SaaS Analyst @CloudRatings. Previously in software PE. Subscribe to my newsletter below:

How to get URL link on X (Twitter) App

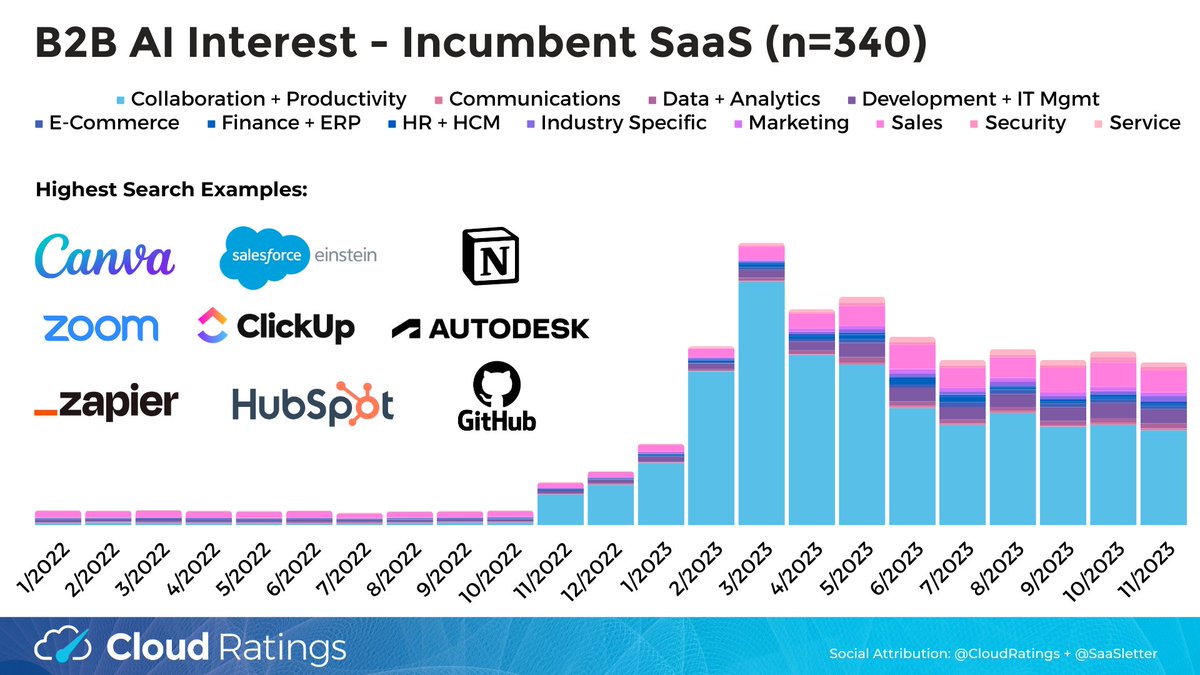

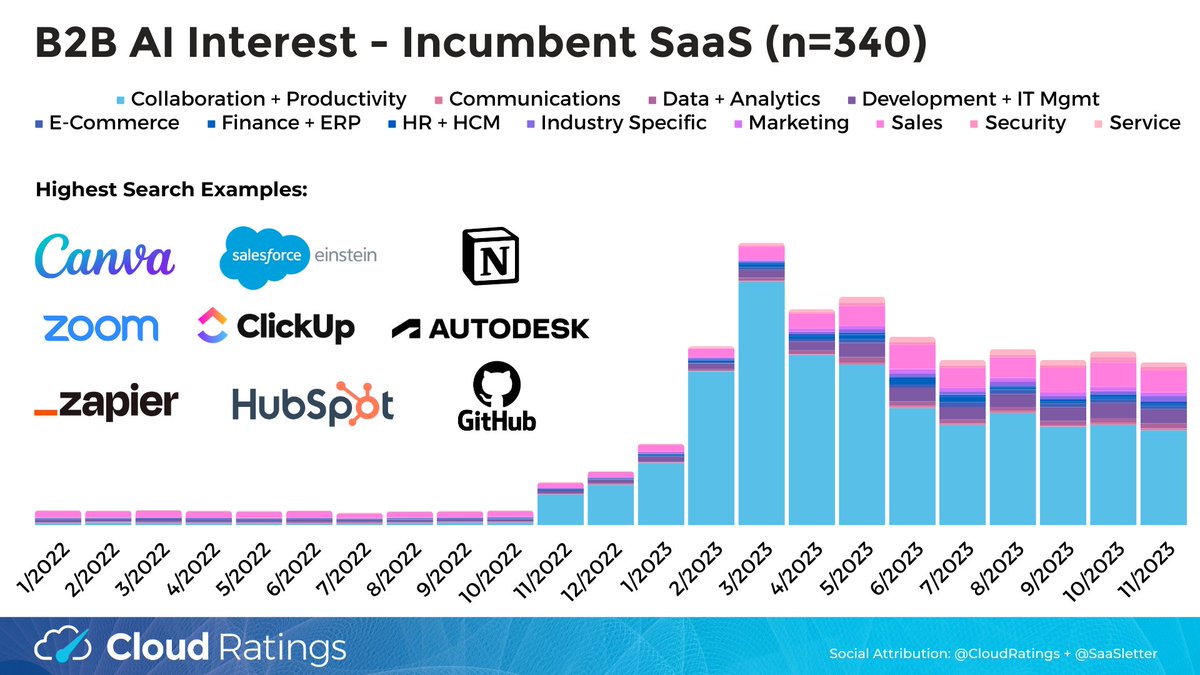

Trends for Blue Chip Basket:

Trends for Blue Chip Basket:

🔥 GRR + NRR data, especially transactional vs consultative split

🔥 GRR + NRR data, especially transactional vs consultative split

🆘 "In the first half of the year, 63% of companies missed their revenue targets.

🆘 "In the first half of the year, 63% of companies missed their revenue targets.

Meritech itself uses an adjusted Rule of 40 (with a 3x weighting on revenue growth)...

Meritech itself uses an adjusted Rule of 40 (with a 3x weighting on revenue growth)...

Now excerpts from report at :

Now excerpts from report at :