@BlackRock CIO of Global Fixed Income | Emory and Wharton Alum | Go Orioles!

Lead PM for BINC, BSIIX, MALOX, MAWIX

Content intended for a U.S. audience

10 subscribers

How to get URL link on X (Twitter) App

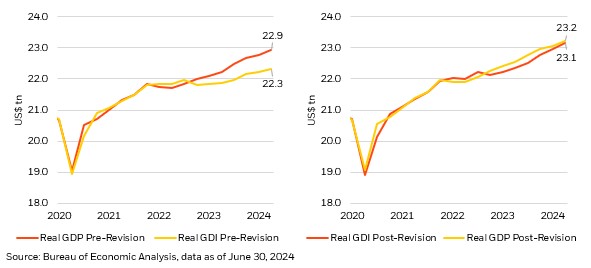

Almost more impressively, GDI, a measure often cited as the better representation of growth through the tracking of income rather than expenditures, had previously been running over $500bn below GDP! This growing discrepancy blurred the picture of the state of the economy and called into question the relative strength of households as they seemed to be spending more via GDP, but not making more via GDI. However, in last week’s revisions, GDI was revised up to match GDP!

Almost more impressively, GDI, a measure often cited as the better representation of growth through the tracking of income rather than expenditures, had previously been running over $500bn below GDP! This growing discrepancy blurred the picture of the state of the economy and called into question the relative strength of households as they seemed to be spending more via GDP, but not making more via GDI. However, in last week’s revisions, GDI was revised up to match GDP!

While the recent labor market data is clearly softer, it is very far from a disastrous indicator of recession, hard-landing, or some pernicious foreshadowing of future consumer weakness. Rather, we continue to believe the job market is moderating from robust post-COVID demand. In fact, almost none of the recent increase in unemployment has been permanent job losers; rather, it was driven by temporary (weather-related) layoffs in August, which reversed this month, and a steady stream of new entrants.

While the recent labor market data is clearly softer, it is very far from a disastrous indicator of recession, hard-landing, or some pernicious foreshadowing of future consumer weakness. Rather, we continue to believe the job market is moderating from robust post-COVID demand. In fact, almost none of the recent increase in unemployment has been permanent job losers; rather, it was driven by temporary (weather-related) layoffs in August, which reversed this month, and a steady stream of new entrants.

Shortly thereafter, the US Tech sector, which had risen to >20% above its 200d moving average, reversed dramatically on the largest ever 1-week small cap > tech outperformance!

Shortly thereafter, the US Tech sector, which had risen to >20% above its 200d moving average, reversed dramatically on the largest ever 1-week small cap > tech outperformance!

Earlier this week @federalreserve Chair Powell delivered testimony before Congress that underscored the progress that’s been made in both bringing labor markets into better balance after the severe pandemic-era disruptions, and improvements achieved in taming the high inflation rates of that period as well- a narrative which today’s data continues to support. 2/

Earlier this week @federalreserve Chair Powell delivered testimony before Congress that underscored the progress that’s been made in both bringing labor markets into better balance after the severe pandemic-era disruptions, and improvements achieved in taming the high inflation rates of that period as well- a narrative which today’s data continues to support. 2/

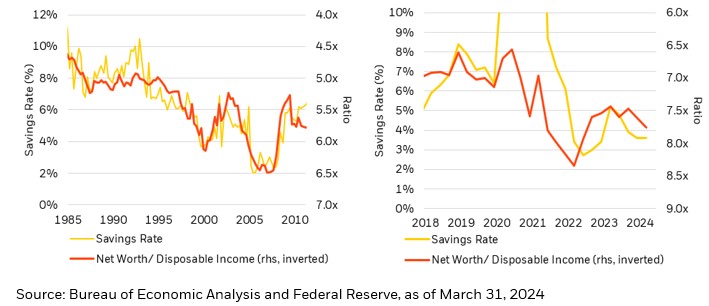

How could it be that Excess Savings have not been depleted at all? While many things can influence the Savings Rate (especially anything that affects consumer psychology in a big way), the primary driver in the U.S. over the past 40 years has been wealth (as measured by Net Worth/Disposable Income). It is intuitive that as households experience higher wealth, they feel less need to save. This relationship was crystal clear from 1985 – 2010. The post-GFC period saw a psychological shift towards higher savings, but the relationship returned once the economy finally recovered in 2018. For anyone wondering why the savings rate is so low today, look no further than the new highs in Net Worth/Disposable Income.

How could it be that Excess Savings have not been depleted at all? While many things can influence the Savings Rate (especially anything that affects consumer psychology in a big way), the primary driver in the U.S. over the past 40 years has been wealth (as measured by Net Worth/Disposable Income). It is intuitive that as households experience higher wealth, they feel less need to save. This relationship was crystal clear from 1985 – 2010. The post-GFC period saw a psychological shift towards higher savings, but the relationship returned once the economy finally recovered in 2018. For anyone wondering why the savings rate is so low today, look no further than the new highs in Net Worth/Disposable Income.

The @sffed visualized this very well in a recent analysis… the components of inflation that are “most responsive” to rates have completely normalized! It is the “least responsive” components that are responsible for the sticky inflation we are experiencing today... there is not much Fed policy rates can do about that.

The @sffed visualized this very well in a recent analysis… the components of inflation that are “most responsive” to rates have completely normalized! It is the “least responsive” components that are responsible for the sticky inflation we are experiencing today... there is not much Fed policy rates can do about that.