AW Phillips Professor of Economics @LSEecon. Colunista @expresso. Director @CFMUK

9 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/ojblanchard1/status/1692882786099605766Also like @ojblanchard1 I think nominal rigidities are fundamental. Especially because with limits to acquire, absorb, and process information, there is inevitable disagreement across economic agents that are making nominal choices in units of account.

https://twitter.com/ojblanchard1/status/1692882791539560783

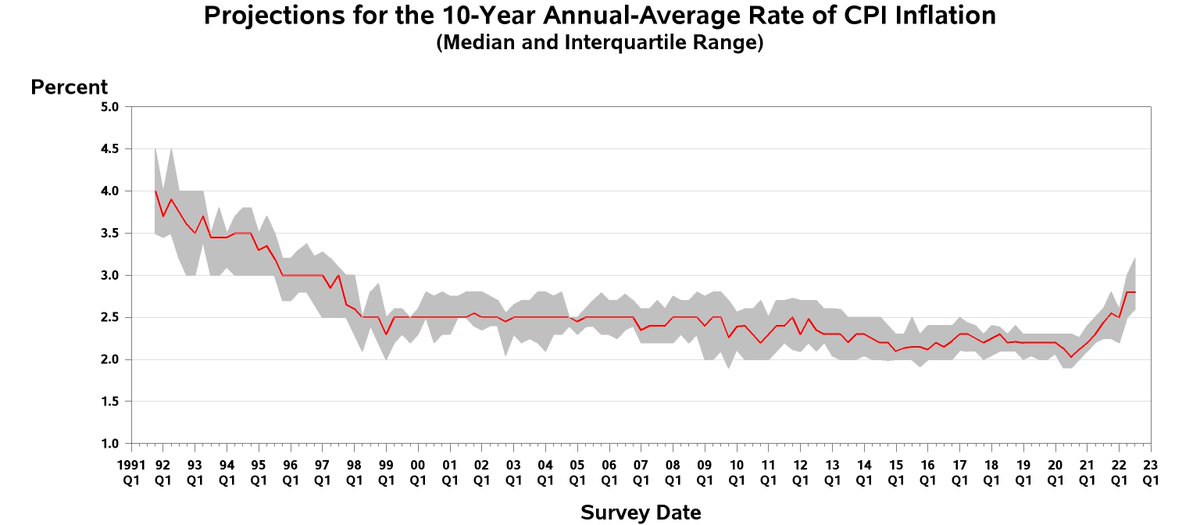

https://twitter.com/R2Rsquared/status/1553410950157459461The “ignore it” view is that inflation expectations do not matter and are useless to predict inflation. That view took a serious beating in 2021-22. Those who dismissed the expectations data badly missed the 2021-22 run-up in inflation.

https://twitter.com/R2Rsquared/status/1444696271835570181

https://twitter.com/R2Rsquared/status/1553410950157459461My 1⃣: having all supply shocks feed 100% to higher inflation and zero to output

https://twitter.com/R2Rsquared/status/1553410950157459461If it suddenly starts raining, and my head gets soaking wet, it was the rain that caused it. Not my fault?

The focus is on advanced economies and the examples come from the @federalreserve and the @ecb. I highlight 🔢 factors, which I think were central. They are not exclusive, and I hope are broad enough to include other views in the public debate, with different weights on each one

The focus is on advanced economies and the examples come from the @federalreserve and the @ecb. I highlight 🔢 factors, which I think were central. They are not exclusive, and I hope are broad enough to include other views in the public debate, with different weights on each one

https://twitter.com/michaelsderby/status/1484231673776644102"Imagine that inflation was running at 5% against our inflation objective of 2%. Is there a doubt that any central banker worth their salt would be reacting strongly to fight this high inflation rate? No, there isn’t any doubt. They would be acting as if their hair was on fire."

The 1st theory (Phillips, Keynesian) sees inflation as following from the closing of gaps in labor and product markets. Given how quickly the economy was rebounding already at the start of the year (and partly due to fiscal stimulus), inflation was expected to rise in 2021.

The 1st theory (Phillips, Keynesian) sees inflation as following from the closing of gaps in labor and product markets. Given how quickly the economy was rebounding already at the start of the year (and partly due to fiscal stimulus), inflation was expected to rise in 2021.