How to get URL link on X (Twitter) App

https://twitter.com/masonnystrom/status/1493615756910727173Here is the jupyter notebook with the code to re-create the heatmap

https://twitter.com/RobertoTalamas/status/1465838010583470088?s=20DAO landscape growth over the 3 months

https://twitter.com/RobertoTalamas/status/1465882794878550019

DAO membership increased a staggering 133% since August

DAO membership increased a staggering 133% since August

Although the growth of the L1 and L2 sectors could potentially benefit Ethereum, its dominance in the space is beginning to dwindle.

Although the growth of the L1 and L2 sectors could potentially benefit Ethereum, its dominance in the space is beginning to dwindle.

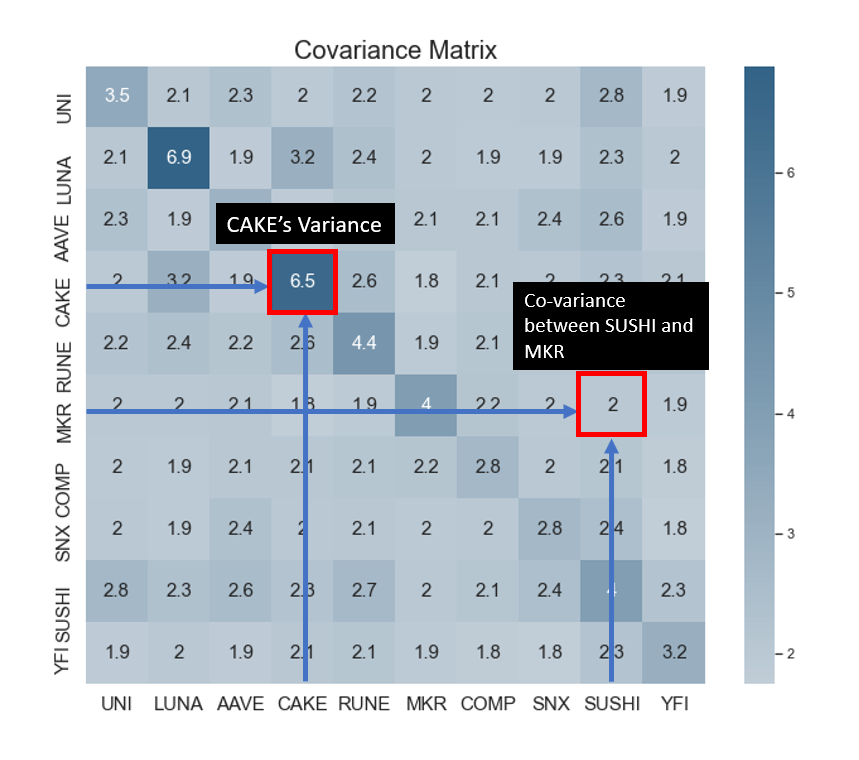

https://twitter.com/MonetSupply/status/1400883373279645697Mean-Variance Optimization (MVO) is a framework to construct asset allocations that maximize return for a given level of risk.

In this enterprise piece @masonnystrom and I explore the DAO treasury landscape from a portfolio management perspective and provide solutions to address the vulnerabilities of current treasury allocations.

In this enterprise piece @masonnystrom and I explore the DAO treasury landscape from a portfolio management perspective and provide solutions to address the vulnerabilities of current treasury allocations.

messari.io/article/weekly…

messari.io/article/weekly…

messari.io/article/weekly…

messari.io/article/weekly…

Ethereum

Ethereum

The derivatives section of our piece investigates the rise of decentralized perpetual and synthetic protocols during Q1 2021.

The derivatives section of our piece investigates the rise of decentralized perpetual and synthetic protocols during Q1 2021.

Q1 DeFi Review: Lending, Derivatives, Insurance, and more.

Q1 DeFi Review: Lending, Derivatives, Insurance, and more.

Top Assets by Market Capitalization

Top Assets by Market Capitalization

In this piece, the @MessariCrypto research team and I dive into the performance of the overall market and drill down on some of the top-performing assets in each sector according to our taxonomy.

In this piece, the @MessariCrypto research team and I dive into the performance of the overall market and drill down on some of the top-performing assets in each sector according to our taxonomy.