Futures mkt trader since 1975. Shokunin. Author. Market Wizard. ✝an.

Membership https://t.co/83DcDyEv36

https://t.co/ilO2kzMsJv

Scam https://t.co/cQVu4ipglx

9 subscribers

How to get URL link on X (Twitter) App

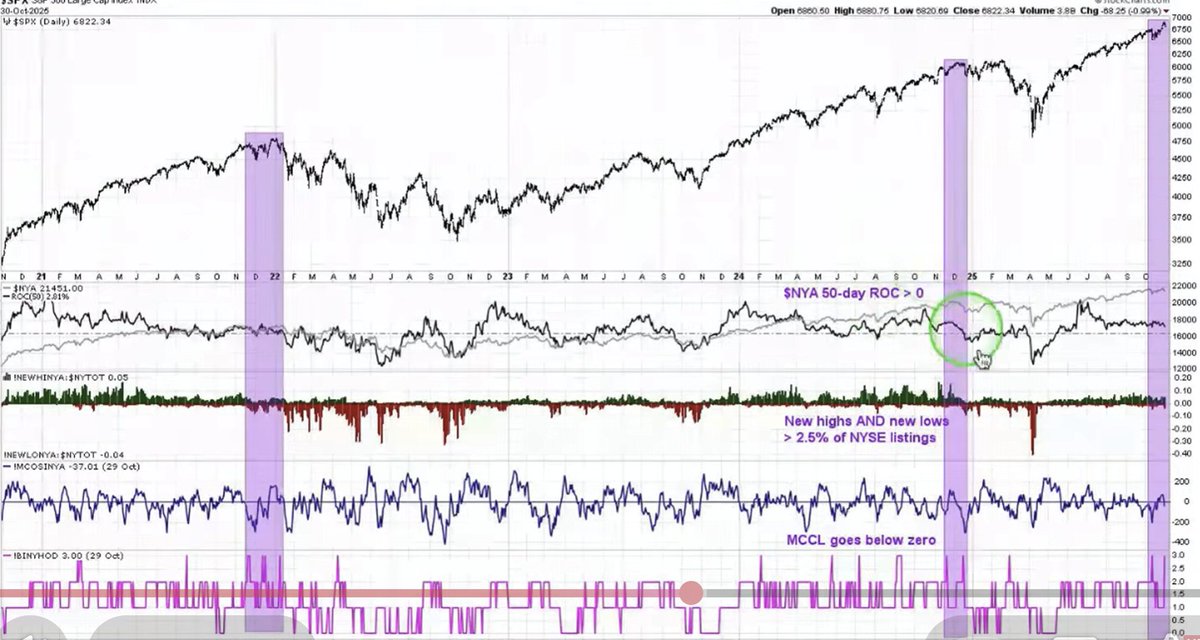

2. Hindenburg Omen signals - typical for tops. Do your research on this yourself. Read @McClellanOsc at

2. Hindenburg Omen signals - typical for tops. Do your research on this yourself. Read @McClellanOsc at https://x.com/McClellanOsc/status/1986204132819251389

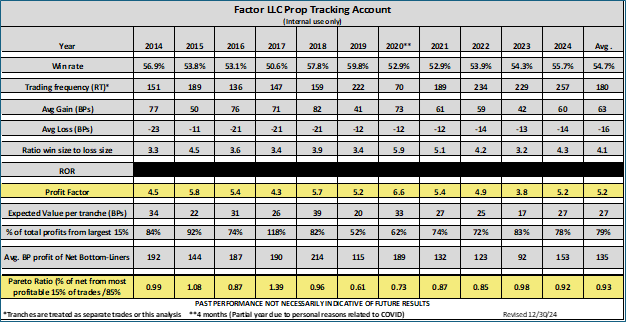

https://twitter.com/samuraipips358/status/1884209822922596395Confidence in an approach to trading is born out of the times of misery than from the times of bliss. Any approach to trading -- sooner or later -- will have some good scores. But only those approaches that survive the losing times with capital intact will succeed long-term 🧵🔽

1. Have realistic expectations on success. The world's best traders achieve 40% annual RORs. Aspiring traders who think 10X is possible every year will become rekt - this has my guarantee

1. Have realistic expectations on success. The world's best traders achieve 40% annual RORs. Aspiring traders who think 10X is possible every year will become rekt - this has my guarantee

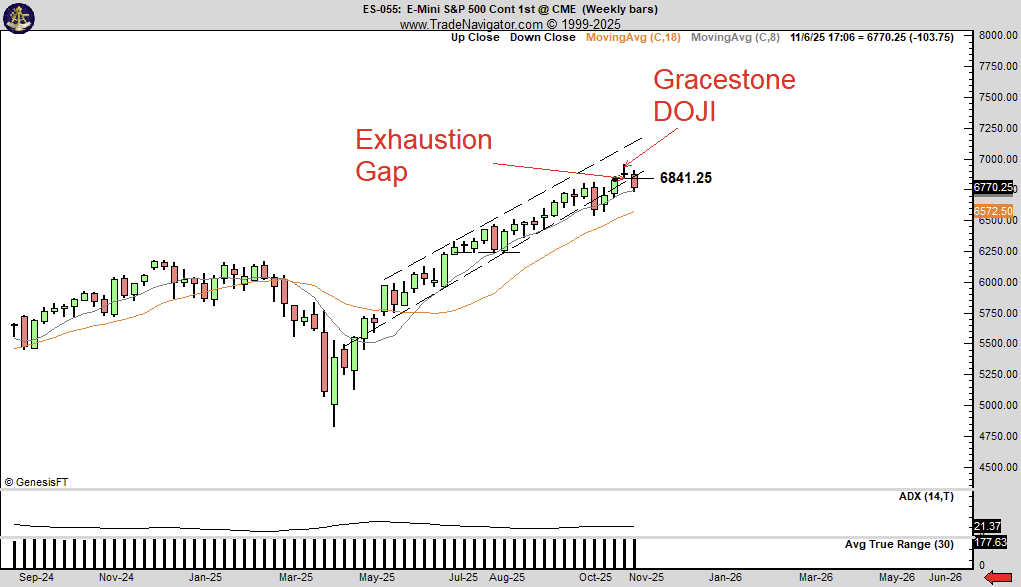

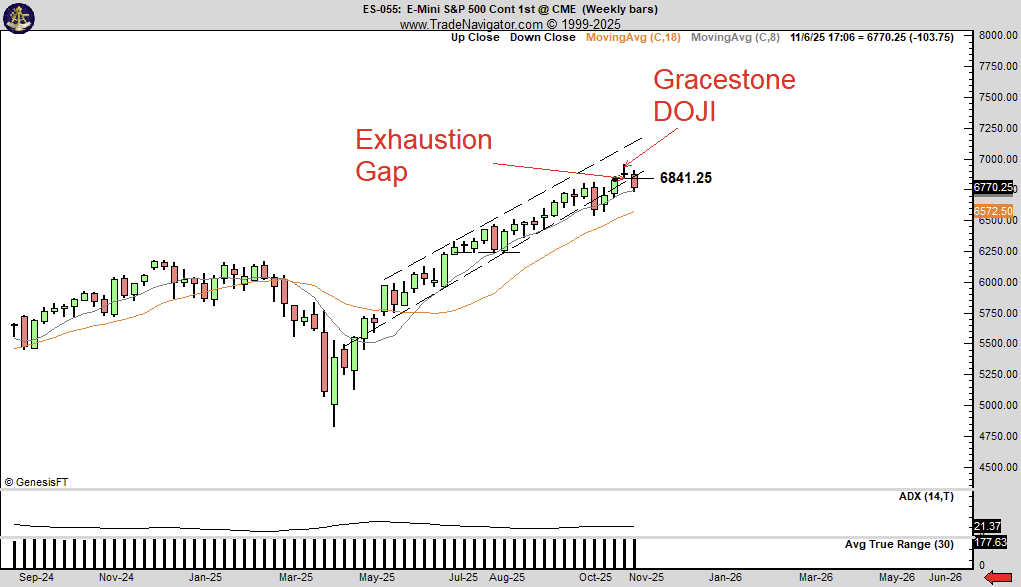

A swing target can also be determined by projecting the Nov 2022 low to Mar 2024 high upwards from Aug 2024 low as shown also on log scale

A swing target can also be determined by projecting the Nov 2022 low to Mar 2024 high upwards from Aug 2024 low as shown also on log scale