CRO at EliseAI ("ChatGPT for real estate"). Previously Head of Business Ops (Launch, Strategy, Finance and Competition) at Uber Eats Canada

How to get URL link on X (Twitter) App

2/ At least in recent memory, never has a tech company made an investment like this. IMO what makes this so different from other bets like AWS, Netflix originals, etc. is the following..

2/ At least in recent memory, never has a tech company made an investment like this. IMO what makes this so different from other bets like AWS, Netflix originals, etc. is the following..

2/ Implied expectations from CS - only 5% sales growth with EBITDA margins falling to 34% longer term. If 11% sales growth through ‘30 = 40% upside. Est. ’21 growth rate at 28% and EBITDA margins at 37%. FCF expected to compound ~20% from ‘21-‘26

2/ Implied expectations from CS - only 5% sales growth with EBITDA margins falling to 34% longer term. If 11% sales growth through ‘30 = 40% upside. Est. ’21 growth rate at 28% and EBITDA margins at 37%. FCF expected to compound ~20% from ‘21-‘26

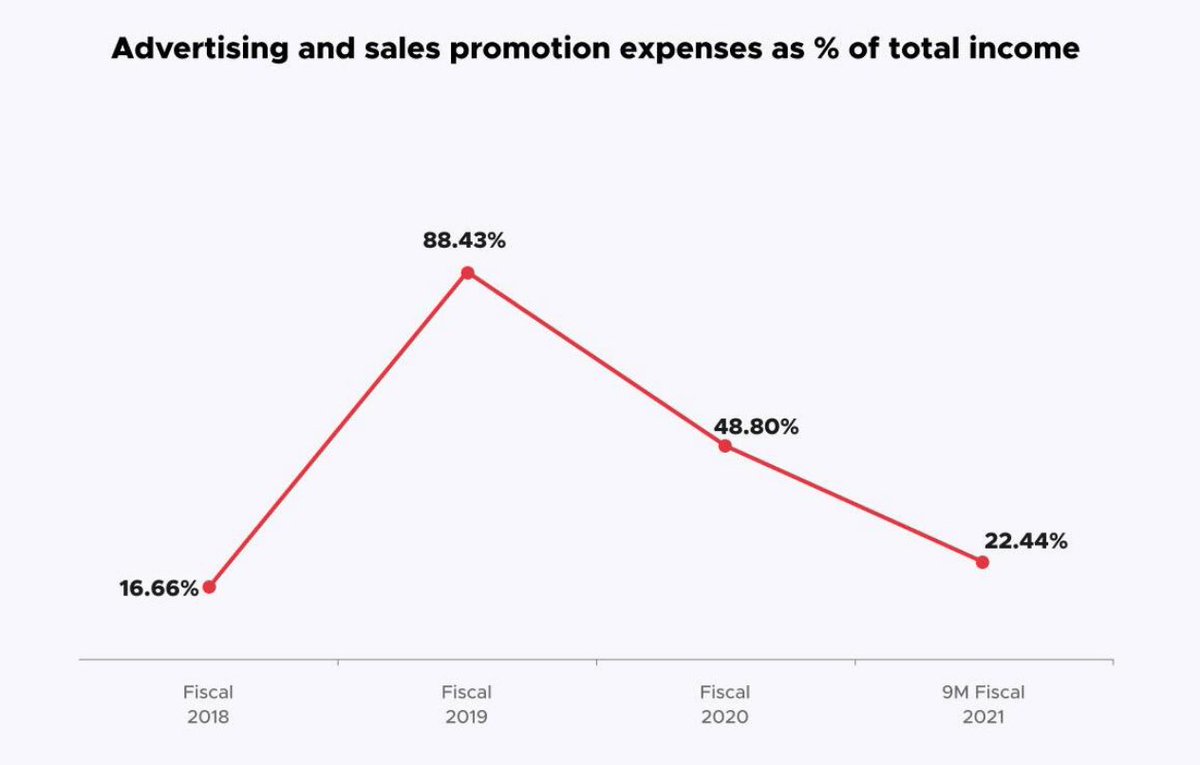

2/ You can also see they've been aggressively cutting costs. Adj EBITDA % losses as a % of revenue rapidly going down.

2/ You can also see they've been aggressively cutting costs. Adj EBITDA % losses as a % of revenue rapidly going down.

2/ Unlike a $GOOG or $FB, Uber is extremely decentralized. Partly because it’s a physical product and partly because execution and strategy require a lot of “boots on the ground” for localization (regulations, marketing, competition, etc).

2/ Unlike a $GOOG or $FB, Uber is extremely decentralized. Partly because it’s a physical product and partly because execution and strategy require a lot of “boots on the ground” for localization (regulations, marketing, competition, etc).

2/ But the key is to understand that resto supply shows a diminishing return to network effects (see chart).

2/ But the key is to understand that resto supply shows a diminishing return to network effects (see chart).

https://twitter.com/ProtagorasTO/status/1327276303607881728?s=202/ As demand scales, driver costs go down. Say I'd like to pay drivers $14 / hr, if they only do one delivery / hr, I'd pay them $14 / delivery. If they do 2 deliveries / hr, I can bring that down to $7, etc. So lots of room in newly launched markets to reduce per delivery costs