Director @BCG Centre for Growth. Former: Special Adviser to the PM on Europe & @DExEUgov 2016-19. Also previously @DeloitteUK & @openeurope. Views my own.

5 subscribers

How to get URL link on X (Twitter) App

At this level we could start to see 60%+ of businesses have their debt interest payments reach 40%+ of their income - suggesting many may struggle to make repayments. It differs across sectors, but real estate in particular exposed (2/4) bankofengland.co.uk/bank-overgroun…

At this level we could start to see 60%+ of businesses have their debt interest payments reach 40%+ of their income - suggesting many may struggle to make repayments. It differs across sectors, but real estate in particular exposed (2/4) bankofengland.co.uk/bank-overgroun…

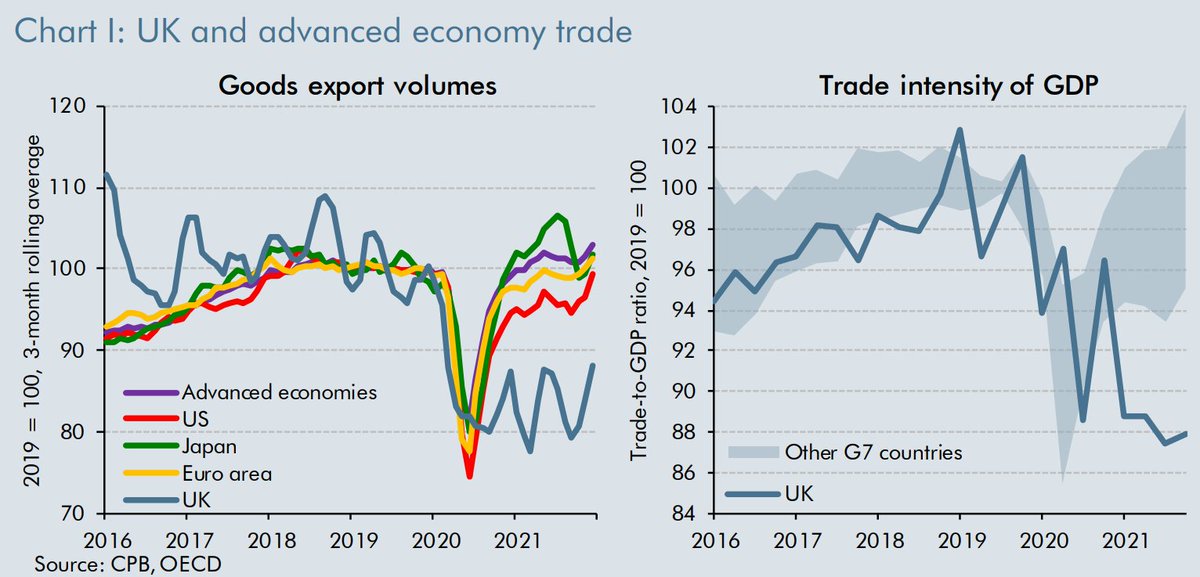

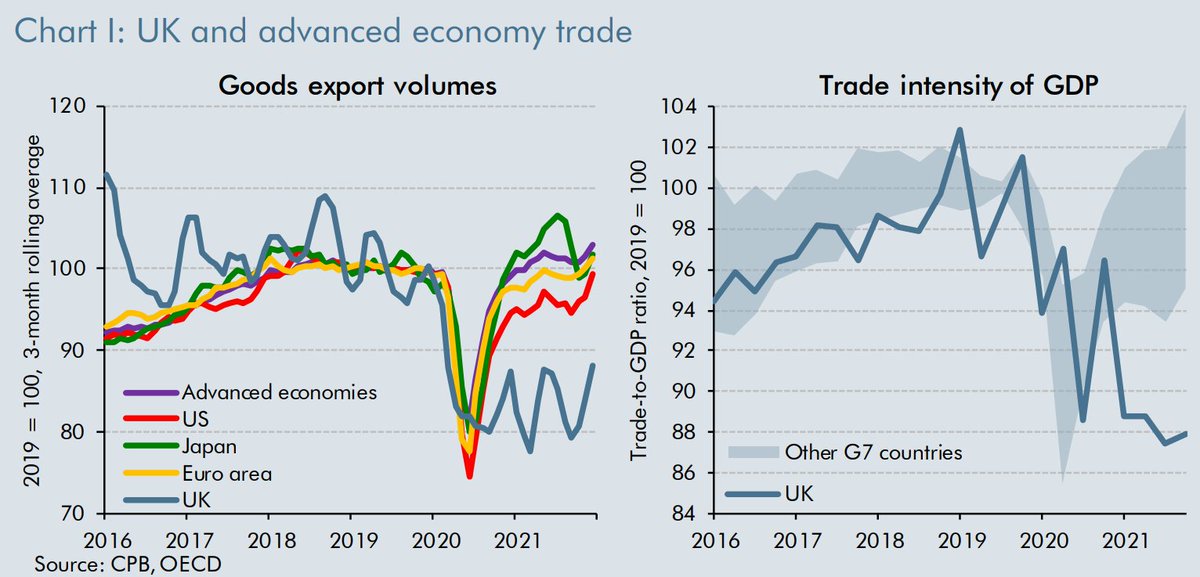

https://twitter.com/RaoulRuparel/status/1523587218656301056Capacity issues, labour constraints & reduced access to EU supply chains could all impact UK global competitiveness. That said, if the impact was so large, you’d expect it to show up as much directly (EU exports) as indirectly (non-EU exports). Which it doesn’t. 2/

https://twitter.com/MarkerJParker/status/1485554365540843522In terms of the negotiations, yes the atmosphere & tone has improved but the substance remains the same & the gaps are very large. UK approach remains as set in Command Paper last summer, very far from EU proposals in Autumn last year. 2/

https://twitter.com/Mij_Europe/status/1456520115814535186If EU were to retaliate by terminating TCA it is logically & legally neater in many ways. EU always said TCA is predicated on WA & Protocol so if the latter falls away so does the former. It also uses a clause in TCA rather than arguing over what is doable under A16 itself 2/

https://twitter.com/pmdfoster/status/1417466220421517312The approach sets out mutual enforcement of each others rules for things being sold into the other party. But what counts as an export? Is it goods moving from GB to NI or from NI to RoI? If the latter then this amounts to a big shift back to potentially having a land border 2/

https://twitter.com/tconnellyRTE/status/1390595036849614851

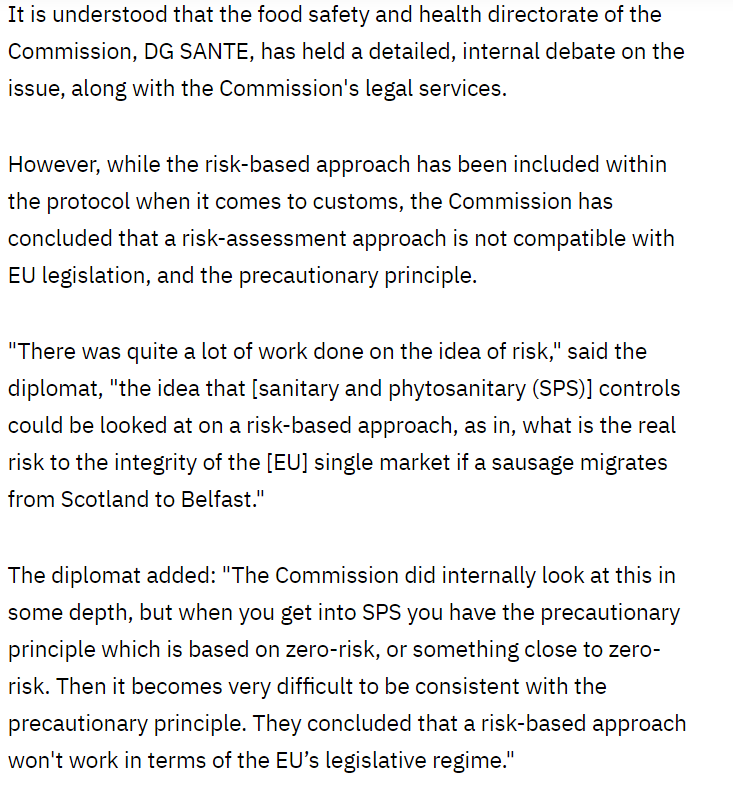

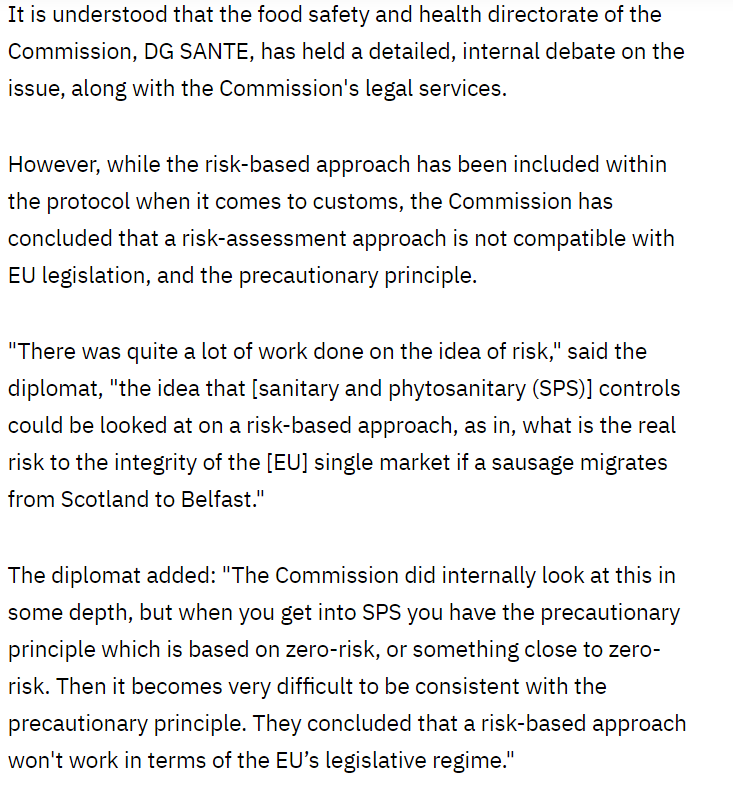

1st of course it isn't compatible with EU legislation as it stands, that's the point. If the metric to judge is, does it work within EU law then the Protocol itself would never have been agreed. Why use that metric now but not before? Who decided where the line is? 2/

1st of course it isn't compatible with EU legislation as it stands, that's the point. If the metric to judge is, does it work within EU law then the Protocol itself would never have been agreed. Why use that metric now but not before? Who decided where the line is? 2/

https://twitter.com/jlpobrien/status/1362159860691972096The chart highlights that the reduction in trade share with the UK didn't come from switching trade away from UK but from taking advantage of opportunities elsewhere & increasing trade overall as share of GNP. 2/

https://twitter.com/duponline/status/1344249360197029888As a reminder they had the offer under the previous govt at 3rd meaningful vote of entire UK in a customs union, with alignment on other areas & Stormont lock on new laws. As well as a wider econ package. They voted against it & were main reason it failed 2/

https://twitter.com/RaoulRuparel/status/1343245806716014593First, we shouldn't look at this through the lens of UK having trade deficit with EU in goods & surplus in services. That is too simplistic. EU accounts for a large proportion of UK's goods trade so zero tariff zero quota is beneficial for UK as well for the EU. 2/