@ColumbiaLaw professor; @MillsteinCenter director; law & econ nebbish; green chile addict; mercurial guitarist; perfervid cyclist; begetter of dad jokes.

How to get URL link on X (Twitter) App

Here's the skinny: A struggling startup with several VC backers needs more capital, but the incumbents aren’t interested in re-upping. So a new investor is smoked out who’s willing to kick in, but who conditions his investment on cleaning up the capital structure in two ways: 2/n

Here's the skinny: A struggling startup with several VC backers needs more capital, but the incumbents aren’t interested in re-upping. So a new investor is smoked out who’s willing to kick in, but who conditions his investment on cleaning up the capital structure in two ways: 2/n

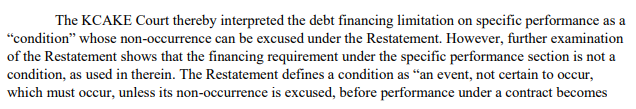

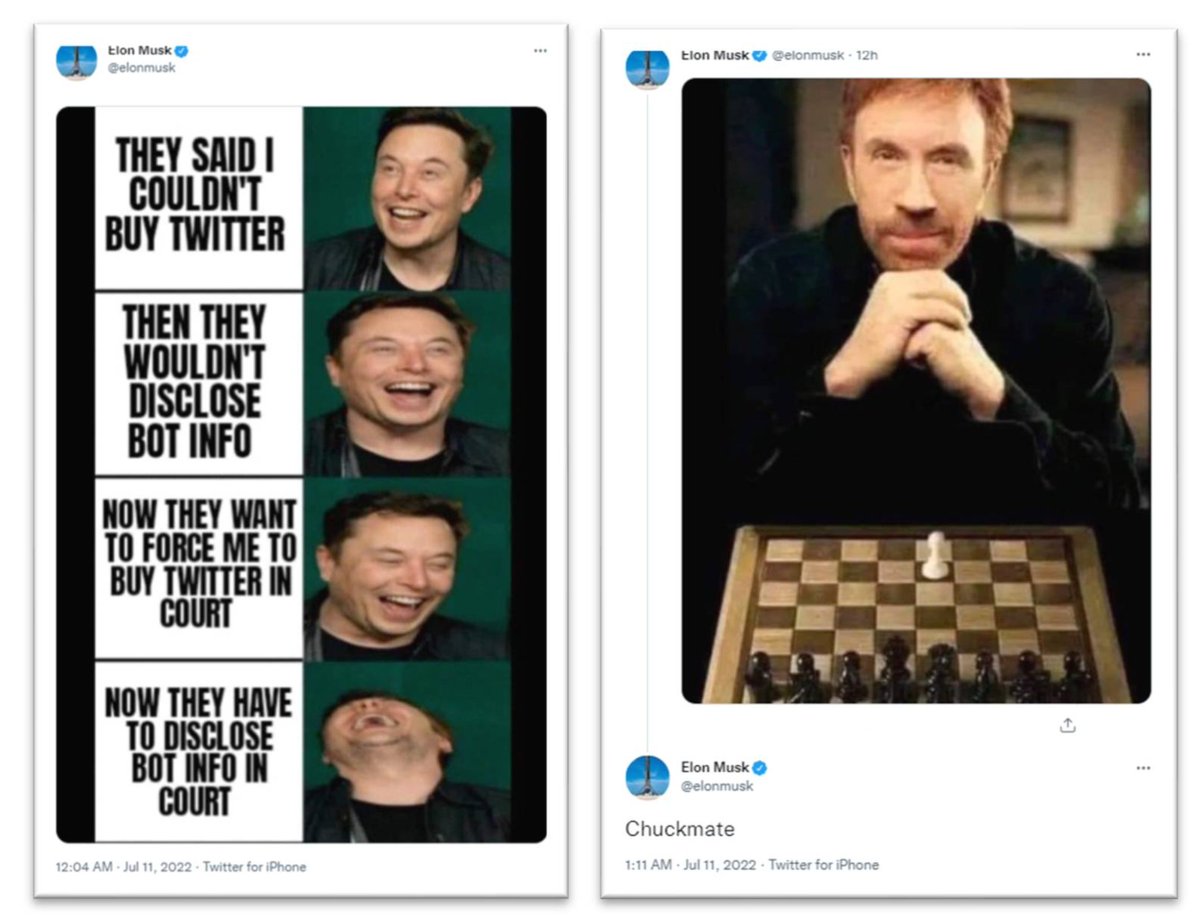

https://twitter.com/ProfRobAnderson/status/1571863003406172172A key point concerns the "prevention" doctrine, which CM used in Decopac to disregard a financing failure engineered by the buyer in order to trigger an escape hatch on SP. Rob argues that prevention applies only to "conditions", not "remedies" (under his reading of the Rtmt 2d).

https://twitter.com/chancery_daily/status/1568011580876668928The key damages provision that needs to be interpreted here is 8.3(c)(ii), which reads (in relevant part):

https://twitter.com/ProfEricTalley/status/1546910997956345856Twitter SHs would probably sue, alleging a Revlon violation and claiming that the Board did not undertake reasonable efforts to protect the $54.20 price already negotiated. How should the board respond? One (boring) way is to fight it, of course….

https://twitter.com/akjennings/status/1546963585288519680Not many surprises--nor should there be, since so much of this deal was done, ironically, over Twitter. The plaintiffs have asked for Specific Performance (no surprise), &complaint details various allegations of disparagement by Musk, the (un)reasonability of his info requests...