Chief economist @CER_EU. Eurozone macroeconomic policies | institutional development of EMU | Role of 🇩🇪 🇳🇱 in EU. Formerly @ecb (+ @IMFNews) & @Worldbank

3 subscribers

How to get URL link on X (Twitter) App

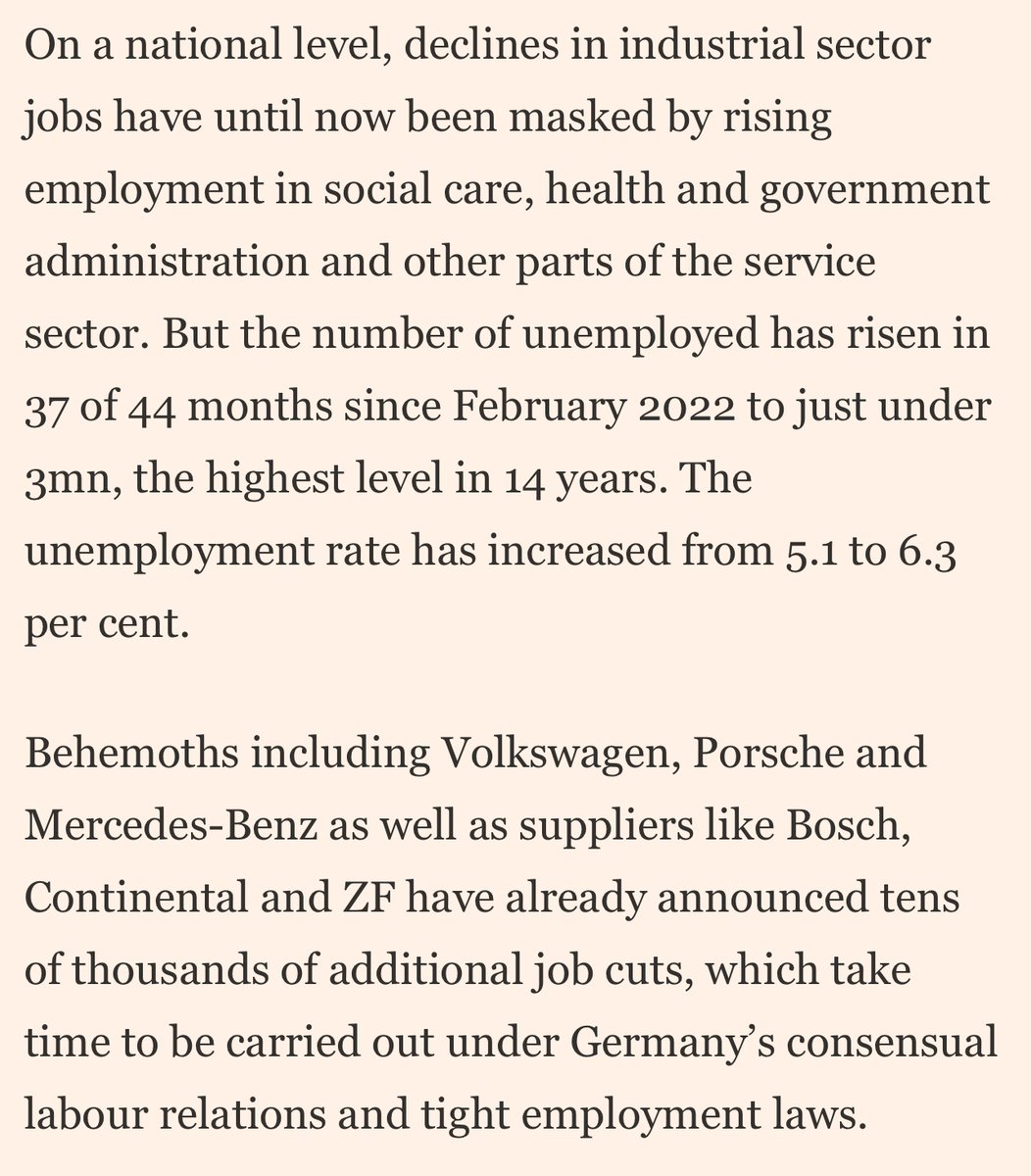

The changing role of China from customer to fierce competitor is a key reason why German industrial production has slumped back to 2005 (ouch) levels.

The changing role of China from customer to fierce competitor is a key reason why German industrial production has slumped back to 2005 (ouch) levels.

The problems are clear. European economies grew 2-3% py throughout the 90s, early 00's. But growth never recovered from the 2008 financial crisis. While Europe continues to rank highly on broader measures of wellbeing, its meagre growth has fallen well behind that of the US

The problems are clear. European economies grew 2-3% py throughout the 90s, early 00's. But growth never recovered from the 2008 financial crisis. While Europe continues to rank highly on broader measures of wellbeing, its meagre growth has fallen well behind that of the US

The US has long been the consumer-of-last-resort. China's consumption is depressed.

The US has long been the consumer-of-last-resort. China's consumption is depressed.

https://twitter.com/vonderburchard/status/1841899516267487283The stakes are hard to overstate.

https://x.com/lucasguttenberg/status/1835965649027269025Unlike during the Eurozone crisis, Germany is now at the center of the storm. Since 2019, the German economy has practically flatlined.

In terms of GDP per capita the lowlands are far ahead, and the gulf has grown as Germany remains stuck in multi-year stagnation.

In terms of GDP per capita the lowlands are far ahead, and the gulf has grown as Germany remains stuck in multi-year stagnation.

As China's manufacturing exports exploded in the 2000s (to 19% of world total by 2013), aided by protectionism/subsidies, the US lost one million manufacturing jobs.

As China's manufacturing exports exploded in the 2000s (to 19% of world total by 2013), aided by protectionism/subsidies, the US lost one million manufacturing jobs.