Predicted the 2008 financial crisis. Honorary Professor at UCL. Learn 50 Years of Real Economics in only 7 weeks. Apply here: https://t.co/r9HH876IWf

3 subscribers

How to get URL link on X (Twitter) App

In 1944, the US made a fatal error. Instead of adopting Keynes's neutral "Bancor" for global trade, we let Harry Dexter White install the US Dollar as the global reserve currency. We thought it was a power move. It was actually a suicide pact for US industry.

In 1944, the US made a fatal error. Instead of adopting Keynes's neutral "Bancor" for global trade, we let Harry Dexter White install the US Dollar as the global reserve currency. We thought it was a power move. It was actually a suicide pact for US industry.

2/10

2/10

2/ Between 1990 and 2015, the correlation between private debt and unemployment was minus 0.93.

2/ Between 1990 and 2015, the correlation between private debt and unemployment was minus 0.93.

9/9 Ed, apply your manufacturing insights to money. Watch full debunk with Ravel models:

9/9 Ed, apply your manufacturing insights to money. Watch full debunk with Ravel models:

@elonmusk 3 / I just released a video showing what happens when engineers actually apply first principles to #economics instead of trusting textbook analogies.

@elonmusk 3 / I just released a video showing what happens when engineers actually apply first principles to #economics instead of trusting textbook analogies.

3/Most economics degrees teach the loanable funds model/money supply comes from saving, dictated by supply and demand curves. This is fundamentally wrong. #LoanableFunds #Econ101

3/Most economics degrees teach the loanable funds model/money supply comes from saving, dictated by supply and demand curves. This is fundamentally wrong. #LoanableFunds #Econ101

2/8 At the Bretton Woods conference, there were two competing visions for the future of global finance. The first, put forward by John Maynard Keynes, was a truly international system designed for stability. He proposed a neutral currency, the 'Bancor', and an International Clearing Union.

2/8 At the Bretton Woods conference, there were two competing visions for the future of global finance. The first, put forward by John Maynard Keynes, was a truly international system designed for stability. He proposed a neutral currency, the 'Bancor', and an International Clearing Union.

2/ Most economists still think money is just "fancy barter" between two parties. This primitive thinking dominates every economics textbook worldwide.

2/ Most economists still think money is just "fancy barter" between two parties. This primitive thinking dominates every economics textbook worldwide.

4/ Telecommunications "success"? Original monopolists still dominate 40 years later. Telstra in Australia, BT in the UK. Most supposed "competitors" failed spectacularly.

4/ Telecommunications "success"? Original monopolists still dominate 40 years later. Telstra in Australia, BT in the UK. Most supposed "competitors" failed spectacularly.

3/ Real economics must embrace complexity, not equilibrium. My Minsky software shows how to model dynamic, evolving systems rather than static mathematical fantasies.

3/ Real economics must embrace complexity, not equilibrium. My Minsky software shows how to model dynamic, evolving systems rather than static mathematical fantasies.

2/8 Buffett’s view: A trade deficit = "selling the farm." You exchange assets (bonds, land) for imports today. Over time, foreigners own your capital. Squanderville parable shows how complacency leads to colonization-by-purchase.

2/8 Buffett’s view: A trade deficit = "selling the farm." You exchange assets (bonds, land) for imports today. Over time, foreigners own your capital. Squanderville parable shows how complacency leads to colonization-by-purchase.

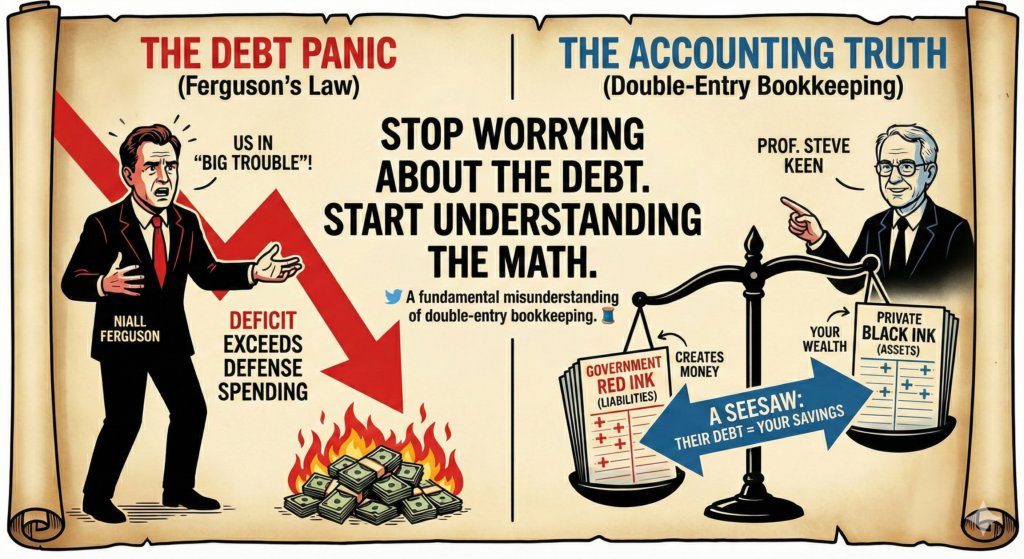

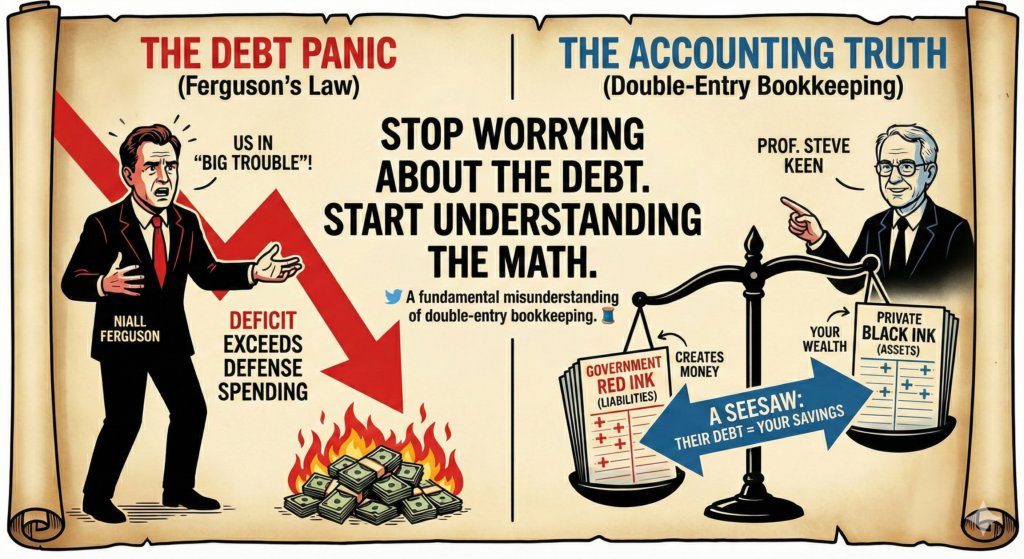

(2/9) They're confusing city budgets with national budgets—it's like panicking that Samsung will shut down because your local electronics store ran out of Galaxy phones.

(2/9) They're confusing city budgets with national budgets—it's like panicking that Samsung will shut down because your local electronics store ran out of Galaxy phones.

(2/9) Your bank lied to you. They don't take your savings and lend them out. When you get a loan, they literally create new money out of thin air by typing numbers on a computer. Your deposit comes from someone else's loan, not the other way around.

(2/9) Your bank lied to you. They don't take your savings and lend them out. When you get a loan, they literally create new money out of thin air by typing numbers on a computer. Your deposit comes from someone else's loan, not the other way around.

(2/9) Every global trade needs dollars first. When China buys from Australia, they convert to dollars, then buy Australian goods. This artificial demand makes dollars overvalued, killing US manufacturing competitiveness.

(2/9) Every global trade needs dollars first. When China buys from Australia, they convert to dollars, then buy Australian goods. This artificial demand makes dollars overvalued, killing US manufacturing competitiveness.

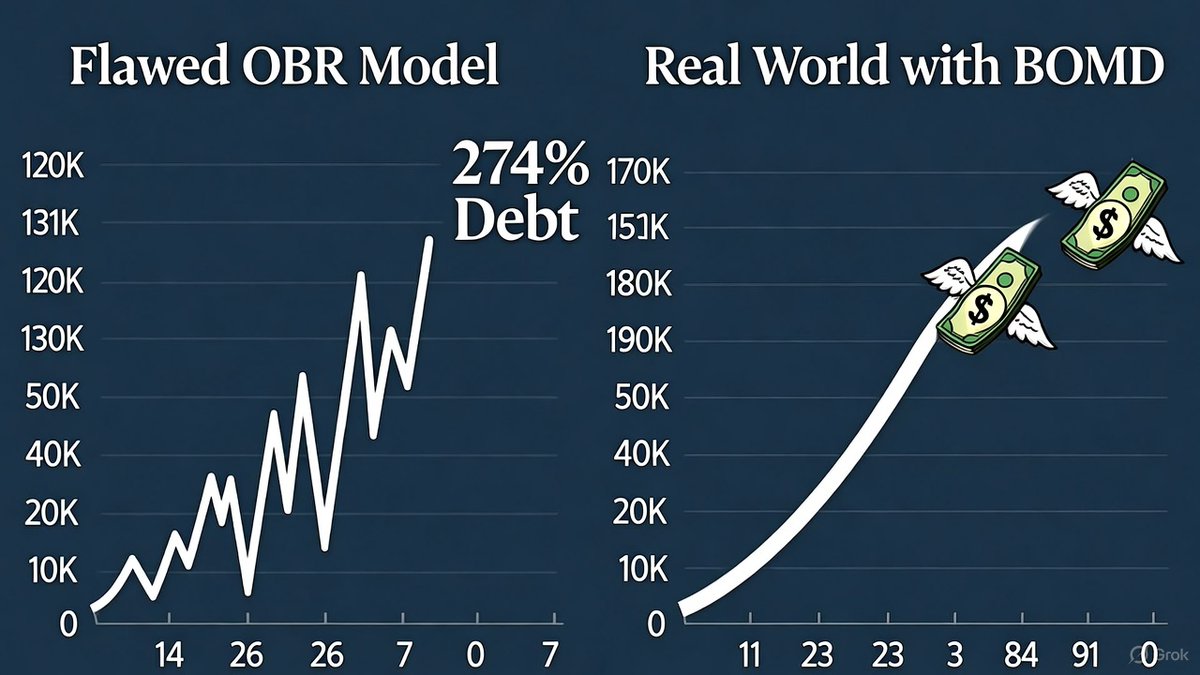

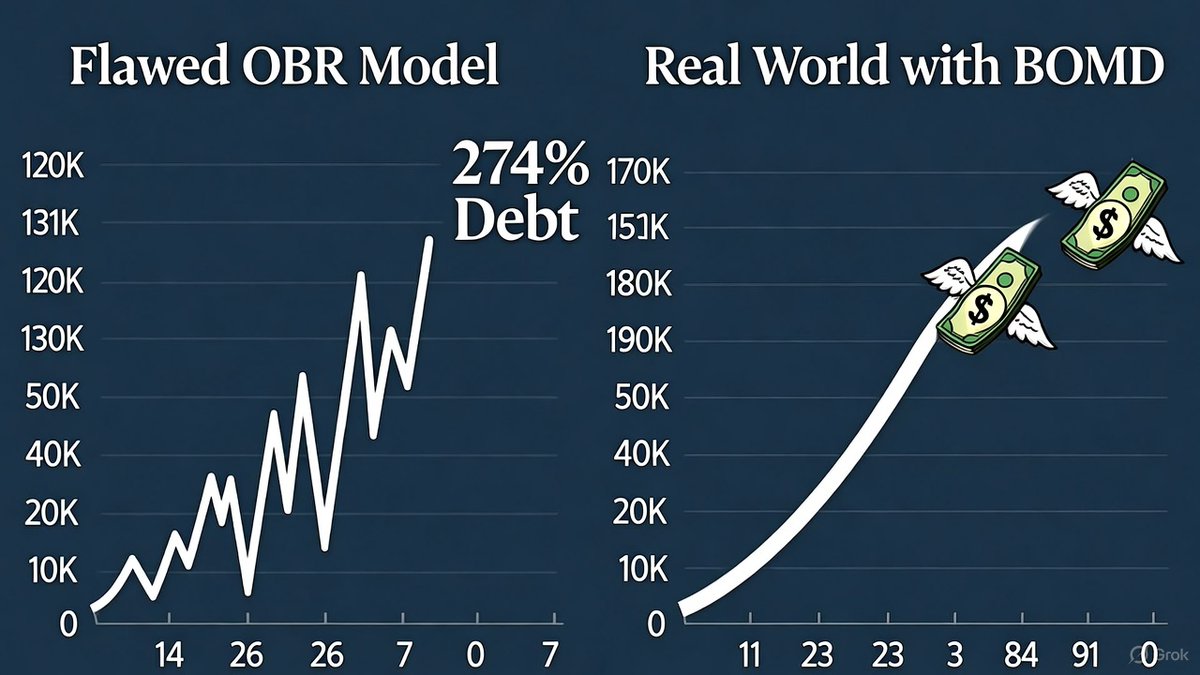

(2/8) Economists say:

(2/8) Economists say:

2/ They're both missing the monetary reality. When America exports, it creates new money in the domestic banking system. When it imports, it destroys money.

2/ They're both missing the monetary reality. When America exports, it creates new money in the domestic banking system. When it imports, it destroys money.