Quant Finance Education| GenAI Backed Algo Trading Platform https://t.co/eUs8f0t1dO| Daily Thread on Quant Trading/Research/Dev | Linkedin 130k+

How to get URL link on X (Twitter) App

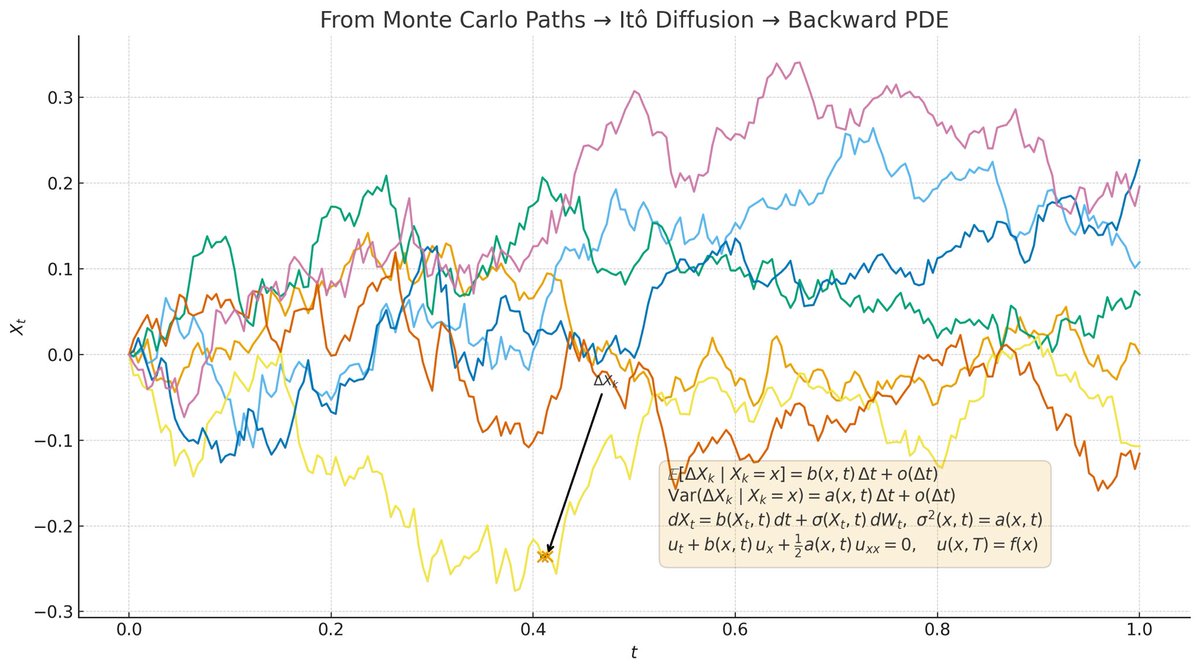

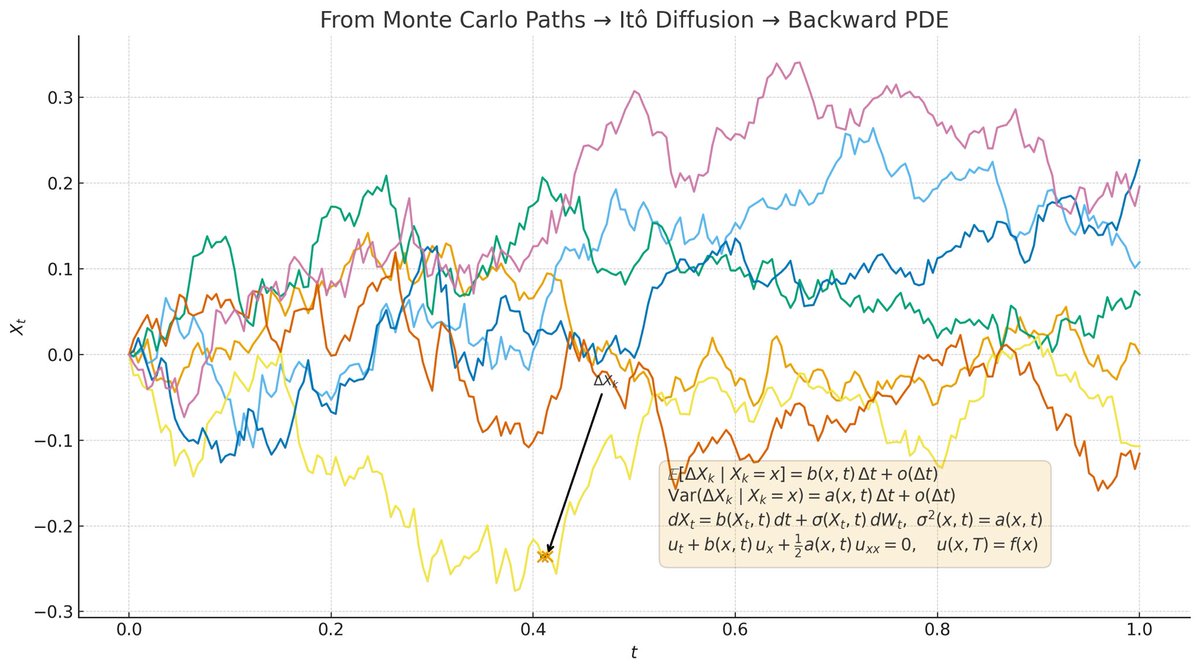

From Monte Carlo Paths to a PDE: Why Drift & Vol Alone Define the Limit

From Monte Carlo Paths to a PDE: Why Drift & Vol Alone Define the Limit

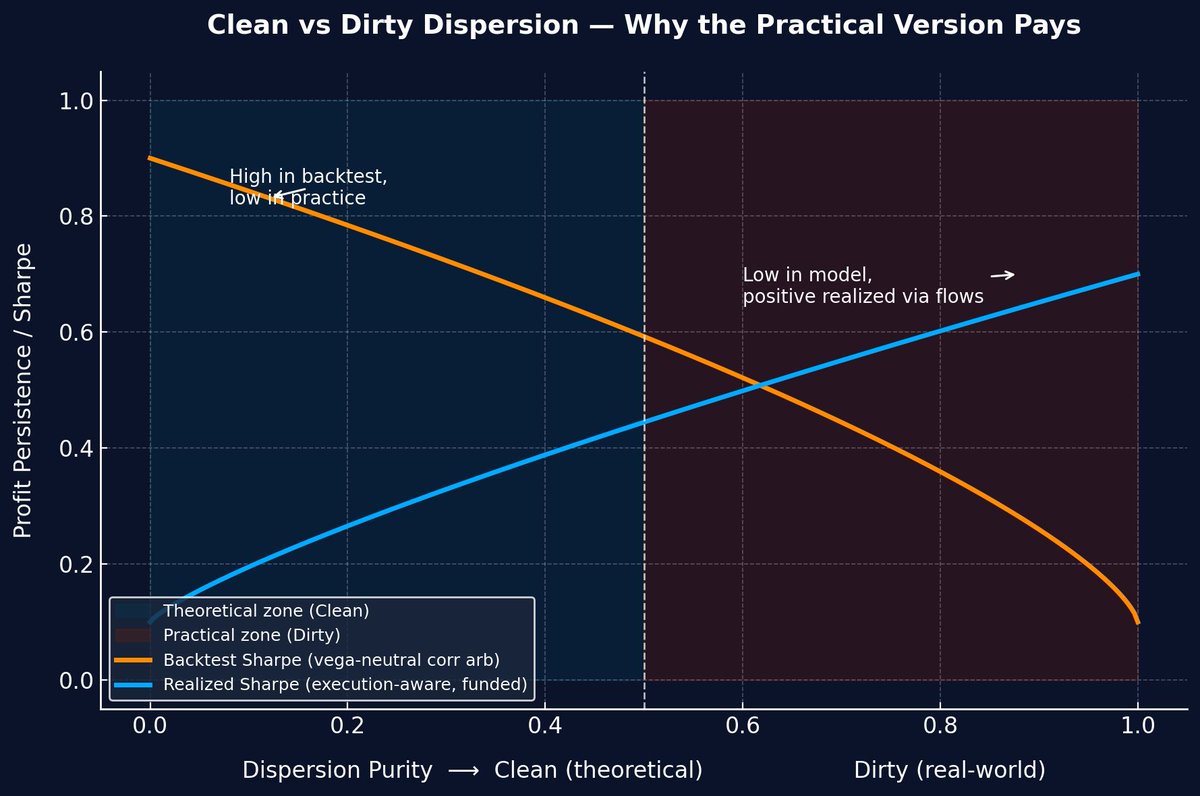

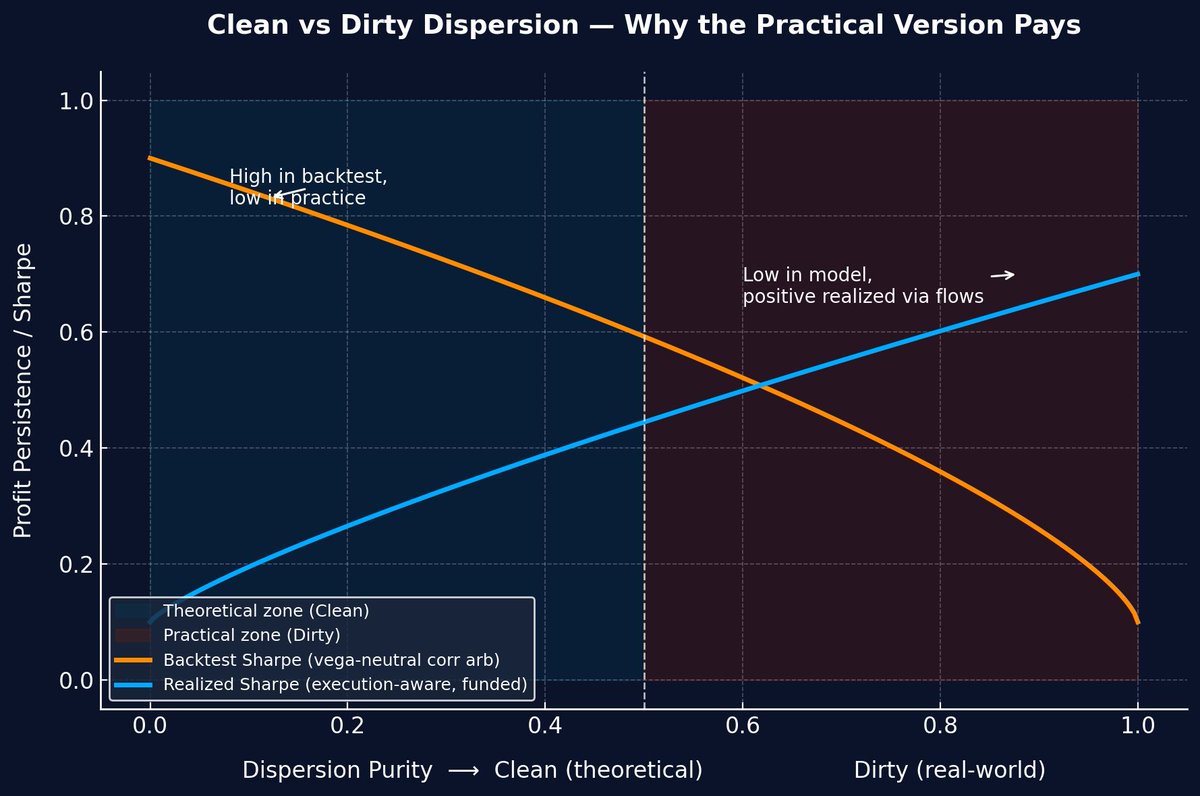

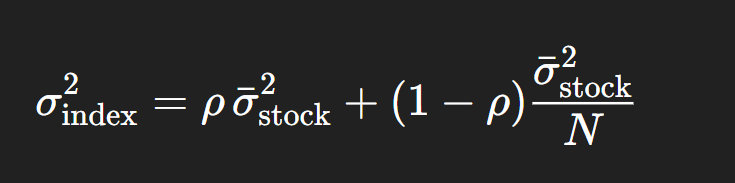

In theory, dispersion trading isolates the correlation risk embedded in index options.

In theory, dispersion trading isolates the correlation risk embedded in index options.

1. Option Values Depend on Funding

1. Option Values Depend on Funding

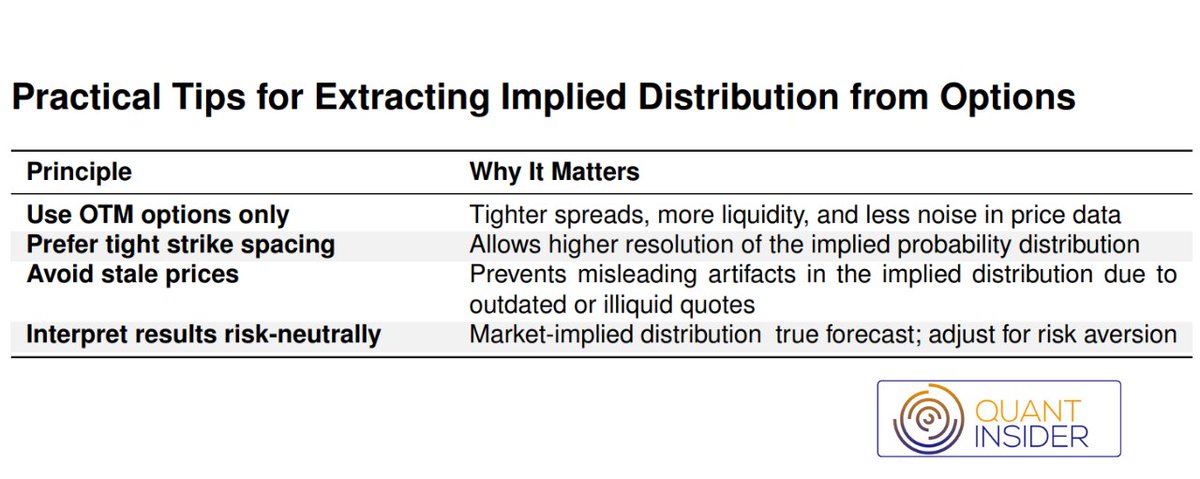

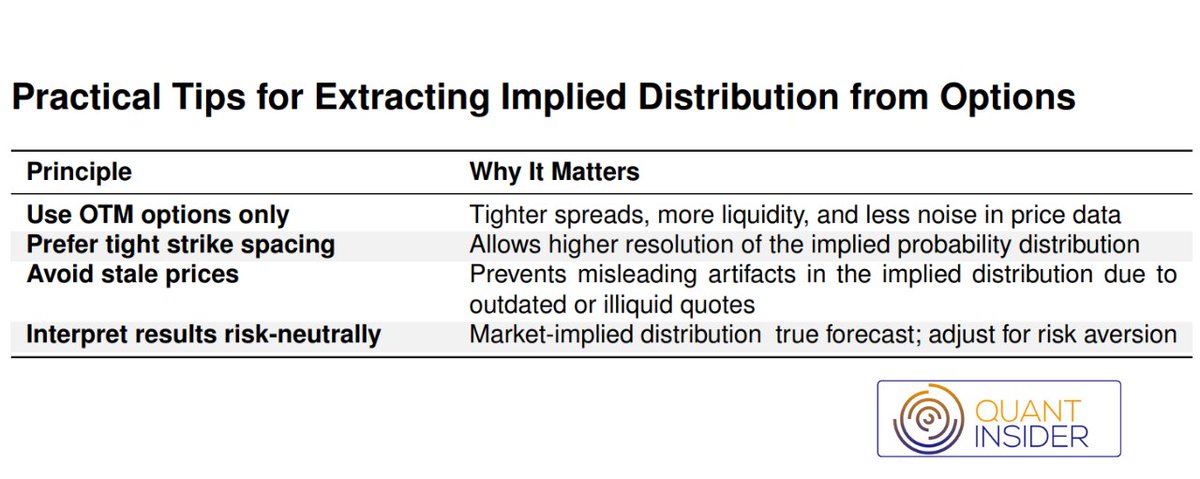

Why Use Options to Infer Distribution?

Why Use Options to Infer Distribution?

2/n

2/n

Stock Characteristics and Implied Volatility

Stock Characteristics and Implied Volatility

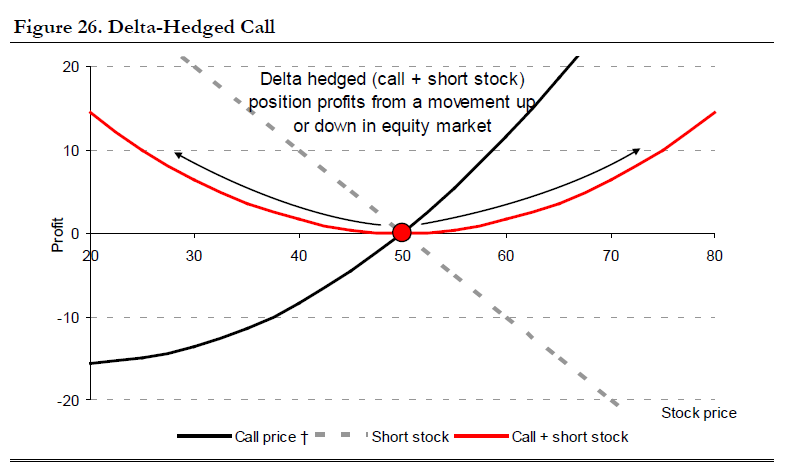

Delta Hedging and Matching Maturity

Delta Hedging and Matching Maturity

1/12

1/12

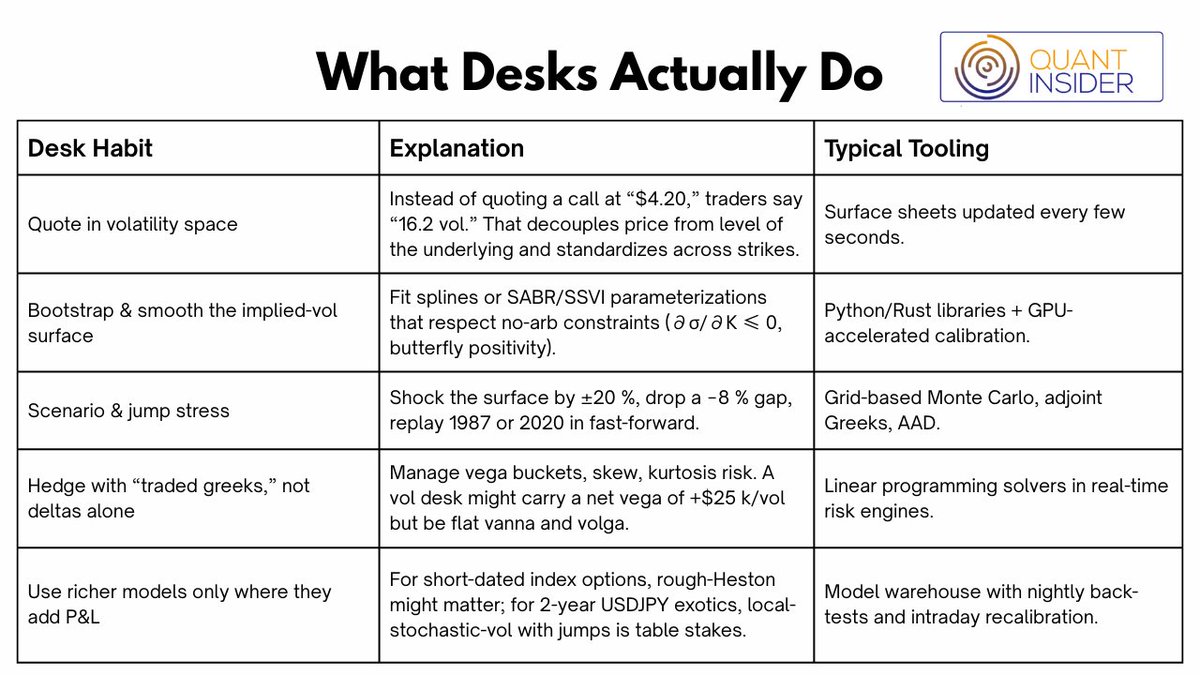

Textbook Assumptions and How the Real World Breaks Them

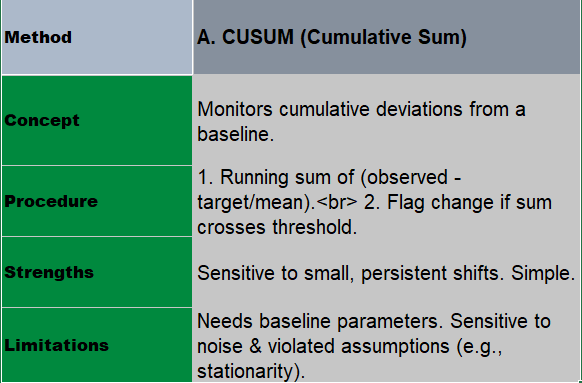

Textbook Assumptions and How the Real World Breaks Them II. Supplementary Analytics Functions

II. Supplementary Analytics Functions

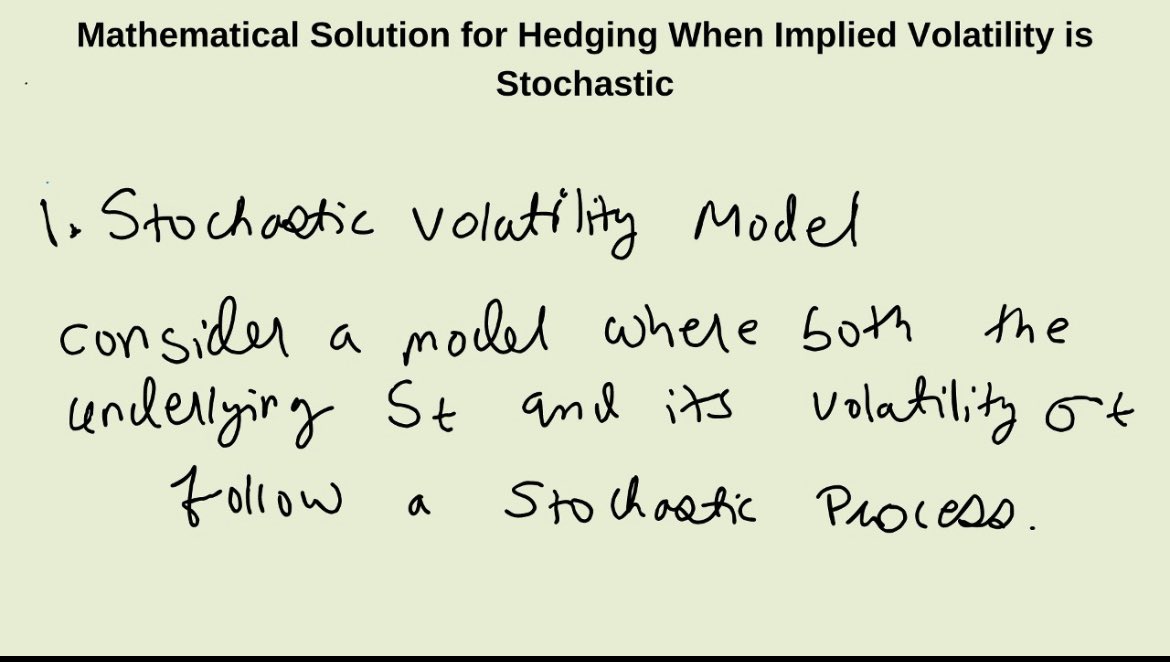

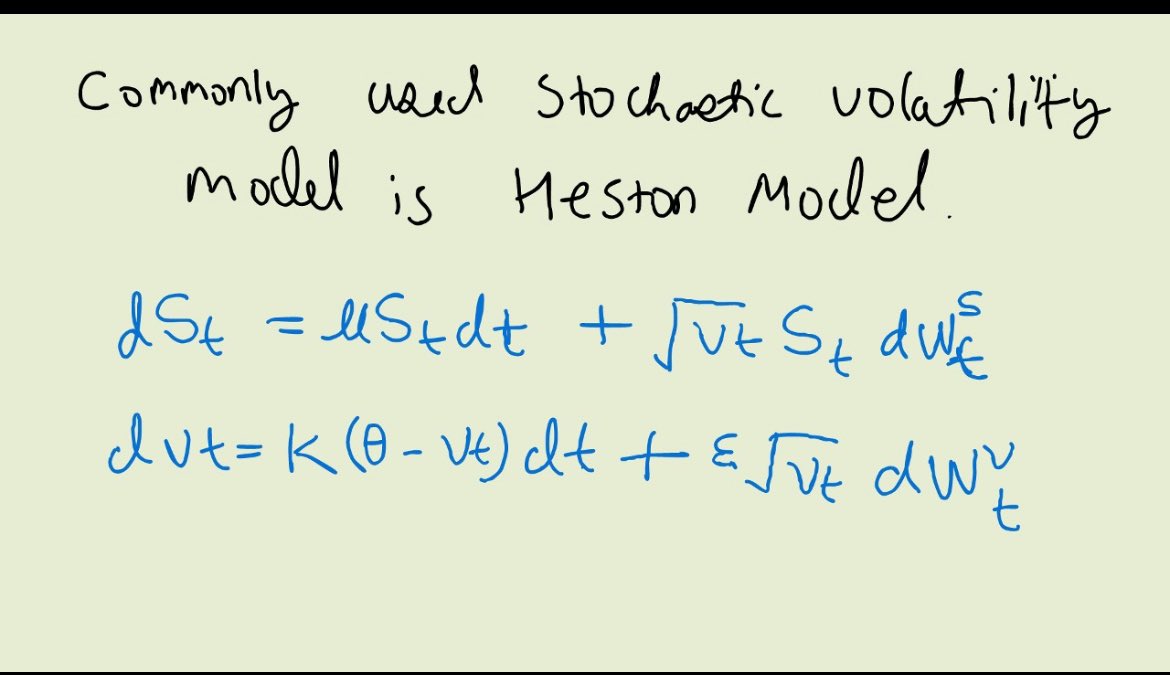

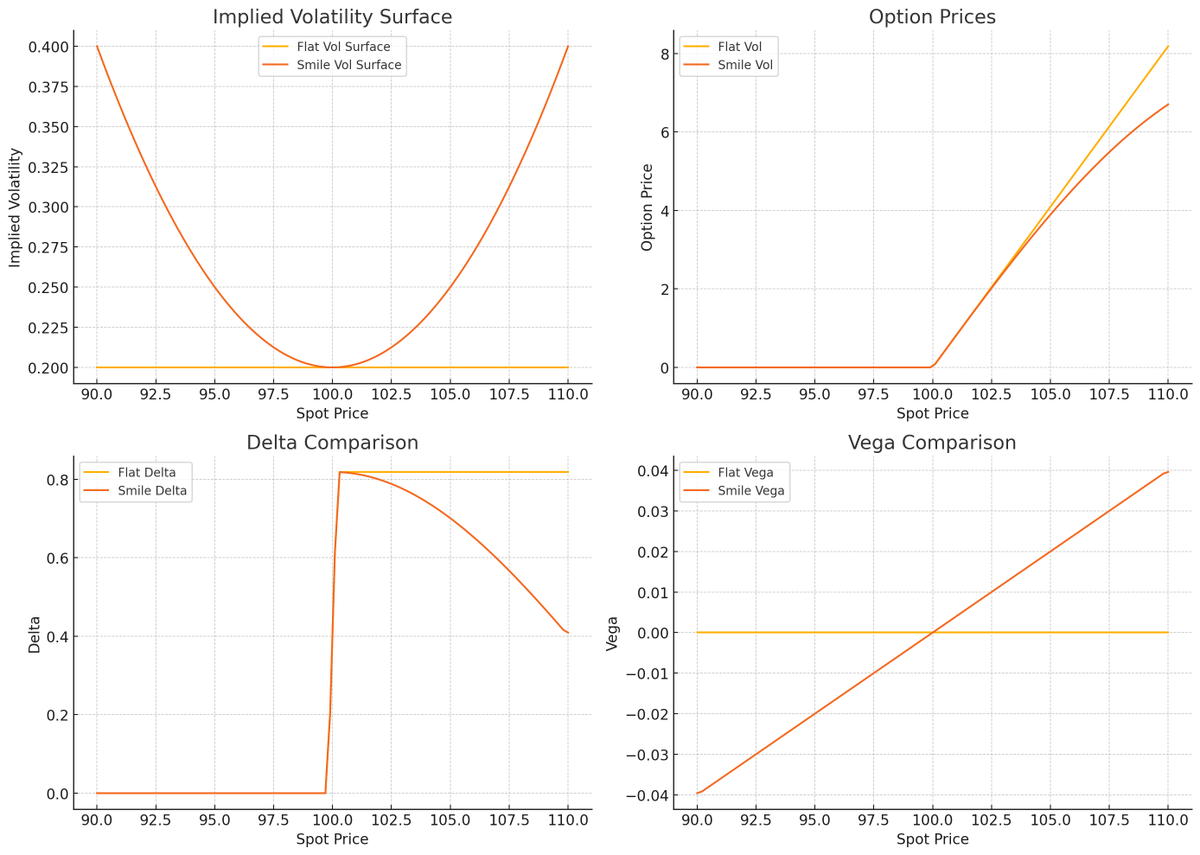

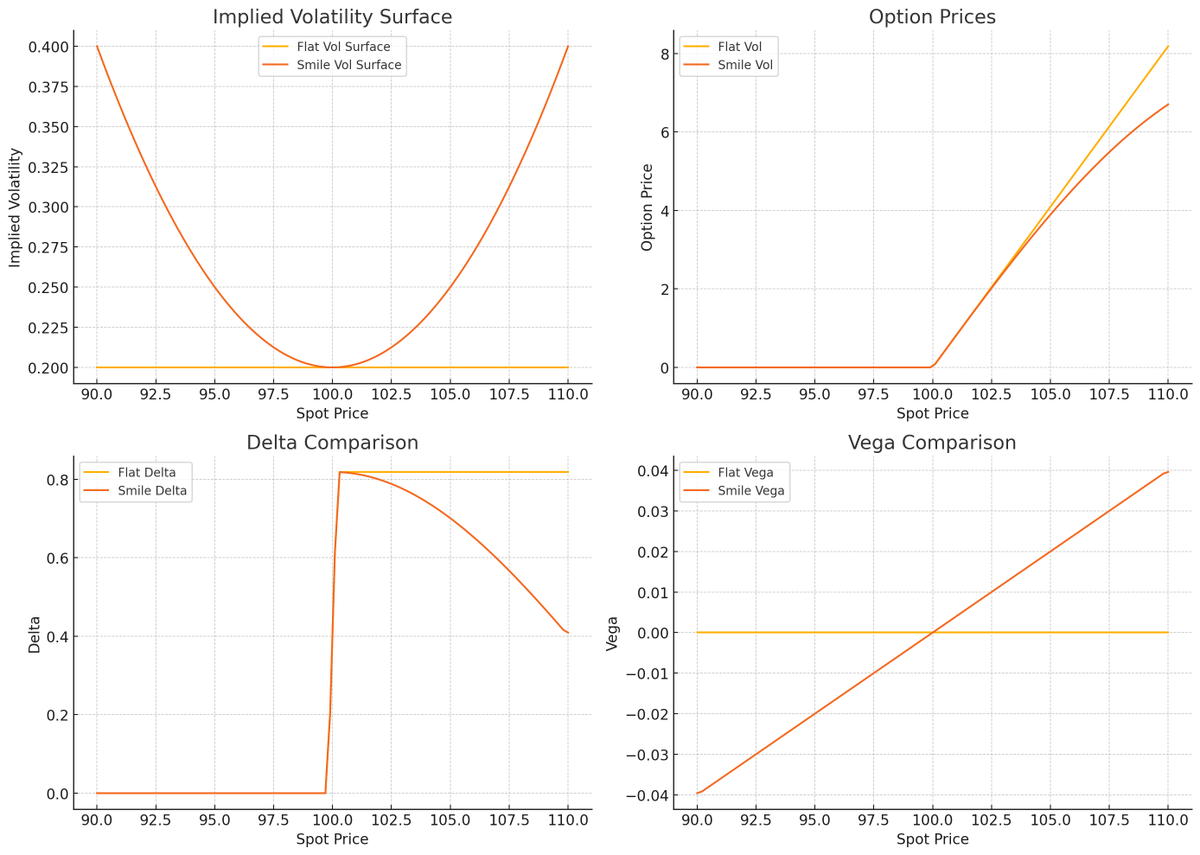

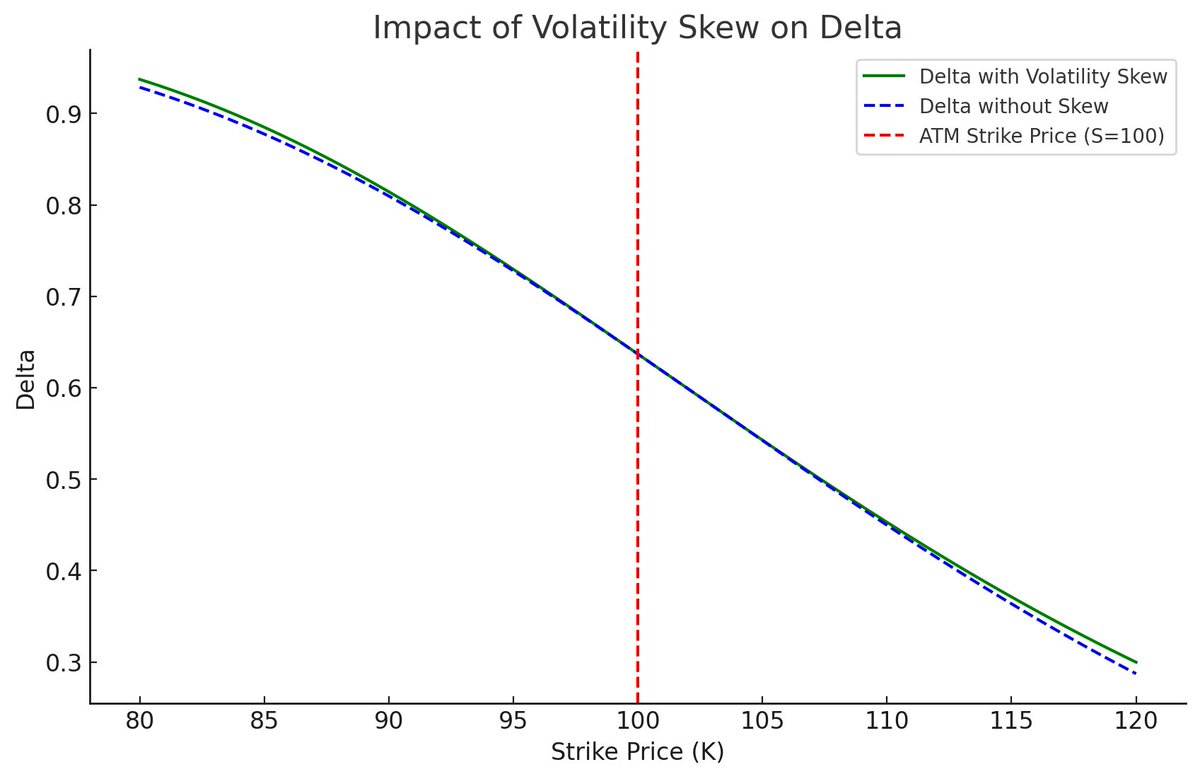

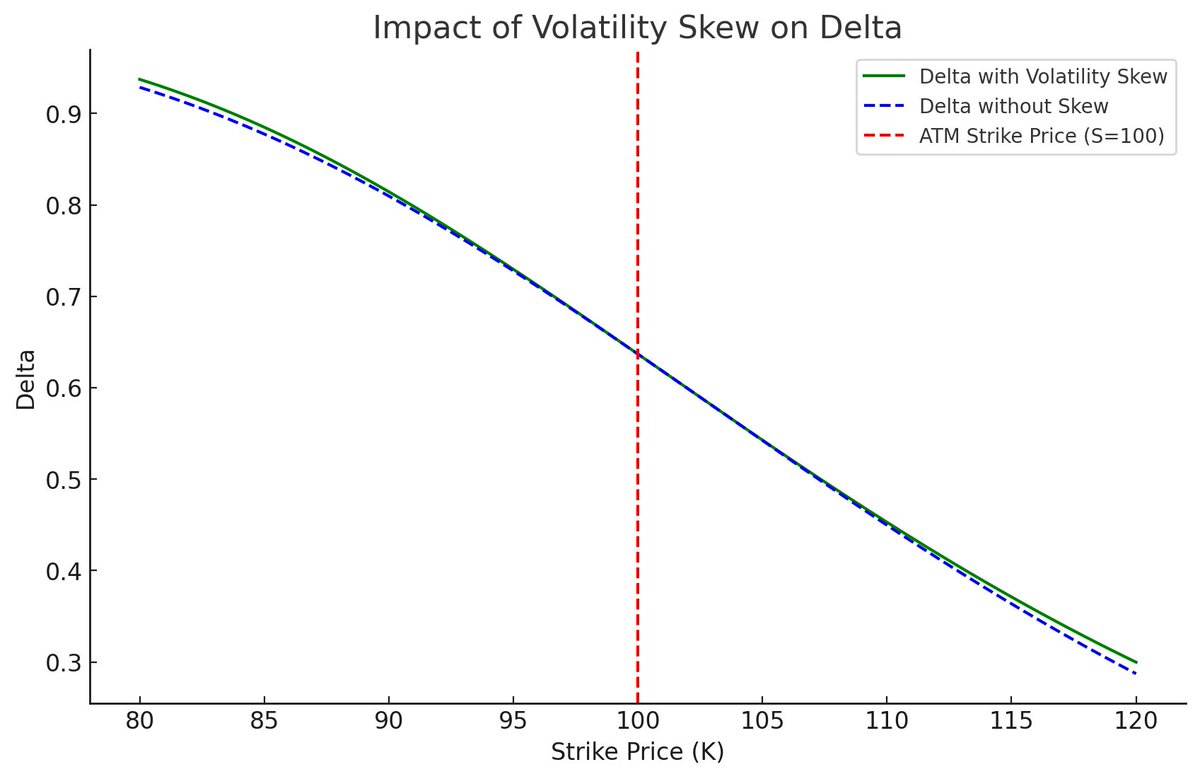

Why Black-Scholes Delta Isn't Always Accurate?

Why Black-Scholes Delta Isn't Always Accurate?

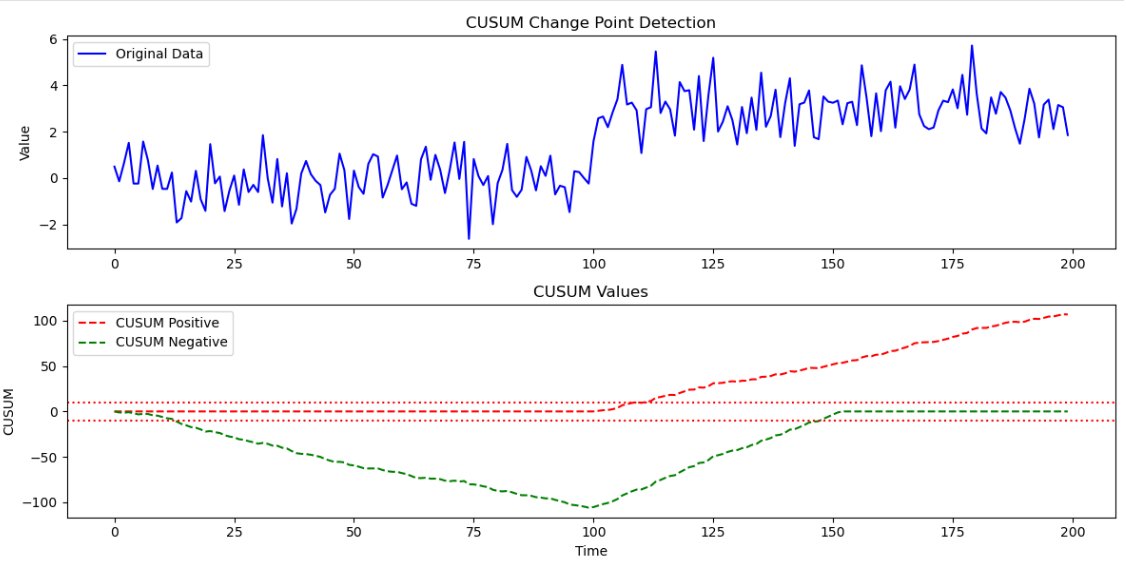

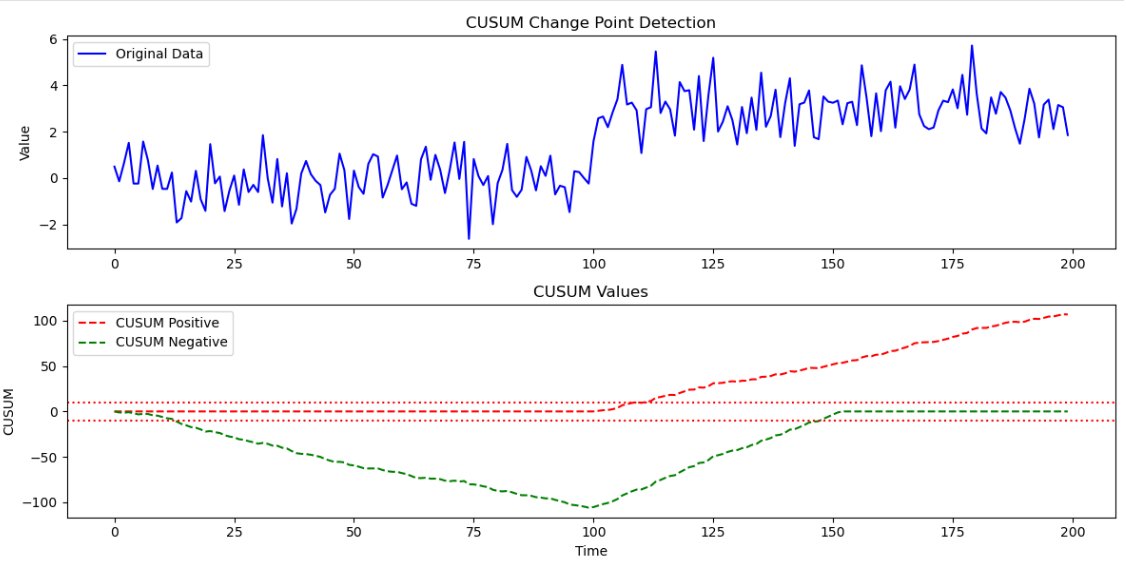

Use Case: Quickly detects shifts in mean returns or volatility. Ideal for simple, real-time signals where efficiency is key.

Use Case: Quickly detects shifts in mean returns or volatility. Ideal for simple, real-time signals where efficiency is key.

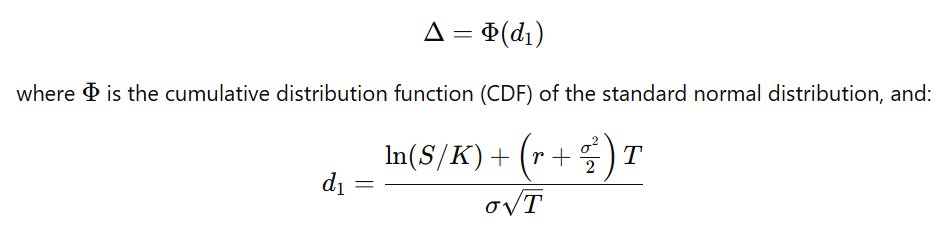

In the Black-Scholes model:

In the Black-Scholes model:

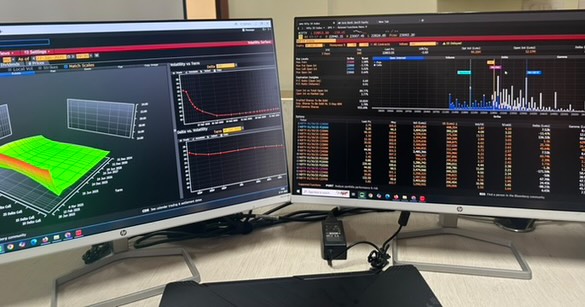

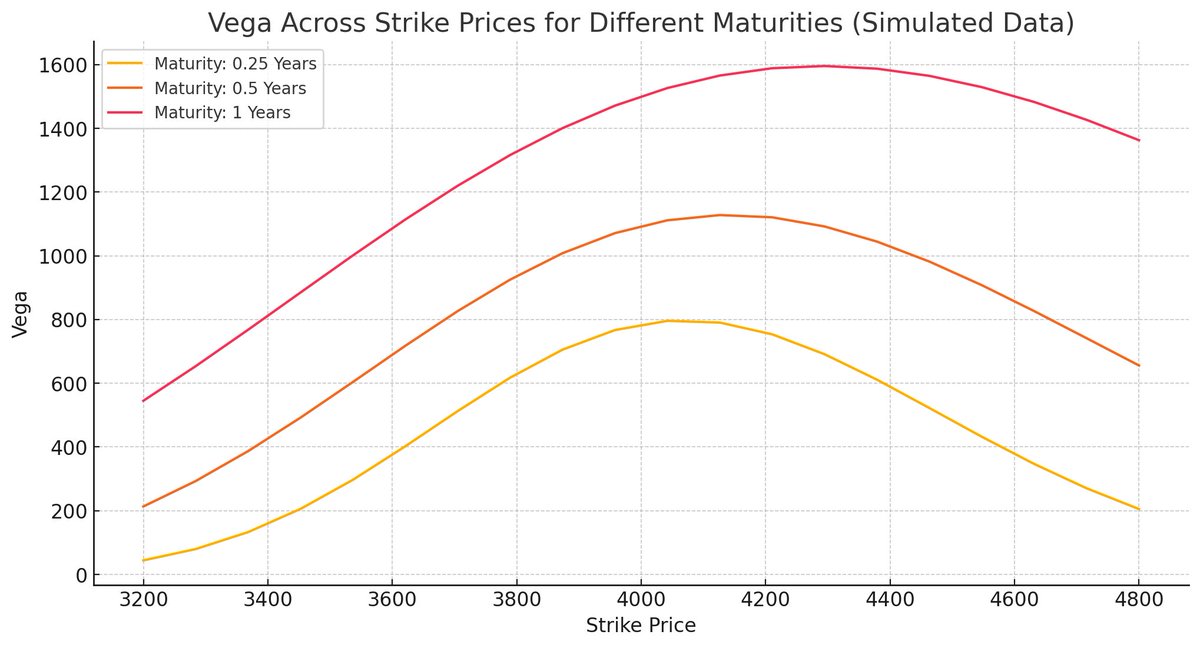

Volatility Smile and Term Structure:

Volatility Smile and Term Structure:

Stock Characteristics and Implied Volatility

Stock Characteristics and Implied Volatility

The derivatives market is a fundamental, "primitive" concept in finance.

The derivatives market is a fundamental, "primitive" concept in finance.

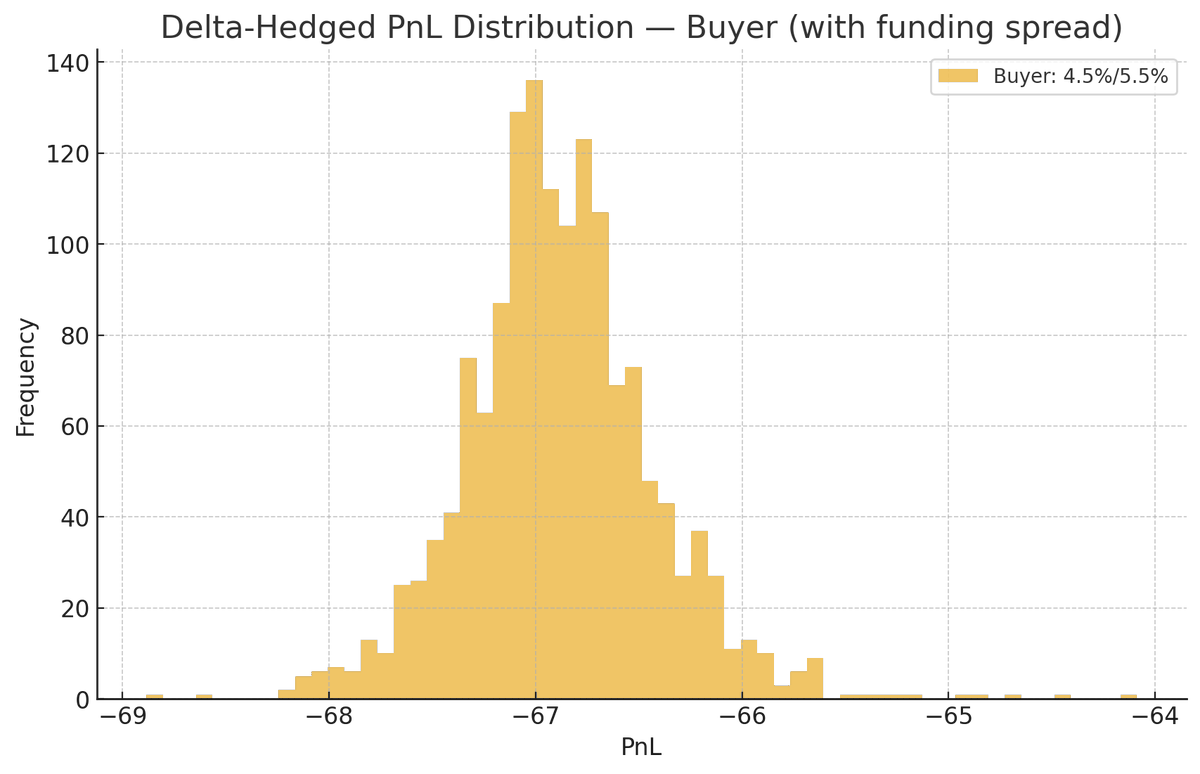

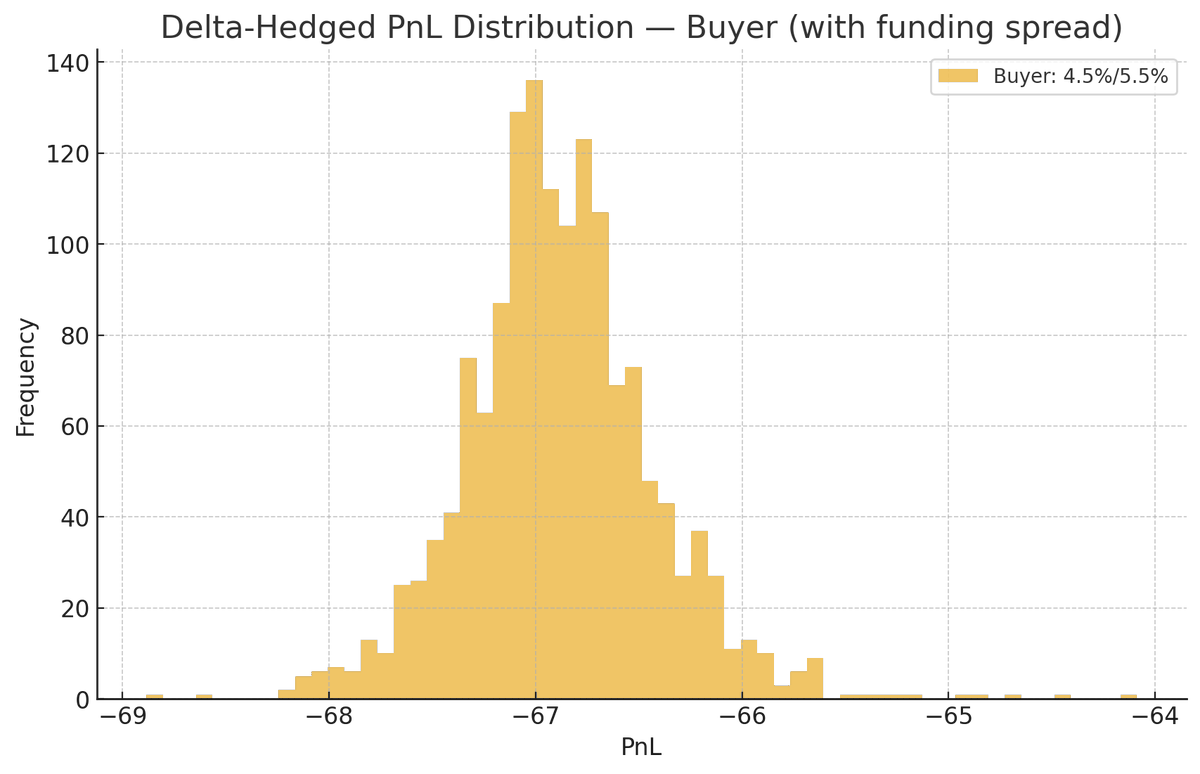

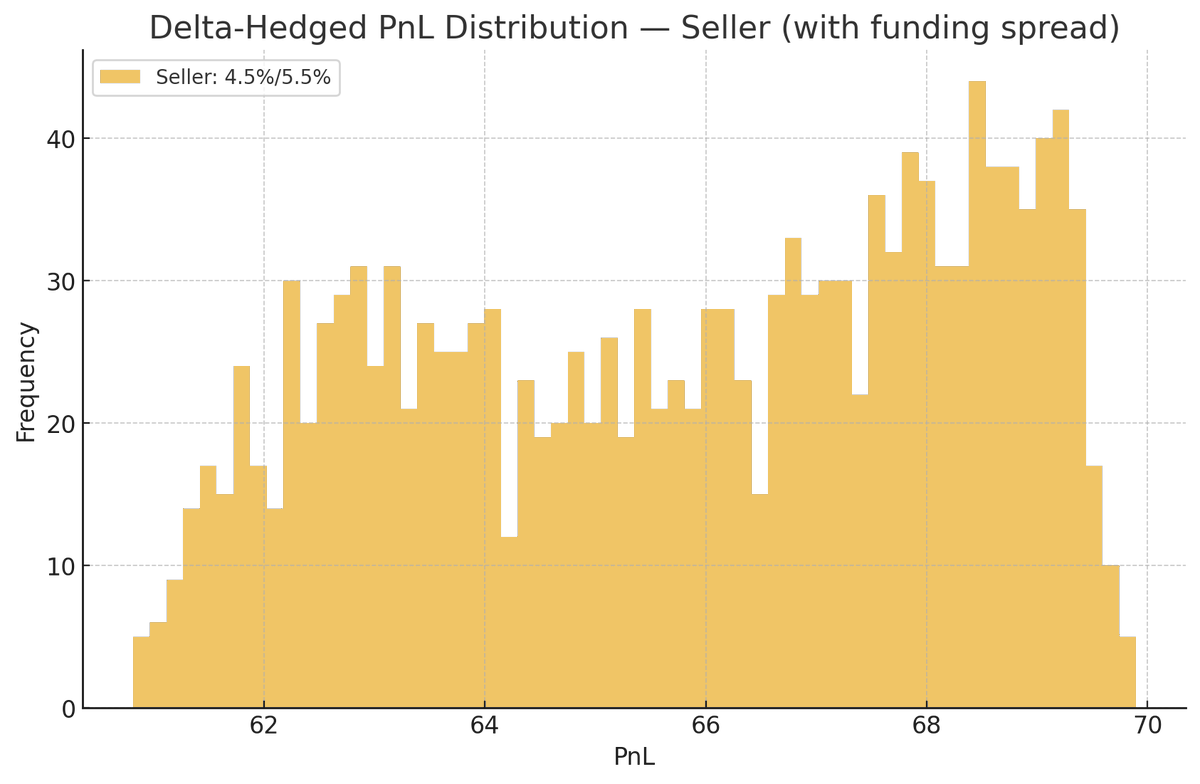

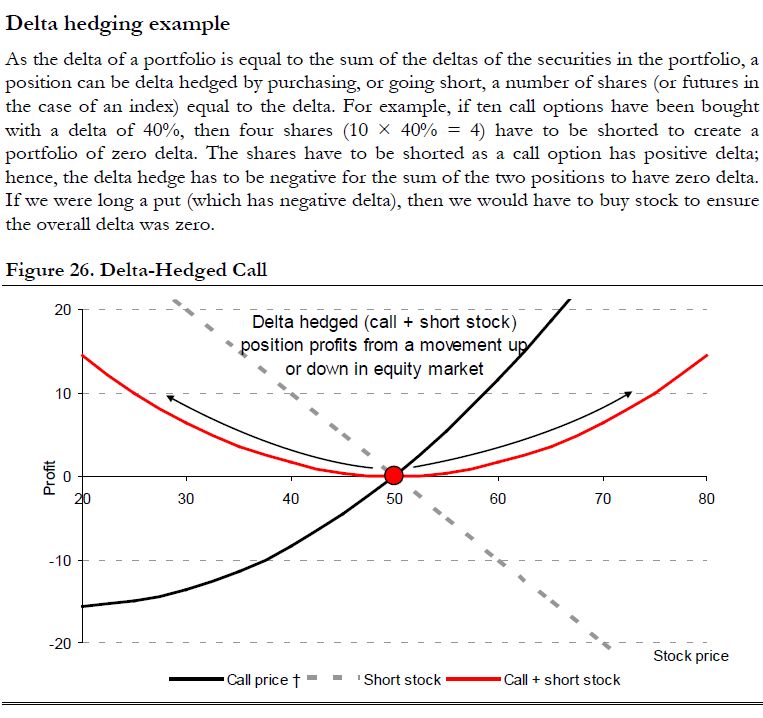

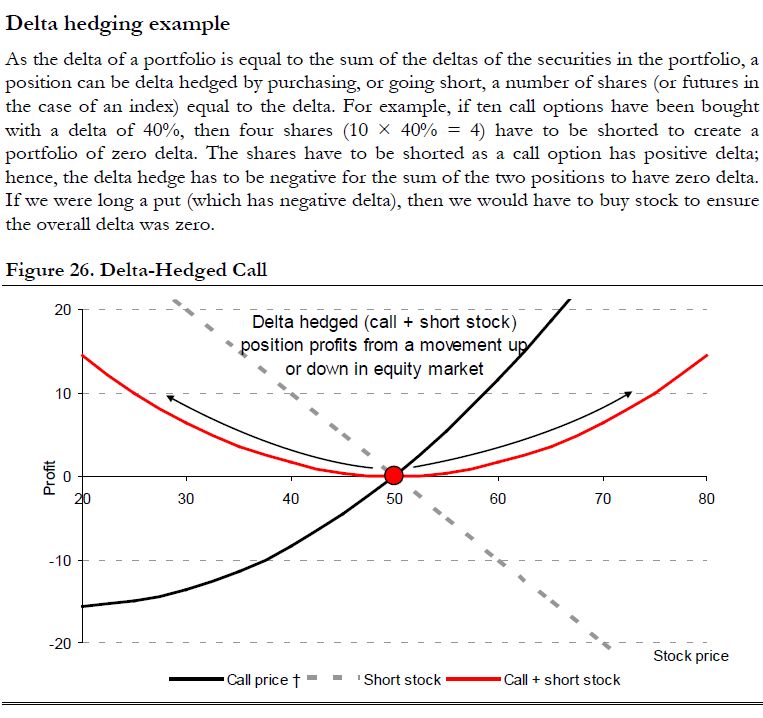

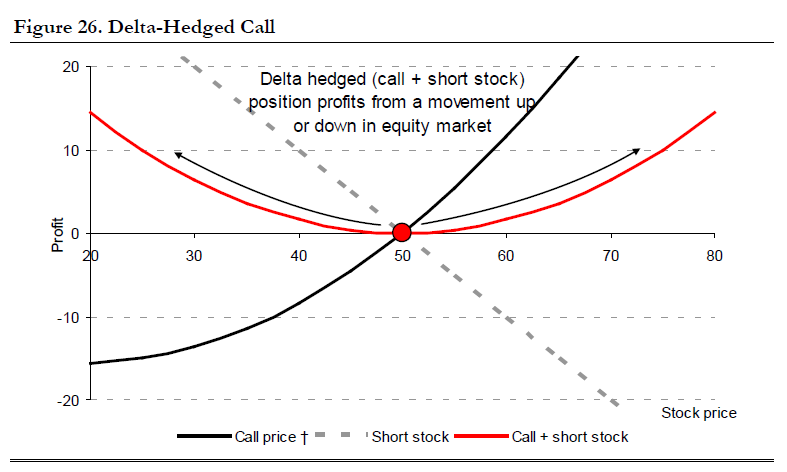

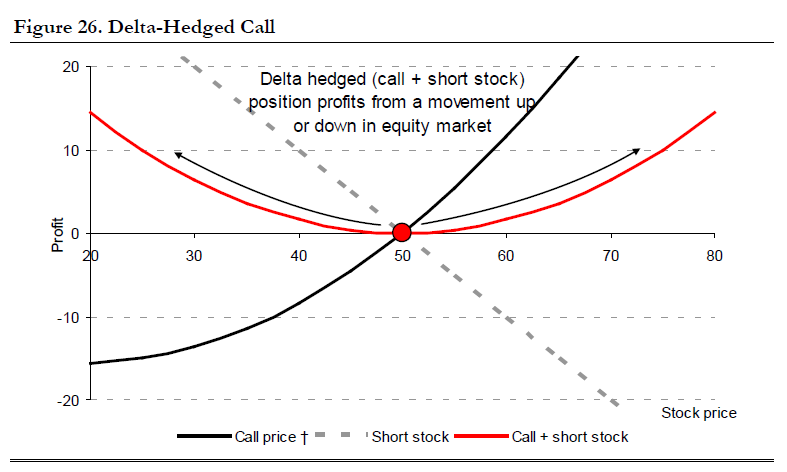

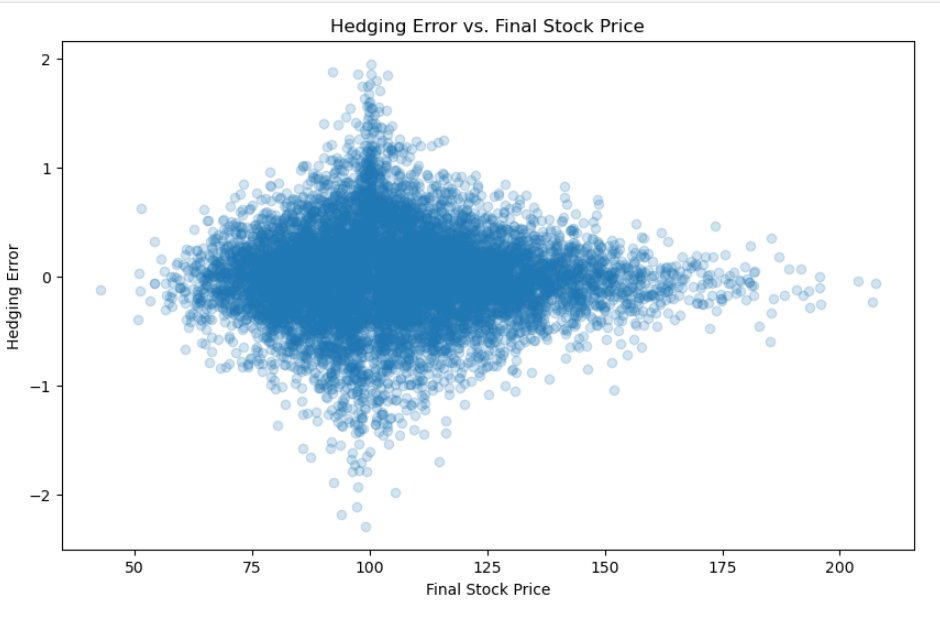

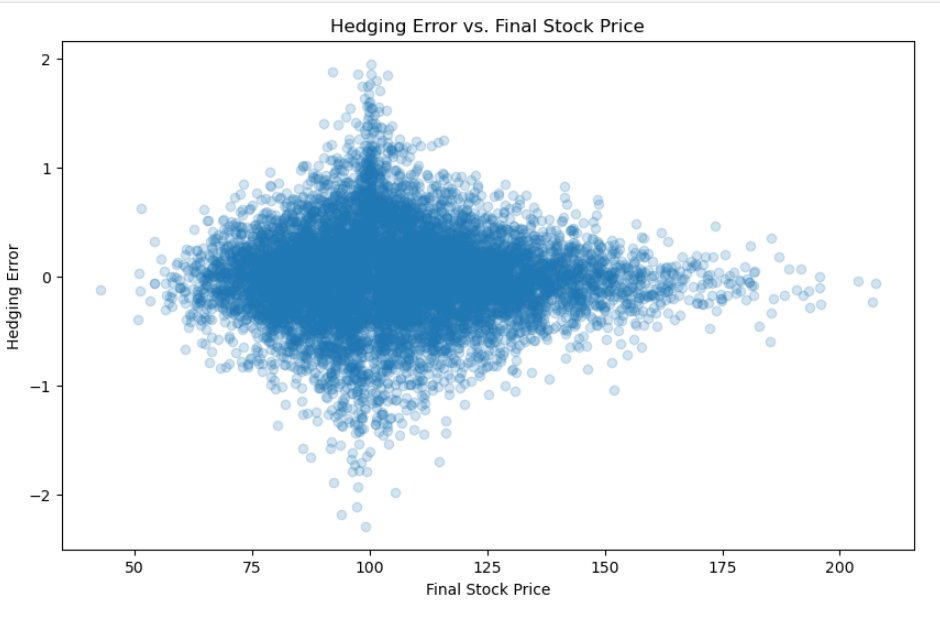

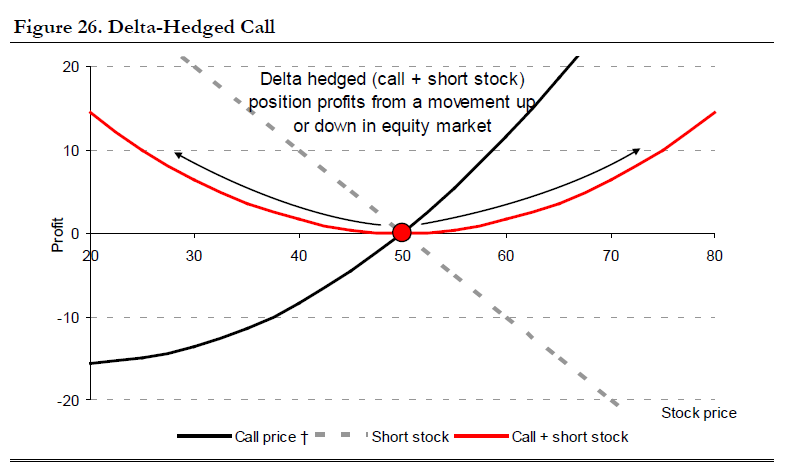

Dynamic delta hedging is a fundamental strategy used by option traders to mitigate the risk associated with movements in the underlying asset's price.

Dynamic delta hedging is a fundamental strategy used by option traders to mitigate the risk associated with movements in the underlying asset's price.

Delta Hedging and Matching Maturity

Delta Hedging and Matching Maturity

In the paper Three neural network models are discussed

In the paper Three neural network models are discussed