Skeptic - Analyst - Not investment advice. Check out my articles/research/other nonsense at https://t.co/297GqkCu9I

How to get URL link on X (Twitter) App

2/ First impression: Somewhat quiet in there. Two or three families with kids looking at the different showroom cars. There was one X P100D, S P100D and a Model 3 performance on the floor. No noticeable quality issues on any of the showroom cars.

2/ First impression: Somewhat quiet in there. Two or three families with kids looking at the different showroom cars. There was one X P100D, S P100D and a Model 3 performance on the floor. No noticeable quality issues on any of the showroom cars.

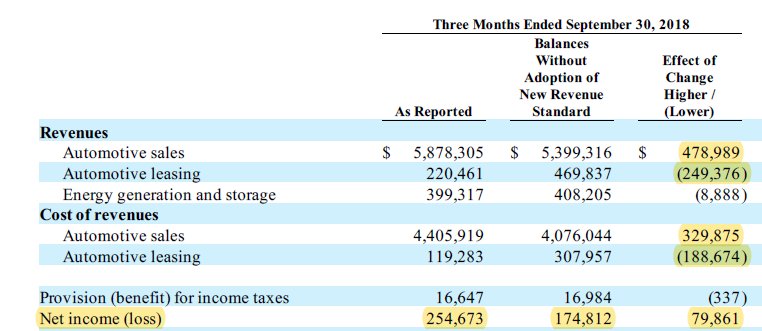

2/ As I pointed out in my dissection of the 10Q back in October, $TSLA was able to pull forward $79,861,000 on the bottom line thanks to these adjustments, as disclosed in the 10Q:

2/ As I pointed out in my dissection of the 10Q back in October, $TSLA was able to pull forward $79,861,000 on the bottom line thanks to these adjustments, as disclosed in the 10Q:

If anyone was still wondering, Elon did take cash for the 08/18 promissory notes $TSLA

If anyone was still wondering, Elon did take cash for the 08/18 promissory notes $TSLA