Bridging the information gap between Main Street and Wall Street.

Disclaimer: https://t.co/dIbqx0Q4fW

How to get URL link on X (Twitter) App

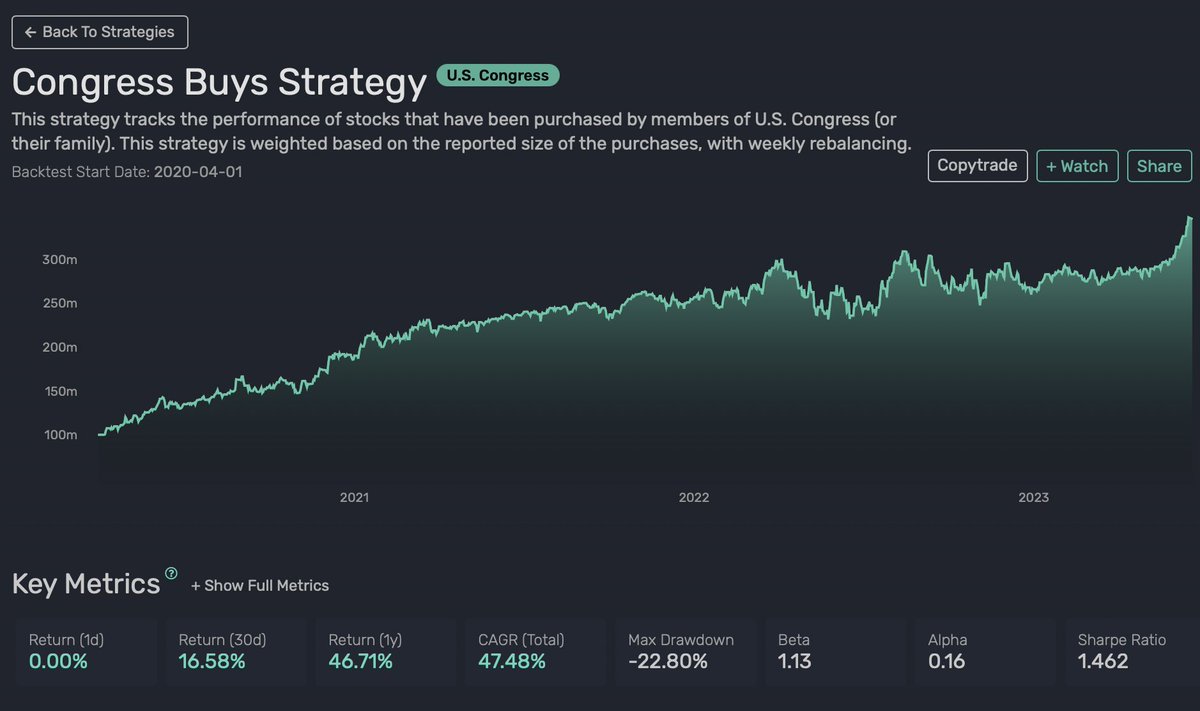

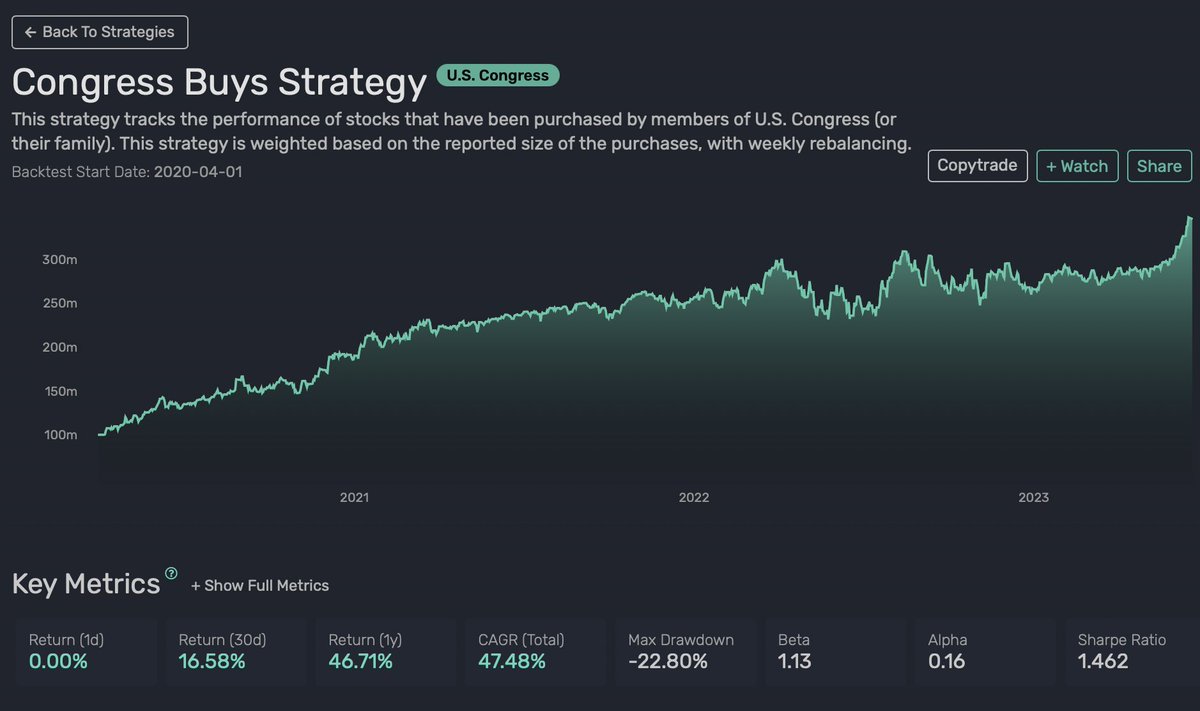

The way the strategy works is simple:

The way the strategy works is simple:

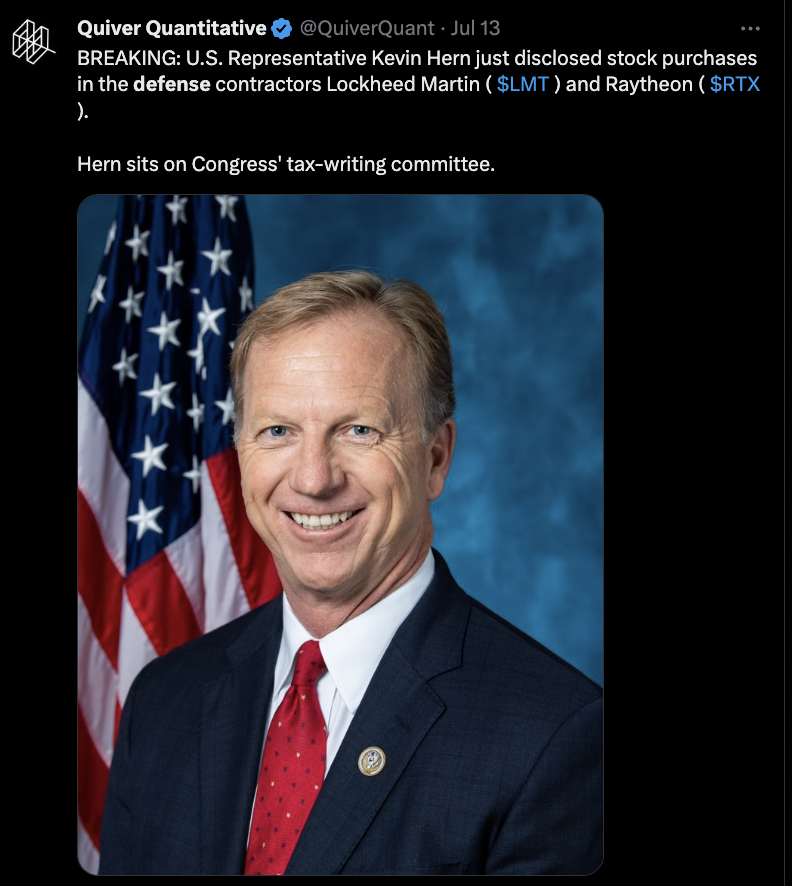

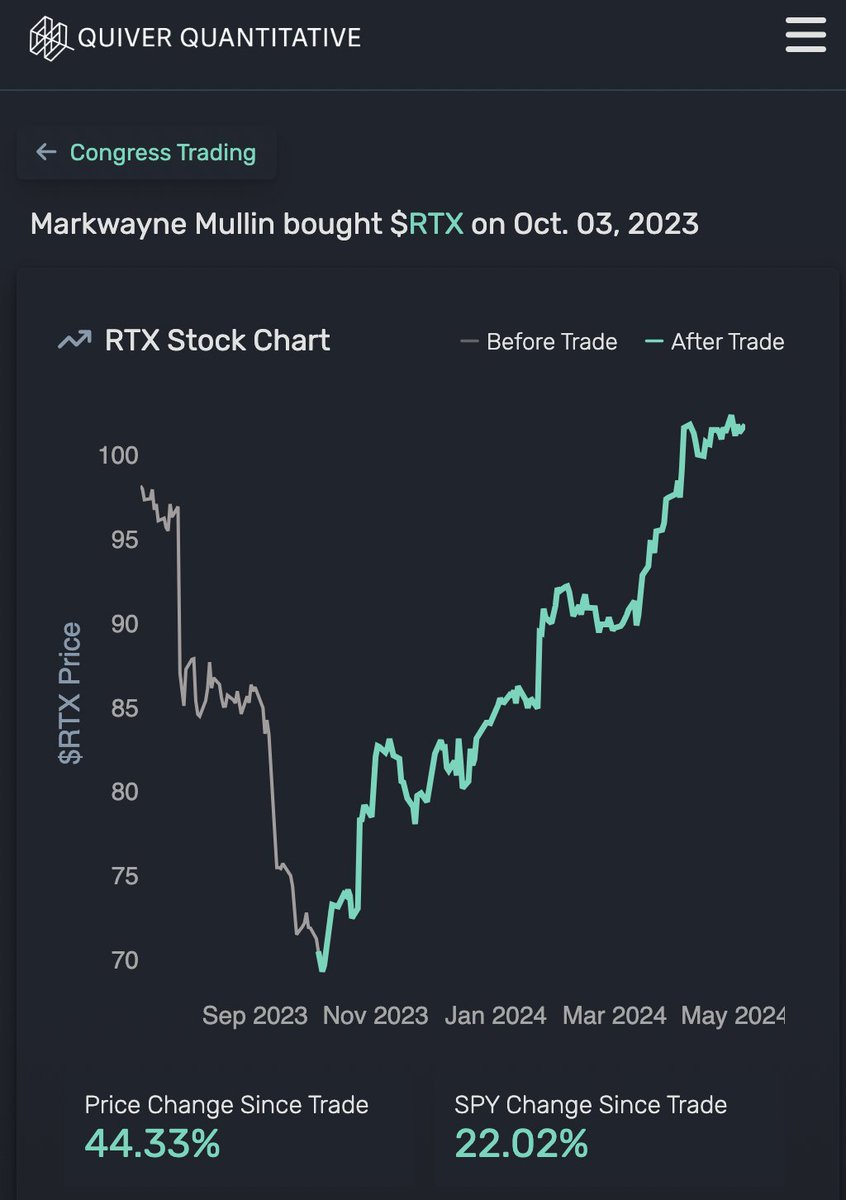

Representative Kevin Hern has been buying Lockheed Martin and Raytheon stock:

Representative Kevin Hern has been buying Lockheed Martin and Raytheon stock:

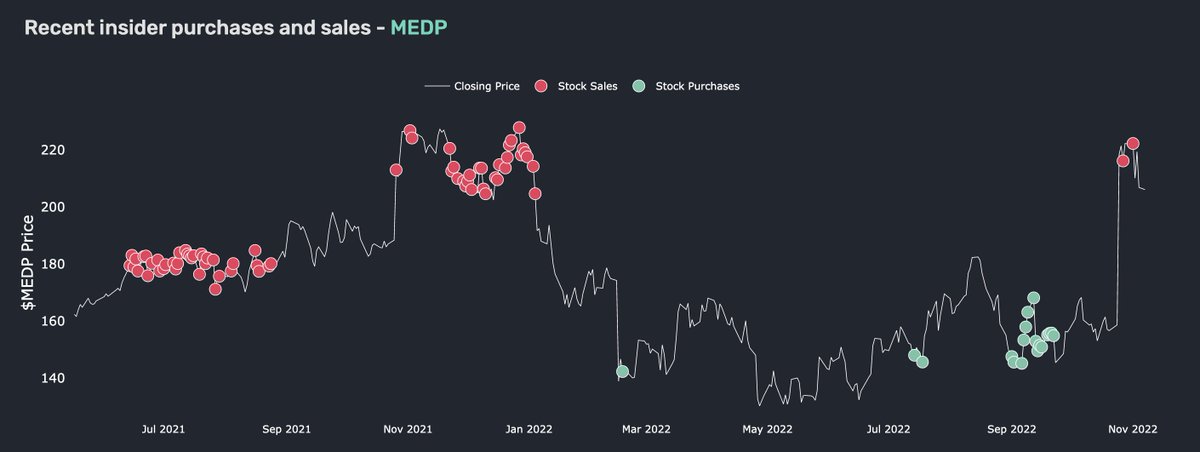

In November, I posted a report on a suspicious trade I noticed from Senator Tina Smith.

In November, I posted a report on a suspicious trade I noticed from Senator Tina Smith.

Crenshaw purchased the Direction Daily Financial Bull 3X Shares ETF, $FAS, at almost exactly the lowest point of the COVID market crash.

Crenshaw purchased the Direction Daily Financial Bull 3X Shares ETF, $FAS, at almost exactly the lowest point of the COVID market crash.

The Dan Meuser Strategy has been the top performer this year.

The Dan Meuser Strategy has been the top performer this year.

32% of the portfolio is in NGL Energy, $NGL.

32% of the portfolio is in NGL Energy, $NGL.

Crenshaw purchased the Direction Daily Financial Bull 3X Shares ETF, $FAS, at almost exactly the lowest point of the COVID market crash.

Crenshaw purchased the Direction Daily Financial Bull 3X Shares ETF, $FAS, at almost exactly the lowest point of the COVID market crash.

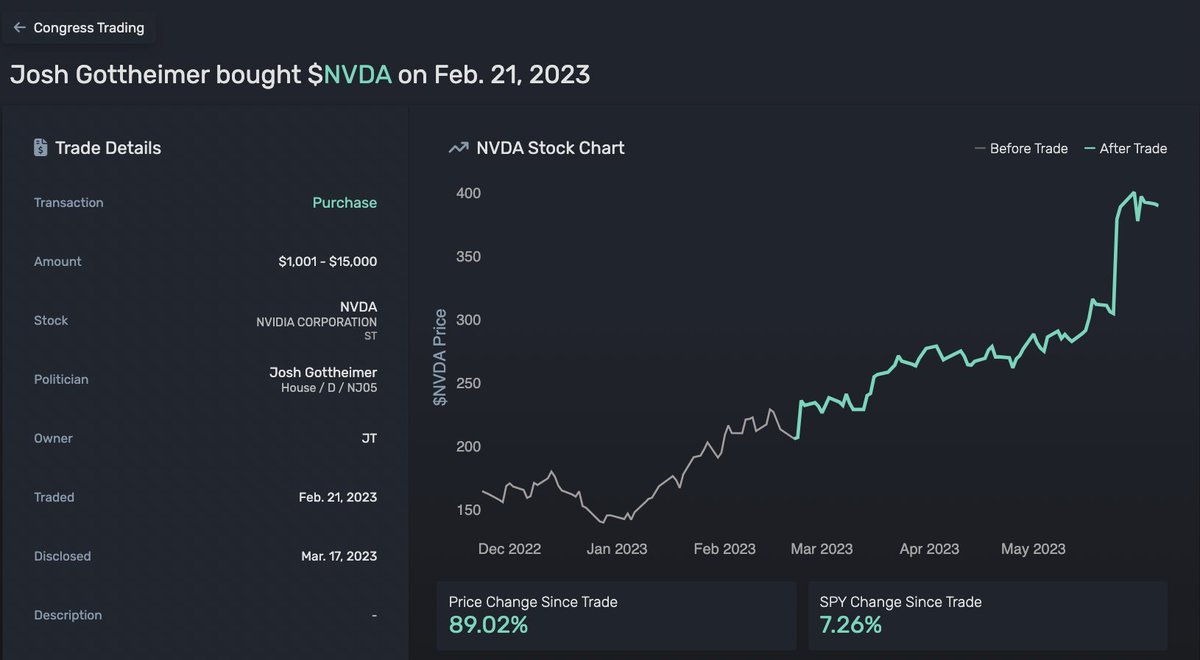

Gottheimer purchased Nvidia stock, $NVDA, on March 6th.

Gottheimer purchased Nvidia stock, $NVDA, on March 6th.