Assistant Professor of Economics @GWtweets | Columnist @FinancialReview | Visiting Fellow @Austaxpolicy | Author "Australia's Pandemic Exceptionalism" | 🇦🇺

2 subscribers

How to get URL link on X (Twitter) App

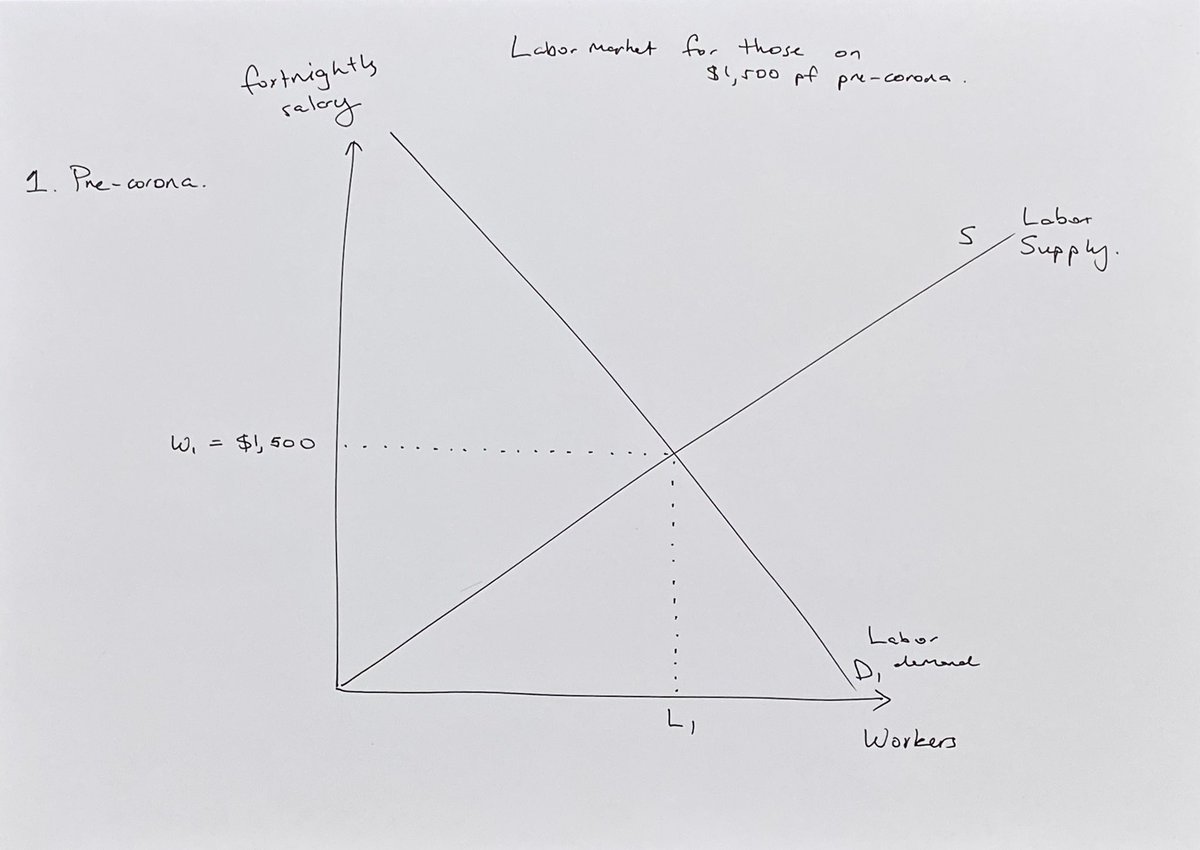

Australia has a private retirement saving system in which 10.5% of all wage earnings are contributed to retirement accounts and inaccessible until retirement. The government allowed eligible people to withdraw $10k by June 30 and $10k after June 30 in 2020. 1 in 6 withdrew. 2/

Australia has a private retirement saving system in which 10.5% of all wage earnings are contributed to retirement accounts and inaccessible until retirement. The government allowed eligible people to withdraw $10k by June 30 and $10k after June 30 in 2020. 1 in 6 withdrew. 2/

https://twitter.com/RobinBrooksIIF/status/1499438042280517640Moreover, the Russian economy is about to experience likely an unprecedented dislocation, causing a significant recession, all while macro-stabilization tools are unavailable. How does Russia produce things without crucial inputs? Hitting energy is worse but likely unnecessary.

https://twitter.com/postopinions/status/1375426491467640833The first correction to make is that we definitely don’t want to perfectly enforce the tax law. Extracting the last dollar owed is likely to incur a resource cost that far exceeds the social value of the revenue raised. Instead, we should think of enforcement as a trade-off. 2/4

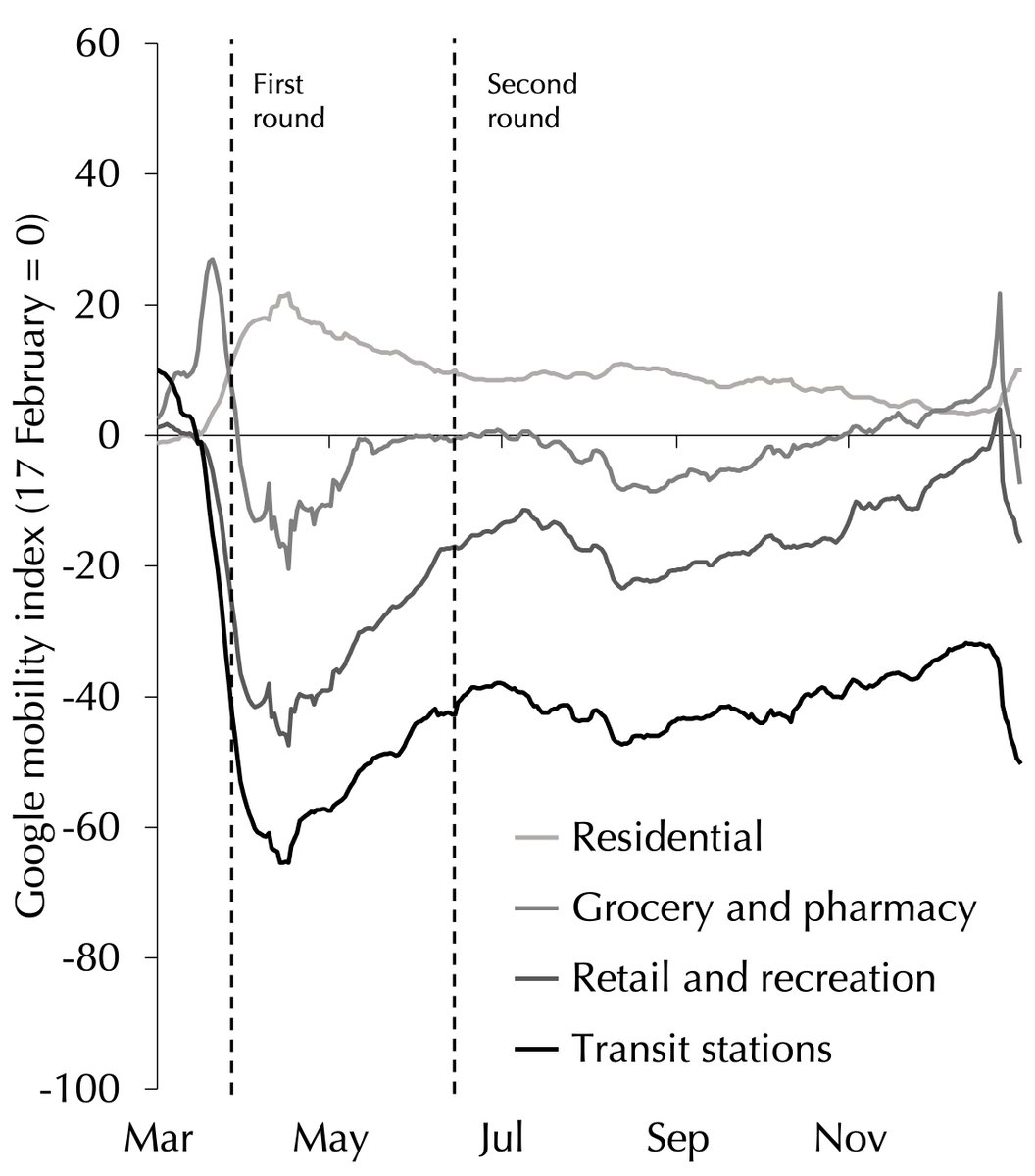

Notwithstanding the Melbourne outbreak, Australia has successfully suppressed the virus. America has... not. Australia is far more exposed to China. And I hadn’t realised the US and Oz tracked each other closely over the first 6 weeks. But in mid-March, the US pulled away. 2/16

Notwithstanding the Melbourne outbreak, Australia has successfully suppressed the virus. America has... not. Australia is far more exposed to China. And I hadn’t realised the US and Oz tracked each other closely over the first 6 weeks. But in mid-March, the US pulled away. 2/16

1) We started this with net-debt-to-GDP of around 40%. The US started at over 100%. And they’re going *further* than us on stimulus.

1) We started this with net-debt-to-GDP of around 40%. The US started at over 100%. And they’re going *further* than us on stimulus.

https://twitter.com/shamiltonian/status/1244510801920028672This is a per-worker wage subsidy. @stanveuger and I called for a revenue-loss subsidy in our @FinancialReview op-ed on Wednesday, below. At that point the government had ruled it all out. I noticed some uncannily similar language in the presser. 2/13

The government should provide immediate funding for emergency loans to any small- and medium-sized business in America. These loans would:

The government should provide immediate funding for emergency loans to any small- and medium-sized business in America. These loans would:https://twitter.com/SHamiltonian/status/1238435129133010944First, pumping up the economy with cash stimulus payments will be impossible because the spending response will be strongly impaired. So the goal of cash payments should not be to target those most likely to spend, but rather those who will be hit hardest by the downturn. 2/4