Foxhole Investor🧘🏽♂️, Chain Reader📚, Fitness Focused💪

Contemplative, Eclectic.

Disciple of Discipline.

All views are personal.

16 subscribers

How to get URL link on X (Twitter) App

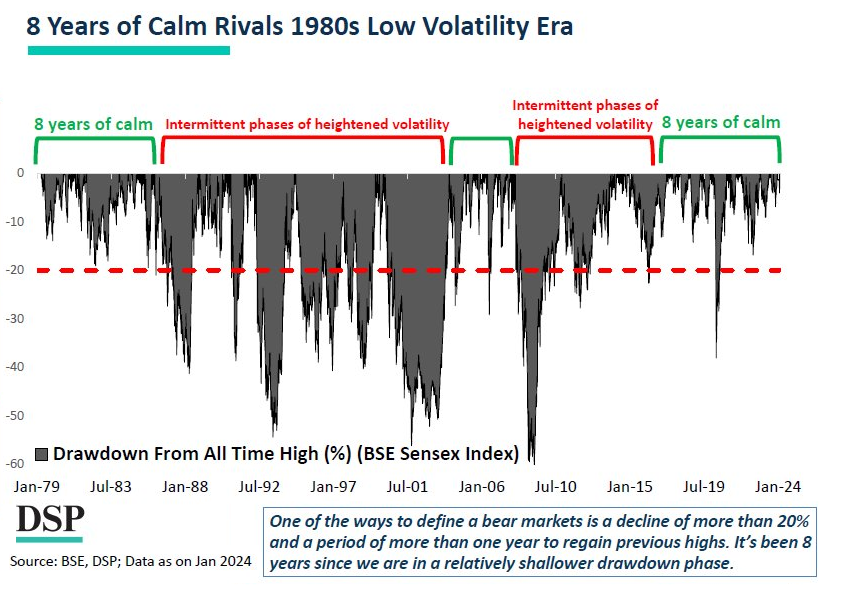

MOVE is widely used as a benchmark for measuring the level of risk in the US Treasury market. Higher MOVE readings generally indicate higher levels of market uncertainty or volatility, while lower readings indicate lower levels of market volatility.

MOVE is widely used as a benchmark for measuring the level of risk in the US Treasury market. Higher MOVE readings generally indicate higher levels of market uncertainty or volatility, while lower readings indicate lower levels of market volatility.

What Are We Saying?

What Are We Saying?