Chief economist at Pictet Asset Management. Tweeting about #GlobalMacro #EmergingMarkets #China #US. All views my own. RT=interesting

3 subscribers

How to get URL link on X (Twitter) App

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/

2/5

2/5

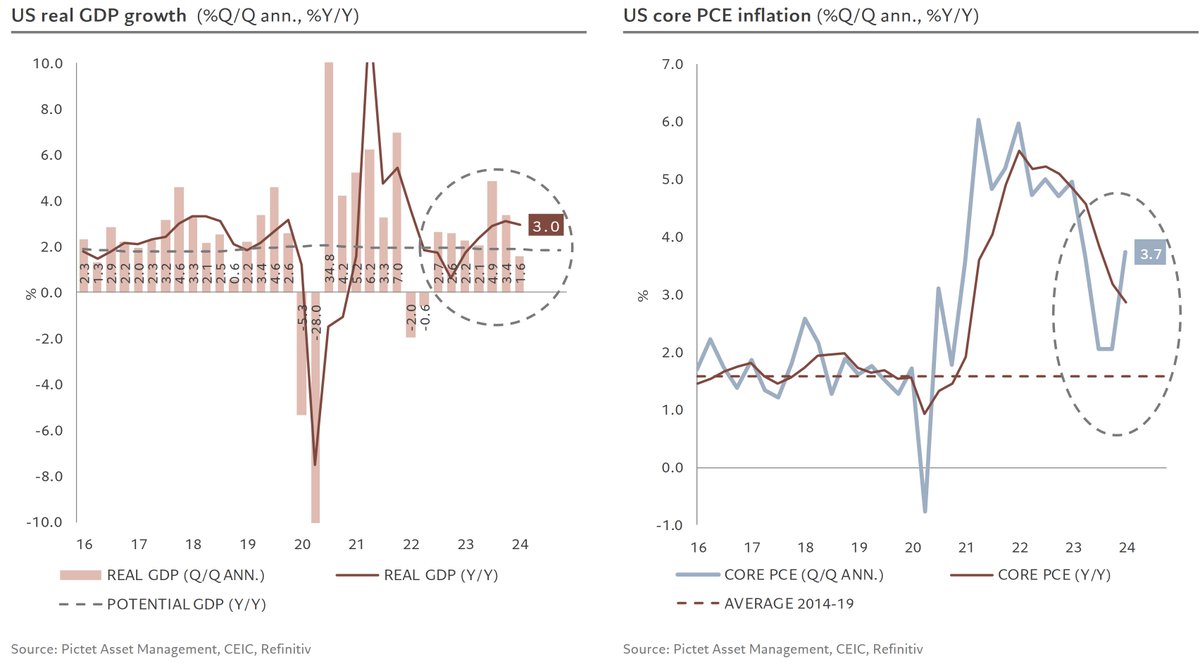

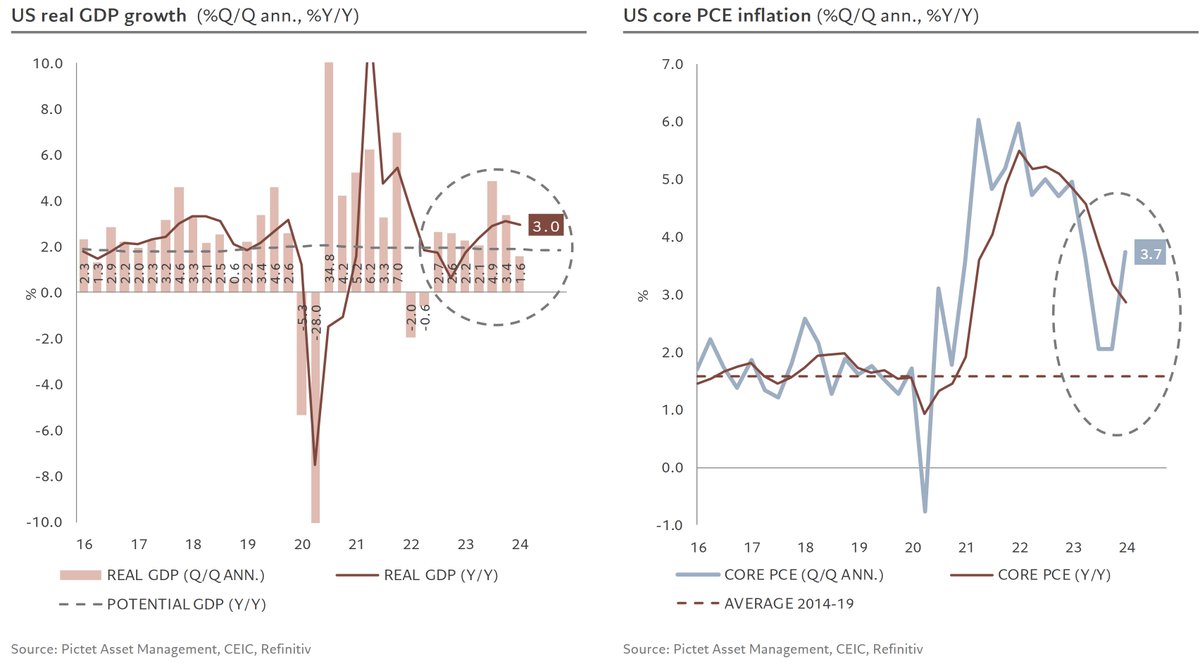

2. short-term inflationary pressures remain consistent with inflation returning towards its target

2. short-term inflationary pressures remain consistent with inflation returning towards its target

2/

2/