Managing Director of Bitcoin Magazine Pro.

Founder of Trendstorm (powering BM Pro).

Helping people understand Bitcoin through data.

5 subscribers

How to get URL link on X (Twitter) App

All the way from the x21 multiple down to the final multiple of x1.6, which was tapped by price last week.

All the way from the x21 multiple down to the final multiple of x1.6, which was tapped by price last week.

The Z-score is a standard deviation that looks at differences between MV and RV.

The Z-score is a standard deviation that looks at differences between MV and RV.

2/ $BTC is incredible value when we see dips below Realized Value.

2/ $BTC is incredible value when we see dips below Realized Value.

2/ Bitcoin investors who are used to market cycle and on-chain indicators can jump straight in to live charts like the brilliant MVRV Z-score that has historically picked cycle tops to within 2 weeks…

2/ Bitcoin investors who are used to market cycle and on-chain indicators can jump straight in to live charts like the brilliant MVRV Z-score that has historically picked cycle tops to within 2 weeks…

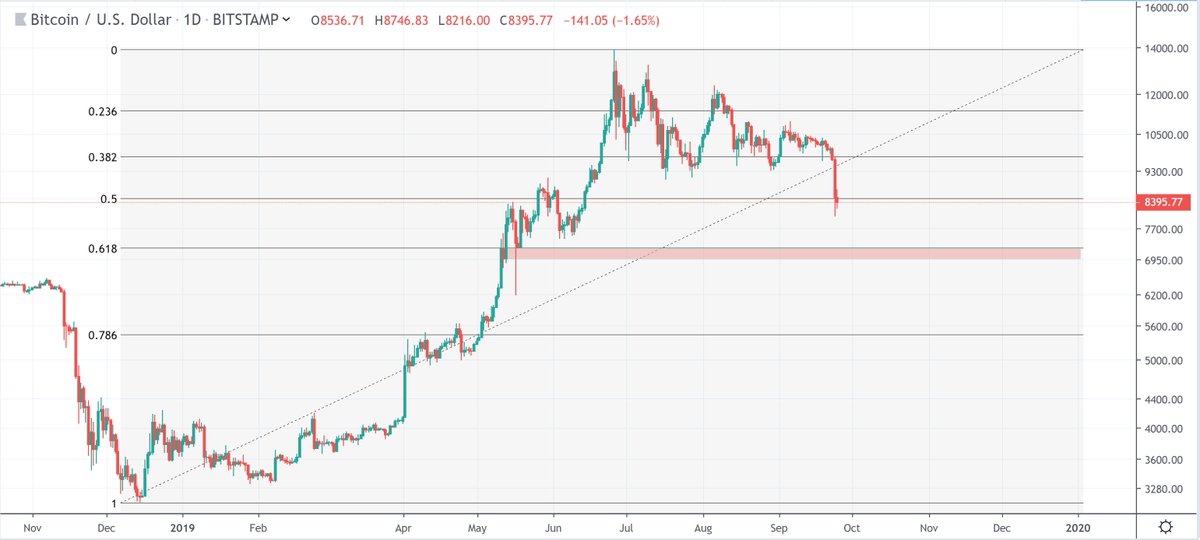

2/ This red candle lines up with the 0.618 which I believe would act as very strong support, given we are in a bull market.

2/ This red candle lines up with the 0.618 which I believe would act as very strong support, given we are in a bull market.

https://twitter.com/MustStopMurad/status/10904261825695457292/ If we do bounce up price would also need to get past these bear market dominating moving averages (112, 128) which I don't think it will be able to so it will get stuck around that $4300 area. A great shorting opportunity if we get to them...

2/ May feel optimistic at this point, but with every single bounce in this bear market price has hit one of these moving averages

2/ May feel optimistic at this point, but with every single bounce in this bear market price has hit one of these moving averages

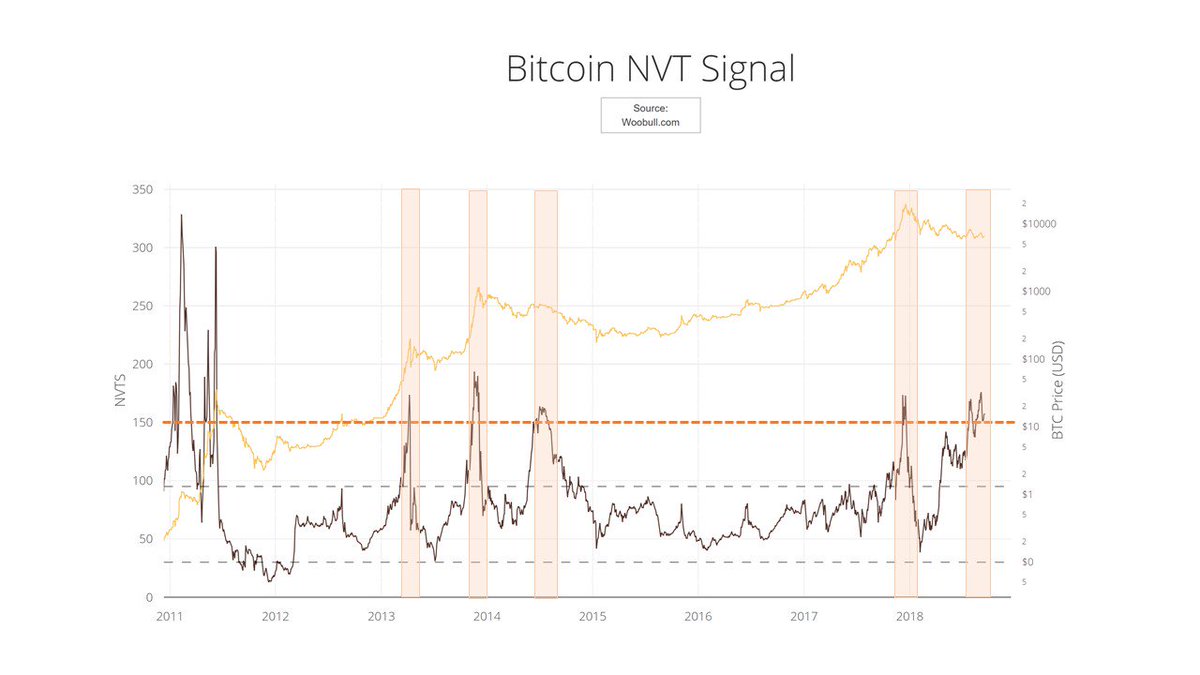

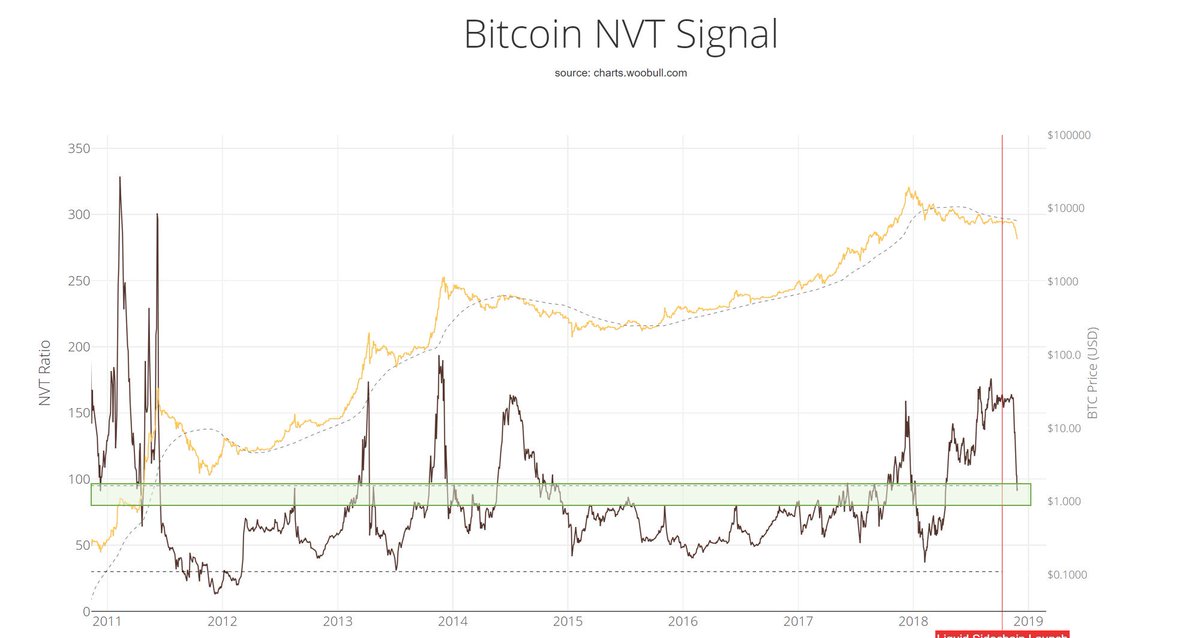

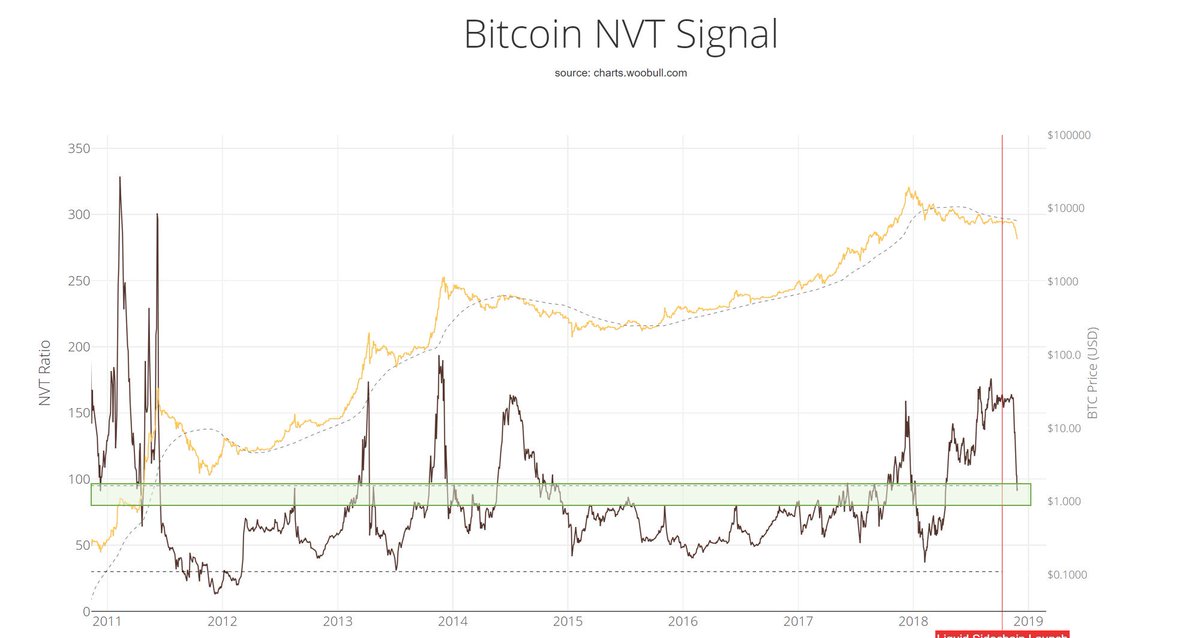

@ToneVays @novogratz Given this is the case I'm with @woonomic, we just bounced on NVT Signal but once that support line breaks 150,we go down. Building on @woonomic great analysis, there are also a couple of other key indicators that will help optimise BTC investment timing during the bear market..

@ToneVays @novogratz Given this is the case I'm with @woonomic, we just bounced on NVT Signal but once that support line breaks 150,we go down. Building on @woonomic great analysis, there are also a couple of other key indicators that will help optimise BTC investment timing during the bear market..