Islamic finance - FinTech - Start ups - Ex Global Head Islamic Structuring JPMorgan - Author - Venture Capital

7 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/realmozds/status/1965927677732466714Ensuring the vast majority of scholars are excluded from this and any dissenting voices are marginalised

https://twitter.com/SafdarAlam/status/1484752551333486596

NOTE - I was brief here, what goes on is a lot more than this, but I just wrote this from the top of my head. In my book, it takes over 50 pages to describe what goes on.

NOTE - I was brief here, what goes on is a lot more than this, but I just wrote this from the top of my head. In my book, it takes over 50 pages to describe what goes on.

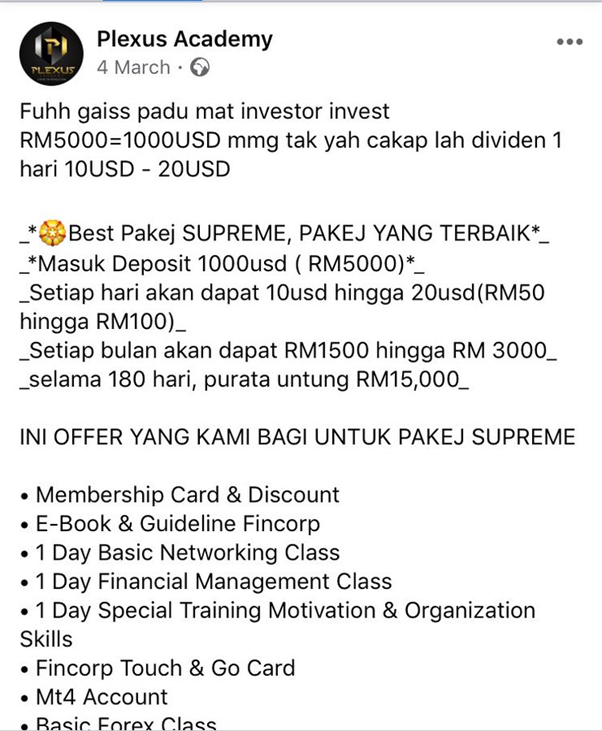

Firstly, they offer to triple your money in 6 months, not only this they say MINIMUM profit is 2.7 times your investment, and max profit is 3.6 times your investment.

Firstly, they offer to triple your money in 6 months, not only this they say MINIMUM profit is 2.7 times your investment, and max profit is 3.6 times your investment.

Berdagang (trade) matawang ni secara umumnya dibenarkan. Sebagai cth kalau anda ada RM100k & anda nak gunakannya utk beli duit EURO.

Berdagang (trade) matawang ni secara umumnya dibenarkan. Sebagai cth kalau anda ada RM100k & anda nak gunakannya utk beli duit EURO.

Trading in currency is generally seen as permitted. For example, you have £100k and you use it to buy some EUR. This must be done at spot (“hand to hand” as per the famous hadith of the 6 commodities). From there, you can trade as often as you like,

Trading in currency is generally seen as permitted. For example, you have £100k and you use it to buy some EUR. This must be done at spot (“hand to hand” as per the famous hadith of the 6 commodities). From there, you can trade as often as you like,

Riba ada banyak jenis. Kita secara amnya kenal riba sebagai faedah, atau duit di atas duit. Walau bagaimanapun, satu definisi lain bagi riba ialah Riba al Fadl (riba yang boleh berlaku dalam perdagangan)

Riba ada banyak jenis. Kita secara amnya kenal riba sebagai faedah, atau duit di atas duit. Walau bagaimanapun, satu definisi lain bagi riba ialah Riba al Fadl (riba yang boleh berlaku dalam perdagangan)

Riba has many different types, we mainly know it as interest, or money on money. However, one of the other definitions is that of Riba al Fadl, meaning Riba that can occur in trade.

Riba has many different types, we mainly know it as interest, or money on money. However, one of the other definitions is that of Riba al Fadl, meaning Riba that can occur in trade.

https://twitter.com/SafdarAlam/status/1192764262743183361?s=20

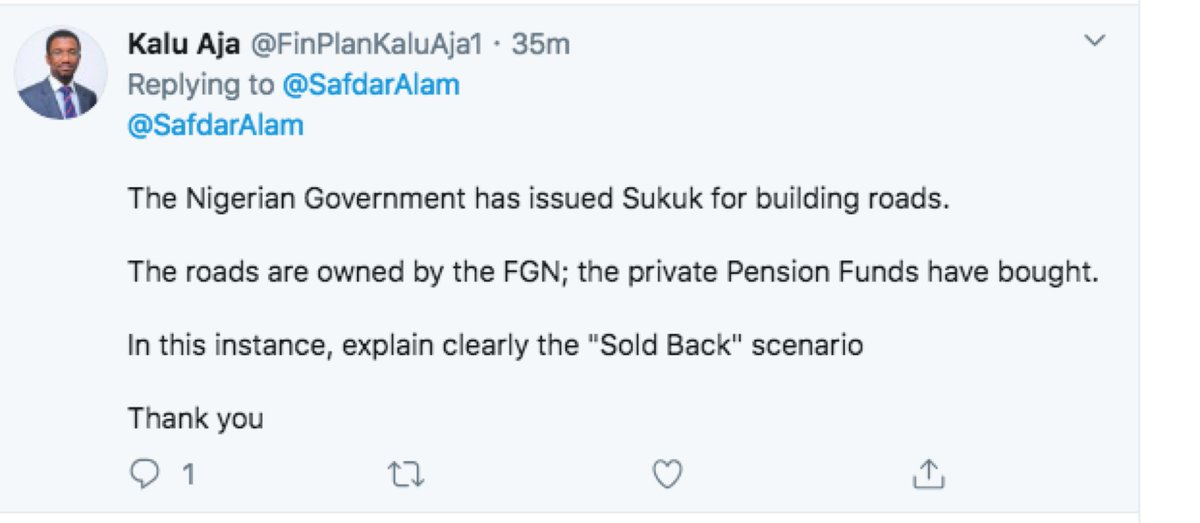

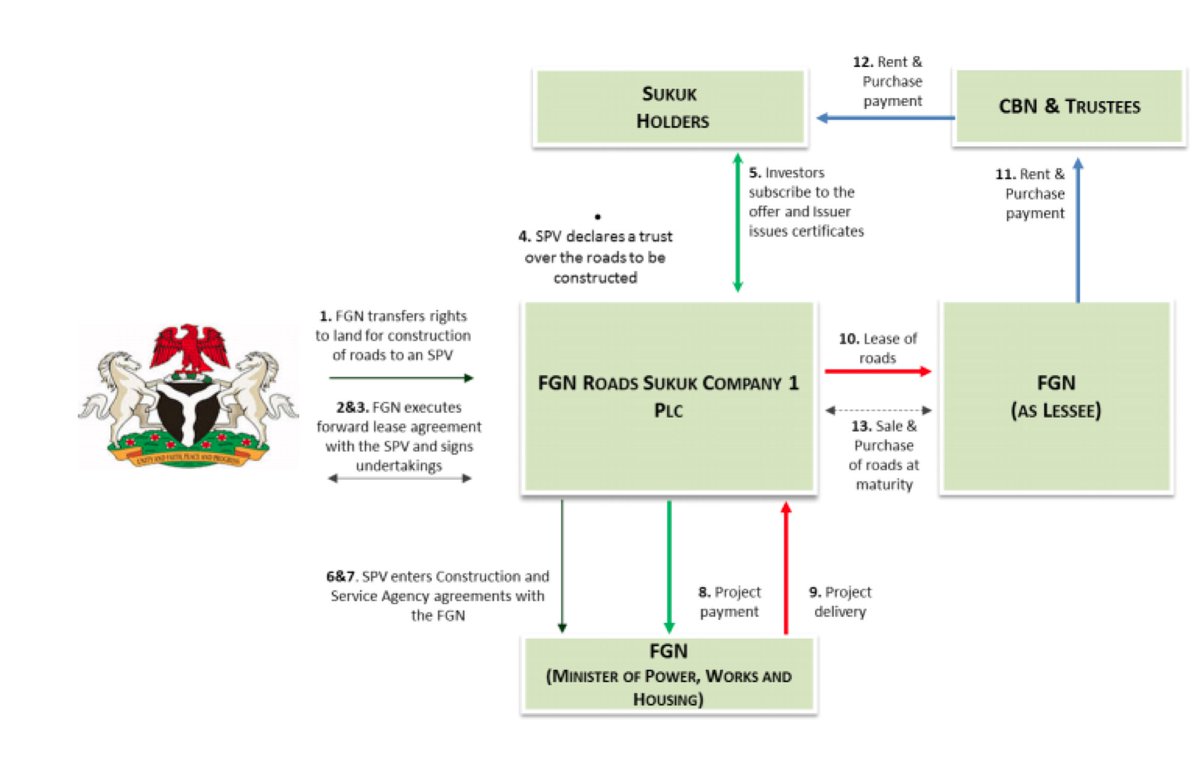

Ok, this is an interesting structure for the FGN roads Sukuk.

Ok, this is an interesting structure for the FGN roads Sukuk.

This is mainly BANKS creating debts out of thin air. In the UK around 97% of all money supply is created this way. This shows bank home lending in Malaysia.

This is mainly BANKS creating debts out of thin air. In the UK around 97% of all money supply is created this way. This shows bank home lending in Malaysia.

Here we will talk about what goes in underneath the surface, and then how this can help us identify trading opportunities.

Here we will talk about what goes in underneath the surface, and then how this can help us identify trading opportunities.

I have always been fascinated by financial markets and how they operate. Some years ago I decided to educate myself on this topic, and I found one great method of explanation that captivated me for two reasons:

I have always been fascinated by financial markets and how they operate. Some years ago I decided to educate myself on this topic, and I found one great method of explanation that captivated me for two reasons:

The development of money has gone through four major stages

The development of money has gone through four major stages

I have to admit my first reaction is that these are generally pointless questions. Let me explain why.

I have to admit my first reaction is that these are generally pointless questions. Let me explain why.

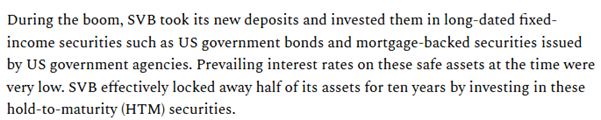

https://twitter.com/SafdarAlam/status/1192764262743183361) we talked about Sukuk, now we will see how market practice breaks the required Shariah rules.

AAOIFI have very clear rules on Sukuk, and some of the key areas were changed in around 2008, after criticism by Justice Taqi Usmani, perhaps the most prominent Islamic finance scholar in the world.

AAOIFI have very clear rules on Sukuk, and some of the key areas were changed in around 2008, after criticism by Justice Taqi Usmani, perhaps the most prominent Islamic finance scholar in the world.