Trying to invest. Previously in institutional money mang @ $ DD billion AUM shop

How to get URL link on X (Twitter) App

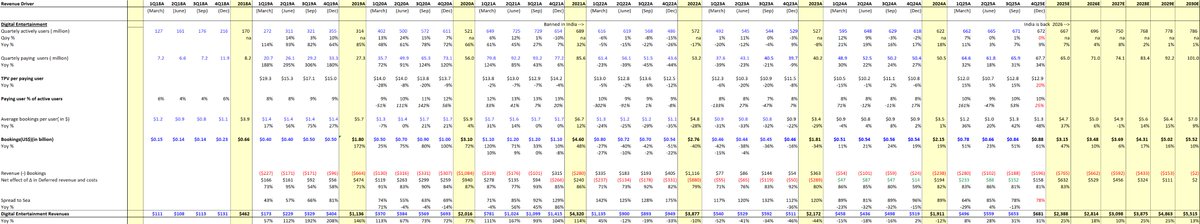

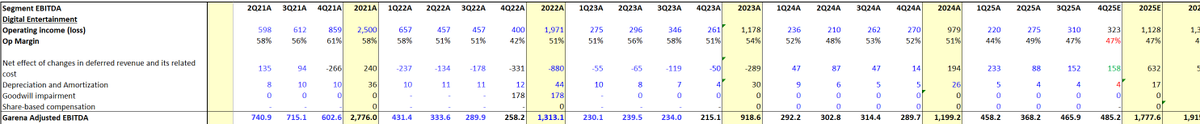

$SE has always historically funded the co with bookings cash coming from Garena. This is a business that we are most excited about near term with the upcoming growth in India, where they were banned/unbanned, etc. Please do your own DD and our forecasts are just for information purposes, not to be relied upon. But these numbers is how one should look at modeling - bookings which is the KEY for Garena. For clarity we have highlighted when India banned Free Fire and the game is expected to be back in 2026 in the country. Some bulls estimate QAUs to reach 1B users w/150M paying users. To provide context -> $SE had in a matter of short period gone from 127M to 730M QAUs w/paying users going from 7M to 93M paying users in 3Q21 (pre-ban)! We dont want to put the cart ahead of the horse but we are fairly confident our 100M paying users by 2030 could prove conservative if management really executes the India/ROW growth.

$SE has always historically funded the co with bookings cash coming from Garena. This is a business that we are most excited about near term with the upcoming growth in India, where they were banned/unbanned, etc. Please do your own DD and our forecasts are just for information purposes, not to be relied upon. But these numbers is how one should look at modeling - bookings which is the KEY for Garena. For clarity we have highlighted when India banned Free Fire and the game is expected to be back in 2026 in the country. Some bulls estimate QAUs to reach 1B users w/150M paying users. To provide context -> $SE had in a matter of short period gone from 127M to 730M QAUs w/paying users going from 7M to 93M paying users in 3Q21 (pre-ban)! We dont want to put the cart ahead of the horse but we are fairly confident our 100M paying users by 2030 could prove conservative if management really executes the India/ROW growth.

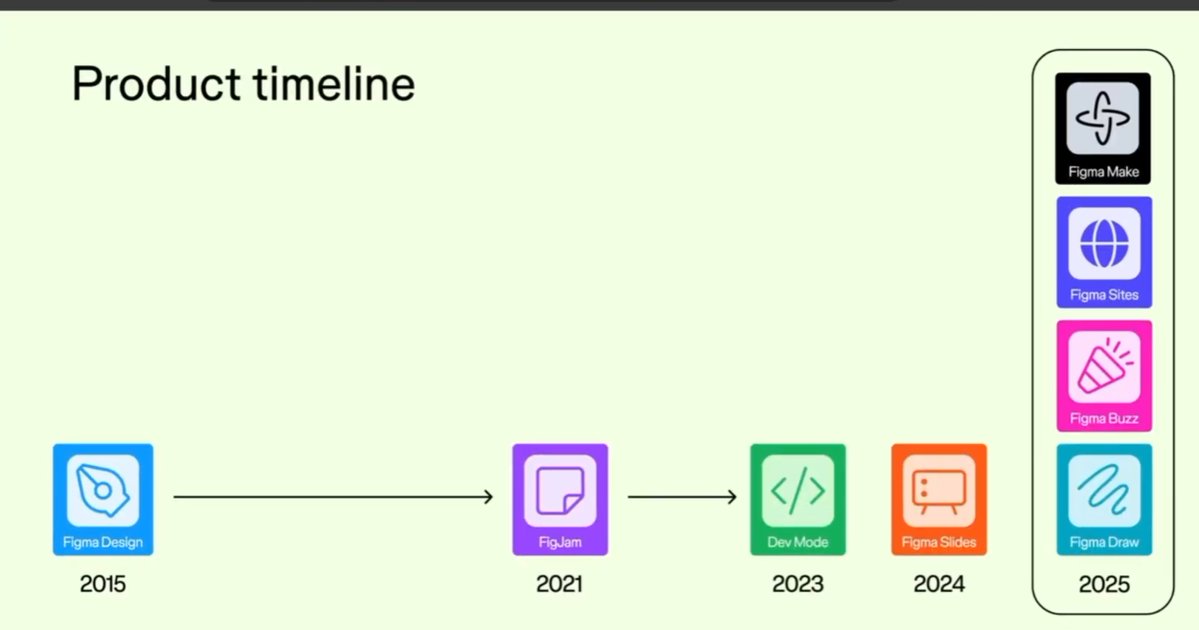

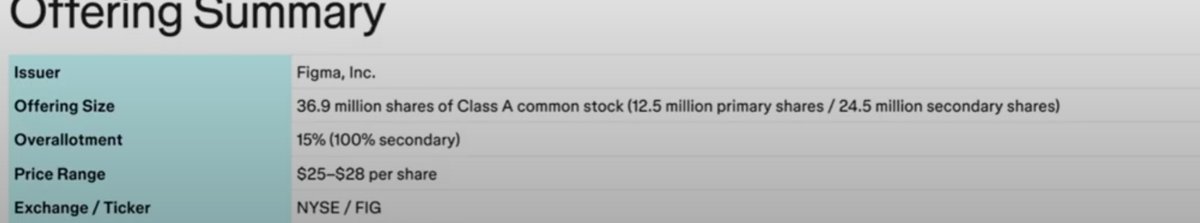

Figma's offerings have expanded from a single design tool to eight products in a few years, aiming to serve the entire product development process (so NO need for Asana, Monday, Jira/Team?/TWLO). This expansion is supported by platform, which ensures each new product is easier to incubate, test, and launch, and shares the same underlying DNA. This platform consists of five key ingredients:

Figma's offerings have expanded from a single design tool to eight products in a few years, aiming to serve the entire product development process (so NO need for Asana, Monday, Jira/Team?/TWLO). This expansion is supported by platform, which ensures each new product is easier to incubate, test, and launch, and shares the same underlying DNA. This platform consists of five key ingredients: