▫️Book Author▫️Advanced Options Seller ▫️Long Term Investor▫️Passionate Educator ▫️Cash Secured Puts ▫️Covered Calls ▫️LEAPS ▫️Credit Spreads▫️

How to get URL link on X (Twitter) App

If you wanted to sell 16DTE Cash Secure Puts today on $SMH your average premiums ~$2.04 per contract

If you wanted to sell 16DTE Cash Secure Puts today on $SMH your average premiums ~$2.04 per contract

References to Selling Put Options

References to Selling Put Options

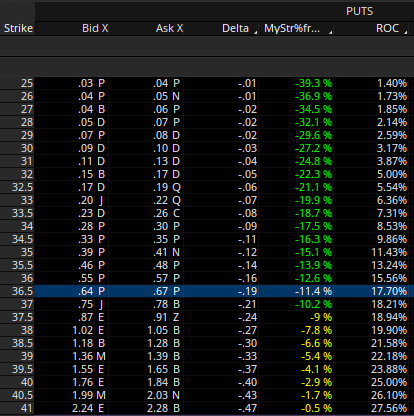

If you were selling Cash Secured Put of $SOXL at ~20 delta and 11 DTE you would have received 64$ in premium and that would have impacted your buying power by ~3,500$

If you were selling Cash Secured Put of $SOXL at ~20 delta and 11 DTE you would have received 64$ in premium and that would have impacted your buying power by ~3,500$

Q

Q

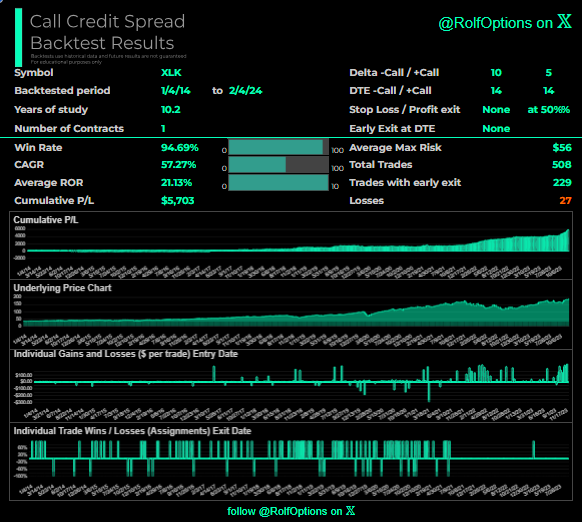

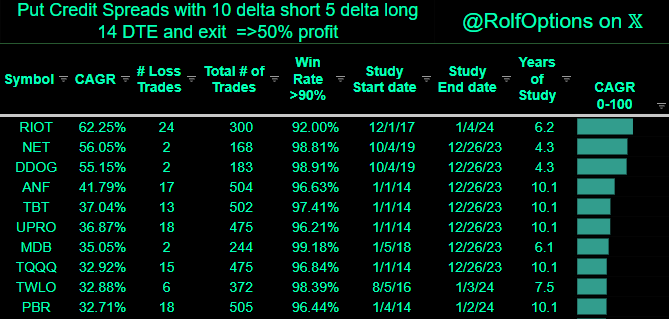

Credit put spread example:

Credit put spread example: