Journalist @TheEconomist, focusing on Chinese economics and finance.

How to get URL link on X (Twitter) App

https://twitter.com/JChengWSJ/status/1503733001892470798A quick caveat before getting into this. I'm not looking at implications for the riyal USD peg or at Saudi Arabia's need for oil hedging. Both of these will impose additional limits on its use of yuan. What I'm interested in is: how much yuan can it absorb & put to work? (2/9)

https://twitter.com/PPGMacro/status/1421061834359123970Yes, that chart does look alarming. Passenger traffic on its highways is down about 25% compared with the same time last year. So much for the recovery! The data don't lie! Well, not quite.

It's also useful to compare housing prices across most of China (excluding its four biggest cities) with the risk-free rate of return. Is speculative excess driving the market? If so, investors sure don't have much to show for it. (2/x)

It's also useful to compare housing prices across most of China (excluding its four biggest cities) with the risk-free rate of return. Is speculative excess driving the market? If so, investors sure don't have much to show for it. (2/x)

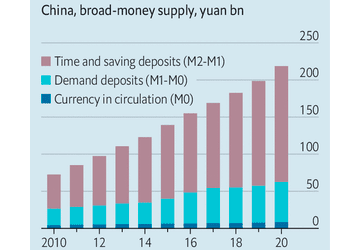

It's also notable that in absolute terms, the increase in China's outstanding debt was, by its recent standards, quite modest. Up 12% last year, a far cry from its post-GFC stimulus. It was the collapse in nominal growth that so pushed up its debt-to-GDP ratio. (2/5)

It's also notable that in absolute terms, the increase in China's outstanding debt was, by its recent standards, quite modest. Up 12% last year, a far cry from its post-GFC stimulus. It was the collapse in nominal growth that so pushed up its debt-to-GDP ratio. (2/5)

To make that clearer, here's the GDP gap in percentage terms. From 2005-2017, the sum of provincial GDP was, on average, more than 5% bigger than China's national GDP. Last year, it was just 1.6% bigger. (2/)

To make that clearer, here's the GDP gap in percentage terms. From 2005-2017, the sum of provincial GDP was, on average, more than 5% bigger than China's national GDP. Last year, it was just 1.6% bigger. (2/)

https://twitter.com/Noahpinion/status/10750890012524994562. The magnitude of the resulting net capital outflows and where the exchange rate then settles are anyone's guess. The IMF took a stab in 2013; it estimated that net outflows could be as much as 18% of Chinese GDP.