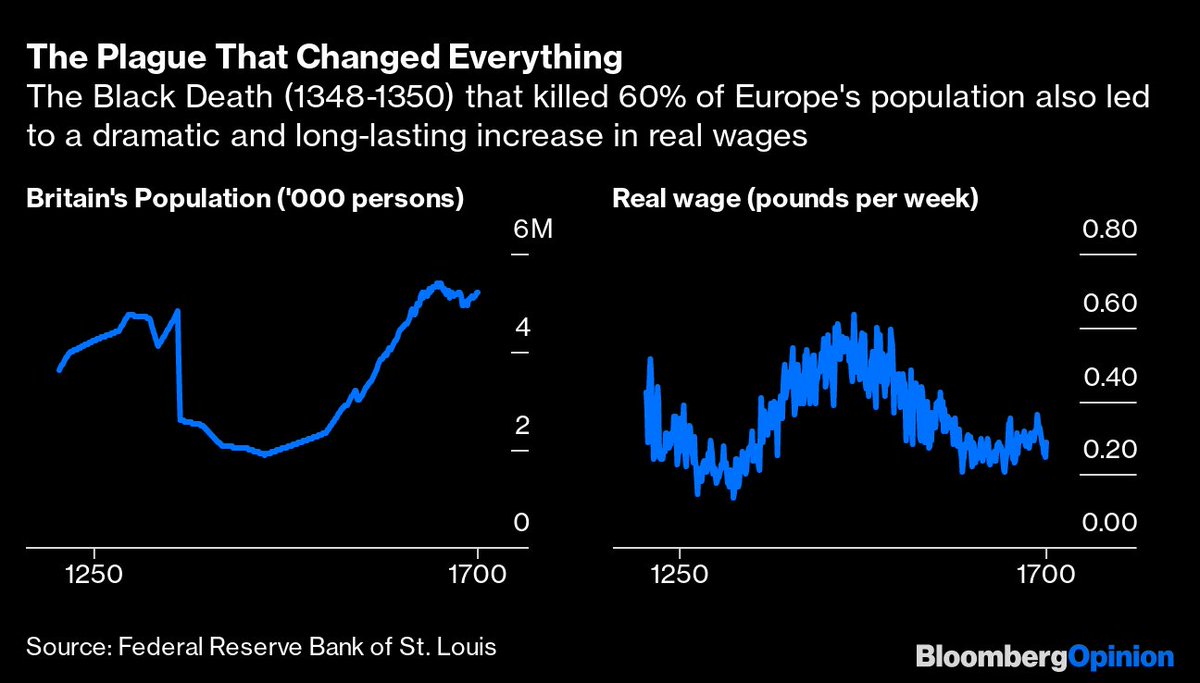

So many peasants died from the plague (60% of Europe ☠️) that the medieval system of serfdom collapsed.

So many peasants died from the plague (60% of Europe ☠️) that the medieval system of serfdom collapsed.

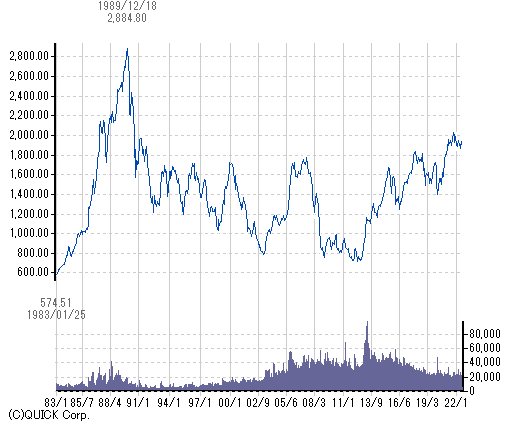

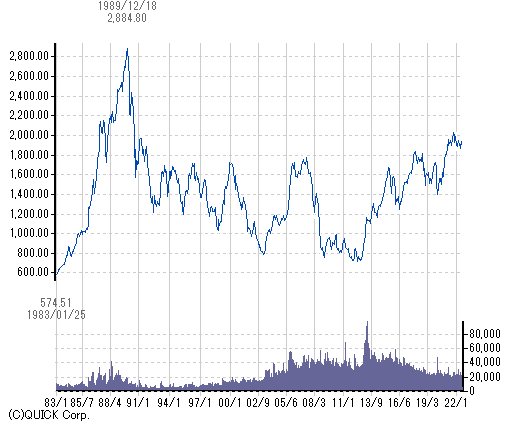

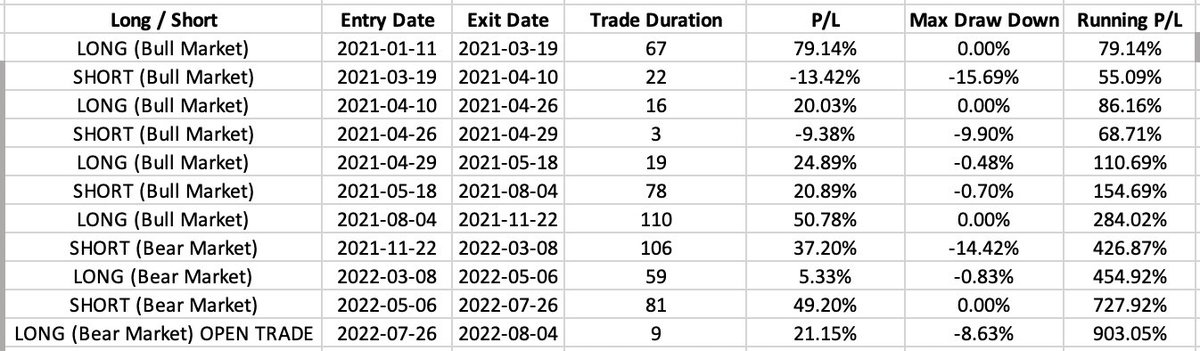

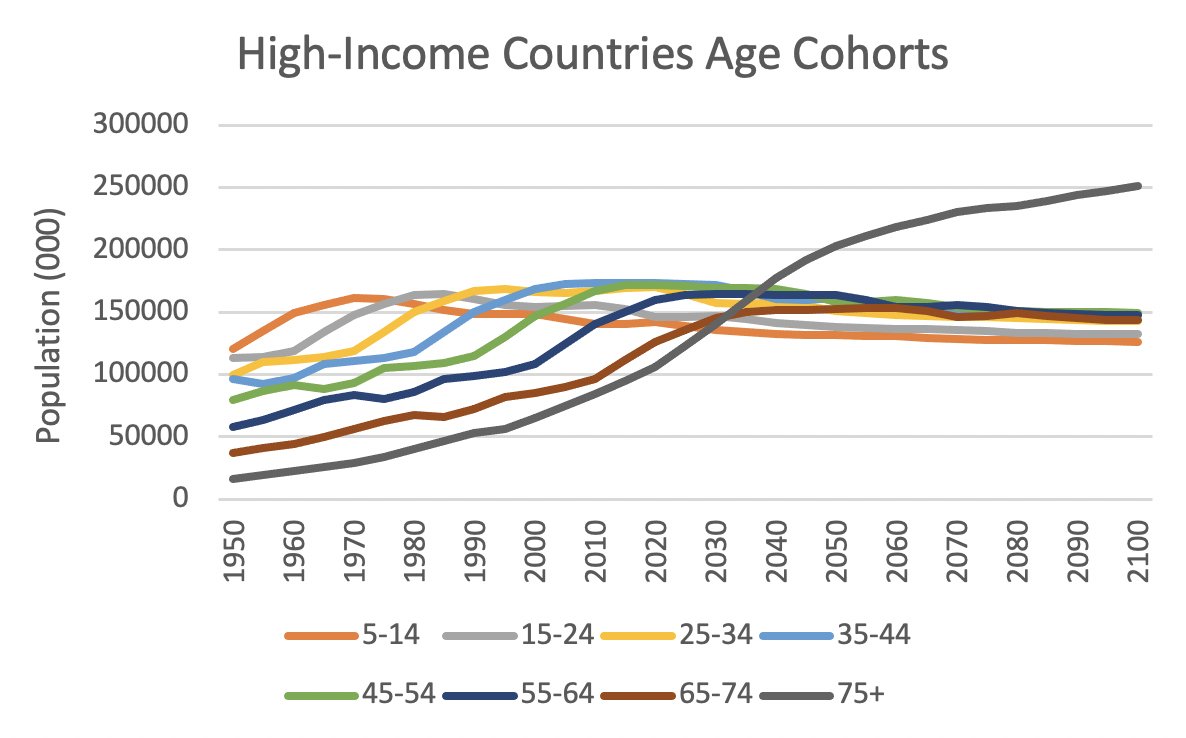

Japan has had many issues but the reason why they have been unable to recover is due to terminal demographics.

Japan has had many issues but the reason why they have been unable to recover is due to terminal demographics.https://twitter.com/farmerdbrown/status/1550439784161906688?s=20&t=enhFHto4MV5OvJ4n9Vy0Hg

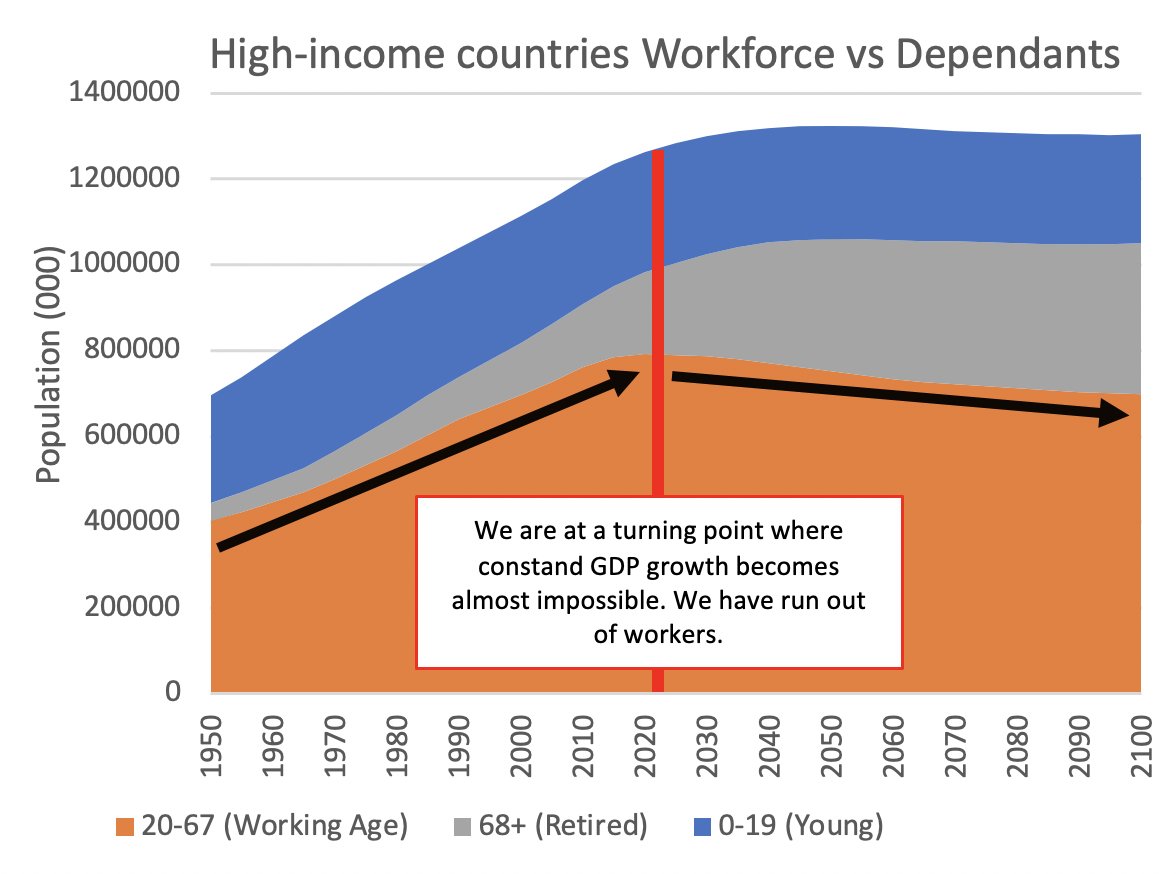

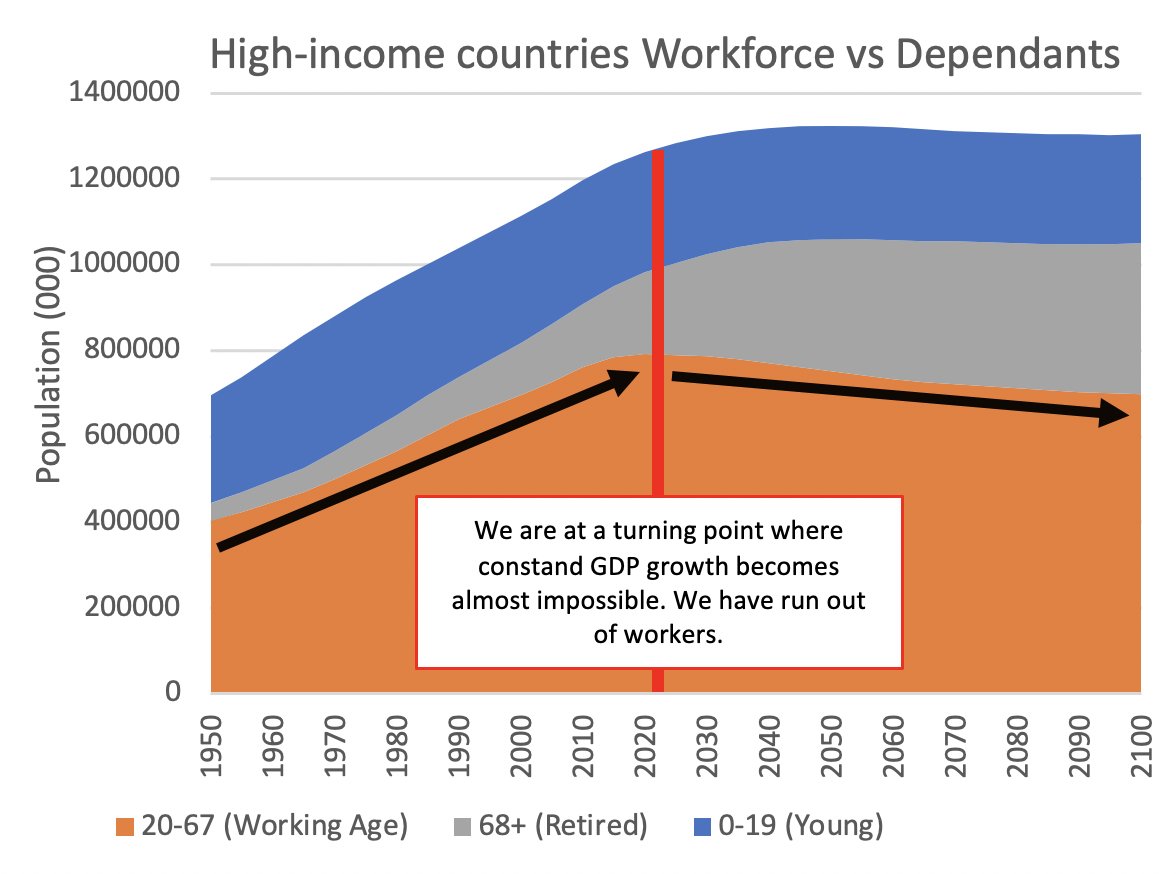

The last 100 years has seen ever-increasing consumption facilitating the capitalism we know.

The last 100 years has seen ever-increasing consumption facilitating the capitalism we know.

TVL data is total market excluding non-fiat stables. Measure is momentum and slope of TVL change.

TVL data is total market excluding non-fiat stables. Measure is momentum and slope of TVL change.

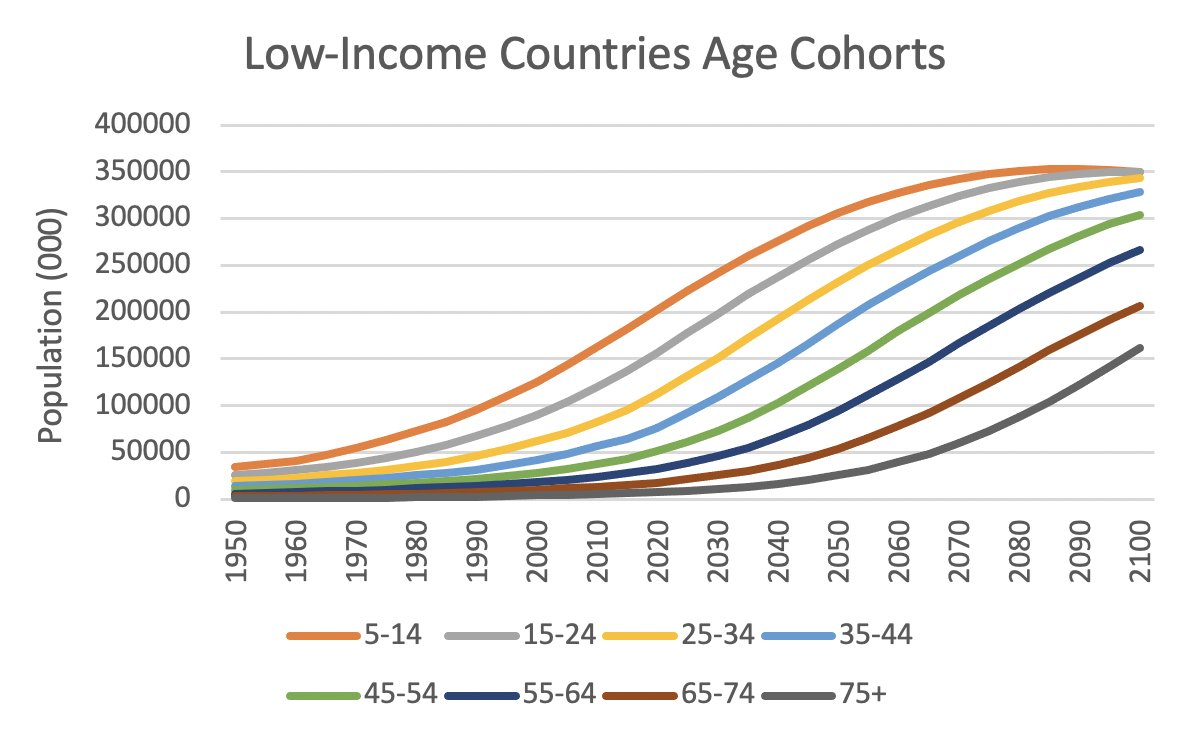

Demographic projections for low-income countries are very different and this will lead to a major wealth shift.

Demographic projections for low-income countries are very different and this will lead to a major wealth shift.