Former Crazy Eddie CFO turned forensic accountant. From Wall Street criminal to fraud investigator.

2 subscribers

How to get URL link on X (Twitter) App

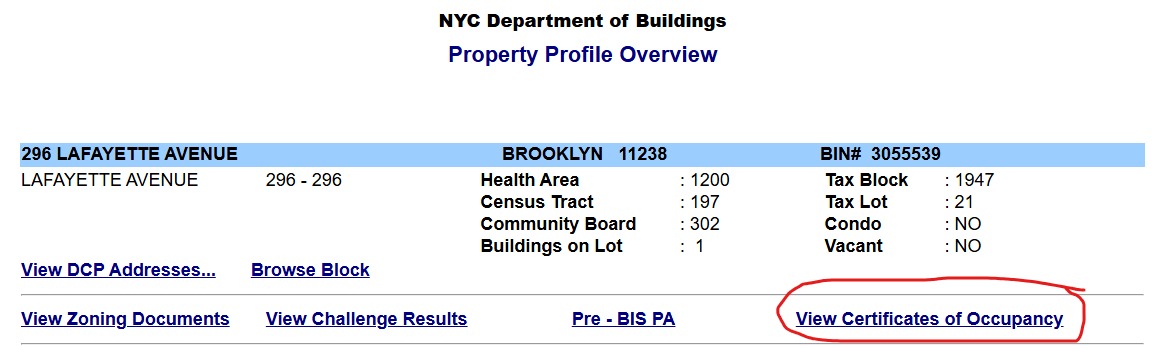

THREAD, PART 2: Select "View Certificates of Occupancy"

THREAD, PART 2: Select "View Certificates of Occupancy"

Channel 1 – Direct Soros Political Pipeline:

Channel 1 – Direct Soros Political Pipeline:

https://twitter.com/retheauditors/status/1366779868944326658•What are called “audits” today are merely limited reviews of financial statements designed to catch the accounting equivalent of grammatical errors and typos (like the review tool used in Microsoft Word).

https://twitter.com/alexfrangos/status/1317143093116809223At best, so-called audits as they are conducted today are limited reviews of financial reports similar to the grammar/spellcheck feature on MS Word. [thread 2/4]