Formerly many things. 1st to rhyme Duce & Juche; describe US as Transfer Union. Says Poujadist often. Aging Macro Expat. Equal parts phlegm, spleen, dad humor.

How to get URL link on X (Twitter) App

It’s remarkable how many American progressives have embraced 3 deeply reactionary ideas re:CN —that poor people deserve crap capital stock; that increasing it cannot reduce poverty; and that something called “social capital” is an immutable constraint on its productive use.

It’s remarkable how many American progressives have embraced 3 deeply reactionary ideas re:CN —that poor people deserve crap capital stock; that increasing it cannot reduce poverty; and that something called “social capital” is an immutable constraint on its productive use.

https://twitter.com/deitaone/status/1663944885819277318There’s more here, but if nothing else, look at the graph that shows up on the link. karthiksankaran.medium.com/the-burden-of-…

https://twitter.com/middleeast/status/1660995701856165888But this raises a stylized (albeit ad absurdum) question. Is it better for world for KSA to blow 400 mio $ annually to lease Messi, an imported intermediate good who helps boost domestic services consumption, or to acquire an equity interest in a plant making windmills somewhere?

This tweet, and the numbers therein, should be considered not only an indication of what chafes, but also an indication of why it is extremely premature to conclude that those chafing are anywhere close to the Tinactin.

This tweet, and the numbers therein, should be considered not only an indication of what chafes, but also an indication of why it is extremely premature to conclude that those chafing are anywhere close to the Tinactin.

Just some interesting pointers here--1. EUR is clearly the only other currency that comes close but is still behind USD (I also suspect that a big chunk of cross-border claims in EUR are intra EU or intra EZ). 2. The US banking system is not as large a global USD intermediary

Just some interesting pointers here--1. EUR is clearly the only other currency that comes close but is still behind USD (I also suspect that a big chunk of cross-border claims in EUR are intra EU or intra EZ). 2. The US banking system is not as large a global USD intermediary

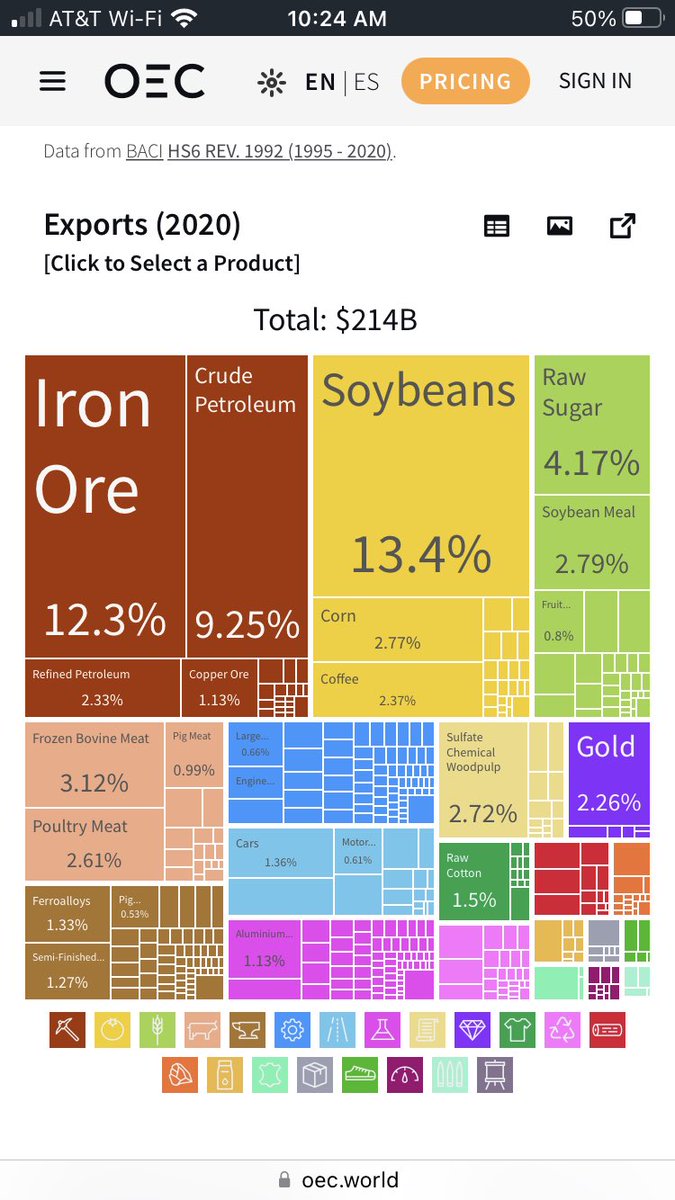

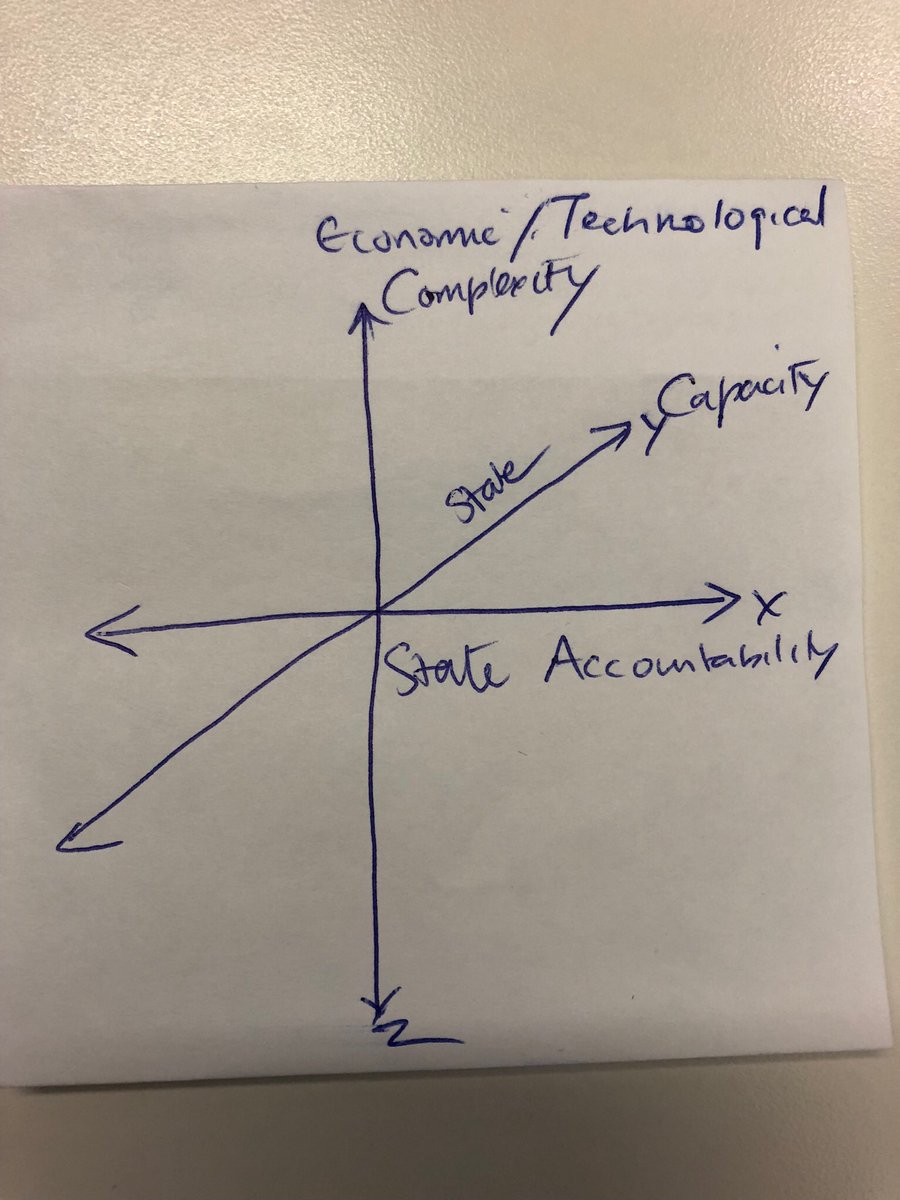

https://twitter.com/rajakorman/status/1071841108445999104@70sBachchan @zeithistoriker @BrankoMilan When I ask friends on the left how they plan to replicate the income -and complexity-converging effects of technological and managerial diffusion and market access that helped at least huge chunks of Asia after 1990, I get a lame-ass “swap lines + expert aid” answer.

More pungently.

More pungently. https://twitter.com/RajaKorman/status/1394751933672394754

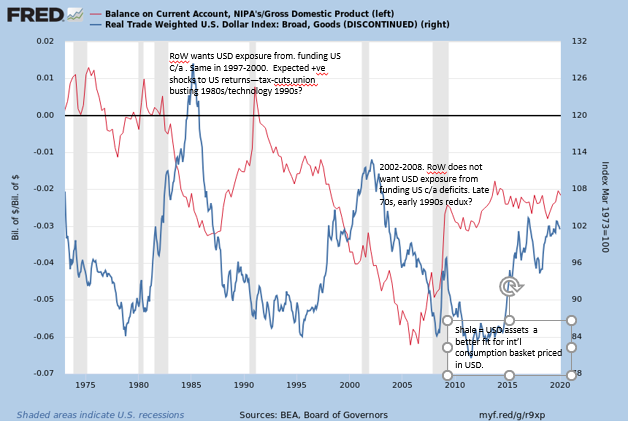

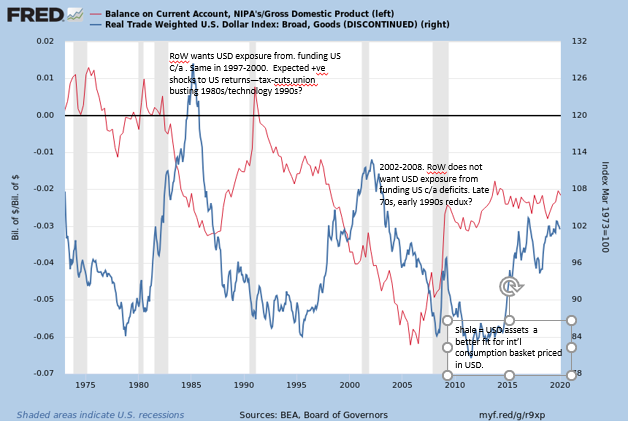

Couple of other thoughts. At times large scale reserve accumulation occurs precisely because the global private sector does not want to accumulate assets or is shedding net assets in a currency. Think of BoJ purchases of USDJPY in the early 2000 or SNB activity in €.

Couple of other thoughts. At times large scale reserve accumulation occurs precisely because the global private sector does not want to accumulate assets or is shedding net assets in a currency. Think of BoJ purchases of USDJPY in the early 2000 or SNB activity in €.

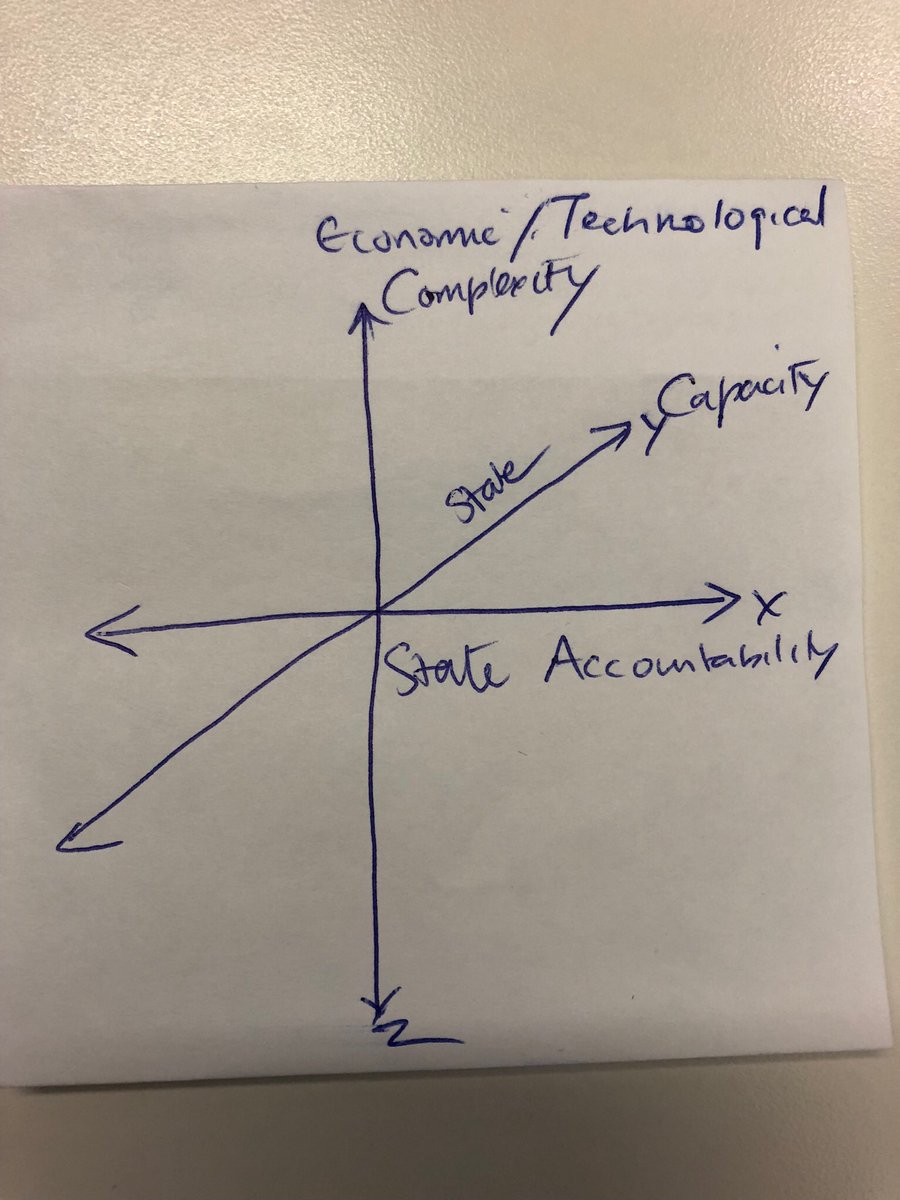

Cc:@DanielaGabor the diagram is up.

Cc:@DanielaGabor the diagram is up.

External Tweet loading...

If nothing shows, it may have been deleted

by @RajaKorman view original on Twitter