East Coast Capital Management (ECCM)

https://t.co/ZnWl84jasv

2 subscribers

How to get URL link on X (Twitter) App

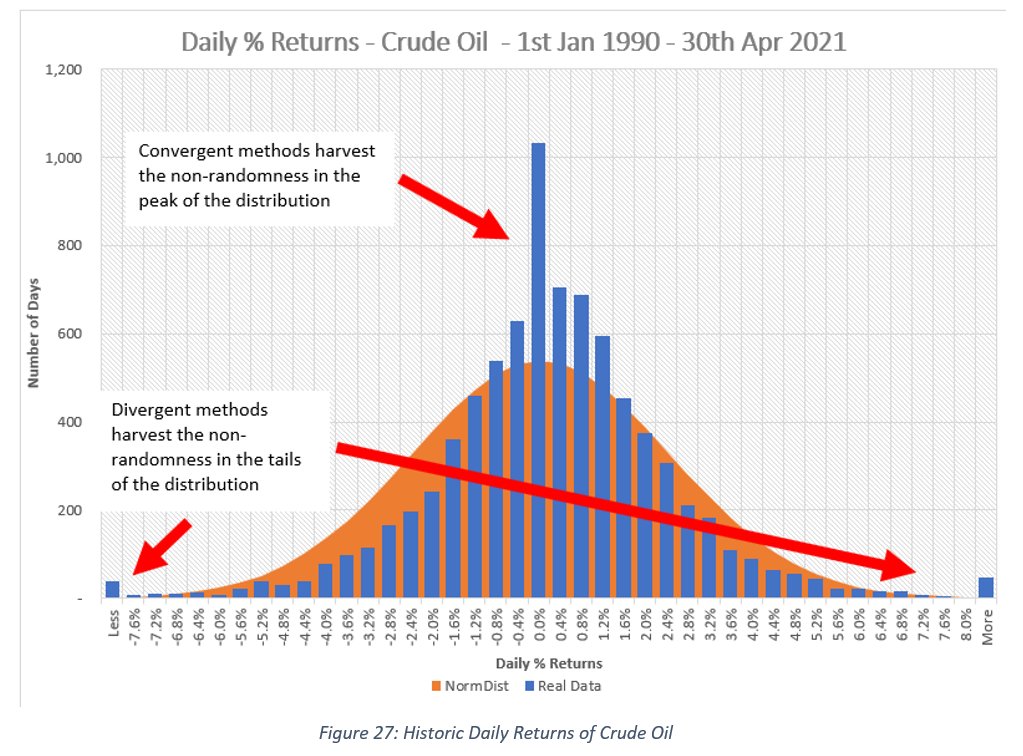

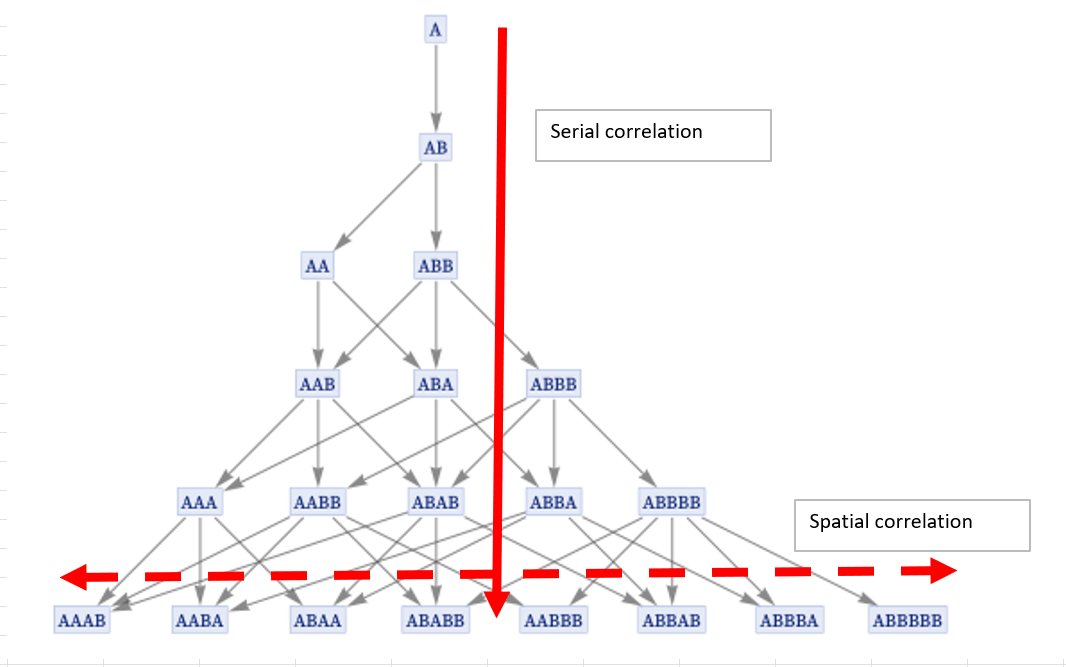

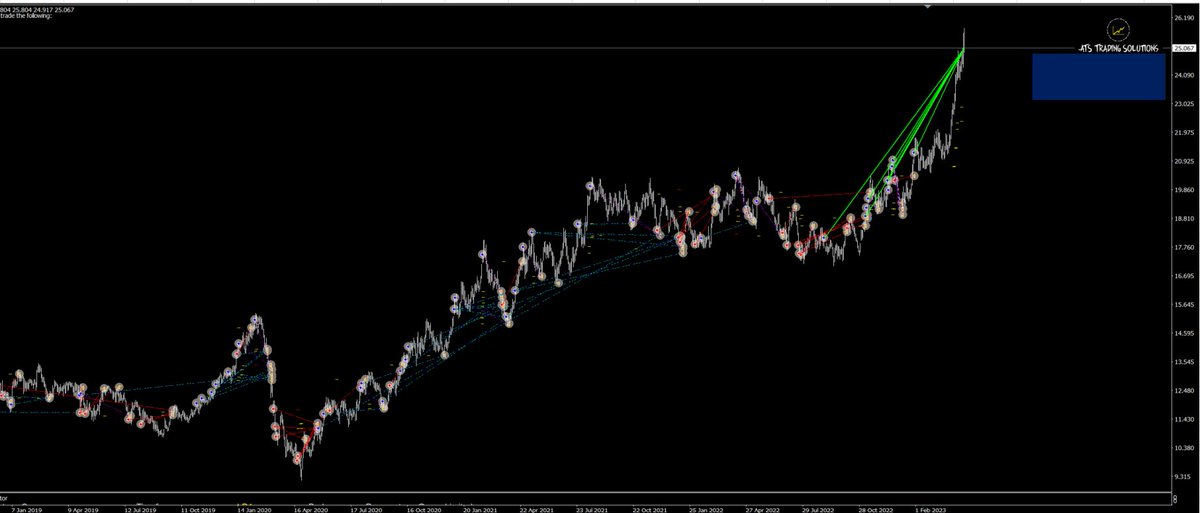

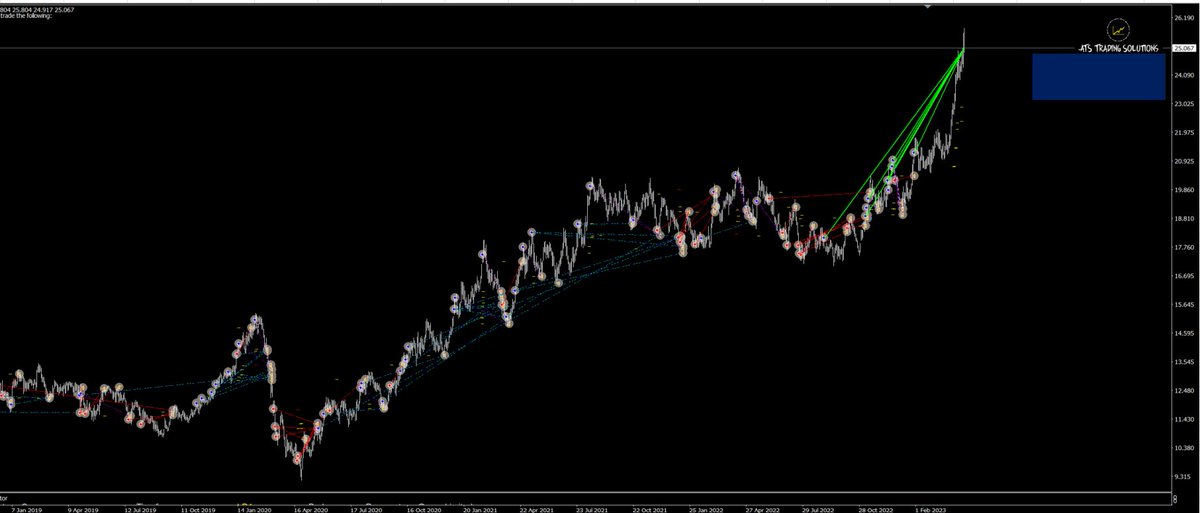

2/ Unlike many other forms of momentum seeker, to capture these directional trends, we need loose pants to allow for the many other forms of trend that interfere with the trend we are seeking.....the Outlier.

2/ Unlike many other forms of momentum seeker, to capture these directional trends, we need loose pants to allow for the many other forms of trend that interfere with the trend we are seeking.....the Outlier.

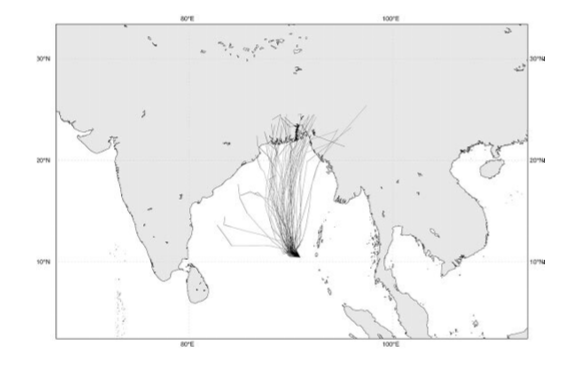

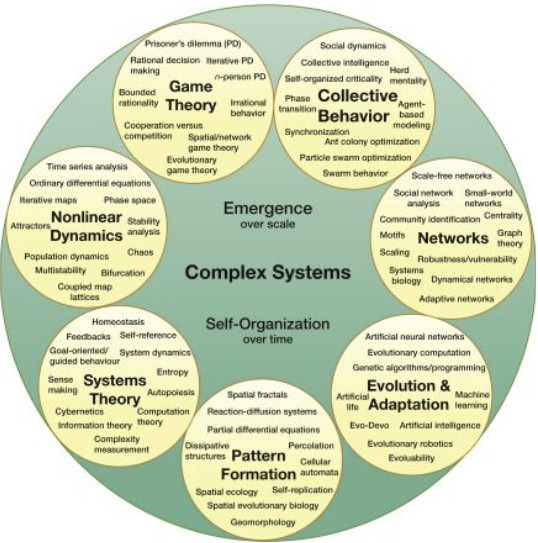

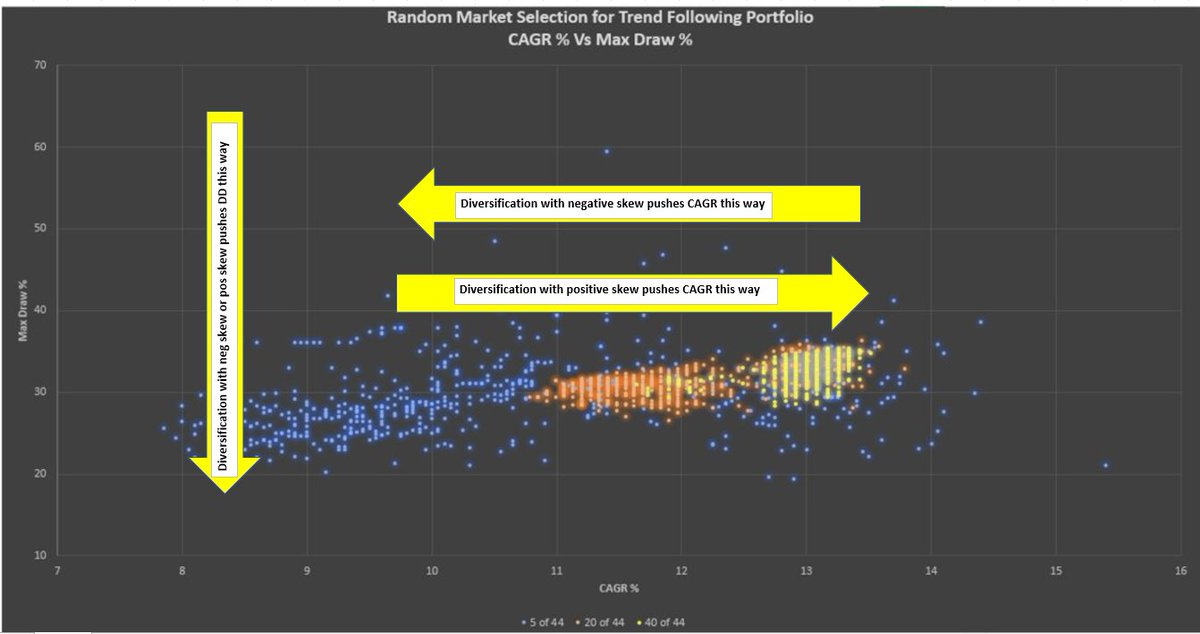

2/ But let's see what happens with a real example of a TF portfolio that diversifies extensively across more markets.

2/ But let's see what happens with a real example of a TF portfolio that diversifies extensively across more markets.

2/ Now notice where the Index plots in the CAFR/Max Draw% Distribution Plot. A CAGR of 8.77 and a Max Draw % of 18.04%.

2/ Now notice where the Index plots in the CAFR/Max Draw% Distribution Plot. A CAGR of 8.77 and a Max Draw % of 18.04%.

Multiple systems squeeze the juice out of the many different possible forms of Outlier.

Multiple systems squeeze the juice out of the many different possible forms of Outlier.

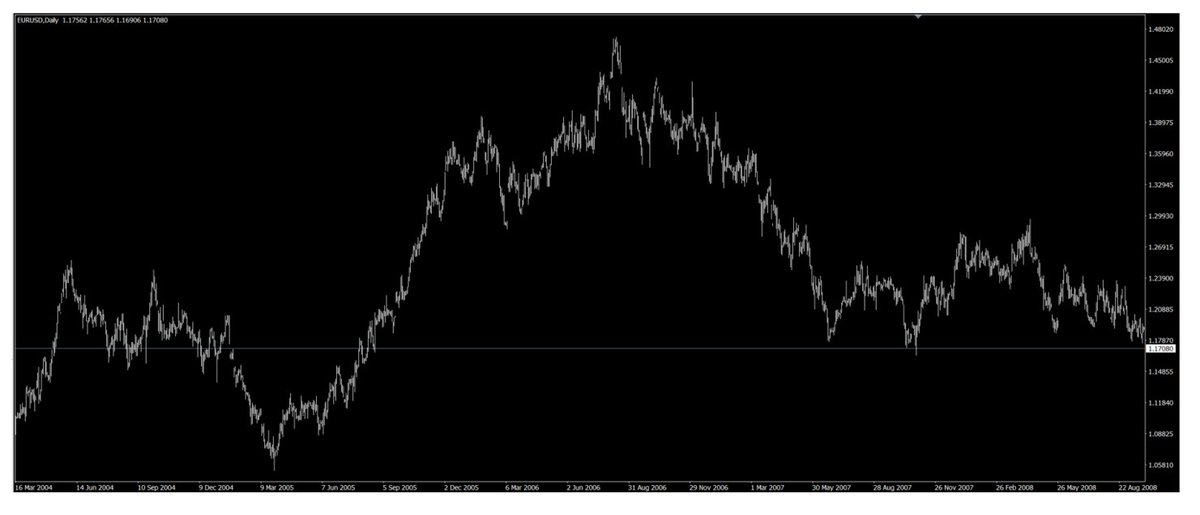

2/ Type A Trend – A Random Trend

2/ Type A Trend – A Random Trend