oil market researcher | founder of https://t.co/8wKzFUwRqf | former bank economist | markets, code, barbecue | subscribe to my research:

3 subscribers

How to get URL link on X (Twitter) App

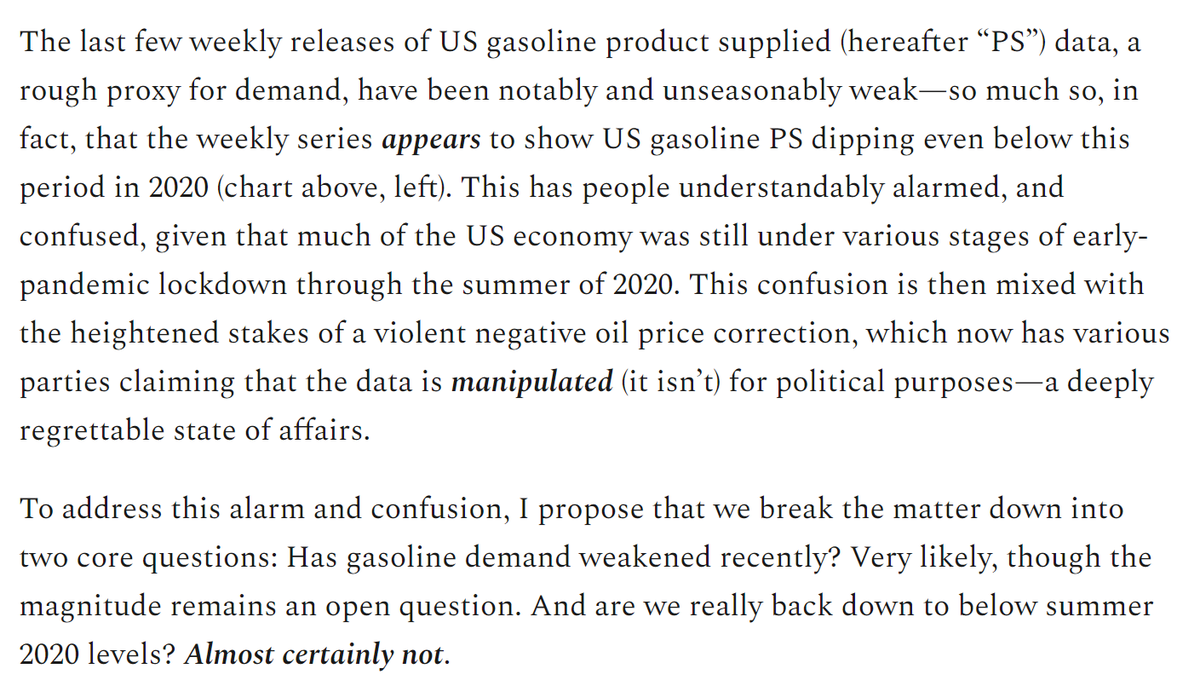

2/ First, is this entirely BS?

2/ First, is this entirely BS?https://x.com/Rory_Johnston/status/1839288430586364244

Unfortunately we still don't have the more granular refined product output data yet so can't land on a final apparent demand number, but this'll obviously help!

Unfortunately we still don't have the more granular refined product output data yet so can't land on a final apparent demand number, but this'll obviously help!

2/ Refinery maintenance:

2/ Refinery maintenance:

Admittedly this series only goes back to 2018 but I used to infer a similar series for the "quality-proxy" component of the WCS differential from Mexican Maya crude and I don't recall it ever getting this bad.

Admittedly this series only goes back to 2018 but I used to infer a similar series for the "quality-proxy" component of the WCS differential from Mexican Maya crude and I don't recall it ever getting this bad.

The 12-month signal had some false alarms (summer 2012, Christmas 2018), so it's not perfect and why I didn't say it *caused* the routs.

The 12-month signal had some false alarms (summer 2012, Christmas 2018), so it's not perfect and why I didn't say it *caused* the routs.

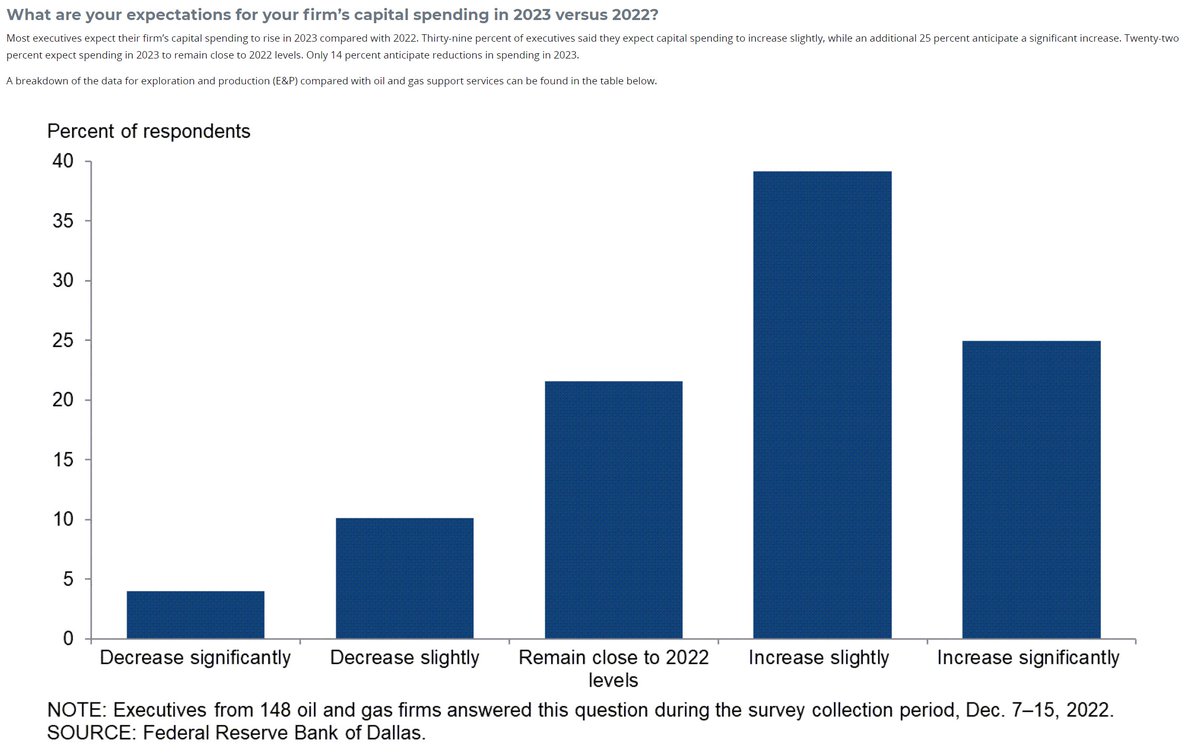

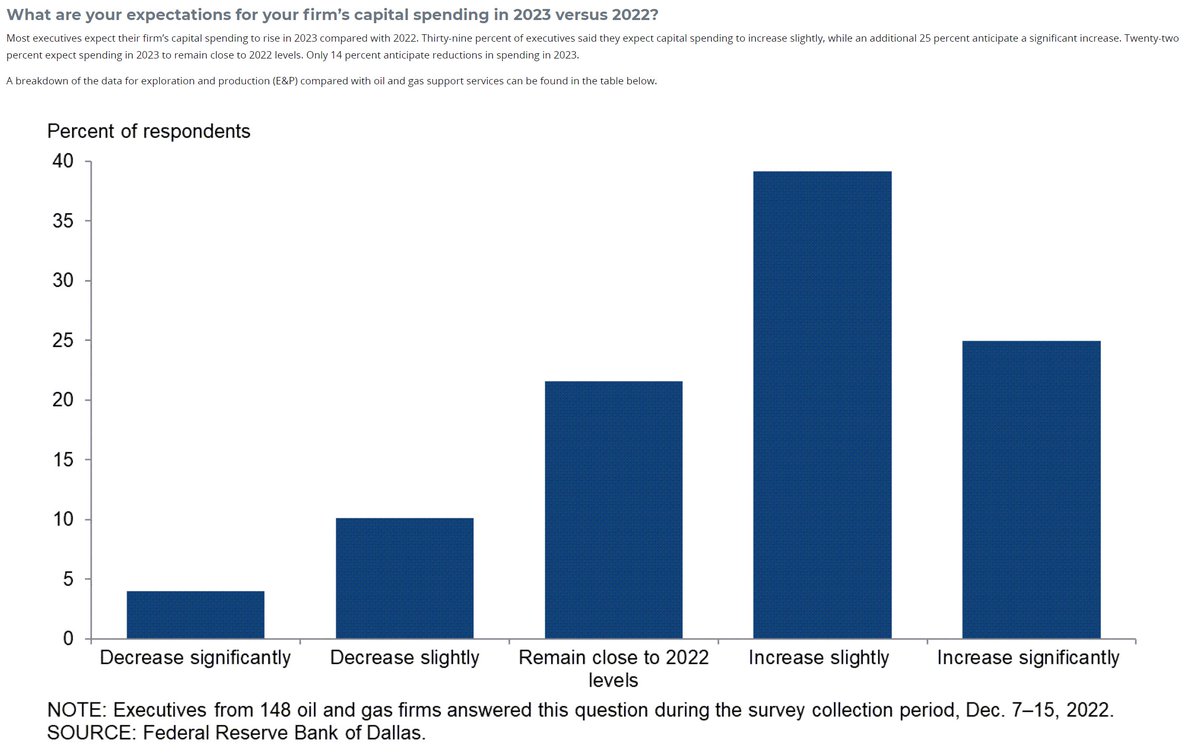

This is a v different story than we got from the last survey, which asked a different question.

This is a v different story than we got from the last survey, which asked a different question.https://twitter.com/Rory_Johnston/status/1506644598743044107

https://twitter.com/natnewswatch/status/1539622483833266176I've long believed that the pipeline would likely not break even at a project level: costs kept rising and can't pass all those costs onto shippers without industry-wide repercussions (more in next tweet).

https://twitter.com/RW_UNP/status/1526206621755805698I've mentioned before how it's important to differentiate between demand losses stemming from income/price effects (is demand falling bc of substitution or loss of spending capacity?)

https://twitter.com/Rory_Johnston/status/1501217810307072006?s=20&t=CDlmwkHMoXph-mTCzJ52yg