I cover U.S. tax policy for the @WSJ. There is ALWAYS a tax angle. Retweets are not endorsements or tax advice.

How to get URL link on X (Twitter) App

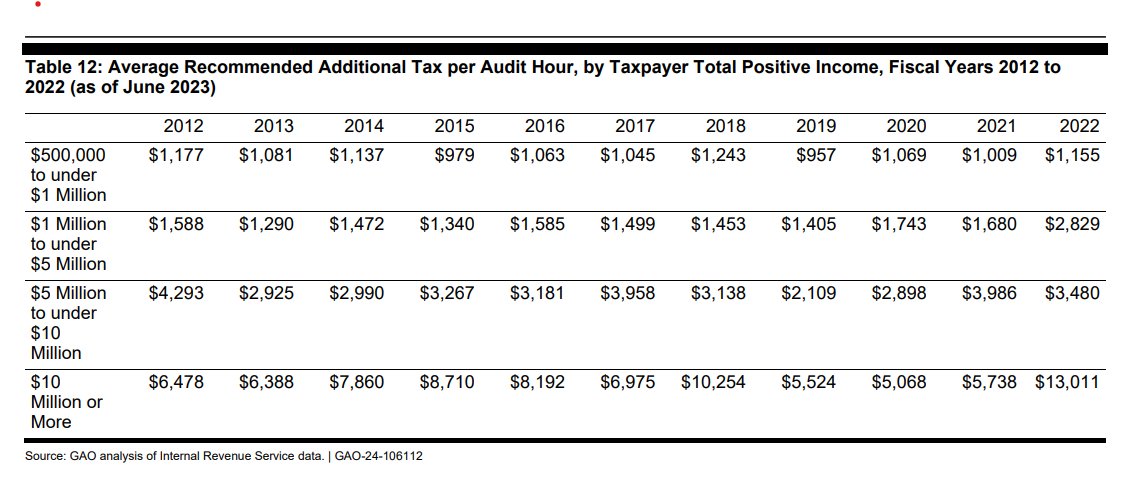

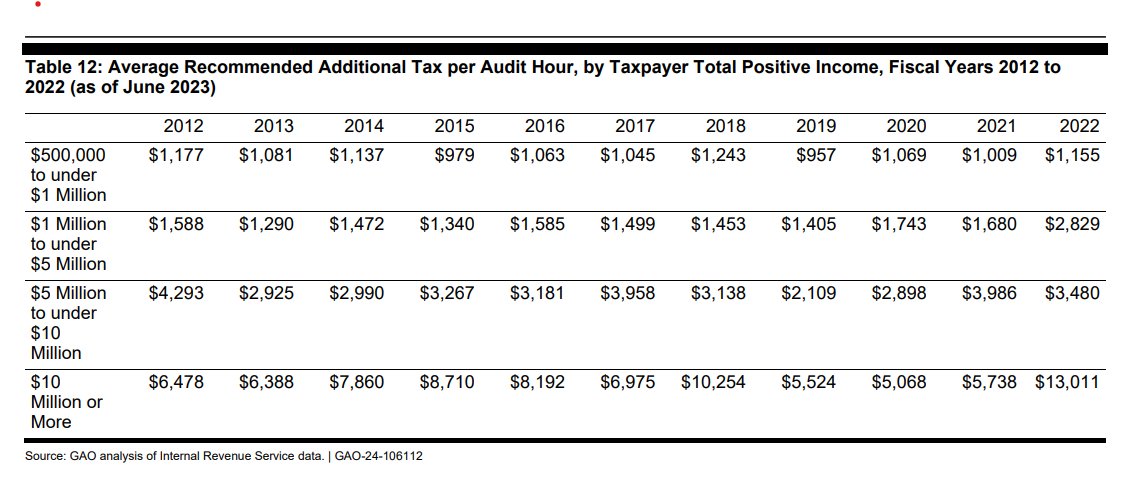

A second useful chart on high-income audits. No-change means IRS did an audit and identified no additional tax or refund -- this is inevitable at some level because case selection is imperfect, but it's also not a great use of government or taxpayer time.

A second useful chart on high-income audits. No-change means IRS did an audit and identified no additional tax or refund -- this is inevitable at some level because case selection is imperfect, but it's also not a great use of government or taxpayer time.

https://twitter.com/danieldbunn/status/1398336234200748036The score does reflect taxpayer behavioral changes to avoid SHIELD.